Did you miss Monday’s post: Fearless!

China Vows ‘Fight to the End’ on Tariffs as It Props Up Markets

China pledged to retaliate against Donald Trump’s latest tariff threat and mobilized state organs to send a message of resilience, raising the risk of a prolonged trade war between the world’s two largest economies.

“The US threat to escalate tariffs on China is a mistake on top of a mistake,” the Chinese Ministry of Commerce said in a Tuesday statement, hours after the US president vowed to impose additional import taxes. “If the US insists on its own way, China will fight to the end.”

The Chinese response came after Trump threatened a further 50% tariff on all Chinese goods unless Beijing withdraws its tit-for-tat retaliation against his earlier “reciprocal” levies. That takes the cumulative tariff rate announced this year to 104% — effectively doubling the import price of any goods shipped from China to the US. (…)

The yuan slid to the weakest level since September 2023 in onshore trading after the People’s Bank of China signaled more tolerance for depreciation with a fixing past the keenly-watched 7.20 per dollar level. (…)

While China hasn’t said how it would respond if Trump follows through on his threat, two influential state-linked Chinese bloggers posted an identical set of countermeasures that they said authorities are considering. They include raising tariffs on US farm products, a ban on Hollywood movies and investigating American firms’ intellectual property gains in the country.

China will hit back at new US tariffs with equivalent measures as any fresh US levies will add limited pain to the Asian nation, according to Ding Shuang, chief economist for Greater China & North Asia at Standard Chartered.

“The marginal effect of raising tariffs further from the existing level of about 65% will shrink,” he said of additional US tariffs. “Most Chinese exports to the US have already been affected. For goods that are not price sensitive, tariffs won’t work no matter how high they go.”

The escalation in tensions makes any imminent call between the two world leaders less likely. Trump hasn’t spoken with Chinese President Xi Jinping since returning to the White House, the longest a US president has gone without talking to his Chinese counterpart post-inauguration in 20 years.

The Communist Party’s official newspaper this week published an editorial declaring that Beijing is no longer “clinging to illusions” of striking a deal.

Instead, officials are focusing on shielding the economy. Xi has vowed to boost domestic consumption as tariffs are expected to hurt exports, a sector responsible for a third of China’s economic growth last year. (…)

Apple, for example, now assembles and ships roughly four-fifths of its iPhones from China even after the company began migrating its supply chain to other countries like India and Vietnam since the first Trump term. That’s probably due to the complexity and cost of building the industrial ecosystem elsewhere from scratch.

China’s robust supply chain is likely one of the factors giving Xi confidence as he goes head to head with Trump, and projects a defiant image to a domestic audience.

“For President Xi, there is only one politically viable response to Trump’s latest threat: Bring it on!” according to a note from Enodo Economics, a macroeconomic forecasting company.

Fast-fashion giant Shein’s plans to shift some production out of China have met with opposition from the Chinese government, people familiar with the matter said, as Beijing seeks to stave off a manufacturing exodus in the face of Donald Trump’s escalating tariffs.

The Ministry of Commerce has communicated with Shein and other companies to discourage them from diversifying supply chains by sourcing from other countries, said one person familiar with the discussion. The person said the requests came in the days leading up to Trump’s announcement of “reciprocal tariffs,” which have spurred firms to look for ways to avoid the duties. It wasn’t immediately clear which other firms were contacted.

One way Shein has responded is by halting reconnaissance tours it arranged for its major Chinese suppliers of factories in Vietnam and other Southeast Asian nations, another person said. The sources requested anonymity to discuss private matters.

The threat of job losses associated with production moving overseas has made it a substantial concern for Chinese officials. (…)

With tariff exemptions for small parcels set to expire in less than a month, the cost of products sold by Shein and rival Temu will jump dramatically, likely pushing up prices for US shoppers who favored them over Amazon.com Inc.

It also reflects a deepening fault line between China and its exporters in the fight against Trump’s barrage, as the state effort to protect the domestic manufacturing sector clashes with companies seeking to dodge ever-rising costs.

While many Chinese firms sidestepped tariffs slapped on China during Trump’s first term by shifting production overseas — more than half of Cambodia’s factories are now Chinese-owned, for example — the commerce ministry’s move suggests that Beijing won’t look kindly on similar strategies being deployed this time. (…)

So long free enterprises, on both sides of the “Pacific” ocean.

Here and there:

- “Not only does the shifting trade policy threaten to spark a global recession, but it also materially changes the way many companies do business.”

- The US president said he would not consider a blanket pause on higher tariffs expected to take effect Wednesday, nor did he answer when asked if he would consider reducing rates below the minimum 10%.

- When asked Monday whether the tariffs are permanent or up for negotiation, Trump said: “They can both be true.”

- Israeli Prime Minister Benjamin Netanyahu promised in an Oval Office meeting with the president to eliminate his nation’s trade surplus with the US and slash tariff and non-tariff barriers. A reporter asked if that would be enough to reduce the tariffs. “Maybe not,” Trump replied. “Don’t forget, we help Israel a lot.”

- Slapdash and often conflicting remarks from the president and his advisers underscored the chaotic approach that has befuddled markets, and the difficulty facing even the US’s staunchest partners as they look to negotiate with Trump.

- “There can be permanent tariffs and there can also be negotiations, because there are things that we need beyond tariffs,” Trump said.

- “It’s the only chance our country will have to reset the table, because no other president would be willing to do what I’m doing or to even go through it,” Trump said. “Now I don’t mind going through it because I see a beautiful picture at the end, but we are making tremendous progress with a lot of countries. And the countries that really took advantage of us are now saying, ‘please negotiate.’”

- Trump hasn’t ruled out extensions or deferrals before Wednesday, but it’s too soon to say if there’ll be any, a White House official said. Trump is looking for more than just tariff reductions and wants other concessions, and he’s willing to listen, but negotiations depend on how substantive an offer is, the official said.

- White House adviser Peter Navarro reiterated Monday the tariffs are “not a negotiation,” while Bessent indicated on Fox Business part of the tariffs’ purpose is gaining leverage on trading partners.

- Bessent later told Bloomberg Television he does not expect any deals with countries before tariffs kick in Wednesday.

- Europeans are struggling to prevent the dispute spinning out of control, with the US singling out the EU and China as two of the main targets of his trade policy.

- The EU “was formed to really do damage to the US on trade, that’s the reason it was formed,” Trump said.

- BlackRock Inc. Chief Executive Officer Larry Fink said Monday that most CEOs he talks to think the US is already in a recession, warning that stock markets could decline further as Trump destabilizes the global economy.

Trump Team Mulls Exporter Tax Credit as Tariff Counterweight

The rebate, which would be geared toward boosting US manufacturers, would be issued at the end of the year to offset the effects of retaliatory tariffs as American companies seek to sell their goods in foreign markets, according to people familiar with the deliberations.

The credit, which would require congressional approval, could also apply to companies that export services abroad, said the people, who requested anonymity to discuss private talks.

The credit would serve as a subsidy to US companies that sell overseas to help offset difficulties as retaliatory duties go into effect, the people said. However, it’s US importers that face the most immediate impact from Trump’s new levies, because they will have to shoulder the burden of higher costs for goods they buy from trading partners.

Trump’s economic advisers are also considering whether to design the credit to benefit importers as well, which would be more difficult to craft, the people said.

Neither President Donald Trump nor Treasury Secretary Scott Bessent have been formally briefed on the plan, and the idea has divided the administration’s economic team, they said. (…)

The exporter credit idea, which gained steam on Friday, signals that some of the president’s economic advisers are unconvinced about the soundness of his trade policies.

IN THE REAL WORLD

Credit Markets Paralyzed by Trade War, Putting Debt Deals on Ice

Company debt sales have ground to a halt in the US as markets across the globe show increasing fear of President Donald Trump’s escalating trade war triggering a global recession.

A $1.1 billion leveraged loan sale that was meant to help finance HIG Capital LLC’s purchase of Canadian firm Converge Technology Solutions Corp., was put on pause, according to people with knowledge of the matter. In the commercial mortgage bond market, Brookfield delayed a $2.4 billion refinancing package for a Hawaiian mall and office complex, citing volatility as the market saw its biggest two-day price decline since March 2020 on Friday.

No new US investment-grade bonds have been issued since Wednesday morning, before Trump announced his sweeping tariffs. There are eight issuers that held investor calls and have still yet been able to sell debt. Transactions on riskier debt are being pulled or postponed, while measures of perceived risk for high-grade and high-yield US corporate bonds are flashing a warning sign. Across Europe, investors are dumping risky assets, especially those tied to the auto industry.

“Credit volatility is back,” Deutsche Bank strategists led by Steve Caprio wrote in a note Monday. “Crippling policy uncertainty, haphazard tariff rate calculations, a partial loss of confidence in US institutional norms and rising inflation are all notably increasing US risks.”

Should a rout spread and a broad-based freeze in lending to corporations persist it risks further slowing down economic growth, deepening any contraction. At Saba Capital Management, founder Boaz Weinstein, warned the corporate bond selloff is only going to get worse and could accelerate bankruptcies. (…)

UBS Group AG strategists expect Trump’s tariffs to push corporate-bond spreads to levels last seen during the early part of the pandemic. (…)

CEOs Break Silence on Trump Trade War Business leaders have avoided voicing concerns about tariffs for weeks but some of them are getting more vocal

(…) “Tariff is not a beautiful word. I disagree with that—we are in a global economy,” said Bahram Akradi, CEO of the high-end fitness chain Life Time Group Holdings, in an interview Monday.

“This cannot stay,” he added. “You cannot apply this type of gridlock and this much friction to the world’s trade.”

The CEO of Ethan Allen, which manufactures 75% of its furniture across North America, also suggested the president retreat from the tariff offensive he unveiled in the White House Rose Garden last week.

“There’s nothing wrong in coming down—it’s not a failure,” said Farooq Kathwari, CEO of the Danbury, Conn.-based furniture maker. A mountain climber, Kathwari compared the rollout of the tariff policies to an ascent up a steep cliff. “If you go too fast, you can get water in your lungs.” (…)

Walmart executives face shareholders at an investor day Wednesday, while Delta Air Lines reports earnings the same day. Wells Fargo presents its results Friday, followed by other big banks next week.

Some of the first leaders to speak out have been vocal Trump supporters. Ackman, the billionaire hedge-fund manager behind Pershing Square, called for a 90-day pause in the tariffs to negotiate with other countries, warning that the alternative was “a self-induced, economic nuclear winter.”

“We are in the process of destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital,” Ackman wrote in a social-media post on X over the weekend.

Ryan Cohen, the Trump-supporting CEO of the videogame retailer GameStop, posted on X last week that the tariffs “are turning me into a dem.”

A day later, he quipped: “I can’t wait for my $10,000 made in the USA iPhone.” GameStop has already taken a hit: Nintendo said it would indefinitely halt U.S. preorders of the Nintendo Switch 2 because of new planned tariffs.

Even Elon Musk, one of Trump’s most influential advisers, took a swipe at the White House’s trade agenda. On Monday, the billionaire posted a well-known video of economist Milton Friedman touting free trade by explaining how the component parts of a pencil require complex supply chains.

From Hotel News:

Every day, when MegAnne Offredi, general manager of the Holiday Inn & Suites-Bellingham Airport, sits down at her desk, she braces for fresh news about growing hostility between the United States and Canada that’s driving down revenue and bookings at her hotel.

In the first three months of this year, her hotel in Bellingham, Washington — just 20 miles southeast of the U.S.-Canada border — saw a 22% year-over-year drop in room revenue, plus 29% and 34% declines in restaurant and bar sales, respectively. All in all, the hotel, which sold around 2,500 fewer rooms in the first quarter compared to the same time last year, has suffered a 28% drop in total revenue, Offredi said.

Border crossings between Canada and Washington state have declined by half, according to data from the British Columbia Ministry of Transportation and Washington state’s Department of Transportation. Crossings have dropped from 216,000 in March 2024 to 121,000 vehicles last month, the Vancouver Sun reported. Flight bookings and short-term rentals also have dropped, according to CoStar reporting.

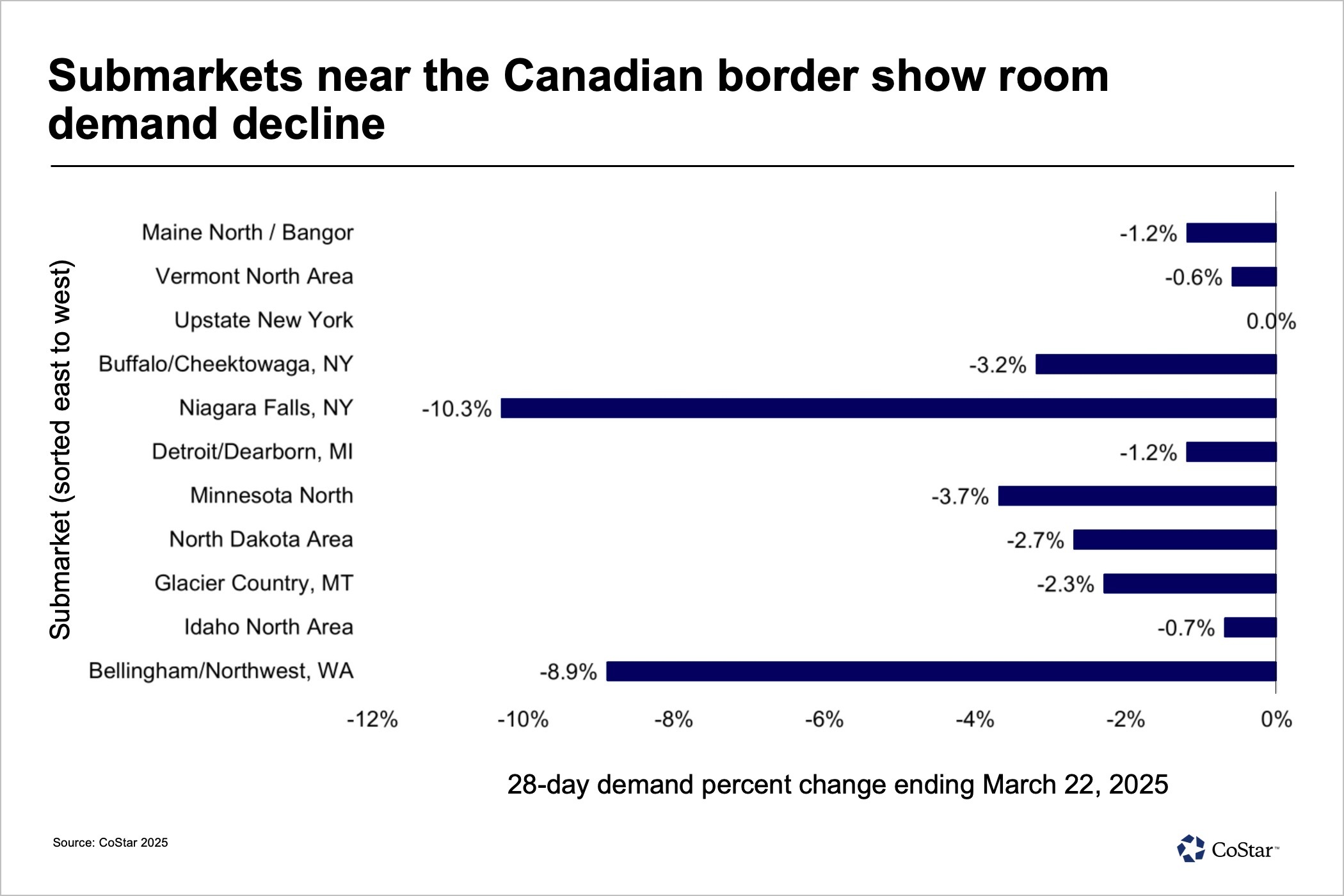

According to CoStar hospitality data for the 28-day period ending March 22, markets along the Canadian border saw declines in room demand as steep as 10.3% in Niagara Falls, New York, and 8.9% in the Bellingham/Northwest Washington region.

(…) groups have canceled conferences at her hotel both in the short term and for later this year (…)

For now, Offredi has not yet made major personnel changes, but she has had to start making other cuts where she can.

“Really, all we can do is buckle down on our expenses,” she said. “I have the staff coming to me asking, ‘are our jobs in jeopardy?’ And at this point they’re not, but the hours are. You can only support the labor for the business that we have. We thought we’d be busier this time of year, so we have more hours technically scheduled that we’ve had to reduce.”

Manic Monday Looks Like the End of the Beginning There was a breather in the Lehman crisis, too, but the low was months away.

John Authers:

(…) Volatility like this is not normal. By my calculations, the major US indexes haven’t traded in such a wide percentage range in one day since 2015. Nothing as extreme as this happened during the Covid selloff. (…)

Oct. 10 came a month after Lehman Brothers declared bankruptcy. Market losses were limited for three weeks. Capitulation came in the week of Oct. 6-10, culminating in an extraordinarily volatile Friday that ended with indexes flat. (…)

After such a fall, it generally takes markets a while to find a level, and the low was a full five months later. But the period of precipitous falls was over; that bizarre day was the end of the beginning. Trading volume also suggests that the initial post-Liberation Day has come to a climax. More shares in the biggest exchange-traded fund tracking the S&P 500 changed hands than on any day since Covid five years ago:

Source: Bloomberg

If there is reason for concern, it stemmed from the bond market, which suffered an epic selloff. As the dollar gained a little, it’s unlikely that it was foreigners who were selling Treasuries. And as the stock market was directionless amid the drama, it’s hard to believe that asset allocators exited bonds to put money there. (…)

This was the biggest daily Treasury selloff since Covid. The 30-year yield has only risen this much in a day six times since 2010 — and all of this when risk is perceived to be extreme. What on earth happened?

A logical but alarming explanation is that someone somewhere had to make forced sales to raise cash. If there is one alarming scenario that recurs, it’s of a contemporary LTCM meltdown — a repetition of the extreme market pain that resulted when the Long-Term Capital Management hedge fund ran into trouble in the wake of the 1998 Russian debt default. That incident only ended with a rescue coordinated by the Fed and then an emergency rate cut.

Ever since LTCM, every market selloff has brought with it fears that some big institution will hit trouble and cause cascading sales. It’s logical to worry about that now. Particular concern attaches to the multi-strategy hedge fund groups that operate several different investment teams — “pod shops” in the Wall Street lingo. As the dust settles on an extraordinary day, traders will be most concerned for the health of the pod shops in their midst. (…)

But this president has made it a lifelong principle never to apologize or admit error. How, then, can the administration correct its course? (…)

A month ago, it was assumed that a run on the stock market or a collapse of consumer sentiment would ensure that tariffs were moderated. That was wrong. A serious pickup in inflation might have more of an impact, but we have to wait a while before that shows up in the figures.

So how is the course correction to happen? There are two broad options. The first is that Republicans in Congress decide to act. They hold majorities in both chambers, and there is a long tradition of the Senate being the arbiter of the crucial decisions on the US role in the world. (…)

In the last few months, senators have been cowed by threats that the president’s backers will sponsor primary challenges against them. He is perceived to have a strong mandate. But there is movement. Rand Paul and Ted Cruz, both prominent senators on the right of the party, have spoken out against tariffs. A bipartisan bill that would curb presidential tariff power doesn’t have the necessary support from the Republican Senate leader, but shows public flickers of intraparty opposition.

Key presidential backer Elon Musk has been criticizing tariffs in an increasingly acrimonious spat with trade adviser Peter Navarro. Bill Ackman, the prominent hedge fund manager who publicly switched his support to Trump last year, has argued for a tariff delay. None of this on its own will move the White House, but does at least suggest that Congress could reassert its power.

Rather than wait for Congressional Republicans, the key for a market recovery could be a move by a competitor that makes clear that tariffs are indeed negotiable, giving the administration a reason or pretext to back down — or at least delay. Jordan Rochester of Mizuho Securities puts it as follows:

The true moment for risk to find a base will be when concessions are made by one or two countries to allow for Trump to announce a delay on reciprocal tariffs. It would be a sign that analysts’ expectations of watered down tariffs could be proven true. But we need the first domino to fall, as simply delaying the broader reciprocal plan without it would be a serious challenge to Trump’s credibility in negotiations.

This selloff is driven almost exclusively by the policy change, and the implications the new tariffs have for company profits and economic growth. This means that only a change in the tariffs, though probably only a modest one, will move the market. (…)

Realistically, no big concessions are coming from China, which has allowed the yuan to weaken almost to its lowest point since 2007 in an unmistakable declaration of intent. The problem for other countries is that they don’t have much to offer. Contrary to the rhetoric, the EU doesn’t have big trade barriers against the US. Even Vietnam, which has a huge trade surplus, only levies tariffs of about 5% on American imports. Removing those barriers, as it’s offered to do, will make minimal difference to US businesses, and Navarro has already said that it would not be enough.

A further problem is that the ferocity of the US rhetoric makes it politically hard to concede. Voters don’t like it when their leaders give in to a bully. (…)

If someone gives the administration a needed excuse to step back, that could draw a line under the selloff.

How about the Fed helping out?

The Fed Must Resist Repeating Past Mistakes Markets have been trained to expect lower rates at the first sign of volatility. Powell mustn’t give in to temptation.

It’s easy to think that the Jerome Powell-led Federal Reserve has been one of the unluckiest on record. From the 2020 pandemic and its messy aftermath to the current tariff-induced economic and financial volatility, it has faced one big external shock after the other. Powell has had repeated run-ins with President Donald Trump, lost key officials over insider trading allegations, seen the institution’s credibility eroded by the misguided 2021 transitory inflation judgement, and more.

Yet what has made this bad luck worse and more consequential for overall economic wellbeing is that it has interacted with self-created weaknesses. Unlike other Feds, those have extended to analysis, forecasts, communication, and policy responses, repeated missteps that were aggravated by a distinct lack of humility and learning. The result is a Fed whose political independence and market credibility are as shaky as they have been since the late 1970s and early 1980s. And that is bad news for a central bank that, in the next few months, will face difficult policy judgements. It’s also bad news for the world’s largest economy that has lost other anchors and is suffering its own period of instability at the center of the global economic and financial order. (…)

The policy dilemma for the Fed’s pursuit of its dual mandate was made vivid by JPMorgan Chase & Co.’s upward revisions in unemployment to 5.3% and inflation all the way up to 4.4%, an adverse move of 1.4 percentage points. (…)

Managing the challenges got off to a troubling start when, in his March press conference, Powell eagerly dismissed the information content of the weakening soft data and reintroduced the concept of “transitory” when opining on the inflationary effects of the tariffs. Fortunately, he walked back both statements last week rather than wait for many months as he did in 2021.

Now the Fed needs to judge whether it should respond to the prospects of higher unemployment by cutting interest rates aggressively, or to hotter inflation by staying put or even opening the door to considering the possibility of a rate hike. For their part, market participants have rushed to price in more than four reductions this year, with some even calling for an emergency inter-meeting cut. (…)

Having failed to bring inflation back down to its often-repeated target three years after annual consumer price rises topped 9%, the Fed faces the risk of protracted inflation that would quickly undermine its efforts to counter the potential rise in unemployment. Moreover, lessons from central banking history suggest that when faced with both parts of the dual mandate going against it, the Fed should give priority to putting the inflation genie back in the bottle. (…)

What the Fed needs more than ever is a good dose of humility, something that it has lacked in recent years to its and the economy’s detriment. Such humility would help reduce the risk of another bout of slippages in analysis, forecasts, communication and policy design. It would also help counter the threat of a prolonged and damaging period of stagflation.

Speaking of the need for a good dose of humility, it has been a while since the last such quotes:

- “I’m not changing. I went to the best schools, I’m, like, a very smart person.” (April 26, 2016)

- “Actually, throughout my life, my two greatest assets have been mental stability and being, like, really smart…. I went from VERY successful businessman, to top T.V. Star… to President of the United States (on my first try). I think that would qualify as not smart, but genius….and a very stable genius at that!” (January 6, 2018)

- “I’m an extremely stable genius” (May 2019)

- “I’m so great looking and smart, a true Stable Genius.” (July 11, 2019)

Maybe another genie to put back in the bottle. ![]()

A Win-Win Exit Strategy for Trump on Tariffs Offer nations truly reciprocal free trade: zero-barriers, zero-subsidies.

By Arthur Laffer and Stephen Moore

(…) It’s time to bring on the promised long-term gain from his trade policies. Here’s how to do just that. In 2018 at the Group of Seven meeting in Charlevoix, Quebec, Mr. Trump made a remarkable free trade proposition to the world’s leaders: The U.S. would lower its tariffs to zero if their nations would do the same.

His exact words were: “No tariffs, no barriers. That’s the way it should be. And no subsidies. I even said, ‘no tariffs.’ . . . Ultimately, that’s what you want. You want tariff-free, no barriers and you want no subsidies.” (…)

This suggests an opportunity for Mr. Trump to avoid the economic damage from tariffs that we saw under Herbert Hoover and Richard Nixon. Our proposal will also immediately reverse the dangerous stock market sell-off.

Mr. Trump should give a globally televised address announcing to the world that the U.S. is ready to drop its tariffs and industry subsidies to zero tomorrow on any nation that does the same. This would be the ultimate reciprocal tariff policy. President Trump and the U.S. would regain the moral high ground in trade disputes. It would be enlightening to see which supposedly “free trade” nations accept Mr. Trump’s challenge.

Who better to pull off what could become the greatest Art of the Deal negotiation in world history? It would restore a free, fair and unfettered global trading system. Everyone, everywhere would get richer. The American economy would be great again. And Donald Trump would win the 2025 Nobel Peace Prize.

Bloomberg today reports that

(…) von der Leyen noted the EU has previously offered to zero out tariffs on industrial products, including autos, if the US does the same, but that Washington hasn’t engaged. (…)

The EU “was formed to really do damage to the US on trade, that’s the reason it was formed,” Trump said, who repeated his complaints that the US has been paying for Europe’s defense since other NATO allies haven’t been spending enough on defense.

Even so, Trump hasn’t been specific about what kind of concessions he’s looking for, and EU officials have struggled to engage with their US counterparts. Von der Leyen has yet to meet with Trump since he took office.

Elsewhere on Bloomberg:

Vietnam’s Party Chief To Lam offered to remove all tariffs on US imports, according to an April 5 letter seen by Bloomberg. Lam requested that Trump not apply any additional levies or fees on Vietnamese goods and asked him to postpone the implementation of the 46% tariff by at least 45 days after April 9.

Peter Navarro, a trade adviser to Trump, suggested Sunday that Vietnam’s initiative didn’t go far enough.

“If you simply lowered our tariffs and they lowered our tariffs to zero, we’d still run about $120 billion trade deficit with Vietnam,” he said on Fox News’ Sunday Morning Futures. “And the problem is all of the non-tariff cheating that they do.”

Earnings Outlook Is Next Possible Pain Point for Investors Analysts have already started cutting their 2025 estimates

(…) Earnings season kicks off Friday with announcements from big banks including JPMorgan Chase, Morgan Stanley and Wells Fargo.

Tariffs could hit consumers so hard that there’s a risk that S&P 500 companies will see zero earnings growth this year according to Bhanu Baweja, UBS Investment Bank’s chief strategist.

When companies start reporting they “won’t have anything they can actually say other than that everything is so uncertain,” said Joe Gilbert, portfolio manager at Integrity Asset Management. “We’ve gone from the fog of a trade war to the fog of the earnings outlook.”

(allstarcharts.com)

(allstarcharts.com)