U.S. Housing Starts Jumped in June

Housing starts rose 8.3% in June from the previous month to a seasonally adjusted annual rate of 1.215 million, the Commerce Department said Wednesday.

Residential building permits, which can signal how much construction is in the pipeline, increased 7.4% to an annual pace of 1.254 million last month. That was the largest one-month jump since November 2015. (…)

Housing starts in the first six months of 2017 were up 3.9% from the same period in 2016. Permits during this period increased 6% from a year earlier.

Starts rose 6.3% in June for single-family construction and increased 13.3% from May for multifamily construction. Permits last month were up 13.9% for buildings with multiple units and up 4.1% for single-family homes. (…)

The increased pace of multifamily construction could create additional challenges for apartment landlords, who already are struggling with tepid rent growth and rising vacancies due to an increase in rental units. The national vacancy rate climbed to 4.4% this spring from 4.2% a year earlier, according to data released by Reis Inc. this week. Average rents across the U.S. increased 3% year-over-year in the second quarter to $1,335 a month, the smallest year-over-year increase since 2011. (…)

From Haver Analytics:

By region, starts in the Northeast strengthened 83.7% (38.6% y/y) to 158,000, the highest level since October. In the Midwest starts, increased 22.0% (9.0% y/y) to 205,000, a seven month high. Starts in the West improved 1.6% (6.0% y/y) to 319,000, the highest level since February. Starts in the South declined 3.8% to 533,000 (-9.2% y/y), the fifth consecutive monthly shortfall.

-

Starts Gain Too Little, Too Late for Second-Quarter GDP

A sharp rebound in housing starts in June, following three months of declines, will not provide enough of a boost to overall residential investment in the second quarter to maintain the first quarter’s stellar pace.

Residential investment jumped by a solid 13 percent in the first quarter, contributing 48 basis points to GDP growth of 1.4 percent in the period. But in the second quarter, housing starts declined and home sales slowed (albeit offset by strong residential-renovation growth), implying that residential investment likely advanced by less than half of the previous quarter’s pace.

The silver lining of the June housing starts report is a strong rebound in single-family permits, which provides reason to believe that the soft patch in the second quarter will prove to be temporary. With growth in multifamily construction slowing amid falling demand and record supply, home construction will increasingly have to rely on single-family units. (…) (Bloomberg Briefs)

Low Earners Are Making the Biggest Gains for the First Time in Years For the first time in years, pay for lowest-income Americans is rising faster than for other groups. Weekly pay for earners at the lowest 10th percentile of the wage scale rose at a faster rate last quarter, from a year earlier, than any other group.

(…) Last quarter marked the first time since late 2010 that this earning group’s gains outpaced all others. Usual weekly earnings for workers ages 25 and older at the bottom of the pay scale rose 3.4% from a year earlier in the second quarter, according to analysis of newly released Labor Department data. That was stronger than median gain of 3.2% and the 3.1% improvement for workers at the 90th percentile, who earn more than nine in 10 other Americans. The percentage increases are based on a four-quarter average of earnings, to smooth out volatility in the data. (…)

Usual weekly earnings is a different wage measure than the more broadly cited average hourly earnings figure reported in the jobs report each month. The jobs report showed average hourly earnings for hospitality workers, the lowest paid of 19 broad sectors tracked monthly, rose 4% in June from a year earlier, the second-strongest gain. The quarterly numbers, which tend to be volatile, are based on a survey of workers and include overtime pay, commissions and tips that might not be captured in the hourly figure.

Average hourly earnings, which have been stuck near a 2.5% annual increase for most of the past year and a half, are based on a separate survey of private-sector employers. (…)

At the start of the year, the minimum wage increased in 19 states, and Maryland and Oregon raised their pay floors this month.

Still, higher-earning Americans have fared much better during the expansion. Pay for workers in the 90th percentile has increased nearly 20% since mid-2009, better than the median gain of 16.3%. The 10th percentile worker fared worse, with pay improving 12.5%. That hasn’t been enough to offset inflation during the past eight years. (…)

Here’s Why Yellen’s Fed Cares About America’s Opioid Epidemic

(…) The opioid epidemic falls outside of the Fed’s traditional macroeconomic purview, yet it matters to the central bank for two reasons. If addiction is rendering people unemployable, it could help to explain why a historically low portion of the prime-age population is working. Second, the Fed has increased its focus on community and workforce development in recent years — and the opioid crisis is a painful reality dragging on human capital across America.

An estimated 2.7 million adults over the age of 26 were misusing painkillers as of 2015, while another 236,000 currently used heroin, based on test Substance Abuse and Mental Health Administration data. While opioid abusers account for a tiny sliver in a workforce of 160 million, they probably make up a great share of the 7 million who are unemployed. (…)

Economic Outlook from Freight’s Perspective – Continues to Show Strength

Not only have both the Shipments and Expenditures Indexes have now been positive for six months in a row, but they are showing accelerating strength. (…) The 4.8% YoY increase in the June Cass Shipments Index is yet another data point which confirms that the first positive indication in October was a change in trend. In fact, it now looks as if the October 2016 Cass Shipments Index, which broke a string of 20 months in negative territory, was one of the first indications that a recovery in freight had begun. (…)

What specifically is driving recent volumes? Parcel volumes associated with e-commerce continue to show outstanding rates of growth, with both FedEx and UPS reporting strong U.S. domestic volumes. According to the proprietary Broughton Capital index in the most recent month available (May), airfreight has also been showing improving strength, with the Asia Pacific lane jumping 12.3% and the Europe Atlantic lane growing 4.3% on a YoY basis. As we have described in previous reports, the strength in the Asia Pacific lane buoys our confidence in continued strength in the tech sector, and continued improvement in the Europe Atlantic lane buoys our confidence in the continued growth, albeit modest, in the overall European Union economy.

