INFLATION WATCH

Families will Pay 17.2% More for Home Heating this Winter Between 2020-21 and 2021-23, the cost of home energy would increase by more than 35%.

Amazon Raises Pay for Hourly Employees as It Prepares for Holidays Average starting pay for warehouse employees to increase from $18 to $19 an hour.

The company on Wednesday said it was increasing average starting pay for its front-line warehouse employees from $18 to more than $19 an hour, with many employees earning between $16 and $26 an hour depending on their location in the U.S. Amazon said the raises represent a nearly $1 billion investment over the next year.

Amazon’s last notable pay increase came about a year ago, when it raised pay for hundreds of thousands of workers to an average starting salary of $18 an hour. (…)

The company shed almost 100,000 employees during the second quarter this year, though it appears to be adding hourly staff again. (…)

The company has shut down, called off or pushed back the openings of more than 60 delivery stations, fulfillment centers and other facilities, according to recent data from supply-chain consulting firm MWPVL International Inc. (…)

This month, the retailer said it would invest $450 million to fund wage increases and other benefits for delivery drivers employed by members of its Delivery Service Partners network. Investments also include up to $5,250 a year for drivers to pay for educational programs, and financial support for a 401(k) investment plan. (…)

Amazon employed more than 1.1 million people in the US at the end of 2021. The company’s minimum level of $15 an hour for all hourly workers in the US remains unchanged. (Bloomberg)

- Police departments raise bonuses to draw new hires.

The small city of Warner Robins, Ga., budgeted for $4,000 retention and recruitment bonuses this year. Ithaca, N.Y., offers $20,000 bonuses for hires from other agencies. And Seattle has approved $30,000 bonuses for lateral hires and $7,500 for new recruits. A tight labor market is compounding what police chiefs describe as waning interest from job seekers, put off by heightened scrutiny of officers’ actions, a less favorable view of the profession by some Americans and a surge in violent crime. (WSJ)

Return of Inflation Makes Deficits More Dangerous Britain’s proposed tax cut shows political leaders still stuck in prepandemic world of limitless borrowing

(…) Elected leaders, though, are still stuck in prepandemic times. They acknowledge inflation is a problem but continue to borrow as if limits don’t exist. After the stimulus-inflated levels of 2020 and 2021, budget deficits fell sharply across developed markets this year, to an average 4.3% of gross domestic product, according to independent economist Phil Suttle. He estimates that will rise to 6.1% next year and 6.9% in 2024. (…)

But the country that resembles the U.K. most closely is the U.S. While the reserve status of the dollar and Treasury debt insulates the U.S. from some of the pressures buffeting Britain, its fiscal policy is just as miscalibrated. While President Biden touts the Inflation Reduction Act, which lowers deficits by $240 billion over a decade, he has also signed into law increased spending on veterans benefits, infrastructure and semiconductors, while taking executive actions that vastly expand food stamp and Obamacare benefits and cancel student debt worth $400 billion to $1 trillion.

Adding that to last year’s stimulus and associated interest, the Committee for a Responsible Federal Budget estimates Mr. Biden will increase deficits by $4.8 trillion, or 1.6% of GDP over a decade—comparable to the amount by which Ms. Truss is boosting the British deficit. The relaxed attitude toward debt is shaped in part by Mr. Biden’s economists’ assumption that real interest rates—the nominal rate minus inflation—will remain around zero for the coming decade. Federal debt is much more manageable when real rates are lower than the economic growth rate. They have some justification: Real rates were well below the economy’s growth rate for the decade before the pandemic.

On the other hand, massive deficits, Fed tightening in response to flare-ups of inflation and diminished private saving could all elevate real rates in coming years—as occurred after then-Fed chairman Paul Volcker crushed inflation in the early 1980s. Here’s one troubling sign: The real yield on five-year inflation-indexed Treasury bonds this week touched 1.91%, about equal to the U.S.’s expected long-term growth rate. On Wednesday, it fell back to 1.63%.

If Greg Ip’s piece sounds too esoteric, Stan Druckenmiller has real world stuff for us: https://twitter.com/i/status/1575134672706748419. Two minutes to understand why the Fed needs to stop inflation now. Financially, economically and socially, we simply can’t afford high interest rates.

U.S. Pending Home Sales Fall Further in August

The Pending Home Sales Index produced by the National Association of Realtors fell 2.0% (-24.2% y/y) to 88.4 in August following a 0.6% easing in July, revised from -1.0%. The August decline was the ninth in ten months. Pending home sales have fallen 30.9% since the August 2020 high.

