Weak spending, sticky prices, rising inflation expectations a bad mix for U.S. Federal Reserve

(…) “No matter how you want to slice it, it’s shaping up to be a very weak quarter for real spending, and it may end up being the weakest quarter since the depths of the (pandemic) lockdowns,” Inflation Insights President Omair Sharif wrote.

Goldman Sachs economists following the data’s release cut their forecast for first-quarter growth nearly in half, to 0.6% from 1%.

For the Fed, it could point to the worst of both worlds emerging, with a potential slowdown in growth, prices moving higher, and firms perhaps contemplating more sticker shock as President Donald Trump’s new taxes on imports are put in place.

In the background: Consumer expectations about inflation are grinding higher, while market-based prices for Treasury Inflation-Protected Securities show the outlook for inflation 10 years from now also rising.

Those figures are closely watched by the Fed, and are perhaps even more likely to make policymakers nervous about their grip on inflation and less likely to cut interest rates.

The latest University of Michigan consumer survey showed long-run inflation expectations topped 4% in March, double the Fed’s target. While central bankers don’t like to react to a single month’s data, “long-run expectations have climbed sharply for three consecutive months and are now comparable to the peak readings from the post-pandemic inflationary episode,” survey Director Joanne Hsu wrote. “They exhibit substantial uncertainty, particularly in light of frequent developments and changes with economic policy.”

In the wake of the latest Personal Consumption Expenditures (PCE) data, analysts again tuned into the risk of “stagflation” – or inflation coupled with rising unemployment, a particular dilemma for the central bank. (…)

“The PCE report for February makes grim reading,” wrote Evercore ISI Vice Chair Krishna Guha. “Consumers – like businesses – are pulling back amid … uncertainty and an expected hit to real income from tariff-driven price increases. With core PCE (prices) 2.8% year-on-year even before the main effect of tariffs has hit, there is currently no scope for good news rate cuts.”

Friday’s Personal Income and Outlays report for February pointed to a stagflation environment:

- Real expenditures barely rose (+0.1%), no rebound after slumping 0.6% in January and growing 4.5% annualized rate in Q4’24.

- Spending on services is –0.06% after 2 months, very rare 2-month negative growth outside of recessions.

- This in spite of real disposable income up 0.5% in February after +0.3% in January.

- The savings rate rose from 3.3% in December to 4.3% in January and to 4.6% in February. Worried Americans.

- Headline PCE inflation was up 4.0% annualized for two consecutive months while core PCE inflation reached 4.5% in February, the highest in 12 months.

- Growth in weekly payrolls was 4.9% a.r. in February but averaged only +2.9% a.r. in the last 3 months. Squeezed Americans.

- Services inflation was steady at +3.8% a.r., averaging +4.1% a.r. in the last 3 months vs +3.5% for all of 2024 and +3.0% in H2’24.

(…) The final March sentiment index declined to 57 from 64.7 a month earlier, according to the University of Michigan. The latest reading was below both the 57.9 preliminary number and the median estimate in a Bloomberg survey of economists. Consumers expect prices to rise at an annual rate of 4.1% over the next five to 10 years, the data released Friday showed. That’s the highest since—wait for it—1993.

Consumers also see costs rising 5% over the next 12 months, the highest since 2022. But even more foreboding is what Americans see for the country’s jobs market. For years, the US has left the rest of the post-pandemic world behind with low employment levels not seen since the 1960s, when Richard Nixon was president. “Notably,” said Joanne Hsu, director of the Michigan survey, “two-thirds of consumers expect unemployment to rise in the year ahead, the highest reading since 2009.” (…)

Gross domestic product is now set to grow 2% in 2025, according to the latest Bloomberg survey of economists, down from the 2.3% estimate in last month’s poll. Their projection for first-quarter growth was marked down a full percentage point to 1.2%.

Americans don’t seem “ok with that little disturbance”, are they?

Americans don’t seem “ok with that little disturbance”, are they?

Friday we get the March employment report.

