Surprisingly Strong US Economic Data Keeps Recession Fears at Bay

Purchases of new homes climbed to the fastest annual rate in more than a year, durable goods orders topped estimates and consumer confidence reached the highest level since the start of 2022, according to the Tuesday reports. Another release showed housing prices in the US rose for a third-straight month.

While the data don’t reject the possibility of a recession in the coming year, they do give reason to believe a downturn isn’t right around the corner, let alone a foregone conclusion. The latest reports on retail sales, inflation-adjusted consumer spending and the job market also support that notion. (…)

While homeowners are reluctant to move and take on a greater mortgage, prospective buyers have adjusted to the shift and are increasingly seeking out new construction instead.

Purchases of new single-family homes increased 12.2% to an annualized 763,000 pace last month, government data showed Tuesday. The figure marked the third-straight monthly advance and beat all but one estimate in a Bloomberg survey of economists. (…)

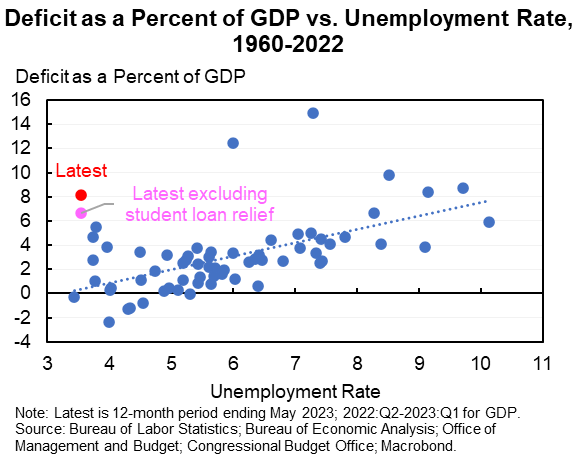

The robust confidence and homebuying data are rooted in what’s still a strong labor market. Unemployment is historically low and job openings are plentiful, though both metrics have been softening in recent months. (…)

Orders placed with US factories for business equipment rose in May for a second month, indicating companies continue to make longer-term investments despite high borrowing costs and economic uncertainty.

Shipments of nondefense capital goods, which are a proxy for actual spending, jumped 3.4%, the biggest increase since the end of 2020. (…)

My comments:

- Home builders are benefitting from the dearth of existing home sellers clinging to their low mortgage, and are buying down mortgage rates for new home buyers. In May, new single-family home sales were 9.2% above their February 2020 level, substantially outpacing starts (-4.0%) and permits (-8.5%). Over time, these 3 series converge.

- Non-defense capital goods orders ex-aircraft are very volatile. They were up in the last 2 months after being down the previous 2. A 3-m moving average shows +1.5% a.r. in May, down from +2.1% in April and March. Flat since August 2022 in spite of rising costs. That said, “core capex” are up nicely from their pre-pandemic levels.

- Consumer confidence, a coincident indicator, remains much lower than pre-pandemic.

- The BLS Job Openings perked up in April but Indeed Job Postings through June 23rd suggest lower levels in May and June.

- Second-Quarter GDP Growth Estimate Decreases On June 27, the GDPNow model estimate for real GDP growth in the second quarter of 2023 is 1.8 percent, down from 1.9 percent on June 20.

U.S. Considers New Curbs on AI Chip Exports to China Restrictions come amid concerns that China could use AI chips from Nvidia and others for weapon development and hacking

The Commerce Department could move as soon as early next month to stop the shipments of chips made by Nvidia and other chip makers to customers in China and other countries of concern without first obtaining a license, the people said.

The action would be part of final rules codifying and expanding the export control measures announced in October, some of the people said. (…)

The new restrictions being contemplated by the department would ban the sale of even A800 chips without a license, according to the people familiar with the matter. [The A800 is a version of Nvdia’s AI chips for the Chinese market that falls below performance thresholds outlined by the Commerce Department]. (…)

The administration is also considering restricting leasing of cloud services to Chinese AI companies, which have used such arrangements to skirt the export bans on advanced chips, some of the people familiar with the discussions say.