Pending home sales declined in most regions in August, except the West where they rose 1.4% (-31.3% y/y), up for the second straight month. Sales were 38.1% below the August 2020 peak. Sales in the South fell 0.9% (-24.2% y/y) after a 1.3% July drop. They were 29.4% below the August 2020 high. Sales in the Northeast fell 3.4% (-19.0% y/y) following a 1.9% July shortfall. Sales were one-third below the August 2020 peak. Sales in the Midwest declined 5.2% (-21.1% y/y) in August after easing 0.5% in July. Sales fell 26.3% from the August 2020 high.

Rental market:

Welcome to the October 2022 Apartment List National Rent Report. Our national index fell by 0.2 percent over the course of September, marking the first time this year that the national median rent has declined month-over-month. The timing of this slight dip in rents is consistent with a seasonal trend that was typical in pre-pandemic years. Assuming that trend continues, it is likely that rents will continue falling in the coming months as we enter the winter slow season for the rental market.

Despite the monthly decline, rent growth over the course of this year continues to outpace the pre-pandemic trend, even as it has slowed significantly from last year’s peaks. So far in 2022 rents are up by a total of 6.8 percent, compared to 17.1 percent at this point in 2021. Year-over-year growth is continuing to decelerate, and now stands at 7.5 percent, down from a peak of nearly 18 percent at the beginning of the year.

This cooldown in rent growth is being mirrored by continued easing on the supply side of the market. Our vacancy index now stands at 5.2 percent, after nearly a year of gradual increases from a low of 4.1 percent last fall. That said, today’s vacancy rate remains well below the pre-pandemic norm, and spiking mortgage rates that continue sidelining first-time homebuyers could contribute additional tightness to the rental market.

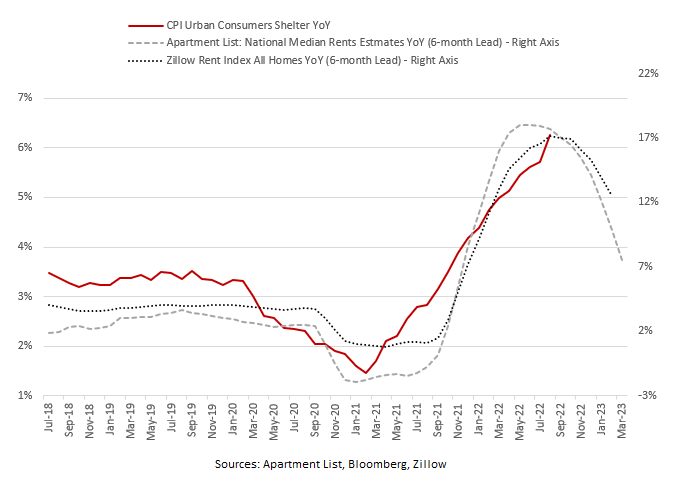

Keep in mind that the above data reflect new leases. The BLS measures for rent account for on-going leases which can lag considerably MoM….

…although we may soon see YoY growth in CPI Shelter peak out.

Immigration Drives Fastest Canada Population Growth Since 1957

The number of people living in Canada rose by 0.7%, or 284,982, to 38.9 million in the second quarter of 2022, according to Statistics Canada estimates released Wednesday in Ottawa. That’s the highest pace for quarterly growth since 1957 and represents an increase of about 3,100 people per day. (…)

Canada’s pace of population growth is the highest among the Group of Seven. Immigration has been one of the main drivers of the Canadian economy, and accounts for almost all of the nation’s employment growth.

From April 1 to July 1, international migration accounted for a gain of nearly 270,000 people, or 95% of the quarterly growth, the highest increase from international migration since comparable records have existed in 1971. This was in part due to high numbers of asylum claimants and permit holders, including people affected by the Russian invasion of Ukraine.

The country’s population grew by 1.8% in the 12-month period that ended June 30. (…) [USA: +0.3%]

The Unstoppable Dollar Is Wreaking Havoc Everywhere But America

(…) By some measures the US currency is already stronger than ever, eclipsing the highs of the Covid-19 pandemic from early 2020. The pain it’s inflicting has echoes of the mid-1980s, when foreign exchange chaos forced the world’s most important finance officials to join hands and impose a solution on markets. Right now, though, it’s every country for itself as the US administration pushes back on the idea of coordinated market action. (…)

Right now the problem bedeviling officials from Frankfurt to Seoul is high inflation—and weak currencies add fuel to that by increasing the cost of imported products and stimulating domestic growth. So some governments and central banks need to respond to the ongoing battering. (…)

