U.S. Industrial Production Holds Steady While Factory Output Declines

Industrial production was unchanged last month (2.1% y/y) following a 1.1% April jump, revised from 1.0%. Manufacturing sector output declined 0.4% (+1.4% y/y) after a 1.1% increase, revised from 1.0%. Utilities output increased 0.4% (0.1% y/y). Mining output improved 1.6% (8.3% y/y), the fourth month of strong increase this year.

Production of final products held steady (1.6% y/y) after a 1.6% jump. Consumer goods production rose 0.2% (1.2% y/y) after a 1.7% jump. Durable consumer goods output declined 0.7% (+3.8% y/y) after a 2.4% increase as motor vehicle output fell 1.0% (+5.8% y/y) following a 4.1% increase. (…)

Capacity utilization eased to 76.6% while factory sector utilization declined to 75.5%. Factory sector capacity rose a steady 0.7% y/y.

Philadelphia Fed Factory Conditions Index Falls Sharply

The Philadelphia Federal Reserve reported that its General Factory Sector Business Conditions Index declined to 27.6 during June and reversed most of May’s jump to 38.8 in May.

The ISM-Adjusted General Business Conditions Index constructed by Haver Analytics fell slightly to 57.9 this month. This figure is comparable to the ISM Composite Index. During the last ten years, there has been a 71% correlation between the adjusted Philadelphia Fed Index and real GDP growth.

The decline in the overall index reflected a sharply lower shipments reading. That was accompanied by higher figures for new orders, unfilled orders, inventories and a higher delivery time index, which indicated the slowest delivery times since 2004.

The employment series eased to the lowest level since February. During the last ten years, there has been an 81% correlation between the jobs index and the m/m change in manufacturing sector payrolls. The average workweek reading slipped but remained near the March 2004 high.

Prices paid declined to the lowest level since October. Twenty-eight percent of respondents (NSA) reported paying higher prices, while four percent paid less. The prices received index increased to the highest level in three months.

U.S. Housing Starts Fall for Third Consecutive Month in May U.S. housing starts decreased for the third consecutive month in May, a sign home builders are struggling to meet buyer demand.

Housing starts dropped 5.5% in May from the prior month to a seasonally adjusted annual rate of 1.092 million, the Commerce Department said Friday. This figure carries a margin of error of 11.9%.

Residential building permits, an indication of how much construction is in the pipeline, fell 4.9% to an annual pace of 1.168 million last month, the agency said. (…)

Starts fell in May for single-family and multifamily construction. Permits last month were down 10.4% for buildings with multiple units and down 1.9% for single-family homes.

Data on housing starts tend to be volatile from month to month and can be subject to sharp revisions. Looking past month-to-month fluctuations, starts in the first five months of the year were up 3.2%. Permits during this period increased 5.5%.

FED UP?

The Fed’s credibility is under assault from a lot of pretty smart people. This is from Robert Kessler:

Yesterday, the Federal Reserve’s statement added another contrary indicator suggesting the end of the expansionary cycle; their avoidance of economic weakness. Going back 10 years, in June of 2007, US Treasury yields had begun to drop precipitously after 100 bonds were downgraded by S&P; the latest sign of the burgeoning sub-prime crisis. In the midst of this, the Fed’s 6/28/2007 statement characterized the economy this way,

“Economic growth appears to have been moderate during the first half of this year, despite the ongoing adjustment in the housing sector. The economy seems likely to continue to expand at a moderate pace over coming quarters. Readings on core inflation have improved modestly in recent months. However, a sustained moderation in inflation pressures has yet to be convincingly demonstrated. Moreover, the high level of resource utilization has the potential to sustain those pressures. In these circumstances, the Committee’s predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.”

No sense of any trouble, just worries about inflation. And yesterday, the Fed’s statement read (in-part),

“Information received since the Federal Open Market Committee met in May indicates that the labor market has continued to strengthen and that economic activity has been rising moderately so far this year. Job gains have moderated but have been solid, on average, since the beginning of the year, and the unemployment rate has declined. Household spending has picked up in recent months, and business fixed investment has continued to expand.”

