COMPOSITE PMIs

Eurozone growth rebounds in February as output price inflation hits new survey high

Following January’s slowdown, economic growth regained momentum midway through the first quarter to reach its strongest pace since last September. Expansions were of equal strength across both manufacturing and services during February, with a more substantial rebound from January in the latter driving the resurgence in growth at the composite level.

However, the accelerated expansion in business activity was accompanied by a survey-record increase in prices charged for goods and services.

After slumping in January to an 11-month low, the seasonally adjusted IHS Markit Eurozone PMI® Composite Output Index rebounded from 52.3 to 55.5 in February. Overall, this signalled the strongest increase in combined manufacturing and services output since last September. The expansion was also faster than the series average, but was still weaker than the highs seen in the second half of last year as business capacity was constrained by supply shortages and poor staff availability.

By sector, rates of output growth were of equal strength at manufacturers and service providers. A notable improvement in service sector growth following January’s virus-driven slowdown drove the quicker overall upturn.

Supporting greater levels of business activity were rising intakes of new business, latest survey data showed. Demand for euro area goods and services increased for a twelfth successive month in February, with the expansion gathering pace to the quickest since last September. Stronger increases in new orders were seen at both sectors.

Business activity was also buoyed by demand conditions across external markets during February as new export orders rose. The upturn, albeit the fastest in four months, was slightly slower than that seen on average across the current 15-month expansion sequence.

To sustain activity levels, and accommodate for growing intakes of new business, private sector employment across the eurozone increased during February. The rate of job creation also gathered some momentum, accelerating to a three-month high. The increase in staffing levels was particularly sharp at manufacturers, although hiring at service providers was nevertheless solid in the context of historical data.

Employment growth also coincided with a stronger level of business optimism in February. The Future Output Index increased to an eight-month high.

Despite increased workforce numbers, latest survey data highlighted additional strain on operating capacities in February as backlogs of work grew. The rate of accumulation was the fastest in six months and among the strongest on record.

Finally, latest survey data pointed to an intensification of price pressures across the eurozone in February. For the second successive month, input costs increased at a faster rate. Moreover, the rate of inflation was the second-quickest on record, surpassed only by last November’s peak. Selling price inflation meanwhile hit a survey high during February.

The IHS Markit Eurozone PMI® Services Business Activity Index rose to 55.5 in February, signalling the strongest expansion in services output for three months and a notable turnaround from January’s nine-month low of 51.1.

Other key gauges of sectoral health also rose in a robust fashion during February, with new orders and employment growing at faster rates than at the beginning of the year. There was, however, a sharper rise in volumes of outstanding business, as backlogs accumulated to the strongest extent since last August.

Business confidence meanwhile strengthened from January. The level of optimism was historically elevated and the greatest in four months.

Meanwhile, service sector companies in the euro area recorded sharper inflationary pressures in February. Input costs and output prices rose at faster rates and in both cases, the increases were the sharpest on record.

Chris Williamson, Chief Business Economist at IHS Markit said:

The survey data for February depict a eurozone economy that was regaining robust growth momentum ahead of the invasion of Ukraine. Business activity accelerated to a pace commensurate with GDP growth in excess of 0.6%, buoyed by a relaxation of virus restrictions. (…)

Prices rose to the greatest extent yet recorded in almost a quarter of a century of data collection.

(…) the risks are heavily tilted towards inflation running even higher and persisting for longer than previously expected, squeezing household budgets. (…)

With inflation risks rising and growth prospects waning, the Ukraine conflict adds to business and household headwinds for the coming months, and exacerbates the difficult juggling act of the ECB in controlling inflation while sustaining a robust economic recovery.

China: Services activity expands at slowest rate for six months

Latest survey data signalled a further slowdown in business activity growth across China’s service sector in February. Output rose only slightly overall, while firms reported a renewed fall in overall new business, which was linked to the ongoing pandemic and measures to contain the virus. Employment meanwhile fell slightly for the second month in a row, and backlogs of work increased marginally. Cost pressures eased, with both input costs and output charges rising at slower rates than those seen at the start of the year.

Despite the recent slowdown in activity growth, businesses expressed stronger optimism for the year ahead, often linked to forecasts of a robust post-pandemic recovery.

The seasonally adjusted headline Business Activity Index slipped from 51.4 in January to 50.2 in February, to signal only a marginal rise in services activity. Notably, the expansion was the softest seen since the current period of growth began last September. According to panel members, the ongoing pandemic and measures to stem the spread of the virus had dampened business activity.

Measures to contain COVID-19 cases, including travel restrictions, also impacted client demand, which fell for the first time in six months. Though mild, it marked the quickest decline in total new work since April 2020. This was partly due to a further reduction in new export business, which was reportedly also dampened by the pandemic.

Capacity pressures moderated in February, as highlighted by a softer increase in outstanding workloads. Notably, the rate of accumulation was the slowest seen for four months and only marginal. When higher backlogs were reported, this was generally due to the pandemic and its impact on operations and logistics.

