FIBER: Industrial Commodity Prices Edge Higher

The Industrial Materials Price Index, from the Foundation for International Business and Economic Research (FIBER), increased 1.4% during the four weeks ended April 16, leaving prices up 45.1% y/y.

Prices in the miscellaneous group rose 3.0% during the last four weeks. Framing lumber prices rose 23.3% and continued to reflect strength in home building. Plywood prices have been unchanged since December 2019. Natural rubber prices declined 6.0% in the last four weeks.

Improvement in the metals group moderated as prices edged 0.4% higher during the last month. The gain was paced by a 4.7% rise in aluminum prices. Lead prices rose 1.9% during the last four weeks (17.0% y/y). The price of copper scrap eased 0.6% and steel scrap prices were off 0.4%. Zinc prices weakened 0.7% (46.4% y/y).

Prices in the crude oil & benzene group rose 3.3% during the last four weeks reflecting a 29.2% surge (252.4% y/y) in prices for the petro-chemical benzene. Crude oil prices declined 4.4% to $61.14 per barrel. Excluding crude oil, industrial commodity prices rose 1.7% in the last four weeks. (Haver)

Materials inflation is reflected in the Manufacturing PMI-Prices Paid Index which leads the PPI:

But investors don’t seem terribly worried:

Complacency?

JP Morgan says that “rising input costs should not be feared at the overall market level…PPIs maintain a clear positive correlation to earnings, and to margins.”

Same Treasury yield chart as above but against CPI:

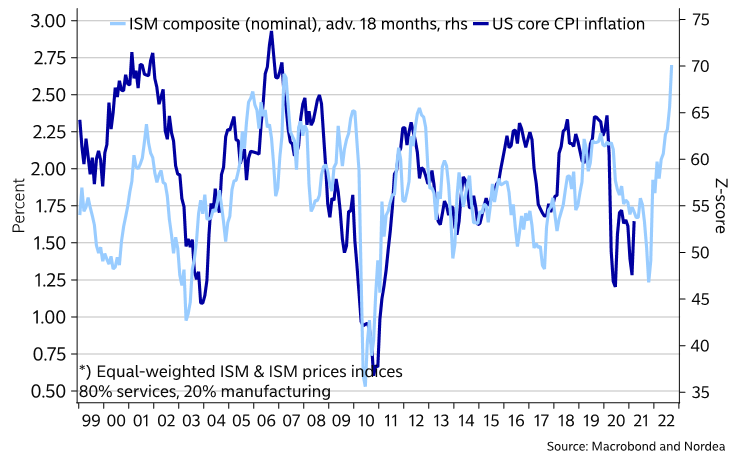

Finally, this Nordea chart suggesting core inflation above 2.5% in late 2022. Happy Fed!

Nominal ISM composite suggests accelerating inflation into 2022

Swedish housing market: Through the roof Home prices increased rapidly to new highs in March. Home prices rose by 2.1% (m/m) and increased by 15.5% over the year. House prices continued to increase more than apartment prices and were up 20.3% (y/y).

SUPPLY vs DEMAND

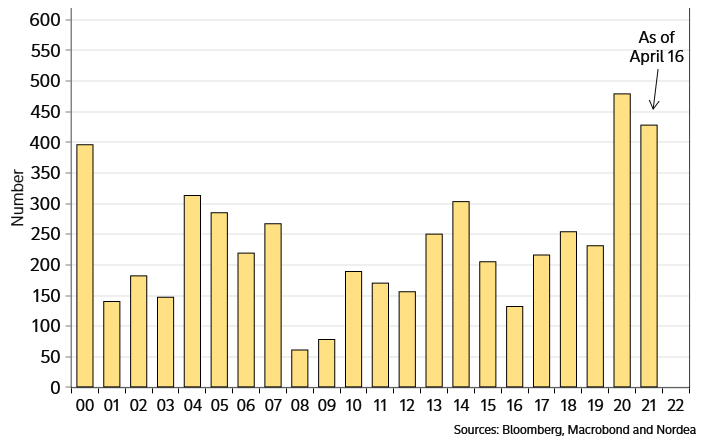

Remember the “shortage of equity” theme? Nordea revisits that:

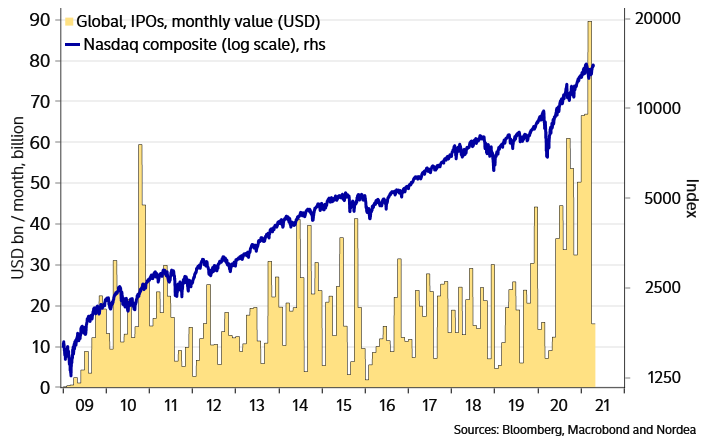

(…) As many as 480 companies were listed on the stock exchange last year, and 2021 has started off way stronger than that – with more than 426 IPOs year to date. If this extreme pace continues throughout the year, as many as ~1,600 companies will be listed this year (are there even that many?).

And it’s not only about the number of IPOs, the value on offer has been surging too – especially since last summer. (…)

Here’s a longer-term chart from Lohman Econometrics:

Sell in May?

Entering summer has traditionally not been a favourable time for equities. Seasonality of MSCI World performance (since 1970):

Datastream

This bull market has tracked the 2009 / 2010 bull market very closely. Recall then, it corrected into the summer months before moving back to new highs by YE10. (The Market Ear)

Morgan Stanley

Some people are not waiting for May as I showed yesterday (via Barron’s)

Here’s a longer-term view courtesy of SentimenTrader:

A weekly ratio of insider sales to buys as computed by Thomson Reuters skyrocketed to an astounding 143-to-1, the highest in the weekly readings as reported by Barron’s in at least 16 years.

COVID-19

Covid-19 Cases Rise in Parts of U.S. Even as Vaccinations Pick Up Public-health officials say relaxed restrictions, pandemic fatigue and variants are contributing to increasing infections in some places.

The seven-day average number of new Covid-19 infections eclipses the 14-day average in about half the country, with 40 states hitting that benchmark last Wednesday. (…) The CDC reported Monday that the seven-day average of new Covid-19 cases is at more than 67,443, up 1% from the prior seven-day average of 66,702. Four weeks ago, the seven-day average was 53,000 cases a day, said Dr. Rochelle Walensky, director of the CDC, during a press briefing Monday. (…)

- Coca-Cola Sounds Alarm on Global Covid-19 Cases With Covid-19 cases surging in some huge markets, Coca-Cola is right to be cautious about continued sales recovery

(…) Chief Executive James Quincey warned analysts on a conference call Monday not to expect a straight-line recovery from this point, noting that confirmed Covid-19 cases globally hit a high last week.

While some countries such as the U.S. and the U.K. are making rapid progress on vaccinations and beginning to reopen, Mr. Quincey said, “you’ve got countries that are going in the exact opposite direction with cases shooting up and more levels of lockdowns.”

Mr. Quincey didn’t name any specific countries, but cases are surging in huge markets including Brazil and India. And the worries aren’t confined to the developing world: The governors of two major Japanese cities, Tokyo and Osaka, both have said in recent days that they are considering declaring new states of emergency due to the spread of virus variants.

This is especially concerning for multinationals such as Coca-Cola, which last year derived only one-third of total revenue from North America. The one saving grace for such companies is that the U.S. dollar remains weak relative to many global currencies, making their overseas earnings worth more in dollar terms. Coca-Cola said this would result in a considerable tailwind of 5 to 6 percentage points to earnings-per-share growth in the second quarter. If the U.S. recovery continues to dramatically outpace the rest of the world, though, then even that may not last.

- The major Asia indexes are mixed in afternoon trading with Japan’s Nikkei off nearly 2%, the biggest fall in a month as further COVID restrictions loom. (Fortune)

Global Corporate Tax Gains Momentum The Netherlands, long seen at the heart of a system in which multinationals minimize their taxes, signals it’s ready to support a U.S. proposal.

