NABE Survey Panel Foresees Further Economic Growth Over Next 12 Months, While Shortages, Higher Resource Prices Start to Affect Firms’ Decision Making

• The net rising index (NRI) for profit margins—the percentage of panelists reporting rising profits minus the percentage reporting falling profits in Q3 2021—is 25, a strong reading, but also a marked decline from the Q2 2021 record high of 35. This is the fifth consecutive survey in which the NRI is positive. The services sector has the largest profit margin NRI for the quarter at 35.

• The NRI for prices charged during Q3 2021 rose 12 points to 40, up from the Q2 2021 reading of 28. No respondents indicate their firms charged lower prices during Q3, and none expect their firms to cut prices over the next three months. Goods-producing firms lead the increase in price hikes, with 85% of respondents from that sector reporting that their firms charged higher prices in Q3, and 92% expecting price increases during Q4.

• The NRI for materials costs in Q3 2021 rose to 70—up from 59 in the previous quarter, and the highest reading since Q2 2008. Seventy percent of respondents report cost increases in Q3, up from 61% in Q2. NRIs for all sectors are positive, led by the transportation, utilities, information, and communications (TUIC) sector at 100, and followed by the goods-producing sector at 92. The NRI for expected costs in the next three months rose to 69 in the October survey, up from 50 in the July survey.

• The percentage of respondents indicating that wages rose in Q3 increased to 58% from 51% in the July survey. This is the fifth consecutive increase in the NRI for wages.

• Hiring decelerated during Q3 2021, resulting in the NRI for employment declining from 28 in the July survey to 23 in the October survey. Thirty percent of respondents cite increased employment at their firms during Q3, with 7% reporting declines.(…) The forward-looking NRI for employment fell to 24 in the October survey, down from 36 in the July survey. (…)

• According to panelists, the biggest downside risk to their company’s outlook is increased cost pressures, cited by 33% of respondents. (…)

• Almost two-thirds (65%) of respondents indicate that their firms will implement a flexible/hybrid work environment even after the pandemic subsides— up from 61% in the July survey.

• None of the panelists indicates that their firms’ labor shortages (if applicable) will abate by the end of 2021. Thirty-six percent of panelists expect this will happen sometime in 2022, and 14% specify it will happen in 2023 or later. Compared to results in the July survey, these shares are up from 18% and 10%, respectively. Nearly a quarter (24%) of panelists cites “Don’t know/NA,” indicating the uncertainty in the labor market.

• Half of the panelists indicates that their companies are experiencing delays or shortages in receiving materials or other inputs, up from 40% in the July survey, with those from the goods-producing sector accounting for the largest share holding this view. (…)

• Despite the increase in shortages and delays compared to those reported for Q2 in the July survey, panelists indicate that their firms are slightly less willing to push the higher costs on to customers. Indeed, 19% of panelists indicate that their firms are passing along these higher costs to their customers, down moderately from 22% in the July survey, with the largest share coming from the goods-producing sector. Twenty-one percent of panelists indicate that their firms are experiencing shortages, but not passing along the higher costs, up from 17% in the July survey.

• Thirty percent of panelists—led by those from the more labor-intensive services and FIRE sectors—anticipate that if their firms are experiencing higher input costs, they expect them to be permanent. This is up from the 22% who cited this in the July survey. Twenty-one percent of respondents anticipate that the increase in costs will be only temporary, down from 34% in the previous survey, and led by respondents from the more materials-intensive goods-producing sector. Nearly one-third (32%) of respondents indicates that their firms are not experiencing any significant cost increases, up from 27% in the July survey. (…)

Markit:

Average input costs consequently rose at record rates in the US, UK, Eurozone and Australia, with input costs in Japan rising at a pace not seen since 2008. Faster rates of increase were registered for both manufacturing and service sector costs across the major economies.

Prices charged also rose at accelerated rates as these higher cost burdens were passed down to customers, with rates of inflation reaching new survey highs in the US, Eurozone and UK and rising to the highest since 2018 in Japan.

Inflation Pinches Restaurants, but Customers Seem Willing to Split the Check Casual-dining stocks such as Brinker International are logging a major hit to profits from food and labor costs but should be able to pass more of it through in the future

Brinker International, EAT -0.18% owner of Chili’s, said last Tuesday that it earned 34 cents a share on an adjusted basis in its fiscal first quarter, which ended in September—far below Wall Street analysts’ estimate of 68 cents a share.(…) For Brinker, labor expense as a share of total revenue was up 1.5 percentage points from a year earlier while the share of food costs rose 0.6 percentage point.