Service sector employment in China fell for the second month running in February. However, the rate of job shedding eased since January and was only slight. Firms that registered lower headcounts often linked this to relatively subdued demand conditions and challenges recruiting or replacing workers due to COVID-19.

Latest survey data showed a notable slowdown in the rate of input price inflation midway through the first quarter. The latest increase in input costs was the softest since August 2021 and mild overall. Where higher expenses were reported, they were often attributed to greater costs for raw materials, energy and labour.

The rate of prices charged inflation likewise slowed in February. Service providers raised their fees only modestly, with some firms choosing to raise their fees in order to pass on additional cost burdens to clients. However, there were reports that increased competition for new business had limited overall pricing power.

Although firms saw a further slowdown in growth momentum during February, optimism around the 12-month outlook for output improved to a three-month high. Service providers generally expect a strong post-pandemic recovery, improving customer demand and new product launches to drive activity growth over the next year.

Fed Beige Book Says U.S. Economy Grew Modestly Amid Omicron Surge Rising costs and difficulty hiring persist, companies say in the Fed’s periodic compilation of business anecdotes from around the country.

(…) The report contains information gathered through Feb. 18, after the Omicron variant drove up Covid-19 cases and hospitalizations to record highs the month before. (…)

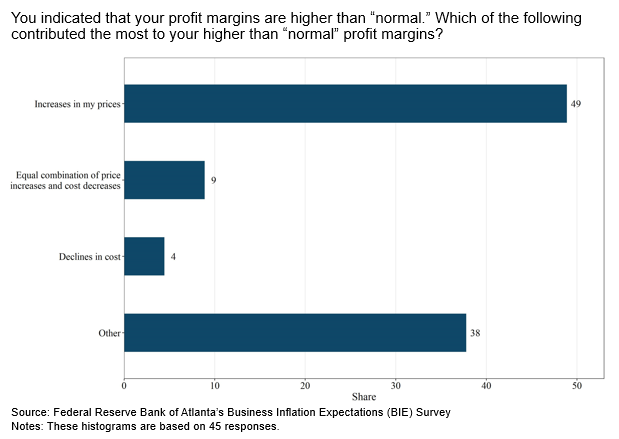

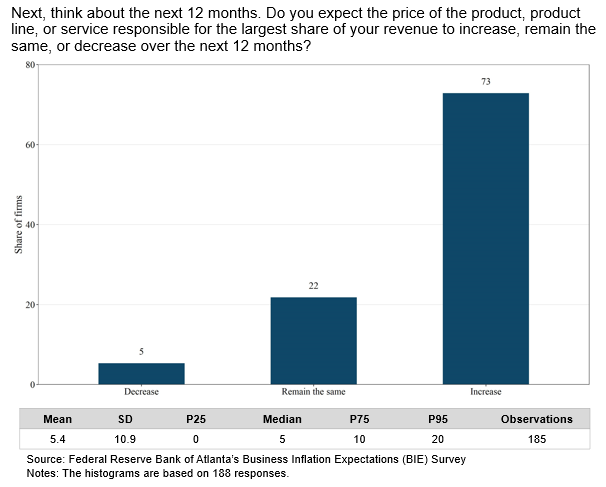

Businesses across the country reported that the prices they charged customers rose robustly, mostly due to the rise of transportation costs. The increased costs of labor and continuing material shortages also contributed to the rise in consumer prices. These businesses expect consumer prices to rise “over the next several months as they continue to pass on input cost increases,” the report said. (…)

Companies across the country also indicated that they have raised or plan to raise wages for lower-paid workers, but many of them also expect those gains to eventually plateau this year. Staffing agents in the Federal Reserve System’s Cleveland district said that some businesses can’t afford to pay workers much more.

A bank in the Fed’s Dallas district reported that it raised its minimum wage to $18 an hour to address retention issues. One manufacturer in the Federal Reserve’s St. Louis district estimated that its labor costs increased 5% to 20% because of overtime and hazard pay. (…)

A manufacturing company in Arkansas said that it has tripled or plans to triple its number of robotic welders to cope with a difficulty in hiring workers. (…)

Schroders just published a piece on automation:

(…) the next decade looks set to herald a new cycle of capital expenditure (capex, or spending on buying, upgrading or improving physical assets).

Companies will lift long-term spending, with investment in automation spearheading this as it addresses both capacity and resilience concerns at the same time. (…)

We now see very clear data points, as well as commentary from company management teams, illustrating that we have reached the tipping point for both reshoring and automation. As the chart below shows, we think the potential for automation remains huge.

(…) 90% of respondents in a UBS Evidence Lab survey of companies in the US and North Asia said they expect to move production away from China within two years. Amid continued semiconductor shortages and tightness for logistics infrastructure, most management teams appear to be aiming to stabilise the supply chain.

For manufacturing moving out of China, popular destinations include Japan, South Korea and Taiwan. Southeast Asia appears to be a less popular destination than it was, maybe due to the impact of Covid lockdowns in various Southeast Asian countries like Vietnam and to concerns about supply chain risks. Nonetheless, we still think the region will prove attractive.