Indeed Job Postings fell 2.7% between Dec. 31 and March 21 and 0.8% since the end of February:

S&P Global’s latest flash PMI:

Employment rose slightly in April, returning to growth after a small decline in February. The upturn was led by renewed hiring in the service sector. However, even here the rate of job creation was marginal, and much weaker than at the turn of the year.

Some companies reported job losses due to sluggish demand plus a wariness to hire due to the uncertain outlook. Manufacturers in particular reported concerns over payroll numbers and rising costs, cutting headcounts for the first time since last October.

Americans have been outspending their slowing payroll gains each of the last 12 months. Rising inflation and economic uncertainty suggest increased frugality in coming months. With payrolls up 4.6% YoY in February, slowing employment growth, rising inflation and higher savings could critically impact spending growth.

Car Buyers Who Fear Tariff Price Hikes Are Rushing to Dealers

This could help shorter term, but hurt medium term:

(…) Across the country, buyers and sellers are rushing to lock down deals and fill lots before they take effect. (…)

The automaker [GM] is rushing shipments amid a stampede of customers that have come to his showroom looking to get ahead of the higher costs. Many of the new arrivals are Equinox, Trailblazer and Trax, imports that are among Chevy’s least expensive models.

“GM has accelerated the build,” said Paddock, the owner of Paddock Chevrolet in suburban Buffalo, New York. “We’ve got a boatload of vehicles in transit and our floor traffic has been through the roof.” (…)

What happens after that supply runs out remains unclear. Analysts say that automakers will most likely absorb some of the higher costs, dealers may see a hit to profitability and consumers will pay the rest. But exactly how that’s all balanced out is anyone’s guess at this point. (…)

Auto prices are broadly expected to increase by thousands of dollars, with JPMorgan Chase & Co. analysts estimating prices will jump 11% on average. (…)

On the other hand, a rush to buy new cars could limit other discretionary expenditures, including travel plans.

- Hotel News informs us that “hotels used to be able to overbook to compensate for no-shows and still sell out, she said. That’s not the case anymore, for the most part. “You’re not sold out in advance,” she said.”

- Bank of America weekly card spending show that spending on lodging is around 2.5% YoY below 2024 levels and airline spending to be around 6% below 2024 levels as of mid-March, across all income categories. “Unlike other categories of tourism spending, spending on airfares is usually done in advance of travel, sometimes well in advance. It could be that [late] Easter is playing a role here too, but it is potentially worrying if consumers are reining in air travel plans more broadly as this could translate into softer spending in other areas of travel and tourism down the road. Tourism and Travel is worth around 3% of US GDP and directly employs around 6.5 million people.”

BTW:

There has been a pivot from travel to the U.S. from Canada, Mexico and even South America. The tariffs and trade war are making people choose to travel elsewhere. Other countries, including the United Kingdom and Germany, have issued travel advisories to their citizens about trips to the U.S.

“I am concerned about a pretty dramatic drop-off from international travelers, and I think it’s something that the U.S. hospitality industry really needs to pay attention to and speak to, because they spend a lot of money,” she said. “They come over for long stays. They definitely affect the economy of markets beyond the hotel.

“This is something we all need to watch very closely and hope that there is some sort of shift. I think it will have an impact in the summer if things do not change.” (Hotel News)

- The land of the free?

Canada and several European countries have issued travel advisories for the US. While most of the government warnings don’t specify why they were added, the timing points to the the Trump administration’s executive orders regarding immigration and the tightening of border policies. (…)

Many of the European countries that have issued US travel warnings have flagged the White House’s executive order that states “it is the policy of the United States to recognize two sexes, male and female,” potentially causing issues for transgender travelers with self-identified or “X” gender markers on their passports. (…)

Australia-based small-group adventure travel company Intrepid Travel has already started to see “some softening in demand for the US, in particular from Europe,” according to its CEO James Thornton, who notes that US domestic travel (travel by Americans in America) is down by 27% and travel to the US from Europe, the Middle East, and Africa is down by 12.8% compared to last year.

