Hiring continued at a moderate pace in February, with nonfarm payrolls rising by 151K. The outturn was only modestly below consensus expectations for a gain of 160K. Over the past three months, employers have added an average of 200K, ahead of the one-year average of 162K. (…) revisions to the prior two months of data were minimal (-2K). (…)

Federal government employment (excluding the Post Office) fell by 7K in February compared to an average increase of 3K the prior six months as a hiring freeze was instituted for certain positions.

Hiring in goods-related industries held up well in February despite uncertainty around trade policy changes, with manufacturing, wholesale trade and transportation & warehousing employment all rising.

Elsewhere, leisure & hospitality employment declined for a second consecutive month (-16K), which may be tempting to blame on cold weather were it not for a solid rebound in construction employment (+19K). Healthcare & social assistance remained out-sized drivers of payroll growth in February (+63K), but the overall breadth of industry hiring continued to generally improve since last summer.

The continued moderation in hiring was accompanied by some weakening in the household survey. The unemployment rate ticked up a tenth to 4.1%, as the number of employed fell 588K and the number of unemployed rose 203K.

To be considered unemployed, individuals must report that they were available to work and actively looked for a job at some point over the past four weeks. Individuals discouraged from job-seeking and those working fewer hours than preferred are not included in the official unemployment rate (the U-3), but they are included in the broader U-6 measure, which rose half-a-percentage point to 8.0% in February, its highest reading since October 2021.

The material rise in under-employment could be a harbinger for weaker labor force attachment in the months ahead. The overall labor force participation rate slipped two-tenths to 62.4% in February. Participation among prime-age workers (25-54), which was already showing signs of topping out in late 2024, held steady in February. Meantime, the participation rate among older workers (age 55+) notably declined 0.3 percentage points to 38.1%.

We suspect severe winter storms in January disproportionately affected payrolls in lower paying industries, which underpinned the stronger-than-expected increase in average hourly earnings that month. As the breadth of hiring normalized in February, wage growth moderated to 0.3%, which is on par with its average run-rate over the past 12 months. The dampened monthly increase led the annual pace of wage growth down a tenth to 4.0%. (…)

Nonfarm payroll growth averaged a lukewarm 138K over January and February (…). Survey data regarding hiring suggest that some of the budding optimism that took hold a few months ago has petered out.

Clouds have gathered on the horizon that add more weight to the argument that the improvement in late 2024 was likely temporary. Uncertainty around trade policy has continued to grow, creating a challenge for goods-producing and goods-related services industries in their planning around staffing. At the same time, efforts to cut federal spending and employment have picked up since the survey week for the February employment report. We expect these forces to weigh on hiring more heavily as soon as next month’s March employment report. (…)

The 0.5 jump to 8.0% in U-6 unemployment is not trivial. It breaks the downtrend since last July, and it brings the U-6 rate to its highest pre-pandemic rate since January 2019, raising questions on U-3’s next prints.

BTW, the BLS records people as unemployed when they actually lose their job and stop receiving a salary, events which generally occur after the delivery of the pink slips, sometimes months after if a severance is given.

Challenger, Gray & Christmas tally job cuts at the time of announcements:

U.S.-based employers announced 172,017 job cuts in February, the highest total for the month since 2009 when 186,350 job cuts were recorded. It is the highest monthly total since July 2020 when 262,649 cuts were announced, according to a report released Thursday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas.

February’s total is a 245% increase from the 49,795 cuts announced one month prior. It is a 103% increase from the 84,638 cuts announced in the same month last year.

So far this year, employers have announced 221,812 job cuts, the highest year-to-date (YTD) total since 2009 when 428,099 job cuts were planned. It is up 33% from the 166,945 cuts announced during the same period in 2024.

The Government led all sectors in job cuts in February. Challenger tracked 62,242 announced job cuts by the Federal Government from 17 different agencies last month.

“It appears the administration wants to cut even more workers, but an order to fire the roughly 200,000 probationary employees was blocked by a federal judge. It remains to be seen how many more workers will lose their Federal Government roles,” said Challenger.

