U.S. Empire State Manufacturing Index Declines in May

The Empire State Manufacturing Index of General Business Conditions dropped thirty-six points to -11.6 in May from 24.6 in April, according to the Empire State Manufacturing Survey released by the Federal Reserve Bank of New York. A reading of 16.0 had been expected for May in the Action Economics Forecast Survey. The May reading was the second negative reading in the past three months. Twenty percent of respondents reported that conditions had improved over the month, while 32% reported that conditions had worsened. The latest survey was conducted between May 2 and May 9.

Haver Analytics constructs an ISM-adjusted Empire State diffusion index using methodology similar to the ISM series. The index was at 51.8 in May, down from 60.2 in April.

The new orders index fell 34 points in May to -8.8 from 25.1 in April. A lessened 24.9% of respondents reported higher orders in May, while an increased 33.7% reported lower orders. The shipments index plunged to -15.4 in May from 34.5 in April. A sharp decline to 22.0% of respondents, from 45.4% in April, reported higher shipments, while an increased 37.4% reported lower shipments in May.

The unfilled orders index fell to 2.6 in May from 17.3 in April. (…)

The number of employees index increased to 14.0 in May from 7.3 in April. An increased 20.9% of respondents reported increases in employment in May, while 6.8% reported lower employment. The average workweek rose moderately to 11.9 from 10.0 in April.

After reaching a record high of 86.4 in April, the prices paid index fell to a still elevated 73.7 in May, and the prices received index edged down to 45.6 from 49.1 in April, signaling ongoing substantial increases in both input prices and selling prices, though at a slower pace than in April. A lessened 76.3% of respondents reported higher prices paid in May, while 2.6% reported lower prices paid. An increased 51.8% of respondents reported higher prices received in May, while 6.1% reported lower prices received.

Bespoke sums it best:

Not only are General Business Conditions back into contractionary territory, but the double-digit negative reading sits in the bottom decile of all months on record going back to the start of the index in 2001. That compares to last month’s reading which was just shy of the top decile. Given the total reversal within the historical range, the month-over-month decline of 36.2 points is now the second-largest one-month drop on record behind the 56.7 point decline in April 2020.

Only New Orders and Shipments fell enough to reach contractionary levels this month, but most other categories also saw large month-over-month declines.

(…) the most shocking declines were in demand-related categories, namely New Orders and Shipments. These two indices fell by 33.9 and 49.9 points, respectively. For New Orders, that was the third-largest decline on record outside of the 56-point drop in April 2020 and a 43.1-point decline in the wake of September 11, 2001. The only larger decline in Shipments happened, again, in April 2020. Unfilled Orders also fell dramatically, though the month-over-month decline was not as close to a record, and the actual level of the index is still relatively elevated in the top quartile of its historical range. Although more New York area firms reported declines in new orders and shipments, expectations were each higher month-over-month following sharp declines leading into this month’s report.