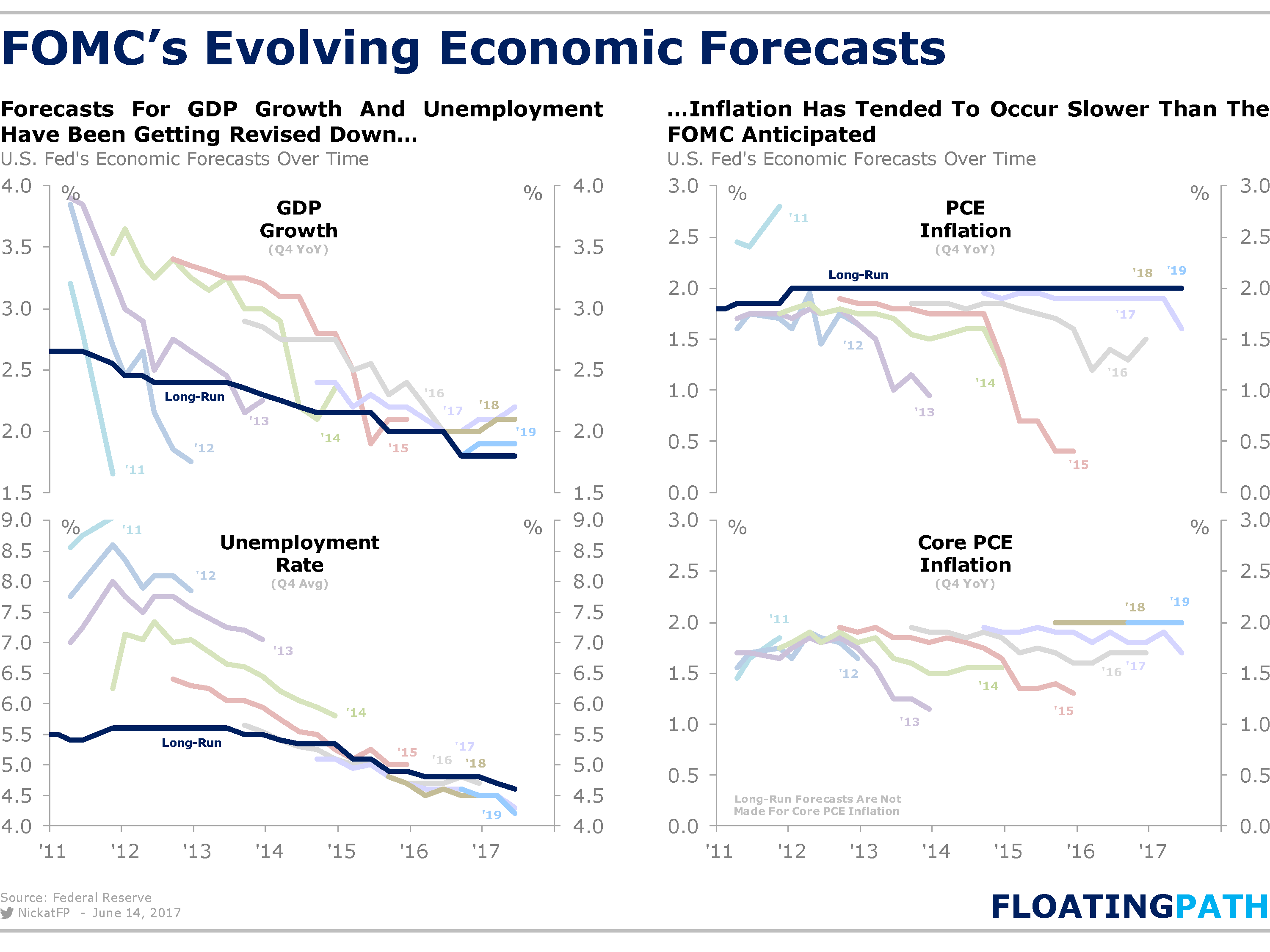

No acknowledgement of the weakness we have seen in a whole bevy of indicators missing their expectations (Citi Surprise Index). A lot of us could see the storm coming in 2007 just as we do today. Don’t mistake the Fed’s statement for an all-clear on the economy. It is likely just the opposite. Echoing this sentiment are three articles in the newspapers today with a similar topic:

- Wall Street Journal Fed Moves One Way, Inflation Another

- Financial Times The Fed can only ignore the lack of inflation for so long

- Financial Times Investors wary of Fed’s newfound assertiveness

ECB next?

Eurozone employment rises to record high as economic recovery gains strength

Employment rose 0.4% in the first quarter, according to Eurostat, in line with survey evidence which also suggests the rate of job creation has accelerated further in the second quarter. PMI data showed private sector employment growing at one of the fastest rates for a decade in May, with manufacturing jobs being created at a pace not previously seen in the 20-year survey history.

The surveys show jobs are being created across all major euro member states, albeit led by Germany.

Industrial production meanwhile rose 0.5% in April, indicating a strong start to the second quarter. The upturn in official production data also tallies with PMI data, which have indicated a strengthening recovery of eurozone manufacturing in recent months. The IHS Markit Eurozone Manufacturing PMI rose to a 73-month high of 57.0 in May, up from 56.7 in April.

Eurozone industrial production

Official data now show the single currency area growing 0.6% in the first quarter, up from a prior estimate of 0.5%. The faster growth is in line with the signals from the PMI surveys, which had been indicating a 0.6% expansion as far back as February.

The first quarter expansion is no aberration. In fact, running at six-year highs, the PMI readingsfor April and May suggest that the rate of GDP growth will have picked up further in the second quarter, rising to 0.7%.

The weak euro appears to be providing a major stimulus to the manufacturing sector.

The Eurozone Manufacturing PMI survey’s new export orders index has been hitting six-year highs in recent months. A ranking of PMI export orders growth in May showed euro member nations dominating the global leader board, holding seven of the top eight places.

European PMI sector data meanwhile add to signs that business investment is rising strongly in the second quarter. Output growth in capex bellwethers such as machinery & equipment, technology equipment and construction & engineering have all seen marked upturns in recent months, with growth accelerating especially sharply in the tech sector to a near-record pace in May. The latter was also the fastest growing sector covered by the PMI, with machinery & equipment manufacturing in third place.

Employment, exports, investment and economic output all therefore appear to be growing at increased rates in the second quarter, representing an encouragingly sustainable-looking upturn.

(…) “The economy is doing very well, is showing resilience,” said Fed Chairwoman Janet Yellen at a news conference following the Fed’s two-day policy meeting.

(…) “The economy is doing very well, is showing resilience,” said Fed Chairwoman Janet Yellen at a news conference following the Fed’s two-day policy meeting.