“This could be due to a number of factors, including the strength of the US dollar, but we believe that the US administration’s polarizing approach is definitely having an impact,” he says. (…) (Condé Nast)

We all know that the American consumer is in good financial shape, at least on average. But there is a not so trivial vulnerability to an income or a price shock as Goldman Sachs illustrates:

- The U.S. savings rate is very low by historical standards and compared with other developed countries.

- The pandemic excess savings have been exhausted in the U.S. considering that prices are up 8.1% since mid-2022.

- American households have really splurged on goods since the pandemic, particularly on durable goods. As Jay Powell once said, they may be running out of space…

- In any event, Americans have totally outspent G7 consumers since 2021:

Exhausted pandemic bounties, historically low savings rates, possibly bursting garages, it’s back to basics in America: employment, inflation, confidence. All shaky.

This indicator is not perfect but must nonetheless get some respect:

Households are much more pessimistic on the jobs market outlook

Source: Macrobond, ING

An historically high 51% of U. of Michigan survey respondents offered unsolicited negative mentions about government economic policy. Right or wrong, it clearly reflects high anxiety about the immediate future. Nearly 45% of U.S. households directly or indirectly own equity.

Source: @M_McDonough

The share of Americans expecting higher stock prices in 12 months per the Conference Board survey just collapsed from an all-time high of 57% to 37%. Wealth effect no more?

First-Quarter GDP Growth Estimate Declined

On March 28, the standard GDPNow model estimate for real GDP growth in the first quarter of 2025 is -2.8 percent. The alternative model growth estimate is -0.5 percent.

- Goldman Sachs Lifts U.S. Recession Probability to 35%

EARNINGS WATCH

The Q1’25 earnings season begins next week. Investors will likely largely dismiss the actual numbers and focus on corporate call comments and guidance (if any is realistically offered).

While nearly 60% of analyst revisions in the last month have been negative, earnings are still expected to grow 10.2% in Q2 (from +12.0% on Jan. 1) and 12.4% in Q3 (+13.1%).

For all of 2025, bottom up estimates are $269.12, up 10.9% YoY.

Goldman Sachs’ top down forecast sees 7% EPS growth in 2025, assuming “that US effective tariff rate increases this year by 10 pp to 13%, the highest rate since 1938. We estimate each 5 pp incremental increase in the effective tariff rate would weigh on S&P 500 EPS by roughly 1-2%.”

Importantly, “our EPS estimate assumes that companies are largely able to pass through tariffs to consumers. If companies are unable to pass through tariffs, it could pose greater downside risk to S&P 500 margins and earnings.”

I could not find how the assumed tariffs pass-through impacts Goldman’s revenue growth forecast but its, and most other current forecasts, are wild guesses at best.

- Tariffs are a Trump work in progress (?), fluctuating irrationally, daily and weekly, by number, country, product and other vague considerations.

- How much of the actual tariffs get passed through is unknown just like what will be the impact on inflation, demand and corporate margins. Trump last week told auto executives that “the White House would look unfavorably” on them raising prices because of tariffs. Like if car manufacturers had high enough margins to inconsequentially absorb 25% tariffs on steel and aluminum used in their U.S. plants plus more tariffs on imports of cars and parts. Is there a real businessman in or near the WH? (In an interview with NBC posted on Saturday, Trump said he “couldn’t care less” if carmakers raised prices as a result of the tariffs. “I hope they raise their prices, because if they do, people are going to buy American-made cars. We have plenty,” Trump said.)

- There is as yet no way to factor in the effects of retaliations and how this madness will end.

- What will be the impact on world growth and U.S. exports?

Trump’s mind seems unidimensional in a highly complex world.

The only thing we can reasonably (?) factor in at this time is that nothing good will come out of that. Either higher inflation will hurt demand, and/or profit margins will drop. How much and for how long is totally unknown. We’re all behind the eight ball!

This is still a historically expensive equity market, critically in need of positive visibility. Bloomberg reckons that “In 17 of the past 18 quarters, the S&P 500 gained quarter on quarter when company sentiment either increased or stayed flat, and dropped when it fell, suggesting the benchmark historically prices in poor earnings-call sentiment prior to earnings reports.”