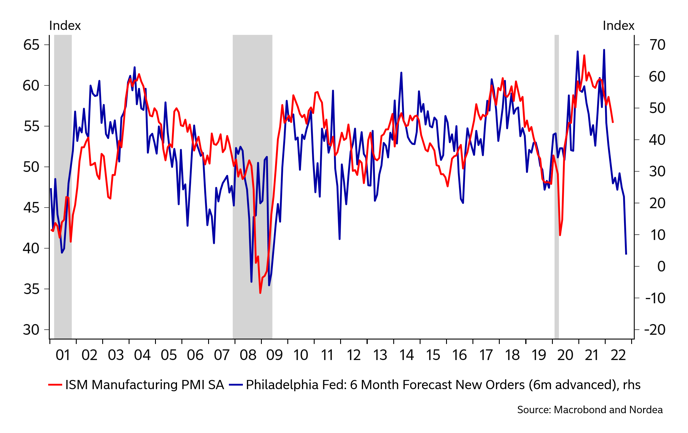

This comes after the Philly Fed’s release of very weak forecasts for new orders…

Philly Fed points to severe ISM contraction

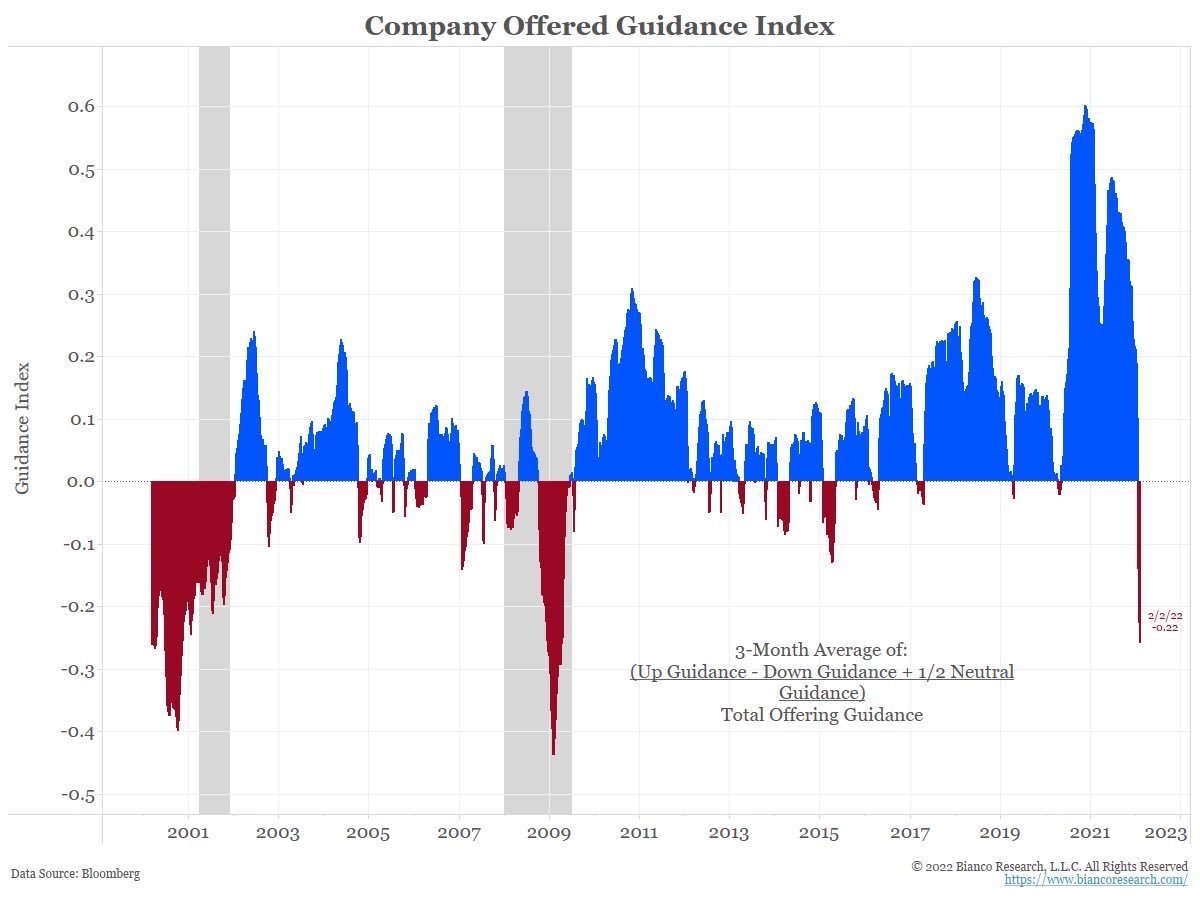

…and BofA’s tally of recent corporate comments:

With housing weakening, the E.U. near stagflation and China in disarray (Omicron and housing), we could be about to get bad news from the goods side of the economy. S&P Global’s flash PMIs will be out next week.

BTW:

Goldman Sachs:

Since the March FOMC, our US FCI has tightened by 80bp. As a result, we have downgraded our US 2022 Q4/Q4 growth forecast by roughly 0.5pp to 1¼% and now believe that the -1pp growth FCI impulse implied by the current level of financial conditions is roughly consistent with the Fed achieving a soft landing. While the March SEP shows 2022 (Q4/Q4) growth well above potential at 2.8%, it predates the recent FCI tightening. (…)

As a result, the 80bp tightening in our FCI since 14th March would on average lead to a 0.6pp year-ahead growth downgrade in the June SEP [Summary of Economic Projections]. This would be one of the largest downgrades since the SEP begun in 2007. Notably larger downgrades have only occurred during the global financial crisis, the initial pandemic hit, and in recent meetings (likely reflecting the end of the post-Covid boom, supply constraints, and fiscal tightening).

Combined with the 2.7% year-ahead growth forecast in the March SEP, this suggests that the recent FCI tightening alone would push the June SEP year-ahead growth forecast down to roughly 2%, and thus much closer to potential. Alongside the much lower than expected Q1 GDP print and the negative turn in growth news so far this year, our analysis points to significant downgrades to Fed growth forecasts in June.

