U.S. Inflation Eases to 5%, Lowest in Nearly Two Years Underlying price pressures increased slightly in March

The consumer-price index, a closely watched inflation gauge that measures what consumers pay for goods and services, rose 5% last month from a year earlier, down from February’s 6% increase and the smallest gain since May 2021, the Labor Department said Wednesday. (…)

Core prices, a measure of underlying inflation that excludes volatile energy and food categories, increased 5.6% in March from a year earlier, accelerating slightly from 5.5% the prior month.

The CPI rose 0.1% in March from the prior month, down sharply from February’s 0.4% increase, while core CPI increased 0.4%, down slightly from 0.5%. (…)

More breakdowns:

- Core CPI: +0.4% MoM (+4.8% a.r.) after +0.5% and +0.4% in Feb and Jan. Last 3 m +5.3% a.r.. Last 2 m +5.4%.

- Core Goods CPI: +0.2% MoM (+2.4% a.r.) after +0.0% and +0.1% in Feb and Jan. Last 3 m +1.2% a.r.. Last 2 m +1.2%.

- Core Services CPI: +0.4% MoM (+4.8% a.r.) after +0.6% and +0.5% in Feb and Jan. Last 3 m +6.1% a.r.. Last 2 m +6.1%.

- CPI Rent: +0.5% MoM (+6.1% a.r.) after +0.8% and +0.7% in Feb and Jan. Last 3 m +8.2% a.r.. Last 2 m +7.9%.

- Services less Rent: +0.0% MoM (+0.0% a.r.) after +0.1% and +0.6% in Feb and Jan. Last 3 m +2.8% a.r.. Last 2 m +0.6%.

@M_McDonough

Deceleration but at a slow pace. As expected (here) Services ex-rent is very encouraging, 27% of CPI, 35% of core CPI. When rent slows down to its usual 0.2-0.3% monthly pace (this summer?), services inflation will reflect wage growth (black) around its Q1 trend of 3.2%, and its pre-pandemic pace.

From a consumer spending standpoint, my CPI-Essentials series was unchanged MoM in March after 0.8% in January and 0.5% in February and is up 6.4% YoY from 8.0% in February and 8.4% in January. It has been growing at the same pace as labor income since June 2022.

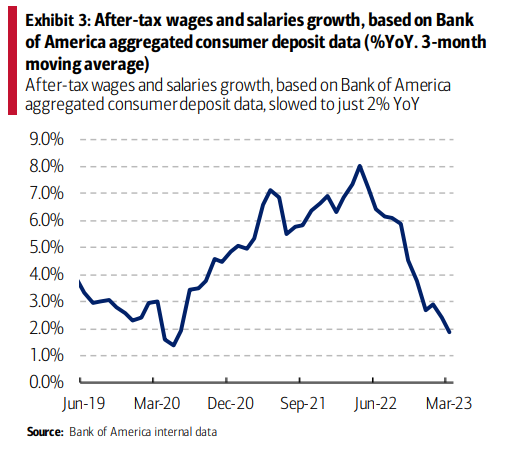

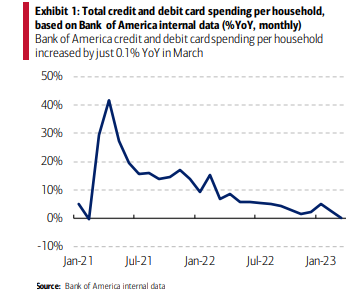

US Credit and Debit Card Spending Slows to Weakest Pace in Two Years, BofA Says

After a strong start of the year, spending per household rose 0.1% [in March] from a year ago, the slowest pace since February 2021, Bank of America Institute said Wednesday. The weakness was broad-based across goods and services.