That damaged the bottom line despite continued strong demand: Total revenue grew by 11% from the same quarter two years earlier, before the pandemic began. That growth could have been even stronger if it weren’t for the spread of the Delta variant during the summer. (…)

Brinker shares are down by about one-third over the past six months while Cheesecake Factory stock has shed about 28% over that period and BJ’s shares have lost about 36%. (…)

Brinker is raising prices by 3% to 3.5% this year to address higher costs. Pricing power is limited in the restaurant industry, but there is reason to believe that strong customer demand will absorb higher costs in the months ahead. (…)

From recent conference calls (courtesy of The Transcript):

- “In this Q3, also as we expected, we probably saw the highest inflation increase ever year-over-year. I mean 6.5% which is sitting in the Q3 P&L. Frankly, in 22 years, I never had a single quarter with that kind of inflation…going forward, we don’t expect that the inflation will quickly fall off and will be short term. But by definition that it will carry over into next year.” – Whirlpool (WHR) CEO Marc Bitzer

- “…as oil and gas prices increased, we are seeing improved energy sector demand. These positive market dynamics are driving strong steel demand across the platform. The steady demand, coupled with continued historically low absolute inventory levels throughout the supply chain, continue to support strong steel selling values, especially within the flat rolled steel market.” – Steel Dynamics (STLD) CEO Mark Millett

- “…it does feel like there is a lot of legs to this inflation story. I always hesitate to predict the macro, but in terms of innings it still feels like relative early innings, and I say that, because of product scarcity, with what’s happening with freight and with — what’s happening with labor the extreme shortages. It just seems like there is still ways to go and that’s consistent with most folks that I talked to. So I would say still relatively early innings of the story” – MSC Industrial Direct (MSM) CEO Erik Gershwind

- “…we anticipate significant supply chain inflation in fiscal 2022 due to higher cost related to raw materials, packaging and logistics.” – Simply Good Foods (SMPL) CFO Todd Cunfer

- “Despite higher prices, we are still sustaining a higher double-digit percentage retail pace currently than 2 years ago.” – Winnebago Industries (WGO) CEO Michael Happe

- “I think the transparency around wages is very high. So workers know exactly what they’re being paid today and what opportunities they have nearby that would pay more. And that’s why you see this increase in quit rates because workers are looking at the opportunities.” – ManpowerGroup (MAN) CEO Jonas Prising

- “PC demand remains very strong. And we believe that 2021 TAM will grow double-digits even as ecosystems shortages constrain our customers’ ability to shift finished systems. Dell, HP, Lenovo, along with other OEMs and ecosystem partners agree that PCs are now a structurally larger and sustainably growing market.” – Intel (INTC) CEO Pat Gelsinger

- “…in the near term, the light vehicle outlook will mainly be determined by the evolution of the situation around semiconductors. In North America, the industry continues to struggle to meet consumer demand for new vehicles due to the shortage of semiconductors. Inventory of new vehicles in the U.S. ended September below 1 million units, the lowest level seen for at least 35 years.” – Autoliv (ALV) CFO Fredrik Westin

- “In terms of some of the pressures year-over-year. I mean, it really is a lot driven by fuel. The cost per gallon and if I’m looking at it year-over-year is going to be up anywhere from call it 75 to 80%. And that’s just very tough to overcome, especially with flat volumes, because that’s essentially how we’re looking at things and you think about our volume guidance in the 5% for full year.” – Union Pacific (UNP) CFO Jennifer Hamann

CFOs Plump Salaries, Perks to Land Elusive New Employees Amid the ‘Great Resignation,’ companies have to offer compensation that stands out in order to draw new workers—and hold on to the ones they have

(…) Workers handed in a seasonally adjusted 4.3 million resignations in August, a record since tracking began in 2000 that came after months of elevated departures, according to the Bureau of Labor Statistics. Jobless claims last week dropped to the lowest level since March 2020.

The “Great Resignation” is exacerbating skills shortages across industries and forcing companies to pay more, driving up costs at a time of already high inflation. In a survey released last week, chief financial officers at U.S. businesses said quality and availability of labor was their No. 1 concern, with three-quarters of them stating they have difficulty hiring, according to Duke University’s Fuqua School of Business, which conducted the poll with the Federal Reserve Banks of Atlanta and Richmond.