Recall that Mr. Powell said that the U.S. economy is “very strong” on April 21. One week later, GDP came in at -1.4% for Q1 with Final Sales down 0.6%.

- A survey earlier this week from CNBC found that more than half of economists and investment professionals expect the Fed to fail in its mission to engineer a “soft landing” for the economy.

- Eight in ten small business owners expect a recession to occur this year, according to the latest CNBC|SurveyMonkey Small Business Survey for Q2 2022. (…) The survey finds few small business owners seeing any bright spots in the current economy: just 6% rate the current state as excellent and 18% as good, while 31% rate it as fair and 44% rate it as poor.

Chinese property developer Logan seeks to extend maturity of offshore bonds, sources say

Chinese property developer Logan Group Co. Ltd. is in talks to extend the maturities of its offshore debt amounting to hundreds of millions of dollars, several sources with knowledge of the matter told Caixin, the latest indication of distressed finances among developers as a growing number of defaults hit the debt-laden real estate sector.

If it can’t get offshore bondholders to approve the extensions, the company plans to undertake debt restructuring, the sources said. The company is seeking an extension of between four and seven years, one institutional investor said.

COST PUSH

Verizon Joins AT&T in Raising Wireless Prices as Inflation Bites

Millions of consumers will see a $1.35 increase in administrative charges for each voice line starting in their June phone bill. And business customers will see a new “economic adjustment charge” beginning June 16, with mobile phone data plans increasing by $2.20 a month and basic service plans going up by 98 cents, according to Verizon representatives. (…)

Rival AT&T Inc. earlier this month raised its rates on older consumer plans by $6 on single lines and $12 for families in order to catch up with rising costs and higher wages. (…)

Microsoft Boosts Pay in Fight for Talent Microsoft’s CEO is promising to boost employee compensation amid continued low unemployment across the U.S. and high inflation.

Walmart Anticipates a Store Manager Shortage Despite $200,000-a-Year Pay Retailer wants to train college graduates to be store managers and move workers into corporate roles to build its talent pipeline

Bank of America Clients Hoard Cash at Highest Level in Two Decades Stagflation worries are rising among the bank’s customers, its latest survey shows.

Cash levels among investors hit the highest level since September 2001, the report showed, with BofA describing the results as “extremely bearish.” The survey of investors with $872 billion under management also showed that hawkish central banks are seen as the biggest risk, followed by a global recession, and stagflation fears have risen to the highest since 2008. (…)

Fears of a recession trumped the tail risks from inflation and the war in Ukraine, BofA’s survey showed. The bearishness has been extreme enough to trigger BofA’s own buy signal, a contrarian indicator for detecting entry points into equities. Strategists such as Kate Moore at BlackRock Inc. and Marko Kolanovic at JPMorgan Chase & Co. have also suggested that concerns of an imminent recession are overblown. (…)

Overall, investors are very long cash, commodities, healthcare and consumer staples, and very short technology, equities, Europe and emerging markets. (…)

- Fund managers are most underweight equities since May 2020; net 13% versus 6% overweight last month (…)

- The Fed ‘put’ is seen at 3,529 for the S&P 500, which is about 12% below the current level

Tiger Global slashes bets on tech groups after stock market sell-off Value of hedge fund’s public shareholdings fell by almost $20bn during first quarter

Investors pull $7bn from Tether as stablecoin jitters intensify

Henry Kissinger: ‘We are now living in a totally new era’ The FT’s US national editor, Edward Luce, talks to former US secretary of state, Henry Kissinger, about Vladimir Putin’s invasion of Ukraine and the spectre of nuclear war.

China’s race to provide for its aging population

As the world’s largest population rapidly ages, China is in a race against time to build a pension system capable of providing for its ballooning group of elderly.

About 18.9% of China’s 1.4 billion people were older than 60 as of the end of 2021. The proportion expanded by 5.64 percentage points within a year, according to data from the National Statistics Bureau. By 2025, people older than 60 will account for 20% of the population and by 2035, 30%, the Ministry of Human Resources and Social Security (MHRSS) projected.

But the country’s pension system is struggling to keep up with the pace of the graying population. At the end of March, the accumulated balance of all types of pension funds — including those funded by the government, by employers and by individuals — totaled 15 trillion yuan ($2.2 trillion), or 13% of GDP. That compares with a pension system equivalent to 150% of GDP in the United States, 130% in Australia and 90% in Singapore.