“DOGE Impact” leads job cut reasons this year and was attributed to 63,583 layoffs, both directly to the Federal workforce and to contractors. Downstream impacts of DOGE, such as loss of funding to private Non-Profits, led to another 894 job cut plans.

Excluding DOGE-related job losses, there were 108,434 job cut announcements in February, 28% more than in February 2024.

ING has the spooky chart:

Chart of the week: US layoffs unexpectedly spike

Source: Macrobond

ING also illustrates another important concern:

Our chief concern about the US jobs market is the quality of jobs that are being added. Since January 2023 only 13% of jobs created have been outside of leisure & hospitality, government and private education & healthcare services.

These sectors tend to be lower paid, less secure and more part time in nature, a point borne out by the fact that the average working week in America remained at just 34.1 hours, down from 35 hours in 2021.

We would feel much happier if it was technology, construction, manufacturing, business services, transport and logistics etc that was leading job creation – sectors that are typically associated with a strong and vibrant economy.

Cumulative jobs creation by industry (000s)

Source: Macrobond, ING

Excluding the 3 above mentioned sectors, the more dynamic parts of the U.S. economy created only 423,000 jobs in the past 24 months, 17,600 per month on average. Not terribly dynamic, is it?

Even the apparent improvement since last October only shows a 1.1% annualized rate of growth.

The composition of aggregate weekly payrolls (jobs x hours x wages) is also concerning. The contribution from new jobs + hours has become marginal so that labor income growth now largely rests on wage growth (black bars). Note also that hours worked did not bounce back in February following 2 weak months and harsh weather in January.

Total private hours, at 34.1, are below their lowest level since 2006 outside of recessions. Even services hours as lower.

In the last 4 months, wages rose at a 3.9% annualized rate.

Last week, Chair Powell said:

-

“The economy is fine. It doesn’t need us to do anything, really. And so we can wait.”

-

“We are focused on separating the signal from the noise as the outlook evolves. We do not need to be in a hurry, and are well positioned to wait for greater clarity.”

-

“An unexpected weakening in the labor market or a decline in inflation would allow the Fed to resume lowering rates.”

-

“In a simple case, where we know it’s a one-time thing [tariffs], the textbook would say, ‘Look through it,’” or don’t change the interest-rate path”.

-

“We will be highly focused on longer-term inflation expectations.”

Well, expectations are up … but beware of averages!

Data dependency means backward looking. Powell clearly said that if and when stat releases give the signal(s), they will cut rates since they will surely see tariffs inflation as “transitory”. Certainly not in March, unlikely in April, maybe in May.

Labor income growth peaked at 5.2% YoY last October and was 4.6% in February mainly because of wages.

Private Labor demand resumed its downtrend after a short burst in November-December while the participation rate declined. Wages are more likely to slow than anything else.

If so, labor income growth will slow towards 4.0% in coming months.

PCE inflation was 2.5% YoY in January but averaged 3.0% a.r. in the last 4 months and 3.8% a.r. in the last 2 months. Layer on whatever tariffs impact you wish, real labor income growth will hover around zero this spring, dragging growth in real expenditures down along the way.

The currently “fine” economy might quickly require another qualifier…

Ed Yardeni has become more cautious:

Over the past three years, we’ve assigned a 20% subjective probability to the various prospects that could go wrong for the economy, resulting in a recession and a bear market for stocks. We are raising it to 35%. (…)

Bond investors are giving more weight to the “stag” than the “flation” components of a stagflation scenario. We are doing the same by raising the odds of a tariff-induced recession from 20% to 35%.

Trump’s tariffs and DOGE-mandated job cuts are depressing consumer confidence. (…) We are still betting on the resilience of consumers and the economy. However, Trump Turmoil 2.0 is significantly testing the resilience of both. That’s why we’ve recalibrated our subjective probabilities.

But the stock market seems to be signaling that stagflation is even more likely than we think given how quickly stock prices have dropped since February 19.

