Lending Slowed, Economy Cooled After Bank Failures, Fed Report Shows Banks in several parts of the country tightened lending standards and raised concerns about liquidity.

Nine of the 12 Fed districts reported little or no change in economic activity over the six-week period ended April 10, according to the report, a compilation of economic anecdotes from the central bank’s business contacts around the country. (…)

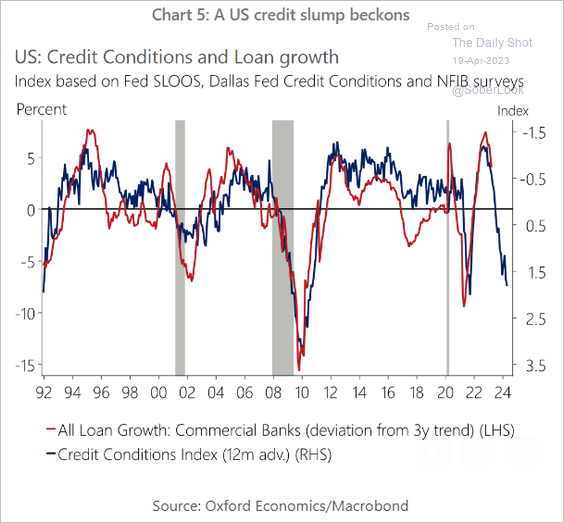

Banking-sector contacts reported that lending behavior changed significantly in the wake of March failures, the Fed said. Banks are scrutinizing customers more and raising lending standards, leading to a decline in commercial and industrial loans in some regions, they said.

Some banks “focused on lending to existing customers and became more prudent in lending to new customers,” the Philadelphia Fed reported.

Banks are facing a liquidity crunch, even as delinquency rates remained low for both commercial and consumer loans.

“Core deposits continued to decline, a situation which bankers attributed to rate competition among banks and to outflows to higher-yielding alternatives,” reported the Cleveland Fed. The St. Louis Fed also noted a decline in bank deposits, but said those in the industry “expressed confidence in their overall position.”

- San Francisco (which covers the Western U.S.): “Lending activity decreased substantially.”