Companies plan to keep hiring new workers and increasing non-wage compensation—for example, for healthcare and other benefits, the survey of 301 CFOs found. Wage bills are forecast to rise by 6.9% this year and next, while wages for new hires are set to rise by about 10%, according to the survey. (…)

“We expect these salary increases to be permanent,” Mr. Graham [professor of finance at the Fuqua School of Business] said. “And they absolutely increase costs for the firms, putting pressure on the firm to increase prices of their own products and thus increasing inflation.” (…)

“It feels like the balance of power has changed from the recruiter to the recruit,” CFO Debbie Clifford said. “I have never seen a market like this in my career.” (…)

Salary growth at companies in the S&P 500 has been flat in recent years, with median compensation per employee totaling $70,496 in 2020, up from $68,410 in 2017, according to MyLogIQ, a data provider. (…)

Team Biden is making the situation worse (Nordea)

(…) Vaccine mandates are intensifying the distortions on the US labour market.

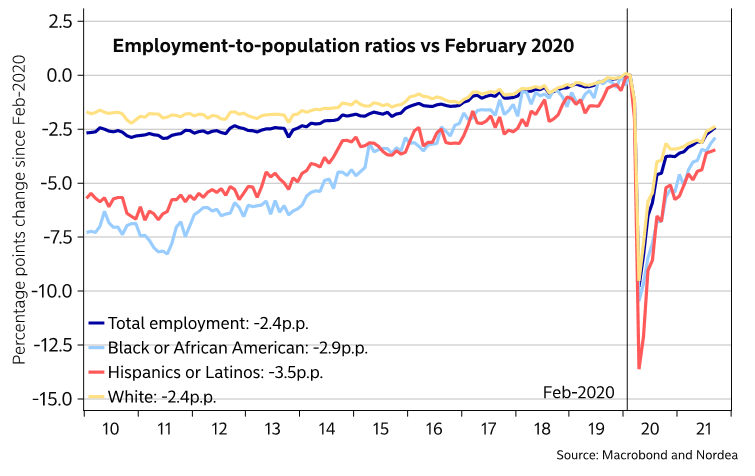

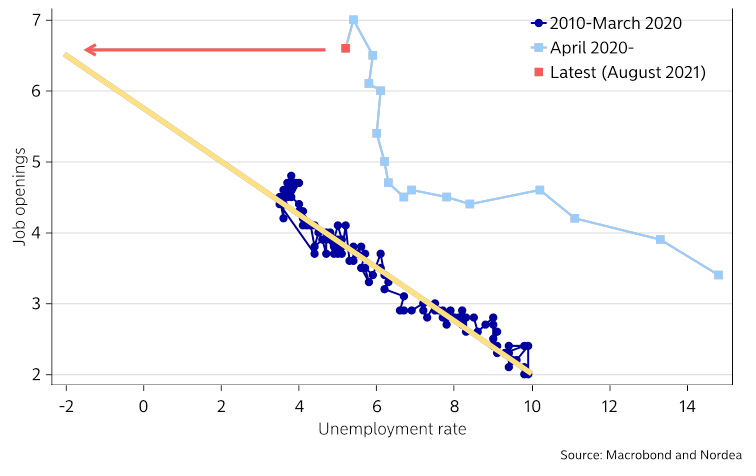

While employment-to-population ratios suggests there should be lots and lots of wage-depressing slack in the labour market, an updated Beveridge curve suggests otherwise – that the equilibrium rate of unemployment/NAIRU (or whatever the economist priest-class calls it nowadays) has surged.

There should be massive slack according to EPOP ratios

Pre-pandemic Beveridge curve suggests an unemployment rate at -2%

The pre-pandemic relationship between job openings and the unemployment rate (the so-called Beveridge curve) suggests that we ought to have been seeing a -2% unemployment rate. However, with workers afraid of the virus, or having trouble to find child care, trying to move from the service sector to the goods sector, NAIRU will be higher at least for a while. Thousands upon thousands of workers have also been fired due to vaccine mandates, which is intensifying worker shortages in some regions (and reducing the flexibility of the US labour market). This is inflationary. Jobless New York nurses are of course welcome to Florida but relocating takes time and it boosts frictional unemployment and thus NAIRU – again at least temporarily.

- Kentucky has the highest rate of job quitters in the nation. Kentucky has a large concentration of jobs in warehousing and transportation — two sectors that have seen employees flee for better working conditions and pay. The rate of job openings in Kentucky (8%) is among the country’s highest (second only to Alaska, 9%). At a national level, it’s 6.6%. There are two open jobs for every unemployed Kentuckian. That doesn’t beat out Nebraska, however, which has three available gigs for every jobless person. The place with the lowest quits rate? D.C. (Axios)

(Bureau of Labor Statistics; Chart: Will Chase/Axios)

