CONSUMER WATCH

Light Vehicles Sales Decrease to 15.65 million SAAR in May

Wards Auto released their estimate of light vehicle sales for May: U.S. Light-Vehicle Sales Growth Slows in May After March-April “Tariff” Surge (pay site).

Although sales in May dropped to a level more in line with – in fact, slightly below – pre-tariff expectations after spiking above trend in the prior two months due to consumers trying to get ahead of potential tariff-related price increases, part of the cooling off was caused by the drain on inventory from the March-April surge.

The drop in inventory, which at the end of last month was down year-over-year for the first time in nearly three years, helped explain a 10% decline in incentive spending in May from April, as there was less pressure to move stock off dealer lots despite the sharp slowdown in demand.

That dynamic likely continues not just in June, but into Q3, as most automakers do not currently appear anxious to raise production levels enough to fully replace declining stock levels.

Sales in May (15.65 million SAAR) were down 9.4% from April, and down 1.1% from May 2024. Sales in May were well below the consensus forecast.

Research paper from Harvard Business School Pricing Lab

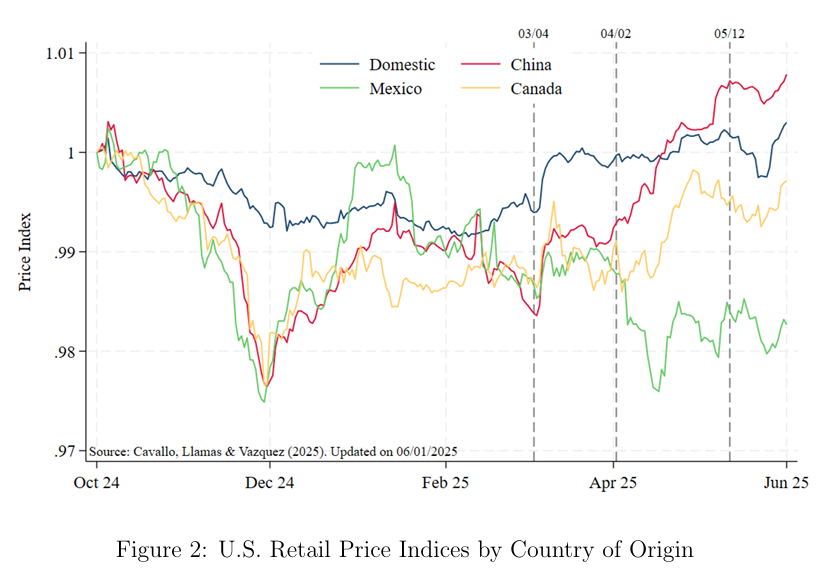

This paper provides a timely analysis of the short-run impact of the 2025 U.S. tariffs on consumer prices by leveraging a novel combination of high-frequency retail price data, detailed country-of-origin information, and tariff classifications. Through custom price indices and targeted visualizations, we capture how prices evolved across affected and unaffected categories, and between imported and domestic goods. (…)

Our analysis reveals that the announcement of U.S. tariffs prompted rapid but still relatively modest price adjustments, with the extent of these changes varying by product origin and category. The most pronounced price increases occurred among imported goods. However, domestic products also saw some gains, likely driven by expectations of rising input costs and shifts in consumer demand.

Notably, we observe differences across countries: price increases for Chinese goods were both larger and more persistent than those for products from Canada and Mexico, where retailers may have viewed the tariffs as more temporary or less likely to be

sustained.Importantly, price pressures extended beyond directly affected categories, with even unaffected sectors showing gradual increases—suggesting broader strategic pricing and supply chain spillovers. These findings underscore the wide-ranging impact of trade policy, which can influence retail prices far beyond the specific goods targeted by tariffs.

Goldman Sachs:

We expect tariffs to raise the effective tariff rate by 13pp, which we estimate would raise core PCE inflation from 2.5% year-over-year in April to 3.6% in December 2025 despite offsetting disinflationary pressures. Our forecast reflects a sharp acceleration in most core goods categories, where tariff-related increases in prices will be most acute in consumer electronics, autos, and apparel categories due to their reliance on imports, but only a limited impact on core services inflation, at least in the near term.

We similarly expect tariffs to boost core CPI inflation this year, from 2.8% in April to 3.5% in December 2025. Aside from tariff effects, we expect underlying trend inflation to fall further this year, reflecting shrinking contributions from the auto, housing rental, and labor markets.

We expect drug pricing policy changes and lower oil prices to weigh modestly on inflation this year, but the effects will only offset a small share of the boost to inflation from tariffs.

We expect tariffs to provide only a one-time price level boost that causes inflation to rise this year before coming back down next year. We are less worried that the reacceleration this year could prove more persistent because we expect the economy to be weak this year, and because we see the coming inflation rebound as less threatening than the 2021-2022 episode because the cumulative inflation overshoot should be much smaller, the labor market is much less tight and forward-looking wage indicators have so far continued to fall, and household spending power is no longer elevated by fiscal transfers.

JOLTS

Job openings increased by 191k to 7,391k in April from an upwardly revised 7,200k in March, above expectations. Job openings increased the most in the professional and business services (+171k) and private education and health services (+115k) sectors but declined the most in the leisure and hospitality (-92k) and other services (-60k) sectors.