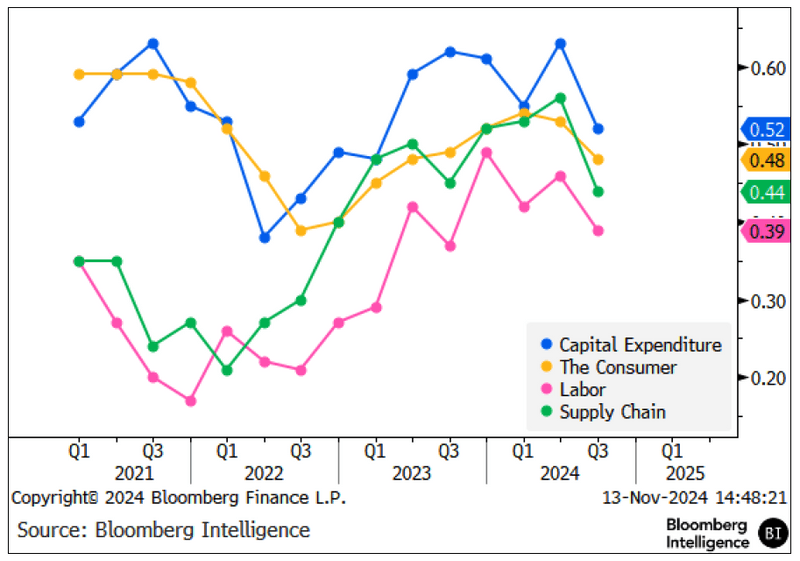

Management sentiment toward hot topics

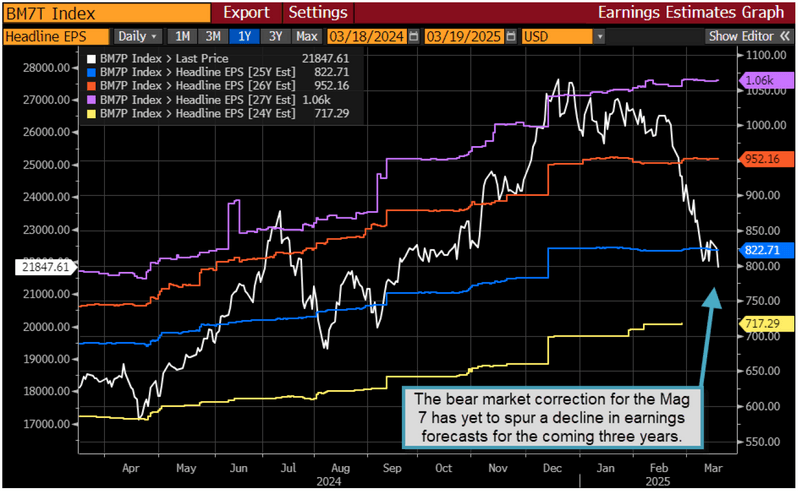

Mag 7 valuations and earnings forecasts have come under renewed scrutiny amid heightened concerns about China’s accelerating entry into the artificial intelligence (AI) space. Investors are showing worry about returns on investments, but that has yet to be realized in forecasts.

![]() Last night, Goldman’s David Kostin got more cautious:

Last night, Goldman’s David Kostin got more cautious:

Higher tariffs, weaker economic growth, and greater inflation than we previously assumed lead us to cut our S&P 500 EPS growth forecasts to +3% in 2025 (from +7%) and +6% in 2026 (from +7%). Our new EPS estimates are $253 and $269, respectively. These estimates are below both the top-down strategist consensus and the bottom-up consensus of equity analysts.

Slowing growth and rising uncertainty warrant a higher equity risk premium and lower valuation multiples for equities. The S&P 500 entered 2025 trading at a 21.5x P/E multiple on consensus forward EPS, and currently trades at a multiple of 20x. With little change to consensus EPS estimates, all of the 9% sell-off from the market peak in February has stemmed from valuation contraction. We expect a further valuation decline in the near-term, with the P/E registering 19x in 3 months and rising modestly to 19.5x in 12 months.