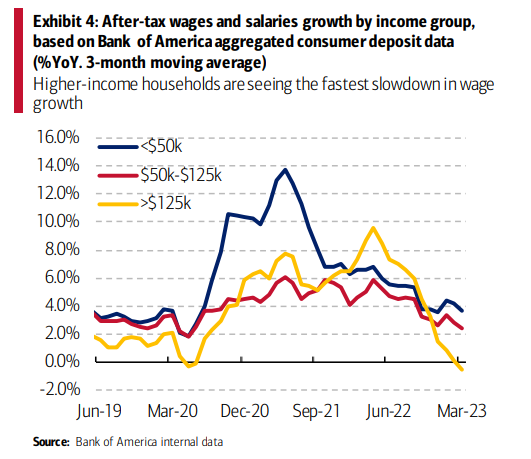

Based on BofA internal data, households that make more than $125,000 a year saw a drop in annual after-tax wages for the first time since May 2020. The decline in pay may be due in part to hiring freezes and job cuts in industries such as technology and financial services, according to the report.

For lower-income families, the expiration of the Child Tax Credit program and of increased food stamp benefits probably weighed on discretionary spending. (…)

@MikeZaccardi

- Business Inflation Expectations Decrease to 2.8 Percent Firms’ inflation expectations for the coming year decreased significantly to 2.8 percent.

Fed Keeps May Interest-Rate Increase on Table High inflation and tight labor markets led Fed officials to signal they could raise interest rates at their next meeting, despite a higher likelihood the economy would enter a recession later this year, according to minutes from their March gathering.

(…) Officials concluded that given the strength of price pressures and the demand for labor, “they anticipated that some additional policy firming may be appropriate” to bring inflation down to the central bank’s 2% goal, the minutes said. They also said they would pay close attention to bank lending conditions as they weigh their next move. (…)

The question ahead of the Fed’s May 2-3 meeting is whether officials place more emphasis on anecdotes and surveys of credit conditions if they signal a pullback in lending, which could call for forgoing an increase or raising rates while signaling a pause, or whether they place more weight on economic data that might show less effect on credit availability but be more dated. (…)

- Fed Leans Toward Another Hike, Defying Staff’s Recession Outlook Fed staff advisers are forecasting a “mild recession” later this year.

(…) John Williams, the New York Fed President and vice chair of the FOMC, said Tuesday that one more hike followed by a pause was “a reasonable starting place” for debate as officials approach their May 2-3 meeting. (…)

San Francisco Fed President Mary Daly, who isn’t a voter but is seen as a key ally of Chair Jerome Powell, said in a speech Wednesday that inflation may cool enough on its own without further rate hikes. That followed comments from Chicago Fed President Austan Goolsbee, who does vote this year, calling for prudence and patience on policy. (…)

Treasury Secretary Janet Yellen has said she’s seen no indication of a contraction in credit following the failure of a string of US banks last month.

Maybe she should talk to her Biden administration colleague, Lael Brainard.

“Banks are showing some signs of pulling back a little on credit,” Brainard, the new head of the President Joe Biden’s National Economic Council, told CNN’s Poppy Harlow at Semafor’s World Economy Summit on Wednesday.

Her comment came just a day after Yellen spoke to reporters in Washington about a variety of topics, including the banking turmoil. “I’ve not really seen evidence at this stage suggesting a contraction in credit, although that is a possibility,” the treasury secretary said. (…)

If you missed Monday’s Daily Edge, you missed this:

Everybody is focused on bank liquidity. But since the Fed has guaranteed all deposits for the next year, the risk to the economy is really on the lending side, corporate liquidity.

Banks had already started to retreat in February (C&I loans down $13B)…

…but just in the 3 weeks after SVB, total bank credit dropped $172B with the biggest hits in C&I and CRE loans.

It got even worse during the first week of April. The -$243B decline in bank credit during the 2 weeks ended April 5 was more than twice the worst 2 weeks during the GFC.

Credit portfolio managers are forecasting a rise in corporate defaults in the coming year while more than four-out-of-five participants see a chance of a US recession in 2023, according to a survey by the International Association of Credit Portfolio Managers.