The currency situation is also forcing central banks around the world to consider ratcheting up their own interest rates further, which risks driving their economies into recession. (…)

From the Fed’s perspective, a strong dollar actually helps the fight against inflation. By crimping the competitiveness of US business on the international stage, it acts to curb growth, in turn removing some inflationary pressure. This gives officials reason not to pull punches as they press the most aggressive monetary tightening since Paul Volcker wrestled with runaway inflation in the 1980s. The dollar’s strength was also a problem then until the so-called Plaza Accord reined it in. One key difference: The 1985 agreement between the UK, France, West Germany, Japan, and the US came only after Volcker had already broken the back of inflation, whereas the outcome of the present battle is very much undecided. (…)

The Treasury secretary said Sept. 27 that she thinks “markets are functioning well,” while White House economic adviser Brian Deese was even more explicit in saying that he doesn’t expect another 1985-type agreement among major economies to counter the dollar’s strength. (…)

International turmoil could conceivably slow the pace of Fed rate hikes. It’s not out of the question that conditions in major foreign economies—and in global financial markets—could so deteriorate that they drag down prospects for growth in the US. If this alleviates inflationary pressures in the US, that could potentially allow the Fed to pause its relentless tightening. (…)

- “In terms of where we are. I think we’re in the ‘things break’ stage. Now, typically when we enter the ‘things break’ stage the Fed is able to get dovish and arrest the move. However, inflation is at 8% and the Fed won’t have confidence it is sustainably falling until the unemployment rate rises a bit. So this is the problem now, and why this rendition of the doom loop is more severe, the Fed doesn’t have its usual off ramp because they are in panic mode over US inflation. The whole global economy is basically waiting for the US unemployment rate to tick up to 4%.” (Jon Turek of JST Advisors via Bloomberg)

- Mexico and Colombia are poised to tighten further today as policymakers hold firm in their inflation fight. Banxico will probably hike rates by 75 basis points to 9.25%. Colombia is seen lifting its benchmark 150 bps to 10.50%. (Bloomberg)

- U.S. Goods Trade Deficit Continues to Narrow in August

The advance estimate of the U.S. international trade deficit in goods narrowed to $87.3 billion in August from $90.2 billion in July. It was the shallowest deficit since last October. The deficit reached a peak of $125.7 billion in March of this year. An $89.0 billion deficit had been expected by the Action Economics Forecast Survey.

Exports of goods declined 0.9% during August (+20.8% y/y) while imports fell 1.7% (+13.1% y/y).

The falloff in exports last month reflected an 8.9% drop (+10.7% y/y) in exports of autos & auto parts. Industrial supplies & materials weakened 3.5% (+29.8% y/y). Auto & auto parts exports fell 8.9% (+10.7% y/y). Working higher, nonauto consumer goods exports rose 8.0% (16.0% y/y). Exports of “other” goods surged 4.8% (37.1% y/y). Exports of foods, feeds & beverages gained 0.8% (24.6% y/y) while capital goods exports rose 0.4% (10.7% y/y).

The August import decline was led by a 6.9% drop (+17.7% y/y) in industrial supplies & materials imports. Capital goods imports declined 1.8% (+13.2% y/y) while nonauto consumer goods imports eased 0.2% (+7.9% y/y). To the upside, auto & parts imports gained 3.8% (22.9% y/y) while imports of foods, feeds & beverages rose 2.4% (11.7% y/y). Imports of “other” goods rose 1.0% (-5.9% y/y).

China Central Bank Warns Against Yuan Speculation After Currency Sinks

(…) “The foreign exchange market is of great importance, and maintaining its stability is the top priority,” it stated. It said investors shouldn’t be betting on the unilateral appreciation or depreciation of the yuan, and called on banks to curb such activity. It also said some companies have been engaging in currency speculation or flouting regulations, without giving details.

The yuan “has withstood the test of many rounds of external shocks,” it said. “You will lose if you keep betting.” (…)

The steep decline of the yuan against the dollar makes it increasingly difficult for China’s central bank to cut interest rates to boost the country’s sagging economy, according to analysts. A widening gap in interest rates between China and the U.S. has been a key driver of the Chinese currency’s weakness. (…)

Plunging business and consumer confidence in China since a lengthy Shanghai Covid-19 lockdown in the second quarter has played a role in weakness of the yuan against the dollar, said Larry Hu, chief China economist at Macquarie. “The prerequisite for stabilizing the yuan is stabilizing the economy,” he said. (…)

A yuan index published by the China Foreign Exchange Trading System, which measures the performance of the yuan against a basket of 24 currencies, has been stable this year and is trading at roughly the same level as January.