Critical industries like medical suppliers, automotive, semiconductors/technology, and aerospace look primed to reshore first. But as a crucial supplier to these industries, the capital goods sector is at the centre of this equation. Capital goods firms make machinery used to manufacture goods and products. (…)

Bank of Canada Raises Interest Rates to Curb Inflation Central bank said more rate increases are required, with inflation well above its 2% target and Ukraine conflict pushing prices upward

(…) Canada’s economy ended last year with what the central bank said was “very strong” fourth-quarter growth of 6.7% annualized, confirming that any spare capacity has disappeared. The level of gross domestic product is now above pre-pandemic levels. Despite a setback in January related to public-health restrictions tied to the Covid-19 Omicron variant, the central bank said household spending remains robust and it anticipates first-quarter growth to surpass expectations for a 2.4% advance. (…)

Russia’s invasion of Ukraine has thrown a curveball into central bankers’ plans, with the Bank of Canada describing it as “a major new source of uncertainty.” Canadian Finance Minister Chrystia Freeland said Tuesday that officials from the Group of Seven economies realize there will be economic collateral damage as Western allies aggressively impose sanctions on Russia.

In order for sanctions to really have an impact, Ms. Freeland said, “we are going to have to be prepared for there to be some adverse consequences for our own economies.”

One of those consequences, the Bank of Canada said, is hotter inflation. (…)

Powell yesterday:

to the extent inflation comes in higher or is more persistently high than that then we would be prepared to move more aggressively by raising the federal funds rate by more than 25bps at a meeting or meetings

Goldman Sachs last week:

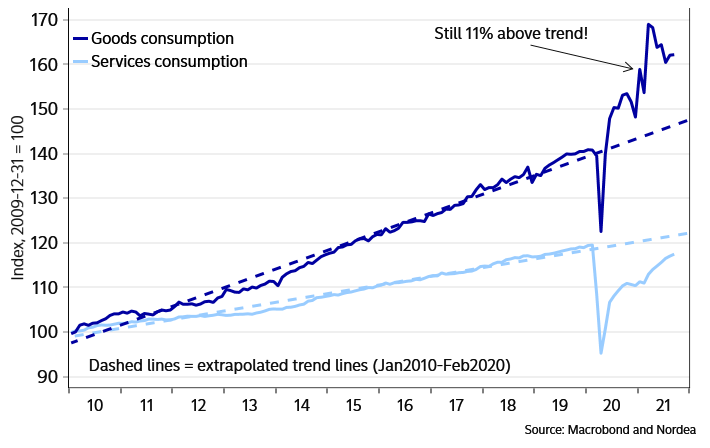

Much of the inflation overshoot has been driven by pandemic-related supply-demand imbalances for durable goods, and a key reason that we and other forecasters expect inflation to fall is that as these imbalances fade, the prices of supply-constrained goods like cars should not only stop rising so quickly, but partially revert toward their pre-pandemic trends.

However, costs of production for these goods have also grown faster than usual, which means that prices are not elevated solely because of scarcity and we should therefore not expect full reversion.

Our updated analysis implies that there is still substantial durables goods inflation payback in the pipeline, but less than we previously estimated. Payback is unlikely to materialize until 2022H2, and prices of some durable goods are likely to rise further in the near term.

FYI, the BLS now has this category “Commodities less food, energy, and used cars and trucks”, i.e. core goods less used cars.

MoM monthly since October: +0.5%, +0.8%, +0.9%. YoY in January: +7.2%. Last 3 months annualized: +9.1%. Last 2 month annualized: +10.6%.

Same data but for Durables: +1.4%, +1.6%, +1.2%. YoY in January: +18.4%. Last 3 months annualized: +17.9%. Last 2 month annualized: +18.0%.

- While Global Supply Chain Pressures Are Decreasing, Pressure Still Remains High

Sources: Bureau of Labor Statistics; Harper Petersen Holding GmbH; Baltic Exchange; IHS Markit; Institute for Supply Management; Haver Analytics; Bloomberg L.P.; authors’ calculations. Note: Each index is scaled by its standard deviation.

Recession watch

This is from NDR courtesy of CMG Wealth’s Steve Blumenthal who says to “focus on the data box in the lower right section of the chart. When the reading is ‘Above 70’ recession has occurred 93.02% of the time. When the reading is ‘Below 30’ recession has occurred just 17.65% of the time.”

PBOC Says Number of High-Risk Banks to Fall as It Cracks Down

By 2025, the number of lenders in the “high-risk” category in the PBOC’s quarterly reviews will likely drop below 200 from 316 in the fourth quarter of 2021, the central bank said in a statement Thursday. At the peak in the third quarter of 2019, there were 649 banks listed in the category, according to the statement.

High-risk banks accounted for only 1.04% of overall assets in the banking industry last year, indicating the sector’s stability, the PBOC said. China had 4,398 banking institutions in the last quarterly review, it said. (…)

FYI:

- Russian Foreign Minister Sergei Lavrov said he believed some foreign leaders were preparing for war against Russia and that Moscow would press on with its military operation in Ukraine until “the end”. Lavrov also said Russia had no thoughts of nuclear war. (Reuters)

I hope he is right, but …

I hope he is right, but …