The timing of the rule’s rollout is still uncertain, as chip makers continue to push the administration to forgo or ease the new restrictions. The administration is likely to wait until after a visit to China by Treasury Secretary Janet Yellen in early July to avoid angering Beijing, according to a source familiar with the situation. (…)

U.S. officials and policy makers increasingly see AI through a national-security lens. Weapons infused with AI could give U.S. rivals a battlefield advantage, and AI tools could be used to create chemical weapons or produce malicious computer code. (…)

Xi Vows to Protect Foreign Investors in Charm Offensive The Chinese leader pledges the nation will do right by foreign investors.

“Development is the top priority of the Communist Party of China in governing and rejuvenating the country,” Xi told New Zealand Prime Minister Chris Hipkins during his official visit to Beijing on Tuesday.

“We will continue to vigorously promote high-level opening up and better protect the rights and interests of foreign investors per the law,” Xi said, according to the official Xinhua News Agency.

China’s attempts to encourage foreign investors have ramped up in recent weeks as it’s become increasingly clear that the economy’s recovery following the end of Beijing’s Covid Zero policies is starting to flag. Efforts in the US and Europe to “de-risk” supply chains by reducing their reliance on China have further clouded the prospects for future growth. (…)

A clampdown this year on foreign consultancy firms that help global investors and multinational firms understand China — part of a nationwide anti-espionage campaign — has weakened the appetite for investment from overseas firms.

That campaign and other government actions likely mean that China’s charm offensive will face skepticism. While Xi has repeatedly insisted that economic development is the Communist Party’s “top priority,” his government has clearly made protecting national security a central focus.

Prior to the consultancy crackdown, abrupt regulatory tightening moves affecting industries ranging from technology to real estate had already been sending foreign capital fleeing from the nation’s financial markets.

A record share of European companies say doing business in China is getting more difficult, according to a recent survey that noted some firms are already following through on plans to divest from the economy. Some American firms have also reconsidered investment.

Bloomberg adds this color in China Shifts Approach Toward De-Risking With Appeals to CEOs:

(…) Beijing’s warmer ties with business leaders compared to some Western politicians was on display earlier this month when President Xi Jinping called American billionaire Bill Gates an “old friend” during a meeting in Beijing. Days later, US Secretary of State Antony Blinken was granted only a brief audience with the Chinese leader in the capital. Xi and Biden haven’t spoken since November. (…)

Senior Communist Party officials also recently rolled out the red carpet in China for the chief executive officers of JPMorgan Chase & Co. and Tesla Inc., and a host of other foreign business chiefs.

While it remains to be seen how business leaders respond to Li’s call to challenge their governments’ economic interventions, he signed deals in Europe last week to deepen China cooperation with Airbus SE, BASF SE, BMW AG, Mercedes-Benz Group AG and Volkswagen AG. Li told those firms that risk prevention and cooperation are “not mutually exclusive.” (…)

Henry Gao, who researches Chinese trade policy at Singapore Management University, said the risk prevention measures Li supported companies pursing was fundamentally different to politicians’ de-risking strategies.

That could lead to both sides talking past each other, but perhaps that was the entire point. (…)

- Billionaires and Bureaucrats Mobilize China for AI Race With US A ChatGPT-inspired global wave of AI activity is only just beginning in the next battle for supremacy in technology.

Billionaire entrepreneurs, mid-level engineers and veterans of foreign firms alike now harbor a remarkably consistent ambition: to outdo China’s geopolitical rival in a technology that may determine the global power stakes. Among them is internet mogul Wang Xiaochuan, who entered the field after OpenAI’s ChatGPT debuted to a social media firestorm in November. He joins the ranks of Chinese scientists, programmers and financiers — including former employees of ByteDance Ltd., e-commerce platform JD.com Inc. and Google — expected to propel some $15 billion of spending on AI technology this year.

For Wang, who founded the search engine Sogou that Tencent Holdings Ltd. bought out in a $3.5 billion deal less than two years ago, the opportunity came fast. By April, the computer science graduate had already set up his own startup and secured $50 million in seed capital. He reached out to former subordinates at Sogou, many of whom he convinced to come on board. By June, his firm had launched an open-source large language model and it’s already in use by researchers at China’s two most prominent universities. (…)

“China is still three years behind the US, but we may not need three years to catch up.” (…)

AI investments in the US dwarf that of China, totaling $26.6 billion in the year to mid-June versus China’s $4 billion, according to previously unreported data collated by consultancy Preqin.