Sensitivity of S&P 500 returns to EPS and P/E scenarios

returns relative to S&P 500 closing price of 5581 on March 28, 2025

Source: Goldman Sachs Global Investment Research

- Our baseline forecast assumes the US economy avoids a recession. However, a central forecast of 1.5% average annual GDP growth (and just 1.0% on a 4Q/4Q basis) means recession is a significant possibility, and our economists ascribe a 35% probability to that outcome in the next 12 months. The historical equity market recession playbook implies a roughly 25% S&P 500 drawdown from the recent market peak alongside a 13% decline in earnings. Based on the S&P 500 record high of 6144 in February, this magnitude of decline would suggest a further 17% drawdown to a trough level of roughly 4600.

The S&P 500 has typically declined by about 25% around economic recessions

Source: Goldman Sachs Global Investment Research

At 4600, using $253 EPS and 3.0% inflation, the Rule of 20 P/E would be 21.2. For the R20 P/E to return to its 20.0 median (where it always returns), the S&P 500 would need to touch 4300 or 17x Goldman’s 2025 EPS estimate.

A 20-30% equity bear would send the wealth effect into a serious wealth defect.

Last Friday, Ed Yardeni, still in muddling through mode, nonetheless wondered “Is a depression possible? We aren’t forecasting a depression, just worrying about one. And we suspect you are too.”

This is an abridged version of his excellent essay:

(…) Unfortunately, a lot is going wrong: commodity prices are falling; debtors are resisting austerity programs; agriculture is in a depression; industry is in a recession; nonperforming loans are increasing; banks are failing; the trade deficit is widening; protectionism is gaining support; fiscal policy is gridlocked; and the Fed is in a box.

These are not the sort of problems we associate with the garden-variety postwar business cycle. Rather, they are very reminiscent of the events that triggered or exacerbated the first phase of the Great Depression from 1929 to 1933. The parallels are becoming obvious to all. (…)

Upon reviewing the economic events of 1929 to 1933, we discovered a number of disturbing similarities. And the differences are even more disturbing! Yet, on balance, we conclude that a rerun of the 1930s is not very likely, but it is a risk if trade protectionists have their way.

In our opinion, the single most catastrophic cause of the Great Depression was the Smoot-Hawley Tariff of June 1930—not the stock market crash of October 1929, not the collapse of the Austrian Kreditanstalt Bank in May 1931, not the sharp increase in the Fed’s discount rate during October 1931, not the tax increase of 1932, not the subsequent bank failures or collapse of the money stock. All these events contributed to the economic explosion, but the detonator was the tariff. That’s confirmed by the collapse in industrial production immediately after the tariff was enacted.

Today, protectionist sentiments are spreading at an alarming rate. (…)

But wouldn’t the Federal Reserve avert such a calamitous chain of events by lowering interest rates? For several reasons, we doubt it:

(1) During October 1931, following the sterling crisis, foreign investors lost their confidence in the dollar and demanded gold in exchange for the U.S. currency. To stop the gold outflow, the Fed raised interest rates. This move calmed the external crisis, but intensified the internal crisis as another wave of banks suspended operations. Again, to halt a run on the dollar, the Fed raised interest rates during February 1933.

(2) In 1985, the Fed has resisted lowering interest rates more aggressively, fearing that foreigners then might sell dollars and withhold capital needed to finance the huge federal deficit.

(3) Moreover, the Fed is so worried about reviving actual and expected inflation that interest rates are never cut unless there is unambiguous justification for such a policy move, such as falling commodity prices and sluggish economic activity—they’re deemed sufficient cause. (…)

But the differences are also disturbing!

For example, the Smoot-Hawley Tariff was imposed on a U.S. economy that enjoyed a trade surplus with the rest of the world. Today, the U.S. is running huge trade deficits. As a result, protectionism probably has more grassroots support now than during 1929 and 1930.