We can’t rule out the possibility that a bear market started on February 20, the day after the S&P 500 rose to a record high.

KKR keeps the faith:

(…) we think this report will provide some relief to the ‘growth scare’ narrative and be viewed as a settling influence, even though the recent federal government layoffs will show up more prominently in March and over the rest of 2025. However, we do not want to underestimate the narrative that both President Trump and Treasury Secretary Scott Bessent are signaling: a ‘transition’ is occurring that will impact growth and create volatility. So, we are not waving the ‘all clear’ signal.

That said, we are not forecasting a recession; the cycle will continue. A global easing cycle, strong U.S. productivity, and a compelling technical backdrop will likely keep the glass half full again in 2025. (…)

Economic Danger!

Economic Danger!

In truth, what many pundits call the resilient consumer does not exist today. Americans are as divided economically as they are politically.

A February 23 WSJ article summed it up:

The U.S. Economy Depends More Than Ever on Rich People

Many Americans are pinching pennies, exhausted by high prices and stubborn inflation. The well-off are spending with abandon.

Many Americans are pinching pennies, exhausted by high prices and stubborn inflation. The well-off are spending with abandon.

The top 10% of earners—households making about $250,000 a year or more—are splurging on everything from vacations to designer handbags, buoyed by big gains in stocks, real estate and other assets.

Those consumers now account for 49.7% of all spending, a record in data going back to 1989, according to an analysis by Moody’s Analytics. Three decades ago, they accounted for about 36%.

All this means that economic growth is unusually reliant on rich Americans continuing to shell out. Mark Zandi, chief economist at Moody’s Analytics, estimated that spending by the top 10% alone accounted for almost one-third of gross domestic product.

Between September 2023 and September 2024, the high earners increased their spending by 12%. Spending by working-class and middle-class households, meanwhile, dropped over the same period. (…)

Taken together, well-off people have increased their spending far beyond inflation, while everyone else hasn’t. The bottom 80% of earners spent 25% more than they did four years earlier, barely outpacing price increases of 21% over that period. The top 10% spent 58% more. (…)

The buying power of the richest Americans, who Zandi said tend to be older and more educated, stems in part from the swelling values of homes and the stock market over the past several years. While rising asset prices are extolled as a sign of a good economy, they also are widening the gap between those who own property and stocks, and those who don’t. (…)

The net worth of the top 20% of earners has risen by more than $35 trillion, or 45%, since the end of 2019, according to Federal Reserve data. Net worth grew at a similar rate for everyone else, but it translated to a lot less money: an increase of $14 trillion for the bottom 80%. (…)

“It’s an extreme bifurcation” between those companies and others that cater to poorer customers, said JPMorgan Chase analyst Matthew Boss. Big Lots filed for bankruptcy last fall. Kohl’s and Family Dollar are closing stores. “They’re all battling for fewer dollars,” Boss said. (…)

But there are more and more indications that even the affluents are looking for ways to save.

But there are more and more indications that even the affluents are looking for ways to save.

- WMT says that 75% of its market share gains comes from affluent consumers shopping its stores

- Costco membership keeps rising rapidly (+6.8% last quarter) with its parking lots hosting more and more fancy cars (I personally saw a Bentley a few weeks ago).

- Companies of all types are talking of “a more cautious consumer”, including Target, Best Buy Co., Macy’s Inc., Abercrombie & Fitch Co. and Victoria’s Secret & Co.

- “The affluent customer that’s shopping Macy’s is just as uncertain and as confused and concerned by what’s transpiring” in the economy.” (Macy’s CEO)

- The Conference Board survey showed that young consumers — those below the age of 55 — with incomes above $125,000 had the largest declines in confidence, and expectations for the job market fell for the first time since last fall.

- From a recent Wells Fargo Money Study conducted from September 5 to October 4, 2024

- 67% say they are able to pay their bills but have little left over for “extras”.

- 50% say they have more debt than they feel comfortable with.

- 76% of US consumers are reportedly cutting back on spending, up from 67% in 2024.

- 74% say they have delayed travel plans.

- 39% say they have put off renovating their homes.

- 30% have put off buying a home.

- 87% say now is a good time to save.

The so-called resilient consumer is thus split in 2 camps:

- the less affluents are already squeezed and struggling by the 23% increase in the cost of living since 2019 (food +29%, energy +32% rent +27%),

- and the more affluents who are beginning to feel it and could really retrench if inflation hits hard and/or if equities decline significantly. The wealth effect does work both ways.

FYI: About 76% of Democrats expect tariffs to lead to higher prices, while 55% of independents and 45% of Republicans do. About 100% of economists do.

Yesterday, we got the infamous “transitory” again!

Trump Says US Economy Faces ‘Transition,’ Avoids Recession Call

Asked on Fox News’ Sunday Morning Futures whether he’s expecting a recession this year, Trump said, “I hate to predict things like that. There is a period of transition, because what we’re doing is very big.” (…)

Trump set the tone on March 4 in his address to a joint session of Congress, acknowledging there may be an “adjustment period” as tariffs take effect. “There’ll be a little disturbance, but we’re okay with that,” he said in his speech. “It won’t be much.” (…)

That must be the “royal We”.

Transitory is quite right, but to what?

Also Sunday, “On “Meet the Press,” Commerce Secretary Howard Lutnick said: “There’s going to be no recession in America. … Donald Trump is bringing growth to America. I would never bet on recession. No chance.”” (Axios)

According to the Labour Force Survey (LFS), hiring in February took a breather as employment was essentially unchanged on the month. However, this comes after a string of very strong reports in which employment advanced 211K between November and January. Normally, a flat employment reading and a 47K rise population increase would produce an increase in the unemployment rate. However, these coincided with a 17K drop in the labour force leaving the jobless rate at 6.6%, below the 6.9% peak registered in November.

What’s clear in these data is that Canadian population growth is slowing dramatically as the federal immigration crackdown continues.

It’s not obvious how much of February’s hiring deceleration is due to trade uncertainty. Manufacturing employment fell in February but that comes after an eye-popping 33K advance in January. More broadly, it was a bad month for goods-producing industries but here too, employment declines were not enough to offset strong net hiring in January.

One must also consider the impact of weather in February, which impacted hours worked and may have contributed to less hiring and job-seeking activity. Ultimately, the impact of the Canada-US trade war should become clearer in coming months. (…)

With tariff uncertainty (and now tariffs themselves) weighing on the economy, the Bank of Canada will want to be a source of stability. To us, that involves delivering a 25 basis point rate cut. Looking beyond the March 12th decision, there’s a compelling case to be made that further cuts are warranted on uncertainty alone. (…)

But if the Canada-US trade war negatively impacts a broader suite of economic data (which we see as more likely), a steady dose of rate cuts are likely in store.

Carney Says Canada’s Tariffs to Stay Until US Shows ‘Respect’

(…) “The Canadian government is rightly retaliating with our own tariffs,” Carney said during his victory speech Sunday. “My government will keep our tariffs on until the Americans show us respect — and make credible, reliable commitments to free and fair trade.”

Carney, the former governor of the Bank of Canada and Bank of England, won the contest to lead the Liberal Party and will be sworn in as prime minister within days, replacing Justin Trudeau. It was a blowout victory — he received 86% of the vote. (…)

“I know these are dark days. Dark days brought on by a country we can no longer trust. We’re getting over the shock, but let us never forget the lessons. We have to look after ourselves. And we have to look out for each other. We need to pull together in the tough days ahead. We can — and will — get through this crisis.” (…)

“There’s someone who’s trying to weaken our economy. Donald Trump has put unjustified tariffs on what we build, on what we sell, on how we earn a living. He’s attacking Canadian workers, families, and businesses. We can’t let him succeed and we won’t.”

“We must build a new economy and create new trading relationships.”

EARNINGS WATCH

491 companies in the S&P 500 Index have reported earnings for Q4 2024. Of these companies, 73.9% reported earnings above analyst expectations and 18.5% reported earnings below analyst expectations. In a typical quarter (since 1994), 67% of companies beat estimates and 20% miss estimates. Over the past four quarters, 78% of companies beat the estimates and 17% missed estimates.

In aggregate, companies are reporting earnings that are 6.9% above estimates, which compares to a long-term (since 1994) average surprise factor of 4.2% and the average surprise factor over the prior four quarters of 6.6%.

Of these companies, 63.2% reported revenue above analyst expectations and 36.8% reported revenue below analyst expectations. In a typical quarter (since 2002), 62% of companies beat estimates and 38% miss estimates. Over the past four quarters, 62% of companies beat the estimates and 38% missed estimates.

In aggregate, companies are reporting revenues that are 1.2% above estimates, which compares to a long-term (since 2002) average surprise factor of 1.3% and the average surprise factor over the prior four quarters of 1.2%.

The estimated earnings growth rate for the S&P 500 for 24Q4 is 17.0%. If the energy sector is excluded, the growth rate improves to 20.5%.

The estimated revenue growth rate for the S&P 500 for 24Q4 is 5.2%. If the energy sector is excluded, the growth rate improves to 5.8%.

The estimated earnings growth rate for the S&P 500 for 25Q1 is 8.0%. If the energy sector is excluded, the growth rate improves to 9.5%.

Trailing EPS are now $245.39. Full year 2025e: $270.56.

Tariffs were center stage in most Q4 conference calls but they were still only possible. They have now become real, but after the end of the earnings season, leaving investors guessing.

Analysts are cautious…

… but only slowing growth rates, so far.

TECHNICALS WATCH

Source: Callum Thomas using MarketCharts

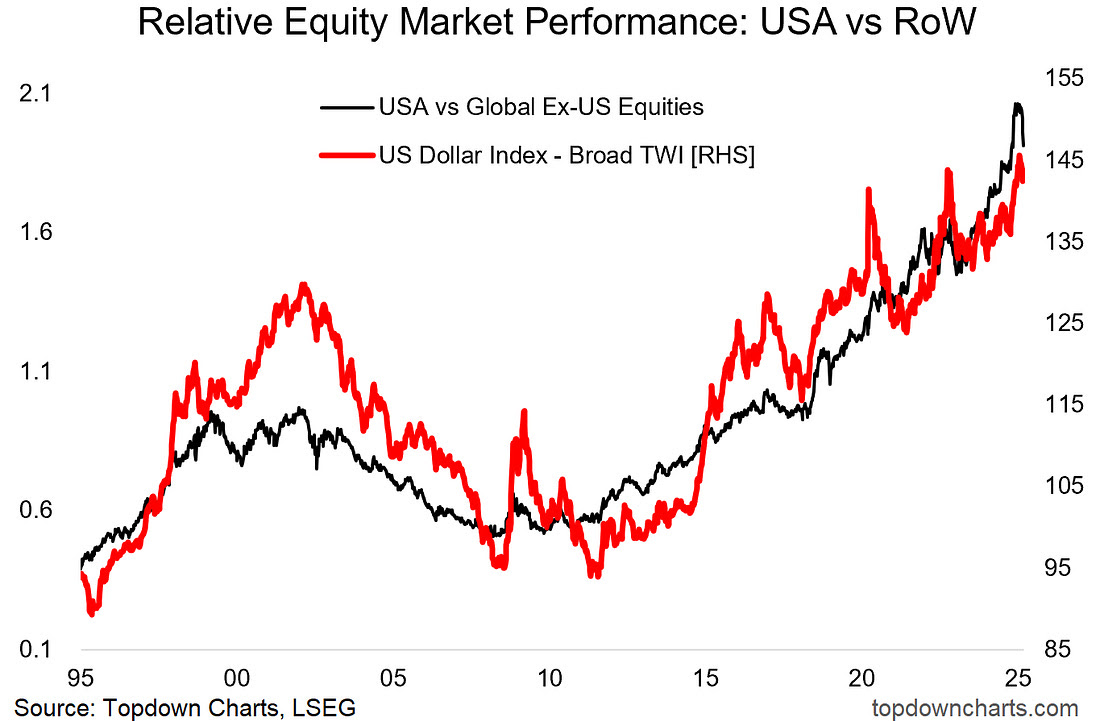

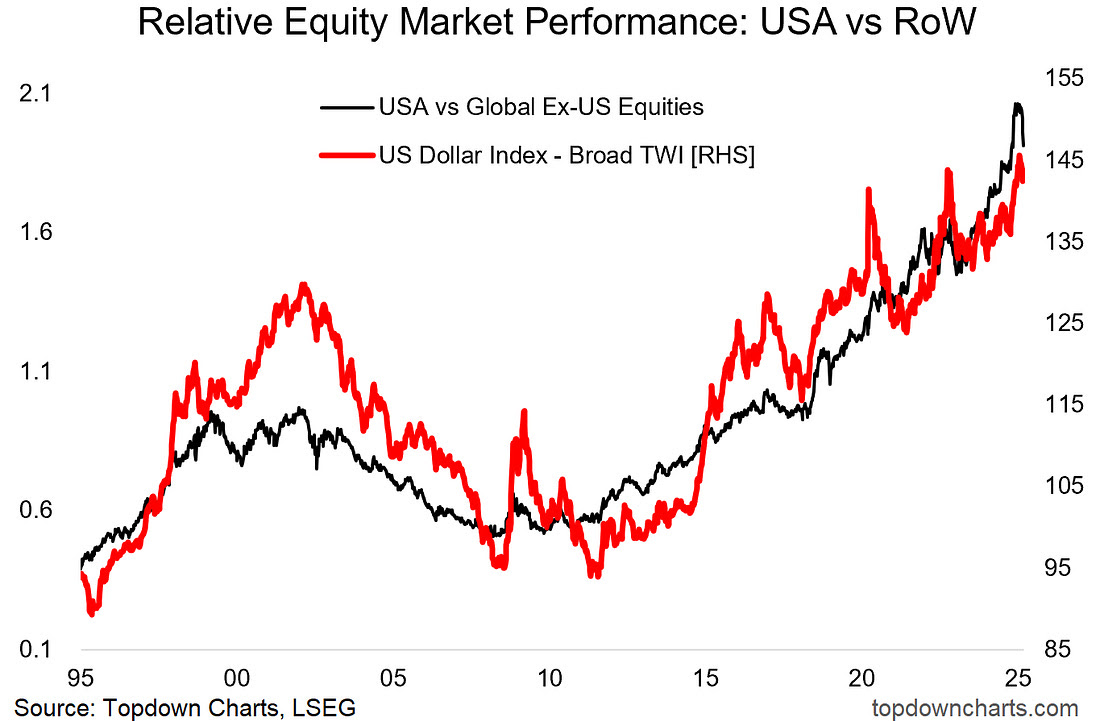

- Global vs US Rotation Rip: Aside from US investor allocations to equities, global flows also matter immensely. And it’s not just domestic investor confidence that’s being rattled — global investors are getting fed up with the toxic combination of heightened policy uncertainty, US recession risk (fiscal contraction and tariff/uncertainty shock), expensive valuations, and a peaking US dollar. So it’s only logical that we begin to see a bit of global vs US rotation as global investors reallocate from expensive US to cheap global/local.

(Callum Thomas)

Source: @sstrazza via @TheChartReport

SHIPS AHOY!

“We used it to make so many ships,” Trump said. “We don’t make them anymore very much, but we’re going to make them very fast, very soon.”

The U.S. built thousands of cargo ships during World Wars I and II, according to a 2023 congressional report.

- “In the 1970s, U.S. shipyards were building about 5% of the world’s tonnage, equating to 15-25 new ships per year.”

- “In the 1980s, this fell to around five ships per year, which is the current rate of U.S. shipbuilding.” (Axios)

Data: UN Trade and Development; Chart: Danielle Alberti/Axios

Steel accounts for 75-85% of a ship’s weight, making steel price fluctuations a critical factor in overall shipbuilding costs.

The cost of steel fabrication in shipbuilding varies considerably across different global regions. This variance is influenced by a myriad of factors, including labor costs, technological capabilities, and market dynamics.

New U.S. import tariffs of 25% on steel and aluminum imports become effective March 12, 2025.

Political Danger!

Musk and Republican Lawmakers Pressure Judges with Impeachment Threats

Congressional Republicans, egged on by Elon Musk and other top allies of President Trump, are escalating calls to remove federal judges who stand in the way of administration efforts to overhaul the government.

The outcry is threatening yet another assault on the constitutional guardrails that constrain the executive branch. (…)

But even the suggestion represents another extraordinary attempt by Republicans to breach the foundational separation of powers barrier as Trump allies seek to exert iron-fisted control over the full apparatus of government. And Democrats charge that it is designed to intimidate federal judges from issuing rulings that may go against Mr. Trump’s wishes.

“The only way to restore rule of the people in America is to impeach judges,” Mr. Musk wrote this week on X, his social media platform, in one of multiple posts demanding that uncooperative federal judges be ousted from their lifetime seats on the bench.

“We must impeach to save democracy,” Mr. Musk said in another entry on X after a series of rulings slowed the Trump administration’s moves to halt congressionally approved spending and conduct mass firings of federal workers. He pointed to a purge of judges by the right-wing government in El Salvador as part of the successful effort to assert control over the government there.

The push comes as arch-conservative House Republicans have filed articles of impeachment against federal judges whom they portrayed as impediments to Mr. Trump, accusing them of acting corruptly in thwarting the administration. (…)

Senator Mike Lee, a Utah Republican who sits on the Judiciary Committee, said in a social media post that “corrupt judges should be impeached and removed” after earlier suggesting that rulings against the administration smacked of a ‘judicial coup.” (…)

He noted that the Constitution provides that judges have lifetime tenure during “good behavior.” “It is not good behavior if you are corrupt, either legally or criminally corrupt, or if you abuse your power,” he said.

Given the slim chance of successful impeachments for rulings rather than criminal misconduct, Democrats say the impeachment drumbeat is an obvious effort to cow judges and discourage them from making what Mr. Trump would consider adverse rulings. (…)

“It may seem absurd and hypothetical to us here, but to judges, it is extremely threatening. It is plainly a device to bully and intimidate judges to think twice about issuing orders.”

Political pressure on federal judges has reached a level that Chief Justice John G. Roberts Jr. noted it in his year-end report issued in January. He scolded those who would try to browbeat the judiciary, saying that “attempts to intimidate judges for their rulings in cases are inappropriate and should be vigorously opposed.”

The American College of Trial Lawyers has pushed back on the impeachment calls by Mr. Musk and others, saying in a statement that “threats of impeachment for such judicial acts have no constitutional grounding and are patently inconsistent with the rule of law upon which our nation was founded.” (…)

The Rule of Law?

Now a “woke” idea per Elon Musk and friends (my emphasis):

”The only way to restore rule of the people in America is to impeach judges,” Musk wrote in one post. “No one is above the law, including judges.”

“When judges egregiously undermine the democratic will of the people, they must be fired,” Musk posted on X.

In response to that post, some of Musk’s followers on X said the judge should be arrested for treason or deported. One suggested “US patriots fire upon him.”

After an earlier February ruling by Ali in the same case, an X user called for him to be beheaded. Another questioned “why so few judges are hanged.” One posted a picture of a noose. (…)

Musk, the world’s richest person, has lambasted judges in more than 30 posts since the end of January on his social media site X, calling them “corrupt,” “radical,” “evil” and deriding the “TYRANNY of the JUDICIARY” after judges blocked parts of the federal downsizing that he’s led. The Tesla CEO has also reposted nearly two dozen tweets by others attacking judges.

The American Bar Association issued a statement on Monday denouncing the ongoing wave of verbal assaults and threats against judges. The Federal Judges Association said in a statement to its 1,100 members late on Tuesday that “continued violence, intimidation and defiance directed at judges simply because they are fulfilling their sworn judicial duties” risked “the collapse of the rule of law.”

Threats against judges have climbed sharply since Trump ramped up his criticism of the judiciary after he lost the 2020 election. In that time, serious threats against federal judges more than doubled, from 220 in 2020 to 457 in 2023. Last year, Reuters documented how Trump’s attacks on judges who rule against his interests often lead to waves of threats against them. (Reuters)

Owning and extensively using his X platform, Musk can significantly influence “the will of the people” towards his own will. (BTW, which “people” is he referring to?)

Reuters interviews with 11 federal judges in multiple districts revealed mounting alarm over their physical security and, in some cases, a rise in violent threats in recent weeks. Most spoke on condition of anonymity and said they did not want to further inflame the situation or make comments that could be interpreted as conflicting with their duties of impartiality.

Several judges said the U.S. Marshals Service, which provides judicial security, has informed them of a heightened threat environment over the past several weeks, either verbally or in writing. The Marshals also discussed security measures, the judges said, including regular searches for threatening posts online.

Another person familiar with the judicial security environment said several federal judges in the Washington D.C. area had received pizzas sent anonymously to their homes, which is being interpreted by law enforcement as a form of intimidation meant to convey that a target’s address is known.

John Jones III, a former U.S. district judge in Pennsylvania appointed by former Republican President George W. Bush in 2002, who also served on the security committee of the federal judiciary’s policymaking arm, said judges are now grappling with being identified by name in viral social media posts criticizing their integrity and demanding their impeachment. He said he has spoken to about a dozen current judges who expressed safety concerns for themselves and their families.

As Reuters documented in a series of stories last year, political pressure on federal judges and violent threats against them have been rising since the 2020 presidential election, when federal courts heard a series of highly politicized cases, including failed lawsuits filed by Trump and his backers seeking to overturn his loss. Recent rhetorical attacks on judges and the rise in threats jeopardize the judicial independence that underpins America’s democratic constitutional order, say legal experts.

The world is watching and wondering what is going on in the USA.

Andy Kessler:

How’s Trump Doing? He’s transactional and trolling but so far only aspires to be transformational.

(…) Where’s the transformation? Shrinking government and getting other countries to pay for their own defense is smart. Closing the Education Department is overdue. Close more.

But Mr. Trump’s America-first agenda is isolationist and means closing the border to goods and people. Will this kick-start economic growth? No. Perversely, each job created by tariffs will destroy multiple others. For every Peter Navarro and Stephen Miller protectionist rationalization, I’ll raise you an Adam Smith and David Ricardo.

Mr. Trump isn’t yet spending his political capital to slay the real spending-addicted swamp beast. Not touching Social Security or Medicare is self-defeating. DOGE, so far, is pocket change. Deficits are still soaring.

Last week, he said, “Look, I’m a huge fan of Ronald Reagan, but he was bad on trade.” Not quite. Reagan campaigned on North American free trade, and his lower taxes and Soviet-bankrupting ushered in globalization. It also transformed Silicon Valley from apricot orchards to an economic powerhouse.

So how’s the president doing? The war in Ukraine continues. China remains a threat to Taiwan. Saudi Arabia needs to be in the Abraham Accords. Will Mr. Trump be a transformational Jacksonian? A Wilsonian? Or a forgotten Fillmorean? If a tariff-weakened dollar crashes the stock market, forget about any transactions, let alone transformation. He will be Hooverian.

A Reaganesque tip: Stop the industrial policy of picking winners and losers via tariffs, and allow markets to do the real work of transformation and unfettered economic growth. You’ll get the credit for it.