(…) The Tax Justice Network this year labeled the country the world’s fourth-biggest tax haven after the British Virgin Islands, the Cayman Islands and Bermuda.

U.S. President Joe Biden’s administration has proposed combating such tax-reduction strategies with a global minimum tax rate of 21%, and a system for ensuring that the world’s 100 or so biggest companies pay more in places they actually do business.

Vijlbrief said he expects a deal by July. That’s in line with the aims of the U.S. and the other members of the Organization for Economic Cooperation and Development, which has been trying for years to get its more-than 135 members to agree.

It would also require the assent of other small nations such as Ireland and Luxembourg that have used competitive taxation to attract business. (…)

- Markets Haven’t Priced in Biden’s Tax Hikes Yet Higher corporate rates may have a big impact. Investors should start preparing. (John Authers)

(…) One further reason for reform is that the tax cut didn’t have the hoped-for effect. There was no obvious boom in capital expenditures or research and development. What did happen was a startling rise in buybacks, almost entirely by companies with lowered tax rates. (…)

It’s just possible that President Trump destroyed the value factor, and a reversal of his corporate tax cut could aid a revival. The following chart from Cara of Absolute Strategy shows the effective tax rates paid by the cheapest and most expensive U.S. large-cap stocks. The cheapest saw a much smaller reduction than the most expensive. Over the preceding decade, cheap and expensive stocks paid tax at much the same rate. Judging by this chart, the Trump cut may have had much to do with the subsequent collapse of value stocks:

(…) More or less any reform that passes will have a bigger negative impact on information technology and healthcare than other sectors. That is because these companies have relatively large foreign profits, and a relatively low effective tax rate on them, as this chart from Credit Suisse Group AG shows:

Credit Suissse also crunched the numbers on the assumption of a hawkish tax hike, in which the rate rose to 28% with a minimum of 15%.Tech would still enjoy the lowest rates, but endure by far the sharpest increase:

Using the same assumptions, consumer discretionary, healthcare and tech companies would take the biggest hit to earnings, while materials and energy would be least affected: (…)

- Senate Democrats settling on 25% corporate tax rate (Axios)

While increasing the rate from 21% to 25% would raise about $600 billion over 15 years, it would leave President Biden well short of paying for his proposed $2.25 trillion, eight-year infrastructure package.

Biden’s plan to increase the rate U.S. multinationals pay on their foreign earnings from 10.5% to 21% is less controversial and stands a better chance of remaining intact in the final legislation. That would raise an additional $700 billion.

Why the Chip Shortage Is So Hard to Overcome Semiconductor producers are trying to increase output by changing manufacturing processes, opening spare capacity to rivals and swapping over production lines. But the small gains are unlikely to fix the shortfalls hampering production of everything from cars to home appliances to PCs. The bad news is, there are no quick fixes, and shortages will likely continue into next year, according to the industry’s executives.

Nvidia’s Deal to Buy Arm Faces U.K. Security Probe The British government said it would investigate Nvidia’s $40 billion deal to buy British chip designer Arm from SoftBank, widening the regulatory scrutiny of the proposed transaction.

Russian military buildup near Ukraine larger than in 2014- Pentagon

- Axios scoop: Leak shows scope of Russian aggression

Russia is holding last-minute military exercises that threaten to strangle Ukraine’s economy, according to an internal memo from Ukraine’s ministry of defense reviewed by Axios’ Jonathan Swan and Zachary Basu. With the eyes of the world on the massive buildup of troops in eastern Ukraine, the leaked document shows Russian forces escalating their presence on all sides of the Ukrainian border.

The leaked Ukrainian document estimates that the total area of Russian military exercises takes up 27% of the Black Sea — a proportion that has steadily crept up, in a sign of efforts to establish de facto control over international waters.

It finds a “high probability” Russia may be trying to provoke Ukrainian forces to create a pretext for incursion, like in Georgia in 2008.

![image_thumb2[1] image_thumb2[1]](https://i0.wp.com/www.edgeandodds.com/wp-content/uploads/2021/04/image_thumb21_thumb.png?resize=554%2C313&ssl=1)