Ding Shuang, regional head of economic research for China and North Asia at Standard Chartered, said the Chinese central bank cares more about the basket because “that reflects yuan’s external competitiveness and therefore serves as an anchor.” He added that the central bank likely won’t stand in the way of the yuan’s depreciation against the dollar—unless it moves so much that the yuan’s value against the basket falls significantly. (…)

RBC Says Hope Overwhelms Reality in Keeping Earnings Estimates Most sell-side analysts are not pricing in the full impact that rising interest rates could have on corporate profits, said Stuart Kedwell of RBC Global Asset Management Inc.

(…) Corporate management teams often use third-quarter earnings season as a chance to “reset the guidance” for the following year, said Irene Fernando, a senior portfolio manager at RBC. It’s only then that most equity analysts start changing their own estimates. (…)

Bank Stocks No Longer a Haven From Rising Rates In a recent survey of investor clients by Piper Sandler analysts, 55% of respondents said that credit risk was the biggest short-term risk to banks. In a survey last year, just 5% said that.

Kagan v. Roberts: Justices Spar Over Supreme Court’s Legitimacy The liberal justice suggested recent court decisions are sapping “reservoirs of public confidence,” while the chief justice and Justice Samuel Alito said institution’s status stands above its opinions.

Kagan v. Roberts: Justices Spar Over Supreme Court’s Legitimacy The liberal justice suggested recent court decisions are sapping “reservoirs of public confidence,” while the chief justice and Justice Samuel Alito said institution’s status stands above its opinions.

During the summer months when the Supreme Court was out of session, new arguments arose between the justices themselves on whether the court’s legitimacy, in the eyes of the American public, was imperiled after it overturned longstanding precedents in its most recent term.

Liberal Justice Elena Kagan, in a series of public appearances, said the court’s conservative majority had diminished the high court’s credibility with decisions that track Republican priorities. Chief Justice John Roberts, speaking at a separate event, retorted that the court’s decisions have no bearing on its legitimacy as it carries out its mandate to interpret the Constitution. On his side was fellow conservative Samuel Alito, author of the majority opinion in the term’s landmark case overturning Roe v. Wade, eliminating a woman’s constitutional right to an abortion.

Across the court’s history, “The very worst moments have been times when judges have even essentially reflected one party’s or one ideology’s set of views in their legal decisions,” Justice Kagan said last week at Salve Regina University in Newport, R.I. “The thing that builds up reservoirs of public confidence is the court acting like a court and not acting like an extension of the political process.” (…)

“If, over time, the court loses all connection with the public and with public sentiment, that is a dangerous thing for democracy.” (…)

Chief Justice Roberts earlier this month took issue with Justice Kagan’s critique.

“Simply because people disagree with an opinion is not a basis for questioning the legitimacy of the court,” he told a judicial conference in Colorado Springs, Colo. The high court’s role, grounded in the Constitution, ”doesn’t change simply because people disagree with this opinion or that opinion or disagree with the particular mode of jurisprudence,” he said.

In a comment Tuesday to The Wall Street Journal, Justice Alito said: “It goes without saying that everyone is free to express disagreement with our decisions and to criticize our reasoning as they see fit. But saying or implying that the court is becoming an illegitimate institution or questioning our integrity crosses an important line.” (…)

Americans’ opinions of the Supreme Court are the worst they have been in 50 years of polling, according to a new survey from Gallup being published Thursday. (…)

Justice Kagan was on the losing side in nearly every major case last term: not only the landmark opinion overruling Roe v. Wade but also decisions that expanded access to concealed weapons; limited the Environmental Protection Agency’s power to fight climate change; and increased religion’s presence in the public education system. (…)

Court precedents, she said, should be respected except in the most extraordinary circumstances. “It just doesn’t look like law when some new judges appointed by a new president come in and just start tossing out the old stuff,” she said, in an apparent reference to the positions of Justices Neil Gorsuch, Brett Kavanaugh and Amy Coney Barrett, who were all confirmed during President Donald Trump’s single term in office.

Justice Kagan added that courts should act incrementally rather than issuing sweeping pronouncements that disrupt the legal order, a point often made by Chief Justice Roberts, including in his explanation for not joining Justices Alito, Clarence Thomas, Gorsuch, Kavanaugh and Barrett in reversing Roe v. Wade’s half-century precedent. (…)

(

(