The poll found that 81% of fund managers see defaults picking up in the next 12 months, compared with 80% in the survey last December, as reduced bank liquidity and credit risk concerns land on top of macroeconomic issues. For North American corporates, 86% of respondents see defaults rising, while 91% see defaults rising in Europe. (…)

Survey respondents are also predicting a recession in the US, with 84% expecting one to occur sometime this year. That’s higher than the 61% of participants who see a recession this year in Europe and the UK.

Credit spreads are expected to move higher, with almost 60% of participants seeing North American credit spreads widening over the next three months and 80% of participants forecasting high-yield spreads rising. (…)

Crosscurrents Hide a Rapidly Cooling Labor Market Even with less demand, a constricted worker supply is keeping pressure on wages, inflation and interest rates

Greg Ip’s analysis leads him to conclude that the Fed is not done:

Add it all up, and there simply isn’t as much labor for employers to draw on. So even if their need for labor has cooled, they must still pay up. Wage growth has slowed in recent months, but not to levels consistent with 2% inflation. The modest 0.3% rise in hourly pay in March was more like 0.4% when adjusted for the shifting composition of jobs, according to independent analyst Riccardo Trezzi, formerly an economist with the Fed and the European Central Bank.

The bottom line is that while labor demand may be weakening, it will likely have to weaken further, perhaps into recessionary territory, for the Fed to consider easing.

The bottom line is that while labor demand may be weakening, it will likely have to weaken further, perhaps into recessionary territory, for the Fed to consider easing.

The Atlanta Fed’s Wage Growth Tracker, which adjust for composition, suggests that wage growth is stuck around 6% YoY:

Looking at various employment sectors, the deceleration has further to go for wage growth to be back to pre-pandemic YoY rates:

Looked at sequentially, however, the same sectors are working their way below the 1% QoQ rate that prevailed in 2019:

The labor market increasingly appears to be headed toward a somewhat more intense version of its pre-pandemic state, when it was quite tight by historical standards but nonetheless did not generate problematic wage pressures.

(…) labor supply has now fully recovered to trend from its pandemic decline. The labor force participation rate is back in line with estimates of its pre-pandemic demographic trend, and the immigrant population has grown quickly enough over the last year and a half to reverse a shortfall in the earlier part of the pandemic. The sharp decline in job openings coupled with the full recovery of labor supply has shrunk our jobs-workers gap from a peak of over 6mn to 4.1mn based on the JOLTS data or 3.1mn based on alternative measures of job openings. (Goldman Sachs)

Real-time job openings on Indeed (trough April 7) lead the BLS openings (last point: February). The horizontal line is openings in 2019.

Manhattan Rents Reach Record High With Busy Season Yet to Come Median on new leases rose to $4,175 in March, even as apartment hunters got more listings to choose from.

The median monthly rate rose to a record-high $4,175 in March, according to a report Thursday by appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. That’s up $25 from the previous peak, reached in July, and almost 13% more than a year ago.

“Landlords are finding that they’re pushing rents and they’re actually getting it,” said Jonathan Miller, president of Miller Samuel. His proof: The average lease was signed with a 0.7% discount from the listing price, well below the 5% discount that new leases got in February.

“The spread between what they’re asking and what it’s renting for is compressing,” Miller said, “and I don’t think that’s because landlords are lowering the prices of their listings.” (…)

And the busiest and most expensive period of the year for rentals — traditionally July and August — is still ahead, signaling more record highs to come. Only an economic downturn and major job losses would shift that upward trajectory, according to Miller.