Europe’s Power Prices Rise on Growing Cold Weather Predictions

EARNINGS WATCH

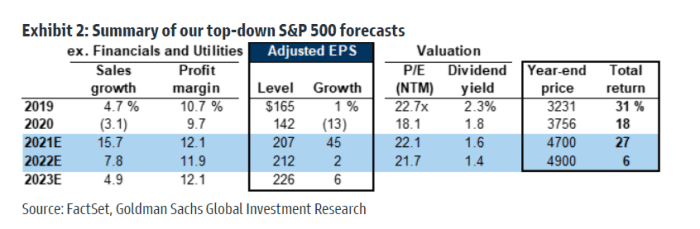

We now have 119 reports in, an 83% beat rate and a +13.9% surprise factor. Deutsche Bank says that a large part of the beat so far is due to loan-loss reserve releases by banks. Excluding those, the surprise factor for the S&P 500 in aggregate is running at a more modest 8.0%, and for the median company at 5.2%, indicating that the headline beats have not been broad based.

We now have 119 reports in, an 83% beat rate and a +13.9% surprise factor. Deutsche Bank says that a large part of the beat so far is due to loan-loss reserve releases by banks. Excluding those, the surprise factor for the S&P 500 in aggregate is running at a more modest 8.0%, and for the median company at 5.2%, indicating that the headline beats have not been broad based.

Interestingly, with nearly 25% of companies having reported, overall margins are up significantly as blended earnings growth is seen at +34.8% against revenues up 14.4%.

So far, only 3 sectors are not showing improving margins: Consumer Discretionary, Staples and Utes, sectors at the very end of the price pipeline.

(FactSet; Chart: Thomas Oide/Axios)

TECHNICALS WATCH

Stocks’ Internal Momentum Has Turned Up

Large caps:

But not small caps:

Hence, NYSE not breaking out just yet:

Many times over the past couple of decades, we’ve discussed the idea that stocks are less likely to suffer a large drawdown in the following months when the advance/decline line breaks out to a new high. We typically use the NYSE Advance/Decline Line, but our version of that indicator hasn’t quite made it over the hump. It very well might on Monday if stocks have a good day.

Below, we can see that since 1928, the S&P 500 was three times more likely to suffer a 10% decline at some point within the next three months if the S&P’s Advance/Decline Line was not at a multi-year high. When it did break out to a new high, as it did on Friday, there was only a 4.6% probability of a 10% or greater decline within the next few months and less than a 2% chance of a 20% decline. Since 1928, the only two instances were the Black Monday crash in October 1987 and the pandemic crash in March 2020.

But The Market Ear notes a changing leadership:

Big tech remains unimpressed with the latest SPX all time high. Big tech (here represented by the FDN index) hasn’t even been able to try all time highs and continues fading the SPX since mid July.

Note that the FDN hasn’t moved since the euphoria highs in mid Feb, while SPX is up some 600 handles since then.

Can this market continue moving higher without the pillar of this market joining?

Chart 2 showing the top 10 components of the FDN index.

Seasonality is positive for the next 2 months as Horan illustrates:

LIQUIDITY WATCH

Maybe an early 2022 story:

Yellen ready to zap dollars while Powell is going taper (Nordea)

Treasury Secretary Yellen has stated that the debt ceiling needs to be fixed by early December, providing us with a new so-called X-date. Fixing the debt ceiling would enable the Treasury to rebuild its crisis account (TGA) at the Fed, which will zap more than 750bn of dollar liquidity over a couple of months – if the latest refunding estimate of a 800bn target for the TGA is to be believed. This boils down to quantitative tightening (QT).

At roughly the same time, the Fed is expected to start tapering its bond purchases. Assuming both processes unfold in December through March, Fed may add 340bn of USD via its QE program while the UST will sterilize >750bn of USD – a net negative of >400bn!

Less liquidity and more issuance could be factors which will underpin the USD in unexpected ways as Christmas starts to approach – perhaps even a Bad Santa Powell will pay you a visit?

- The U.S. regulator is poised to rein in the $131 billion stablecoin market. A report this week will say the SEC has significant authority over tokens like Tether, people familiar said. It will also urge Congress to specify coins should be regulated like bank deposits. (Bloomberg)

Chinese Developer Modern Land Fails to Repay $250 Million U.S. Dollar Bond The Hong Kong-listed real-estate company that focuses on green projects, failed to repay the bond that matured Monday, adding to a string of missed payments by Chinese real-estate companies.

In a statement Tuesday, the Beijing-based company attributed the missed payment to an unexpected cash crunch caused by “factors including the macroeconomic environment, the real-estate industry environment and the Covid-19 pandemic.”

Modern Land didn’t say if the failure to repay the bond would immediately constitute an event of default, or whether it would trigger cross-default provisions on other debts. Credit analysts at Lucror Analytics called the incident a default in a note to clients. (…)