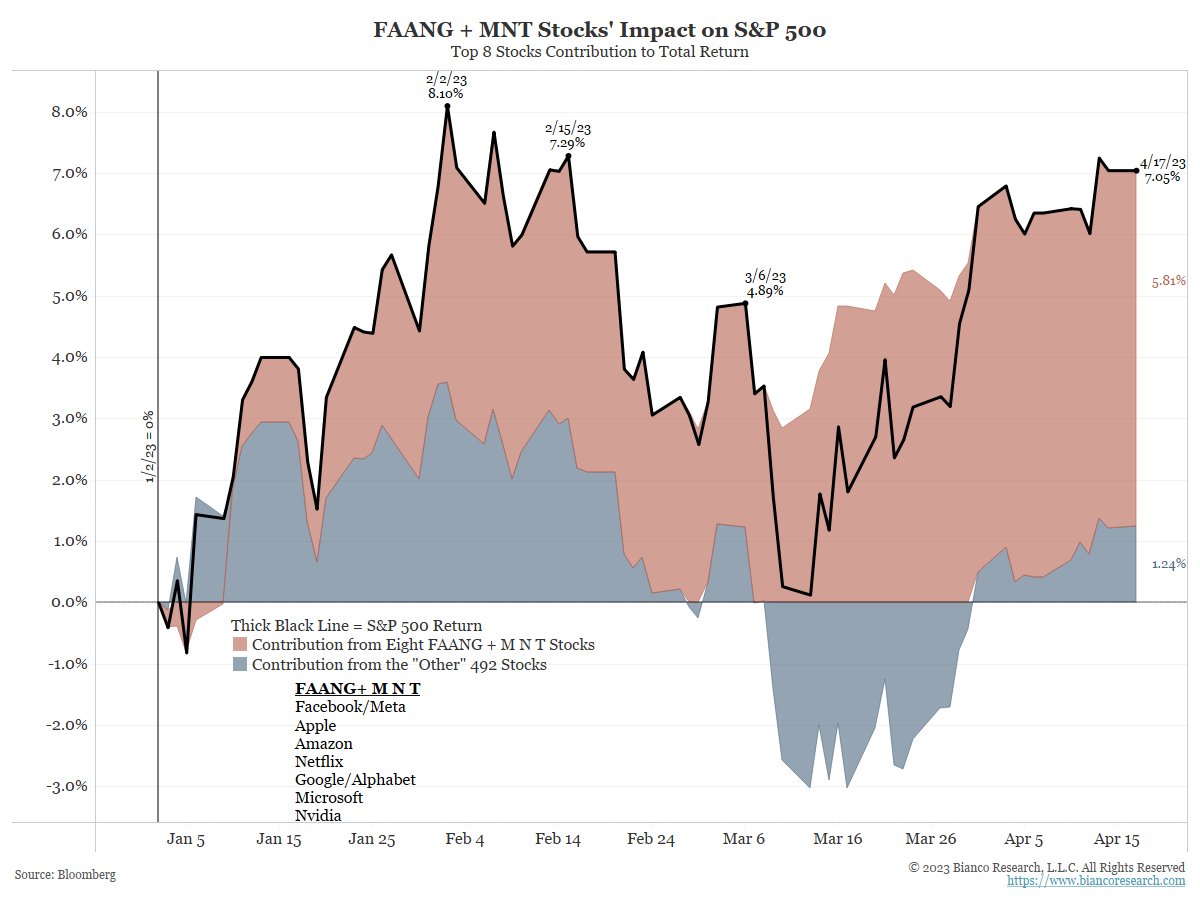

- A credit slump is coming. (The Daily Shot)

- TD Spots a Red Flag Not Seen Since 2007 Coming for the Corporate Bond Market An “exhausted carry trade” could spark a correction.

Last month’s banking drama means a technical tidal wave may be coming for the biggest slice of the $10 trillion market for corporate bonds.

That’s according to TD Securities, where analysts are predicting that banks’ collective higher cost of funding will curb appetite for higher-quality credit and eventually force a spike in risk premiums.

At issue are shrinking yields on investment-grade bonds relative to the effective federal funds rate, a proxy for funding costs. This “carry spread” has now reached levels seen only twice before in the past 27 years — the last time being in 2007.

That means that even though high-quality corporate bonds might look “cheap” based on their mark-to-market values, which have plummeted over the past year as interest rates spiked, the higher cost of funding these positions could still curtail bank purchases and eventually force a move higher in spreads. (…)

“Banks are important in this context as their sensitivity to interest rates may pressure US investment-grade corporate yields to correct,” Maggio says. “While unfunded investors (a large share of the market) may be content with a modest yield pick-up over Treasuries, liquidity providers need margins large enough to beat their internal funding costs.”

“Against this backdrop, the widening of credit spreads we anticipate is necessary to rebalance the market and address pressure from the increasingly exhausted carry trade.”

JPMorgan expects the U.S. debt ceiling to become an issue as early as next month with the Wall Street bank ascribing a “non-trivial risk” of a technical default on U.S. Treasuries.

In a note published to clients late on Wednesday, JPMorgan said it expected both the debate over the debt ceiling as well as the one on the federal funding bill to run “dangerously close” to their final deadlines.

The bank said its U.S. rates strategy team expects the Treasury could run out of available resources by the middle of August. (…)

“Signs of stress typically start in the T-bill market 2-3 months before the X-date given money market funds (MMF), which are large holders of T-bills, will begin to more actively advertise that they don’t hold any bills that mature over those dates,” JPMorgan said.

Treasury Secretary Janet Yellen is expected in the next few days to revise the X-date – or the date by which the federal government can no longer meet all its obligations in full and on time absent actions by Congress – which is currently early June.

U.S. credit default swaps, market-based gauges of the risk of a default, this month hit their highest level since 2012 . Those contracts are denominated in euros, as investors lower exposure to dollar-denominated assets.

Goldman’s take:

Tax receipts for the April filing season continue to run far below last year’s levels. With “Tax Day” receipts now on the books, non-withheld receipts month-to-date are down 29%, a touch below the 28% decline we have been assuming in our projection that the debt limit deadline will hit in late July (we recently moved this up from early August). Adjusted for calendar issues and assuming that a slightly greater share of taxpayers file electronically this year (electronic payments show up more quickly, raising the hurdle for the yoy comparison), month-to-date receipts are down 31% from last year.

If April tax receipts are down by 35% or more, we think the Treasury will be more likely to announce an early June debt limit deadline. If tax receipts are down by less than 30%, we think a late July deadline is still more likely. That said, other Treasury cash flows will influence the deadline that Treasury ultimately projects, as will risk management considerations.

Tax data over the next few days will narrow the range of outcomes. Collections for the day after “Tax Day” (reported April 20) are usually nearly as large as the day of the deadline. By next Tuesday (April 25), the Treasury will probably have collected at least 75% of the non-withheld tax payments it will receive in April and May.

Top Fed Official Signals Support for May Interest-Rate Increase New York Fed President John Williams said the central bank had more work ahead to bring down inflation.