During 1932, President Hoover raised taxes to pay for the increase in public-works spending and therefore to balance the federal budget. Today, the federal deficit is so huge that there is no room for another New Deal. Economists are calling for tax increases, not to lower the deficit but to keep it from swelling above $200 billion.

In the May 5, 1930, issue of The New York Times, 1,028 American economists urged Congress and President Hoover not to raise tariffs. They predicted that other countries would inevitably retaliate by raising their tariffs. (…)

Hoover signed the bill on June 17, 1930.” (…)

International trade retaliation on a massive scale soon proved the economists right. Spain, Canada, Italy, Cuba, Mexico, France, Australia, and New Zealand quickly enacted new tariffs. On November 19, 1931, Britain imposed a 50% duty on 23 classes of goods. In July 1932, the Ottawa Conference forced the British Dominions to grant preferences to British goods. Germany resorted to import licensing and bilateral trading arrangements in November 1931. By 1936, 65% of French imports came under a quota system.

Trade became bilateral or regional within existing empires. Quotas, licensing agreements, and prohibitions complemented tariffs. By the mid-1930s, international trade largely had become barter trade. World trade collapsed.

On March 2, 1934, President Roosevelt (…) noted that measured in terms of the volume of goods in 1933, trade had been reduced by about 70% of its 1929 volume; measured in terms of dollars, it had fallen to 35%. “The drop in the foreign trade of the United States has been even sharper. Our exports in 1933 were but 52% of the 1929 volume, and 32% of the 1929 value.” (…)

Trade protectionism set off a chain reaction of lethal financial crises. (…)

President Hoover was defeated for reelection in November. During the long interregnum until Franklin D. Roosevelt took office the following March 4, efforts to arrange cooperation between the incoming and outgoing presidents broke down. (…)

A rerun of the 1930s is not very likely, in our opinion. Pollster Lou Harris notes that the public is ambivalent on trade issues. Three-quarters of the public say they like access to low-cost foreign products. At the same time, three-quarters say there is unfair competition from abroad that is costing the U.S. jobs. On Capitol Hill, most representatives favor free trade, but believe that no other countries are still practicing it.

Clearly, some import-restricting legislation will pass Congress this fall. And protectionist sentiment could be strong enough to override a presidential veto. But a repeat of the Smoot-Hawley disaster is not very likely.

Also, domestic banking and international debt problems are not causing financial panics and a monetary collapse. (…)

International debtors are resisting IMF-style austerity programs. But the debtors have rejected the idea of walking away from their obligations and continue to work out rescheduling agreements with their creditors.

The Federal Reserve is likely to drop interest rates further if the forces of deflation continue to dampen economic growth. Unlike the 1930s, domestic concerns should outweigh foreign exchange objectives in the conduct of Fed policy. Lower interest rates aren’t likely to reaccelerate or reflate the economy, but they’ll help to avert a recession. In other words, we should continue to muddle down the middle.

Friday:

Trump pushes aides to go bigger on tariffs as key deadline nears The president privately tells advisers that import duties represent a generational opportunity to transform the U.S. economy.

President Donald Trump is pushing senior advisers to go bigger on tariff policy as they prepare for what the White House has called “Liberation Day,” the April 2 date he has set for a major escalation in his global trade war, four people familiar with the matter said.

Although many of his allies on Wall Street and Capitol Hill have urged the White House to take a more conciliatory approach, Trump has continued to press for aggressive measures to fundamentally transform the U.S. economy, the people said. (…)

Trump continues to muse to advisers that his administration should continue to escalate the trade measures and has in recent days revived the idea of a universal tariff that would apply to most imports, regardless of their country of origin, the people said, speaking on the condition of anonymity to describe private discussions.

In public and private, the president has said tariffs represent a win-win that will bring manufacturing jobs back to the United States and fill federal coffers with trillions of dollars in new revenue. (…)

At whose expense?

Trump is right on one thing: his import duties represent a generational opportunity to transform the U.S. economy. One way or the other.