Yet that gap is already gradually narrowing, at least in terms of deal flow. The number of Chinese venture deals in AI comprised more than two-thirds of the US total of about 447 in the year to mid-June, versus about 50% over the previous two years. China-based AI venture deals also outpaced consumer tech in 2022 and early 2023, according to Preqin.

All this is not lost on Beijing. Xi Jinping’s administration realizes that AI, much like semiconductors, will be critical to maintaining China’s ascendancy and is likely to mobilize the nation’s resources to drive advances. While startup investment cratered during the years Beijing went after tech giants and “reckless expansion of capital,” the feeling is the Party encourages AI exploration. (…)

During the mobile era, a generation of startups led by Tencent, Alibaba Group Holding Ltd. and TikTok-owner ByteDance built an industry that could genuinely rival Silicon Valley. It helped that Facebook, YouTube and WhatsApp were shut out of the booming market of 1.4 billion people. At one point in 2018, venture capital funding in China was even on track to surpass that of the US — until the trade war exacerbated an economic downturn. That situation, where local firms thrive when US rivals are absent, is likely to play out once more in an AI arena from which ChatGPT and Google’s Bard are effectively barred.

Large AI models could eventually behave much like the smartphone operating systems Android and iOS, which provided the infrastructure or platforms on which Tencent, ByteDance and Ant Group Co. broke new ground: in social media with WeChat, video with Douyin and Tiktok, and payments with Alipay. The idea is that generative AI services could speed the emergence of new platforms to host a wave of revolutionary apps for businesses and consumers. (…)

Ford to Lay Off at Least 1,000 Contract, Salaried Workers The cuts are expected to significantly affect engineers in North America.

(…) This latest reduction of Ford’s white-collar workforce includes employees in its electric-vehicle and software side of the business, the company spokesman confirmed.

The cuts will also affect workers in the automaker’s gas-engine and commercial-vehicle divisions, he said. (…)

The salaried job cuts at Ford come weeks ahead of the scheduled start of negotiations with the United Auto Workers union over a new four-year labor contract for its hourly factory workers.

The automaker, along with rivals Stellantis and GM, face an especially tough round of talks with a higher-than-usual risk of a strike, analysts say, citing a hard-line stance taken by the UAW’s new leadership team. (…)

Axios:

Through May, there were about the same number of strikes in 2023 as last year — but the number of workers who walked out went up 80%.

Then this month — really in the past week — there was a lot more action:

- About 3,000 Starbucks workers are on strike this week over gay pride decor and accusations of unfair labor practices.

- Two large strikes in the manufacturing industry got underway — 1,400 members of the United Electrical Workers union at a locomotive plant in Erie, Pa., and one involving about 6,000 workers at a Boeing supplier in Wichita.

- Smaller actions sprung up, too: 84 Amazon drivers at a warehouse in California went on strike, demanding the company recognize their newly certified union. And cooks and cashiers at a McDonald’s in Oakland, Calif., walked out.

- Also in June, hundreds of workers at Gannett walked off the job, as well as 250 members of Insider’s newsroom.

- Meanwhile, the writers’ strike continues.

Starting back in “Striketober,” in 2021, mounting labor unrest was really about the pandemic, Johnnie Kallas, a Ph.D. candidate at Cornell University’s School of Industrial and Labor Relations, who works on its labor action tracker. But now?

- “Workers just feel a lot more empowered,” he said. “The increase in strikes speaks to ongoing discontent not just with wages, but disrespect and contentious negotiations, which are especially pronounced at Starbucks.”

- Unionized workers have struggled to come to a first contract with the coffee company, which has been hit with nearly 600 unfair labor practice charges from the National Labor Relations Board.

For all the renewed energy, unions still play a far diminished role in the U.S. compared to where they were decades ago.

Two major collective bargaining agreements are about to expire.

- Later this summer, 150,000 autoworkers from GM, Ford and Stellantis are set to begin what’s expected to be fairly contentious negotiations for their new contract; the existing one expires on Sept. 14.

- UPS is negotiating a contract with its 340,000 drivers right now — it’s the biggest collective bargaining agreement in North America. The union already voted to authorize a strike if the parties don’t come to terms by July 31 when their contract expires.

- Considering the number of workers these two unions represents, if either walks out that would mark a pivotal moment for labor in the U.S.

Data: Cornell ILR School Labor Action Tracker; Table: Kira Wang/Axios Visuals

Canada: A welcomed deceleration in core inflation

Annual inflation as measured by the consumer price index (CPI) fell sharply in May thanks to both a negative base effect (a sharp rise in May 2022 was removed from the calculation) and a moderation in the monthly momentum.

Indeed, the all-items CPI rose by only 0.1% between April and May after seasonal adjustment, the smallest increase in 6 months. The transportation, clothing & footwear and household operation categories all contributed to the monthly moderation in inflation. Conversely, some components have remained above historical norms, notably food prices, which remain surprisingly strong despite weak global commodity prices.

The housing component also continued to hinder the normalization of inflation, especially rents and mortgage interest costs, which continue to rise at a brisk pace.

The trend in annual inflation is welcome and should improve further next month as another strong increase that occurred in June 2022 is removed from the calculation (negative base effect). While inflation is approaching the upper part of the Bank of Canada’s target range, the Bank has expressed concern about a sustained return to the midpoint of the target. This prompted the Bank of Canada to resume its rate hikes earlier this month.

In this respect, May’s core inflation data may allay some of its fears. After a spike in April, the average of the monthly variation in the CPI trim and the CPI median was 0.22% in May, the smallest increase in 9 months. Going forward, we continue to expect a marked slowdown in economic activity over the coming months, in a context where the real interest rate is now the most restrictive it has been since 2009.

This should be sufficient to ease wage pressures in the Canadian economy, while deflation in global manufactured goods prices should eventually translate into lower prices for consumers.

Goldman Sachs views: Energy and Core Goods Push Down Headline Inflation but Services Inflation Remains Elevated

- Headline CPI inflation declined 1.0pp to +3.4% yoy in May—the lowest level since June 2021—in line with consensus expectations.

- CPI ex food and energy inflation declined to +4.0% yoy in May (vs. +4.4% in April), and the average of the BoC-preferred CPI-trim and CPI-median edged down to +3.85% yoy from an upwardly revised average of +4.25% in April.

- On a three-month average annualized basis, CPI-Trim was roughly unchanged at 3.8% relative to an upwardly revised April value, while CPI-Median declined to +3.6% (vs. +3.8% in April).

- Seasonally adjusted CPI ex food and energy inflation declined to +0.2% in May from +0.3% in April.

- Sequential core goods inflation was essentially flat in May, down from +0.7% in April. Sequential inflation for passenger vehicles also moderated to -0.2%.

- On the other hand, sequential services inflation edged up to +0.4% in May (vs. +0.3% in April) despite a marked slowdown in rent inflation (flat, vs. +1.2% in April) and a large negative contribution from telephone services.

- The rent index has been extremely volatile since 2019 and we think that underlying pace of inflation for rents remains much more elevated than what this monthly sequential prints suggests. Owned-accommodation inflation remained elevated at +0.6% (vs. +0.4% in April) due to another strong print for homeowners’ maintenance and repairs and continued strength in mortgage interest cost inflation. Sequential inflation in homeowners’ replacement cost remained negative at -0.4% in May but we expect that the recent uptick in house prices should put upward pressure on this component in the coming months.

- The BoC will likely revise up their inflation forecasts at the July meeting based on accumulated evidence since the last MPR. We therefore continue to forecast that the BoC will hike in July by 25bp and see risk that further policy tightening will be necessary to return inflation to the BoC’s target, although today’s progress on inflation and the softer May employment report raise some risk that the BoC moves more cautiously.

The FRED series for Canada’s headline CPI below ends in April. The dashed line is where May is at +3.4% vs +4.1% for the U.S.