Investors see a greater than 80% chance that the Fed will raise rates by a quarter point at its May 2-3 meeting, according to CME Group. Mr. Williams, a close ally of Fed Chair Jerome Powell, offered little to push back against those expectations just days before central-bank officials begin their traditional premeeting quiet period when Fed officials don’t communicate publicly before their decision. (…)

Mr. Williams said stresses in the banking system had stabilized, but he said he anticipated they would lead to tighter lending standards for households and businesses, which would in turn reduce consumer spending. He said it was too soon to judge the magnitude and duration of any such tightening.

The New York Fed leader pointed to signs that both demand for labor and inflation were cooling, and he said he expected inflation to decline to around 3.5% this year. (…)

“The thing that makes this very difficult [is that] we’re in an economy that’s very strong,” he said. “So the tightening that might happen in credit conditions—that’s in the context of what is otherwise a very strong economy.” (…)

Here’s a summary of the Fed’s Beige Book as of April 10:

- Overall economic activity was little changed in recent weeks. Nine Districts reported either no change or only a slight change in activity this period while three indicated modest growth. Expectations for future growth were mostly unchanged as well; however, two Districts saw outlooks deteriorate.

- Consumer spending was generally seen as flat to down slightly amid continued reports of moderate price growth. Auto sales remained steady overall, with only a couple of Districts reporting improved sales and inventory levels.

- Travel and tourism picked up across much of the country this period.

- Manufacturing activity was widely reported as flat or down even as supply chains continued to improve.

- Transportation and freight volumes were also flat to down, according to several Districts.

- On balance, residential real estate sales and new construction activity softened modestly.

- Nonresidential construction was little changed while sales and leasing activity was generally flat to down.

- Lending volumes and loan demand generally declined across consumer and business loan types. Several Districts noted that banks tightened lending standards amid increased uncertainty and concerns about liquidity. The majority of Districts reported steady to increasing demand and sales for nonfinancial services.

- Agriculture conditions were mostly unchanged in recent weeks while some softening was reported in energy markets.

- Employment growth moderated somewhat this period as several Districts reported a slower pace of growth than in recent Beige Book reports. A small number of firms reported mass layoffs, and those were centered at a subset of the largest companies. Some other firms opted to allow for natural attrition to occur, and to hire only for critically important roles.

- Contacts reported the labor market becoming less tight as several Districts noted increases to the labor supply. Additionally, firms benefited from better employee retention, which allowed them to hire for open roles while not constantly trying to back-fill positions.

- Wages have shown some moderation but remain elevated. Several Districts reported declining needs for off-cycle wage increases compared to last year.

Job postings on Indeed (through April 14) are down 6.55 since the last BLS job openings data (February).

This chart is from John Williams’ own staff showing that services wage pressures are back to normal:

Also from the NY Fed:

- Business Leaders Survey (Survey responses were collected between April 3 and April 10)

The headline business activity index held steady at -9.8. Twenty-eight percent of respondents reported that conditions improved over the month and 38 percent said that conditions worsened.

The business climate index moved down nine points to -47.7, suggesting the business climate remains much worse than normal.

Employment levels were unchanged, representing the first time in two years that employment has not increased.

Wage increases moderated noticeably, and input and selling price increases slowed. After slipping seven points last month, the wages index retreated another nine points to 41.0, indicating that wage growth continued to moderate.

The prices paid index edged down five points to 59.5, and the prices received index fell eleven points to 22.0, pointing to a slowing of input and selling price increases.

Looking ahead, firms do not expect conditions to improve over the next six months.

Goldman Sachs:

In the US, we expect GDP growth to slow to 1.1%yoy in Q4 2023, reflecting a negative impulse from tighter financial conditions and additional drags from a pullback in bank lending following banking stress. We see a 35% probability of entering a recession over the next year, reflecting increased uncertainty around the economic effects of bank stress, although we continue to think the US is headed for a soft landing.

We expect core PCE inflation to decline to 3.3% by Dec 2023 reflecting continued supply chain recovery, a decline in shelter inflation, and slower wage growth. We expect the unemployment rate to remain at 3.6% through 2026.