The recent surge in Asia Pacific airfreight gives us increasing confidence in the technology segment of the global economy, not because everything that moves in this lane is a semiconductor, but because the largest overall segment/type of good that is moved via airfreight in this lane has one or more semiconductors in it. Hence, there historically has been a high level of correlation between Asia Pacific airfreight and semiconductor billings. This is good news for economies in Asia, and good news for the technology segments of the U.S. economy. (…)

After a very strong start to 2017, the Association of American Railroads (AAR) reported that for the trailing four weeks, YoY overall commodity carloads originated by U.S. Class 1 railroads grew by 3.0%, and even intermodal units grew by 4.9%. (…)

[Trucking] Tonnage itself appeared to be growing and gaining momentum (three-month moving average reached +3.1% on a not seasonally adjusted basis in January). Unfortunately, the months since have been both volatile and inconsistent: February, March, April, May, and June tonnage was -2.7%, 1.1%, -1.2%, 4.8%, and 1.6%, bringing the three-month moving average down to just 1.7%.

Dry van truck loads have now contracted on a YoY basis six out of the last eight months and eight out of the last ten months. The most recent month (April) reported by the American Trucking Associations (ATA) was down 2.4% and pulling the three-month moving average even further negative to -1.9%. But fear not, recent data out of DAT Solutions suggests that this may be getting better in June.

Oil Struggles After Rise in U.S. Output Crude prices ticked lower Thursday as the market came under pressure from increased U.S. production, despite signs of a drawdown in stocks.

Data from the U.S. Energy Information Administration on Wednesday showed U.S. production rose by 32,000 barrels a day in the week ended July 14 to its highest level in two years. (…) Data from the U.S. Energy Information Administration showed U.S. stockpiles fell for a 13th week out of the past 15. Weekly decreases in gasoline and distillate stocks also surpassed estimates. (…)

Charts via The Daily Shot:

State-run China Petroleum & Chemical Corp., the globe’s largest oil refiner, will process about 1 million metric tons a month less than previously planned over June to August, according to people with knowledge of the matter. That’s because of weaker demand and increased competition from privately owned rivals, they said, asking not to be identified because the information is confidential. The reduction is equivalent to about 240,000 barrels a day.

While that’s about 3 percent of China’s total crude imports, the curbs are being implemented during the summer, when the nation’s demand typically peaks just as it does in the U.S. (…)

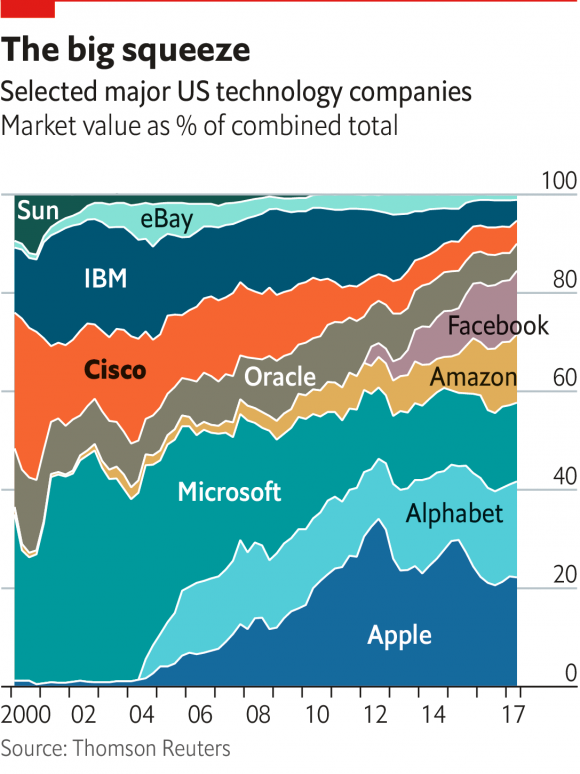

Tech Stocks Eclipse Record From Dot-Com Era Tech stocks broke a nearly two-decade-old record, with the S&P 500’s information-technology sector closing above its previous all-time high set in March 2000 at the peak of the dot-com bubble.

You Are Here

-

This from lplresearch

It has been a great start to 2017, with the S&P 500 Index up more than 11% year to date, but be aware that the index has, on average, peaked near here going back the past 20 years before regrouping for a fourth quarter run-up. Per Ryan Detrick, Senior Market Strategist, “The first half of July has been strong. Check that off for working in 2017, but be aware that the S&P 500 has tended to peak around now and the next few months can be tricky.”

- And that via The Daily Shot:

Based on seasonal patterns, volatility is expected to start rising in the next few weeks.

Source: @bespokeinvest

Source: Moody’s Investors Service (via The Daily Shot)

Source: Moody’s Investors Service (via The Daily Shot)