Let’s hope Mark Twain was wrong…

And today, on the eve of such an important, world-changing policy announcement, we learn that the WH is still scrambling for the formula:

- “The Trump administration is scrambling to determine the specifics of its new tariff agenda ahead of its self-imposed deadline of Wednesday, weighing options (…).” (WSJ)

- On Sunday night, Trump said “he would target “essentially all” of U.S. trading partners with tariffs of some kind.” (WSJ)

- “You’d start with all countries, so let’s see what happens,” Trump told reporters aboard Air Force One. (Bloomberg)

Just after Signalgate…![]()

Economists Slash Canada Growth Forecasts as Trade War Strikes

(…) The economy will expand at an annualized 0.7% clip in the second quarter of this year, according to the Bloomberg survey of 34 economists. That’s down substantially from the 1.7% pace of growth that was expected between April and June in last month’s survey.

Forecasts were slashed across most growth components — export, investment and household consumption output are all expected to contract over the second quarter. Analysts also trimmed their outlook for the third quarter, when output is expected to rise 0.8%, from 1.5% previously.

Economists are starting to see a stagflationary outlook emerging. Inflation is seen running hotter in the northern nation as retaliatory tariffs and currency depreciation push up costs, leading the yearly change in the consumer price index to average 2.4% this year, up from 2.1% in the prior survey.

The unemployment rate is seen rising to 7% in the last half of the year, 0.25 percentage points higher than expected in last month’s survey. (…)

There’s already evidence that the slowdown in the northern nation has begun — flash growth estimates released Friday by Statistics Canada show the economy stalled in February, and surveys are showing plunges in consumer and business confidence.

The survey was conducted between March 21 and March 26. The odds of a recession in Canada are now at a coin flip, according the 11 economists who responded to the question.

The Bank of Canada next sets interest rates on April 16, and officials have said they plan to “move carefully” with any further changes to interest rates. Economists in the survey expect policymakers will hold borrowing costs at 2.75%, in line with the view of traders in overnight swaps.

Canadians Spurn Flights to US as Trade War Resistance Grows

(…) Bookings made from Canada to the US fell by 13% in February and March compared with a year ago, according to data from Canadian website FlightHub.com. Searches for travel within Canada surged over the same period, toppling the US as the most-searched destination. (…)

Jet travel isn’t the only mode of transportation affected by Canadians’ boycott. Cross-border road trips by Canadian residents in February plunged 23% year over year, according to Statistics Canada.

Meanwhile in China (via John Authers)

Real-time data parsed by China Beige Book points to a renewed loss of steam.

Every key indicator covered by CBB weakened both year-on-year and month-on-month in March — including inflation and employment gauges — while every sector reported slower earnings.

The surge in exports and consumer goods trade-in programs in response to the policy splurge was an overreaction that seems merely to have brought forward purchases that would have been made anyway.

This China Beige Book chart shows every sector reporting weaker revenue — a situation amplified by retailers:

BTW, FYI (still John Authers)

As this Gavekal Research chart shows, American firms and affiliates’ sales in China amounted to more than $600 billion in 2022 — the latest year for which data are available — more than three times the amount of US exports there. Their revenue and assets are exposed to Beijing’s regulatory action, even if nothing interrupts physical trade:

US tells European companies to comply with Donald Trump’s anti-diversity order Move signals push by American president to widen his ideological campaign abroad

The Trump administration has sent a letter to some large companies in the EU warning them to comply with an executive order banning diversity, equity and inclusion programmes. The letter, sent by the American embassy in Paris and others around the EU, said that Donald Trump’s executive order applied to companies outside the US if they were a supplier or service provider to the American government, according to three people familiar with the matter.

The embassies also sent a questionnaire that ordered the companies to attest to their compliance. The document, which the Financial Times has seen, is titled “Certification regarding compliance with applicable federal anti-discrimination law”. The document said: “Department of State contractors must certify that they do not operate any programs promoting DEI that violate any applicable anti-discrimination laws and agree that such certification is material for purposes of the government’s payment decision and therefore subject to the False Claims Act.” (…)