The number of new leases signed last month was up 15% from a year earlier, suggesting that many renters opted against renewing and moved on. Those on the hunt had more choices, with listing inventory up 41% from last March. But apartments were scooped up more quickly, spending 39 days on the market, down from 61 days a year ago. (…)

The borough’s vacancy rate rose to 2.54% last month from 1.89% a year earlier. (…)

Bank of Canada Holds Again and Pushes Back Against Rate-Cut Bets

Policymakers led by Governor Tiff Macklem held the overnight lending rate at 4.5% on Wednesday, in line with the expectations in a Bloomberg survey of economists. Central bankers upgraded their outlook and said recent data are “reinforcing” their confidence that inflation pressures will abate, while keeping the door open to additional hikes should the economy surprise to the upside. (…)

Macklem and his officials said that tighter credit conditions — made worse by recent instability in the global banking sector — are now expected to restrain growth in the US and Europe. (…)

He [Macklem] also poured cold water on trader bets for rate cuts later in the year, saying, “that doesn’t look today like the most likely scenario to us.”

While the central bank acknowledged that output was much stronger than projected in the first quarter, policymakers see that momentum ending soon, as the aggressive rate hikes of the past year bite. Growth will be “weak” for the rest of 2023, implying that the economy will have excess supply in the second half. The Bank of Canada said it still sees inflation returning to near its target by the end of 2024 — but also acknowledged risks to that outlook. (…)

No data dependency there.

Infosys Sales Outlook Disappoints After Slowdown Fears Mount Underscoring how clients are tightening IT budgets to weather an economic slowdown.

AI Can Write a Song, but It Can’t Beat the Market Wall Street has long used automated algorithms for tasks such as placing trades and managing risk, but the investing results using AI haven’t been especially impressive.

AI Can Write a Song, but It Can’t Beat the Market Wall Street has long used automated algorithms for tasks such as placing trades and managing risk, but the investing results using AI haven’t been especially impressive.

(…) But few firms have found success turning all of their operations over to machines, quants say. And they haven’t enjoyed dramatic advances with self-learning or reinforcement learning, which entail training computers to learn and develop strategies on their own. Indeed, Renaissance and others rely on advanced statistics rather than cutting-edge AI methods, say people at the firms.

“Most quants still take a “theory-first” approach where they first establish a hypothesis of why a certain anomaly might exist, and they form a model around that,” says Mr. Larkin.

One big problem: Investors rely on more limited data sets than those used to develop the ChatGPT chatbot and similar language-based AI efforts. ChatGPT, for example, is a model with 175 billion parameters that uses decades—and sometimes centuries—of text and other data from books, journals, the internet and more. By contrast, hedge funds and other investors generally train their own trading systems using pricing and other market data, which is limited by nature. (…)

Just as important, market data is “noisier” than language and other data, making it harder to use it to explain or predict market moves. In other words, earnings, share momentum, investor sentiment and other financial data only partly explain stock moves, and the rest is unaccountable “noise.” As a result, machine-learning models can identify correlations in various market data but prove incapable of predicting future stock moves.

Unlike languages, markets can change quickly—companies alter strategies, new leaders make radical decisions and economic and political environments shift abruptly—making it harder to make trades using models reliant on historic, long-term data trends.

And while ChatGPT has proven impressive, it regularly makes the kinds of obvious errors that would cost investors’ money and jeopardize their reputations. (…)

AI-adherents believe their approach will eventually perform well. Machine-learning models could eventually sort the meaningful from the meaningless. (…)

In the near term, the recent advances could shake up areas such as research and sales, some say.

“Now, you can create automated, bespoke information for clients, and that’s a lot of what salespeople [at investment banks] do,” says Jens Nordvig, a former Goldman Sachs and Bridgewater Associates staffer who runs MarketReader, which uses AI to distill financial news.

![]()

![]()

![]() That is based on experiments with ChatGPT. But there is now GPT-4, a much improved version still in beta. Watch this great video to better understand what’s coming at an exponential rate.

That is based on experiments with ChatGPT. But there is now GPT-4, a much improved version still in beta. Watch this great video to better understand what’s coming at an exponential rate.

Sparks of AGI: early experiments with GPT-4

Source:

Source: