SERVICES PMIs

USA: Growth of service sector strengthens in May amid uplift in confidence

The S&P Global US Services PMI® Business Activity Index recorded 53.7 during May, which was stronger than the earlier ‘flash’ reading of 52.3. The index was also up on April’s 50.8 and, being comfortably above the critical 50.0 no-change mark, was indicative of a noticeable acceleration of activity growth on April’s 17-month low. Moreover, activity has now risen on a consecutive monthly basis since February 2023.

Panelists linked May’s upturn in activity to a similar sized increase in new work. There were reports from survey panelists of a more stable business environment compared to April, which helped to drive a rise in client spending. This was however broadly limited to domestic-based customers as foreign sales declined overall for a second successive month. Panelists attributed lower new foreign business to ongoing worries among international clients in relation to tariffs and US trade policy.

A more stable business environment and hopes this will be sustained in the months ahead helped to support an upturn in service sector confidence during May. Overall, sentiment was at its highest for four months (though remained well below the survey average). Panelists are also planning to raise their marketing and expand their business facilities over the coming year.

A more positive outlook, plus a rise in current workloads, helped to support a further upturn in employment during May, the third in as many months. Growth was modest however amid reports in some instances of the non-replacement of leavers. Moreover, the rise in staffing levels was insufficient to prevent the steepest increase in work outstanding since last November. Some firms pointed to delays in the delivery of ordered equipment as a reason for higher backlogs.

Meanwhile, tariffs and suppliers generally raising their prices meant input cost inflation accelerated steeply in May to its highest since June 2023. Wages were also reported to be factor pushing up overall operating expenses.

Service sector companies responded by passing on their increased input costs to customers wherever possible. Output charge inflation subsequently jumped noticeably in May, hitting its highest level since August 2022.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

“Service sector growth has improved more than first estimated in May, with confidence about the year ahead also lifting higher, buoyed in part due to pauses on higher rate tariffs. Companies have matched that optimism with increased spending and hiring.

“That said, the improvements come from a low base, following a very gloomy April, which saw growth nearly stall as confidence sank to a two-and-half year low. Reports from companies underscore how uncertainty about the policy outlook continued to act as a deterrent to expansion plans in May. Output growth and confidence consequently remain subdued by standards seen last year.

“The PMI is so far indicating annualized GDP growth barely above 1% in the second quarter, so avoiding recession but adding to our expectation of only modest GDP growth in 2025 of just 1.3%.

“Alongside sluggish economic growth, the survey is also signaling intensifying inflationary pressures. Rising costs in the service sector were again blamed widely on tariffs, which were in turn passed on to customers to result in the steepest rise in average prices charged since August 2022. These rising price pressures will only add to policymaker reluctance to reduce interest rates, which we consequently expect to remain on hold until December.”

(…) the May Services ISM report was pretty bleak. The index has now been in a trend decline over the past year, and not only did the headline composite index slip below 50, designating contraction in the sector, but the details suggest activity is potentially worse than implied by the 49.9 reading.

Of the four metrics that feed into the headline index, two were down (new orders & business activity) and two were up (employment & supplier deliveries). This mix reveals a potential dry-up in coming production and some false-positive from increased lead times.

Business activity slipped to a reading of 50 with only three industries reporting a decrease in current activity last month. That’s a positive in that even as activity is slowing, it’s not collapsing for a majority of service industries, but there’s a possibility this is short-lived. This point gains traction when considering the report noted a rush to get ahead of tariffs may have influenced activity in May and that new demand is drying up.

One of the weakest points in this report came from the near-six-point plunge in new orders, driving the index to 46.4, which marks the lowest reading in two and a half years. New activity will also be limited by the fact that order backlog slipped to the lowest level in nearly two years and inventory sentiment jumped as most providers feel their inventory levels are high. One selected comment stated “Using existing inventory for sales and not bringing anything inbound” signaling slower demand ahead.

Source: Institute for Supply Management and Wells Fargo Economics

The offsetting upside pressure from the employment and supplier delivery components on the headline ISM also may overstate strength today. Supplier deliveries rose to 52.5 in May, pushing it above its level reached on average over the past six months. This metric is the only inverse indicator meaning a higher reading is consistent with longer wait times, which boosts the ISM. In normal times this is a sign of increased demand activity, making it harder for firms to secure inputs, but today it’s likely more of a story of potential supply-chain bottlenecks amid a tariff-related pull-forward in demand.

We therefore may want to take the demand signal and upward pressure on the ISM from deliveries with a grain of salt today. What we don’t want to overlook, however, is that supply-chain pressure is manifesting in higher cost pressure for service-providers. The prices paid component rose 3.6 points to 68.7 in May as input prices firm. It’s ultimately too soon to know if cost pressure is due to supply pressure amid a rush to secure inventory or more sustained tariff-induced costs.

The employment component improved in May, but even as the index rose back into expansion at 50.7, it’s still consistent with a lackluster hiring environment. The ISMs are consistent with a moderating pace of payroll growth. On Friday, we’ll get the full nonfarm payroll report for May. We expect to see that employers continued to expand broad headcount during the month with 125K net new jobs added. (…)

Source: Institute for Supply Management and Wells Fargo Economics

The May ISMs don’t necessarily force the Fed’s hand clearly toward either side of its mandate. Readings on input prices suggest some tariff-induced cost pressure is materializing, but it remains to be seen how sticky that is. At the same time, the employment metrics may not be consistent with an overly strong pace of hiring today, but they’re not exactly signaling broad layoffs are around the corner either.

With the largest and widest-reaching tariffs not going into effect until early April, it may simply too soon to determine how inflationary and growth-inhibiting tariffs are, but the May ISM tells us demand conditions are softening in the service sector.

ING:

It also means that we have both the services survey and the manufacturing survey pointing to tougher times ahead for the economy. The chart below shows the relationship between the ISM manufacturing and service sector output series. Both are now reporting a clear softening that points to the risk of much cooler GDP growth in the second half of 2025.

ISM activity balances versus GDP growth

The main disappointment was in new orders, which dropped to 46.4 from 52.3 while overall business activity ground to a halt at 50.0 versus 53.7 in April. The backlog of orders was also very weak at 43.4, which doesn’t bode well for a revival in output in the immediate future especially with trade uncertainty continuing. (…)

With prices paid rising to 68.7 versus the 50 break-even level within the ISM services report the Federal Reserve will remain reluctant to acquiesce to Donald Trump’s demands for the next few months at least.

Canada: Service sector downturn eases in May

In May, the index recorded 45.6, up from 41.5 in April, its highest level for three months but still indicative of a marked contraction of activity.

A similar trend was recorded for new work, with demand faltering but to a lesser degree than seen during March and April.

Tariffs also had a noticeable effect on international sales, with new export business declining sharply again in May (albeit to the weakest degree since January).Whilst employment

growth was marginal, it was significant in being the first time in 2025 to date that an increase in staffing levels has been registered.Suppliers were reported to be raising their charges, whilst wages remained a source of cost pressures. Overall, input costs rose at a faster and above trend pace in May. Service providers responded by increasing their output charges to the greatest degree for a year.

Eurozone economy expands but skirting close to stagnation

The HCOB Eurozone Services PMI Business Activity Index fell below the 50.0 mark in May for the first time since last November, signalling a renewed downturn in output. Dropping from 50.1 in April to 49.7, the index pointed to a marginal contraction in services activity midway through the second quarter.

New business continued to decline, stretching the current sequence of decrease to four months. The deterioration in demand for services was the most pronounced in six months, albeit modest. A sharper drop in international orders was partly to blame, with export sales also falling to the quickest degree since November last year.

Outstanding business volumes were depleted for a thirteenth successive month in May. This was facilitated to some degree by greater workforce numbers, with services employment rising again. The rate of job creation was the slowest for three months, however.

Muted hiring activity came amid another month of subdued business confidence. Although future output expectations strengthened, they remained weak by historical standards.

There was little movement on the inflation front, with rates of input cost and output charge inflation holding fairly close to those seen in April and remaining above the respective survey averages.

The seasonally adjusted HCOB Eurozone Composite PMI® Output Index fell to 50.2 in May, from 50.4 in April. Although this marked a fifth successive monthly reading above the 50.0 level and therefore in expansion territory, it pointed to an upturn that was only fractional overall and the softest since February.

Manufacturing was the eurozone’s primary engine for growth as services activity decreased in May for the first time since last November.

Of the four largest euro area economies, the southern nations of Italy and Spain registered growth in private sector output. Italian business activity rose at the fastest pace in over year, whereas Spain’s upturn was the slowest in 17 months. The French economy moved closer to stabilisation, posting its softest decline in nine months, while Germany registered the first decline in five months.

Restraining eurozone growth was a further decrease in new business intakes, extending a period of falling sales that began in June 2024. That said, the contraction was only mild overall. There was no support from export markets, with the latest survey data signalling a thirty-ninth successive reduction in new work received from non-domestic customers.

To compensate for lower volumes of incoming new work, eurozone companies made additional inroads to backlogged orders. The rate of depletion was moderate and even quickened slightly. Employment levels across the euro area private sector increased, albeit only fractionally. Services firms drove hiring as factory workforce numbers were reduced.

Looking ahead, May survey data signalled a pick-up in business confidence for the first time since January. Stronger sentiment was registered at both manufacturers and service providers. However, the overall level of optimism remained weak by historical standards.

Inflation across the euro area cooled midway through the second quarter. Input costs rose at the weakest pace in six months, while selling charges rose only modestly and at the slowest rate since October last year. Trends were markedly different at the sector level, however, as falling expenses and prices charged in the manufacturing industry contrasted with still historically elevated rates of increase across the service sector.

China: Services activity growth accelerates in May

The headline Caixin China General Services Business Activity Index posted 51.1 in May, up from 50.7 in April. (…) The pace of services activity growth accelerated since April but remained modest overall.

Faster new business growth underpinned the latest upturn in services activity. Anecdotal evidence suggested that efforts to expand business and widen the pool of clients drove May’s expansion in new work. This was despite subdued trade conditions dampening exports, according to panellists. Notably, new export business declined for the first time in 2025 so far, though only marginally.

To support higher amounts of incoming new business, service providers hired additional workers in May. This followed two successive months of job shedding. Though only slight, the rate of employment growth was the quickest seen since last November.As a result, backlogs of work accumulated at a softer and only fractional pace in May. Average input costs meanwhile continued to increase across China’s service sector. According to anecdotal evidence, increased purchase prices and wages drove the latest upturn in operating expenses. The rate of inflation was the fastest since last October but remained below the long-run average.

On the other hand, selling prices declined for a fourth straight month in May. Though marginal, the rate of discounting was the steepest in eight months. Chinese service providers often linked the reduction in output prices to greater competition for new work and promotional activities.

Overall sentiment remained positive in the Chinese service sector midway through the second quarter of 2025. Firms were often hopeful that improvements in global trade conditions and business developments plans could help to spur sales and boost activity levels over the next 12 months. The level of confidence strengthened since April, but remained below-average.

The Composite Output Index posted below the 50.0 no-change threshold at 49.6 in May, down from 51.1 in April. This marked the first reduction in output since December 2022. Underlying data indicated that faster services activity growth in May had failed to offset a drop in manufacturing production.

A renewed reduction in composite new orders underpinned the fresh fall in activity. Employment also declined slightly, driven by job shedding across the goods-producing sector. At the same time, backlogs of work were depleted for the first time since January. However, overall business confidence improved, supported by rising optimism across both sectors.

Turning to prices, average charges continued to fall in May, declining at the quickest pace in just over two years as input cost inflation eased.

After experiencing 15 consecutive months of improvements, ASEAN goods-producing companies reported a new downturn in manufacturing performance in April, with the latest figures indicating this decline has persisted into May.

Key indicators — including output, new orders, employment, and inventories of raw materials — have all seen a fall. Vendor performance also deteriorated. Delivery times for inputs lengthened after remaining relatively stable the previous month.

On a slightly more positive note, cost pressures have eased, with companies also raising charges only marginally. However, this adjustment partly reflects a broader trend of declining demand within the market.

(…) new orders received at ASEAN manufacturing sector fell at a quicker rate. New orders from international markets also fell, signalling an overall challenging demand environment. The rates of contraction, though modest, were the most marked in August 2021 and five months respectively.

Bank of Canada Holds Rate Steady as Economy Softens, Inflation Accelerates A rate cut might be necessary in the future if the economy stalls amid U.S. tariffs, Gov. Tiff Macklem says

The Bank of Canada left its main interest rate unchanged, at 2.75%, saying the economy has softened but not deteriorated, and inflation has picked up steam.

Bank of Canada Gov. Tiff Macklem said officials expect second-quarter economic growth to be “much weaker” after a surprise 2.2% annualized increase in the first quarter that was buoyed by exports and inventories as companies rushed to purchase goods to avoid tariffs.

Senior officials on the central bank’s governing council were in consensus on keeping the interest rate steady, but Macklem said officials also agreed that another rate cut might be needed should the economy stall due to uncertainty fueled by U.S. trade policy, so long as inflation is contained. About one-fifth of Canada’s output is tied to trade with the U.S.

“The Canadian economy is softer but not sharply weaker,” Macklem said at a press conference Wednesday after the rate decision was delivered. “Faced with unusual uncertainty, the governing council is proceeding carefully, with particular attention to the risks.” (…)

The decision, though, marks an effort by the Bank of Canada to balance the impact of President Trump’s hefty tariffs on Canadian economic activity and on the prices consumers pay for goods. Macklem has repeatedly warned that tariffs could push prices higher. The Bank of Canada’s mandate is to set rate policy to achieve and maintain 2% inflation, or the midpoint of a 1% to 3% target range. (…)

The Bank of Canada, in its decision, noted that inflation excluding taxes accelerated in April to 2.3%, from a comparable reading of 2.1% in the prior month. Officially, headline inflation in Canada slowed to 1.7% in April due to a pre-election move by Prime Minister Mark Carney to cancel a consumer carbon tax, and Macklem said this impact will be reflected in consumer-price index data for the next 11 months. (…)

In April, the Bank of Canada’s preferred gauges of core inflation accelerated by an average 3.15%, or the fastest pace in nearly a year. Core inflation has remained above 2% for more than four years. Macklem said higher core CPI may reflect the effects of trade disruption, as companies look for new suppliers to avoid tariffs.

The data suggest “underlying inflation could be firmer than we thought,” Macklem said. “That has got our attention.”

He said consumer spending slowed in the first three months of 2025 after a torrid pace late last year, “but continued to grow despite a sharp drop in consumer confidence.” Macklem also said business investment in early 2025 was stronger than anticipated, although some economists reckon the purchases of machinery and equipment were fueled by companies looking to evade tariffs.

Job losses in the labor market are concentrated in trade-exposed sectors, the central bank governor said. Data indicate manufacturing employment dropped 1% in April on a 12-month basis. Employment has held steady in sectors less exposed to trade, Macklem said, but “businesses are generally telling us that they plan to scale back hiring.” (…)

- Slowing Australia Economy Vulnerable as World Growth Stalls The Australian economy grew just 0.2% in the first quarter from the prior quarter

- ECB to Cut Rates as Trade Mess Weighs on the Economy

Global Bond Auctions Show Weaker Trend as Fiscal Pressures Grow

A spate of poorly-received longer-dated sovereign bond auctions worldwide has raised questions about the willingness of investors to fund the spending plans of governments from the US to Japan.

Japan’s 30-year bond sale Thursday was the third in as many weeks to show signs of a cold shoulder from buyers, with one measure of demand the weakest since 2023. A post-auction rally suggested investor expectations of demand had been even lower.

Meanwhile, Tuesday’s auction of 12-year Australian government debt saw the weakest demand in about six years and Wednesday’s post-election South Korean 30-year sale saw the lowest investor appetite since 2022.

The results will amp up scrutiny of issuance in the world’s biggest bond market, with the US set to sell both 10- and 30-year debt next week. Investors there are already demanding more compensation to hold long-dated Treasuries due to growing anxiety about America’s widening fiscal deficit. (…)

With the US’s ‘Big Beautiful Bill’ expected to add trillions of dollars to the federal deficit over a decade, European defense spending on an upward trajectory thanks to the war in Ukraine and Japan pledging to relieve the impact of higher overseas tariffs, governments worldwide have ambitious plans that need funding. But that’s likely to come at a cost, especially if they want to borrow over an extended period — a Bloomberg global gauge of longer-dated sovereign yields has climbed to around the highest since 2008. (…)

Big investors shift away from US markets Donald Trump’s trade war and rapidly mounting government debt have shaken confidence in American assets

(…) “The US has been the best place in the world to invest for a century, but I’m starting to hear investors question whether US exceptionalism is a little less exceptional, and think about whether to position their portfolios accordingly,” Howard Marks, co-founder of $203bn alternatives manager Oaktree Capital Management, told the Financial Times. (…)

Some investors question whether smaller, more fragmented markets in Europe and Asia offer a meaningful alternative. “Europe still has sclerotic growth and a very high level of regulation, and China is still complicated,” said Oaktree’s Marks. “Where else can large amounts of capital be deployed?”

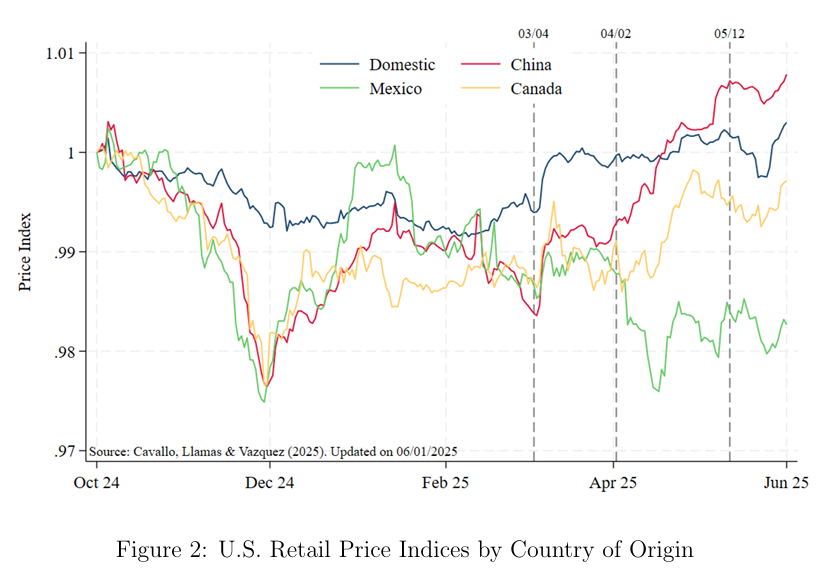

Businesses Hiked Prices Quickly After Tariffs, NY Fed Study Says

Businesses have hiked prices quickly in response to tariffs, though only modestly cut headcount, according to a new study by the Federal Reserve Bank of New York that surveyed companies across the district.

Roughly three-quarters of manufacturers and services firms in the district have passed on to consumers at least some of the higher costs they’ve faced due to tariffs, the study released on Wednesday showed. Around a third of manufacturers and almost half of services firms said they had fully transferred their higher costs.

“Interestingly, a significant share of businesses also reported raising the selling prices of their goods and services unaffected by tariffs,” researchers said. Companies hiked prices to cover rising wages and insurance costs, “though it is possible that in some cases, businesses were taking advantage of an escalating pricing environment to increase prices.”

The survey was conducted May 2-9, before tariffs on many goods from China were temporarily lowered to 30% from 145%.

Price increases happened fairly quickly, the New York Fed report said. More than half of companies surveyed said they had increased prices within a month of experiencing higher import costs and many within a day or a week. A significant share of companies also reported they were purchasing more goods within the US. (…)

“There were some signs that the sharp and rapid increase in tariffs affected employment levels and capital investments,” New York Fed researchers said. Companies were “slightly tilted” toward a small reduction of workers, while nearly a quarter of services firms reduced their investments. Almost half of businesses reported a decrease in their bottom lines, the report said.

Labor Shortages Are Holding Back Desperately Needed Electrification From the slow roll-out of heat pumps to missed data center targets, a lack of skilled workers is making it much harder to electrify everything.

Labor Shortages Are Holding Back Desperately Needed Electrification From the slow roll-out of heat pumps to missed data center targets, a lack of skilled workers is making it much harder to electrify everything.

Western economies need to electrify and fast, but where are all the skilled workers going to come from to install the heat pumps, solar panels and batteries needed? This week on the Zero podcast, Akshat Rathi talks with Olivia Rudgard about the shortage of labor in electrification industries, and why some experts are calling it an ‘existential’ crisis.

(…) we found that shortage of skilled workers is not quite a global problem. Places like India and China, where there is a large population, and where they have seen electricity demand rise 5 or 10% per year, are places that typically don’t face a shortage of workers. In the case of China, in fact, we found that they have many more than they need to do their jobs. It’s really a shortage of workers in western economies. (…)

I think countries are sort of waking up and realizing that actually, if they don’t have the skills among their own population to create these products and carry out these processes that are really critical to the energy transition, they are then reliant on trade and they’re reliant on trading partners. They’re reliant largely now on China. And you know, that looks, I think, like a fairly precarious place to be with the world looking as it is. So there’s a real urgency to solving that problem. (…)

AI needs energy, lots of energy…

- US Peak Summer Power Markets Getting Critically Tight (Goldman Sachs)

US power demand growth has been solid since 2021, with an average annual growth rate at 2% in 2021-2024 (vs stagnation in the previous decade), which we expect to strengthen to 2.5% until at least 2030 (all not weather adjusted), driven by electrification, data centers, and EVs. Based on currently scheduled capacity build outs, we estimate that solid growth in power demand will continue to reduce the effective peak summer spare capacity, taking it to exceptionally low levels later this decade. We expect spare capacity to fall to low levels across several US regions, increasing the risk of price spikes and/or outages at times during peak summer months.

We find that the US peak summer power market is turning critically tight in the next few years. Specifically, we expect national effective spare power generation capacity during the peak demand season to fall below the industry-wide recommended level of 20% this summer, and to decrease further to 14% in 2027, below the 15% critical threshold set by regulators and most power market operators to ensure power reliability.

We find that major US regional power markets are all tightening (…)

Our forecast of significant tightening is generally consistent with assessments from power market operators and regulators. In their respective summer outlooks for 2025 published recently, all three regional power market operators are expecting sufficient power generation for peak demand under normal conditions, but have recognized elevated and increased risks relative to prior years of power shortages and the potential need to reduce power demand or to declare an Energy Emergency Alert in an extreme scenario.

In addition, US national power market regulators and government agencies have also noted reliability challenges in the country, specifically listing MISO and ERCOT among the riskiest along with smaller regional power markets, but not PJM, due to its larger share of contracted demand management (potential demand cuts during peak hours) and lower probability to experience above-normal temperatures.

Currently scheduled generation capacity additions in the next few years are inadequate net of scheduled coal retirements. Solar and wind power is less dispatchable and has a lower utilization rate, while the buildup of natural gas power generation capacity is much constrained in the next years due to significantly higher costs than renewables and limited natural gas turbine supply.

Newer technologies such as power storage are still limited in scale, utilization, and long-duration applications, and are unlikely to fill the gap.

While our spare capacity forecasts are uncertain, we believe the tightening in US power markets significantly increases the risks of power supply shortages and price spikes, leaving peak seasons particularly vulnerable. These risks highlight the need to add power generation and storage capacity beyond what is currently scheduled to come online for power suppliers, and the need to scale up peak demand management for power market operators, in the sense of negotiating with power consumers to cut demand if needed during the peak.

Accordingly, we recommend power consumers and investors to hedge the upside risk to regional power prices, especially during peak seasons.

Trump’s Crackdown on Foreign Students Threatens to Disrupt Pipeline of Inventors Immigrants who came as students created the USB port and numerous other innovations

(…) High-skilled immigration has long been part of the secret sauce that gave the U.S. the world’s most dynamic economy. Studies show newcomers punch well above their weight in innovative output and entrepreneurship. They authored 23% of U.S. patents from 1990 to 2016, according to a 2022 study by Shai Bernstein of Harvard Business School and four co-authors. They founded or co-founded more than half of America’s billion-dollar startups, according to another study. Immigrants co-founded or played a major early role in Nvidia, Alphabet and Tesla.

From Elon Musk to lesser-known figures such as Bhatt [Universal Serial Bus, or USB], many of these inventors and founders originally came to the U.S. on student visas. President Trump’s policies could disrupt that pipeline. (…)

On Wednesday night, the Trump administration banned citizens of a dozen countries from entering the U.S., as well as those from countries including Cuba, Venezuela, and Laos from applying for student visas. The president also issued an order that effectively bans foreign nationals from attending Harvard University. (…)

The U.S. hosted more than 1.1 million international college students in the 2023-24 academic year, according to the Institute of International Education. In fiscal 2024, the government approved 263,000 applications by foreign graduates for temporary employment under the Optional Practical Training program, or OPT, and 52,000 onetime students or dependents rotated into H-1B work visas, which can lead to citizenship. (…)

The changes outlined by Edlow [Trump’s nominee for U.S. Citizenship and Immigration Services director] would effectively kill the OPT [Optional Practical Training] program, said Stuart Anderson, who now runs the National Foundation for American Policy, which supports high-skilled immigration. That would make it impossible for many foreigners to start U.S. businesses after they graduate and significantly dim the allure of American universities for international students, he said.

In a 2022 study, Anderson found that immigrants founded or co-founded 319 of 582 U.S. startup companies that had achieved valuations of $1 billion or more, including Stripe, Instacart and Epic Games. Nearly half of those had been founded by immigrants who attended U.S. universities as international students, the study said. Instagram was co-founded by a Brazilian, Mike Krieger, who studied at Stanford University.

“It’s not that surprising that a lot of international students end up starting a business, because risk-taking is obviously in their makeup,” Anderson said. “They’re willing to take a chance and travel a long way to study in another country. It’s an entrepreneurial thing to do.” (…)

Economists Raise Questions About Quality of U.S. Inflation Data Labor Department says staffing shortages reduced its ability to conduct its massive monthly survey

The Bureau of Labor Statistics, the office that publishes the inflation rate, told outside economists this week that a hiring freeze at the agency was forcing the survey to cut back on the number of businesses where it checks prices. In last month’s inflation report, which examined prices in April, government statisticians had to use a less precise method for guessing price changes more extensively than they did in the past.

Economists say the staffing shortage raises questions about the quality of recent and coming inflation reports. There is no sign of an intentional effort to publish false or misleading statistics. But any problems with the data could have major implications for the economy. (…)

If the government’s enumerators can’t track down a specific price in a given city, they try to make an educated guess based on a close substitute: say, cargo pants instead of slacks. But in April, with fewer workers on hand to check prices, statisticians had to base their guesses on less comparable products or other regions of the country—a process called different-cell imputation—much more often than usual, according to the BLS. (…)

The inflation rate determines how much Social Security benefits go up each year, and where federal tax brackets are set. Private-sector contracts such as wage agreements between companies and unions routinely reference the inflation rate. Payments on $2 trillion of inflation-protected federal bonds hinge on the inflation rate, as do yields on standard Treasury bonds. Businesses, investors and policymakers rely on the reading to guide their decisions. The Federal Reserve is laser-focused on inflation data when it sets interest rates for the country.

A handful of economists noticed quirks in the April data published May 13. When some asked the BLS for more information, government officials sent back an excerpt of an internal report.

“The CPI temporarily reduced the number of outlets and quotes it attempted to collect due to a staffing shortage in certain CPI cities,” beginning in April, the email read. “These procedures will be kept in place until the hiring freeze is lifted, and additional staff can be hired and trained.”

The Trump administration issued a hiring freeze on Jan. 20 for federal employees, and the Department of Government Efficiency, previously led by Elon Musk, cut thousands of federal workers through layoffs and buyouts. It couldn’t be determined if BLS employees were subject to those cuts. (…)

The quality of U.S. economic statistics has been the envy of global policymakers for decades. The system is the product of concerted efforts that began in the depths of the Great Depression to better understand how the economy works.

“Being able to track what’s going on in the economy is very, very important,” Fed Chair Jerome Powell said at a policy conference earlier this year. “It’s something that the United States has led in for a long, long time, and something we need to continue to lead in.”

The concerns around the consumer-inflation survey follow other government-statistics issues that have worried economists in recent months. In May, the BLS suspended publication of hundreds of data series showing wholesale prices for products including some furniture and kitchen utensils. On Tuesday, the BLS said that it had applied incorrect sample weights to the survey of households the unemployment rate is derived from in April. It said the error had a negligible impact. (…)