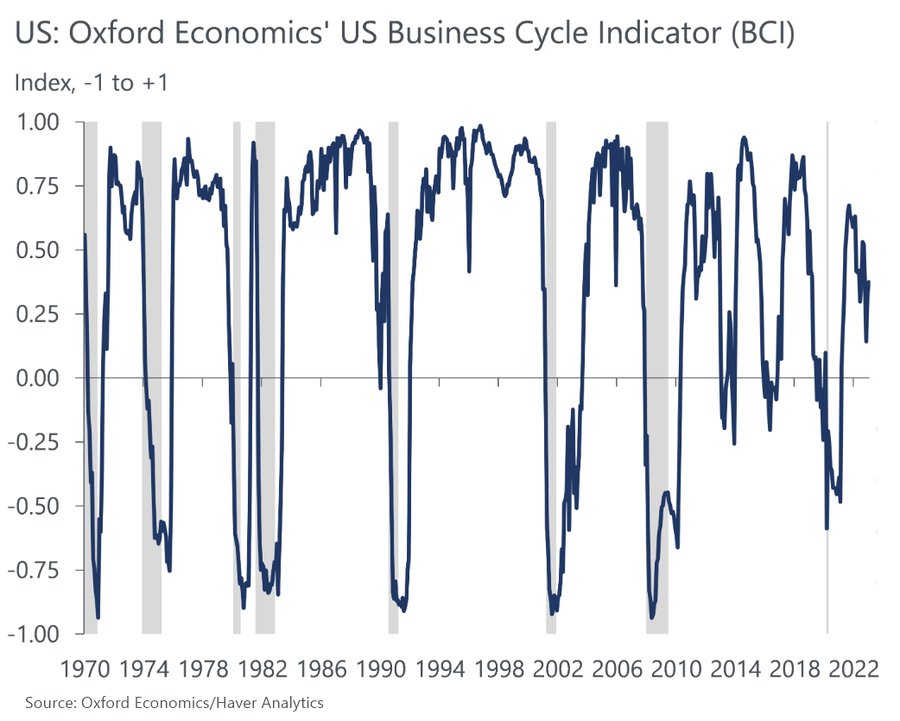

RECESSION WATCH

- The LEI has an impeccable track record:

- The NY Fed (again!) recession probability model has never given a false signal at this level.

Credit Suisse

- But this one is not there yet:

INFLATION WATCH

CANADA: INFLATION SLOWS

- CPI +4.3% YoY in March, prior +5.2%

- Core CPI +4.5%, prior +4.8%

- CPI-Trim +4.4%, prior +4.8%

- CPI-Median +4.6%, prior +4.9%

- CPI MoM +0.1% for March, prior +0.1%

- Core CPI +0.3%, prior +0.3%

On a three-month average annualized basis, CPI-Trim was unchangd at 3.3%, while CPI-Median declined to 3.6% from 3.8% in February.

CPI-Services was +0.4% MoM in March, after +0.3% in February. Rent was unchanged in March.

The core CPI has been running near that 0.3% pace every month since last October. The 3-m YoY trend is +3.1% at an annual rate.

The median CPI was up just less than +0.3% MoM like in each of the past 5 months.

Canada’s inflation does not only matter to Canadians. I have updated the chart below, extending the red line to Canada’s March CPI:

Speaking of inflation:

TESLA CUTS THE PRICE OF ITS BEST SELLING CAR 29%

TESLA CUTS THE PRICE OF ITS BEST SELLING CAR 29%

Elon Musk indicated Tesla will continue to cut prices on its electric vehicles to push for higher volumes, even after the company took significant hit to profit due to markdowns. The news comes after several rounds of price cuts already this year, prompting speculation over whether the strategy comes from a position of weakness or strength.

![]() The Chinese are coming!!!

The Chinese are coming!!!

(…) BYD’s latest electric vehicle (EV) made its debut at the event this week, stunning visitors not so much for its look or its features, but the fact it will sell from just 78,000 yuan ($11,300) – around half the price of the cheapest new energy vehicles available elsewhere. (…)

The car is available in two range versions from 305 to 405 kilometres (190 to 252 miles), with a fast charging system that will allow it to ramp up from 30% to 80% charge within 30 minutes, according to BYD. It will run on a lithium iron phosphate BYD Blade battery.

Bill Russo, the Shanghai-based founder and CEO of strategic advisory firm Automobility, predicts the Seagull will become the best selling car in China within six months of its launch. (…)

America’s Chip War With China May Already Be Lost

(…) The new initiatives by Washington have three main effects, according to an analysis by the Fathom China Team at research group Gavekal Dragonomics:

- They bar Chinese access to “essential machines, parts and maintenance engineers” for making chips beyond a sophistication level going back to 2014.

- They block Chinese companies from buying software tools needed in designing chips, and from making chips in “third-party foundries that use US-origin technology.”

- All Chinese customers, not just the military, are barred from the advanced chips used in the most complex operations, such as machine-learning and supercomputing.

How exactly this heightening tech war plays out is uncertain. The industry has developed over decades of untrammeled globalization. During that time, US firms pioneered new designs, Taiwan Semiconductor Manufacturing Co. made them and Dutch company ASML Holding NV dominated chip-making equipment. Japanese companies provided vital specialty chemicals while China did the packaging, assembly and testing.

Industry experts highlight that developing cutting-edge chip production will be an immense challenge for China, and that the US effort to cut off Chinese buyers will eventually prove hugely damaging to western companies. (…)

The measures will “probably accelerate China’s self sufficiency in a lot of different technologies over the longer-term.” (…)

(

(