The job openings (+0.1pp to 4.4%), hiring (+0.1pp to 3.5%), and layoff (+0.1pp to 1.1%) rates increased, while the quits rate declined (-0.1pp to 2.0%). The federal government hiring rate was unchanged at 1.0%, while the layoff rate declined by 0.2pp to 0.1% in April. (GS)

This was for April. Friday we get May’s job report. Indeed Job Openings keeps weakening:

Foreign Arrivals at US Airports Declining

Trump Signs Order Doubling US Steel, Aluminum Tariffs to 50%

Trump cast the move, which took effect at 12:01 a.m. Washington time on Wednesday, as necessary to protect national security.

An order signed on Tuesday said the previous charge had “not yet enabled” domestic industries “to develop and maintain the rates of capacity production utilization that are necessary for the industries’ sustained health and for projected national defense needs.”

“Increasing the previously imposed tariffs will provide greater support to these industries and reduce or eliminate the national security threat posed by imports of steel and aluminum articles and their derivative articles,” according to the directive, which the White House posted on X. (…)

From my Monday post:

Charts from Goldman Sachs. Spot US HRC prices are 31% higher than EU and Brazil, 50% higher than Japan and 107% higher than China. On rebar: +21-36%, +44% and +93% respectively. Yet, we import less of the lower cost stuff. What cost MAGA?

Automakers Race to Find Workaround to China’s Stranglehold on Rare-Earth Magnets Major manufacturers, fearful they will have to shut down assembly lines, consider moving some parts production to China

Several traditional and electric-vehicle makers—and their suppliers—are considering shifting some auto-parts manufacturing to China to avoid looming factory shutdowns, people familiar with the situation said.

Ideas under review include producing electric motors in Chinese factories or shipping made-in-America motors to China to have magnets installed. Moving production to China as a way to get around the export controls on rare-earth magnets could work because the restrictions only cover magnets, not finished parts, the people said.

If automakers end up shifting some production to China, it would amount to a remarkable outcome from a trade war initiated by President Trump with the intention of bringing manufacturing back to the U.S. (…)

[China] controls roughly 90% of the world’s supply of these elements, which help magnets to operate at high temperatures. Much of the world’s modern technology, from smartphones to F-35 jet fighters, rely on these magnets. (…)

China was supposed to have eased export controls on rare-earth magnets as part of a 90-day tariff truce agreement with the White House, but the country has slow walked license approvals for magnets. Trump accused China of violating its deal with the U.S. China has pushed back at the notion that it was to blame, alleging “discriminatory and restrictive measures” by Washington, including restricting exports of AI chips and revoking visas for Chinese students. (…)

In May, industry groups representing most major automakers and parts suppliers told the Trump administration that vehicle production could be reduced or shut down imminently without more rare-earth components from China. (…)

Analysts say China has superior technical know-how for separating rare earth from surrounding rocks.

American carmakers aren’t the only ones struggling to source magnets from China.

Car companies in Japan and India have also warned of looming manufacturing disruptions. In Europe, automakers say that the pace of export license approvals hasn’t kept up with their demand. (…)

The lack of magnets hits EVs and hybrid vehicles harder than conventional cars and trucks. A typical EV contains far more rare-earths than a gasoline-powered model, but rare-earth magnets are found throughout any modern vehicle. (…)

Bloomberg adds:

One complication is that the US and China appear to have different understandings of what was agreed on rare earths at last month’s trade talks in Geneva, Cory Combs, head of critical mineral supply chain research at Trivium China, told Bloomberg TV.

“On the US side, it seems clear now, there was a sense that Beijing would completely remove the requirement of an approval,” Combs said. “That was not what Beijing seems to think it agreed to.” (…)

Trump had signaled a wish to have a call with his Chinese counterpart as early as February and later said he was willing to travel to the Asian nation to meet with Xi, although no such engagement has been scheduled so far.

China Weighs Ordering Hundreds of Airbus Jets in Major Deal

(…) A deal could involve about 300 planes and include both narrowbody and widebody models, they said, with one person saying the order could range between 200 and as many as 500 aircraft. (…)

Airbus has steadily increased its share of sales to China, helped by a final assembly line in Tianjin for its popular A320 family aircraft. A deal of the magnitude being discussed would help cement the European planemaker’s dominance in one of the world’s top aviation markets.

For its US rival Boeing Co., doing business in China has become more difficult as the company gets caught up in President Donald Trump’s trade war with Beijing. (…)

French President Emmanuel Macron and Chancellor Friedrich Merz of Germany are among leaders that may visit Beijing in July to mark 50 years of diplomatic relations between China and the European Union. Their countries are the two biggest shareholders in Airbus. (…)

Should the order run to 500 planes it would rank as one of the biggest ever and certainly the largest for China. (…)

Any deal would likely be carried out through China’s state-run aircraft procurement body, which typically negotiates on behalf of the country’s airlines.

50% steel and aluminum tariffs probably don’t help Boeing…

India Challenges US on Auto Tariffs in Toughening Trade Stance

New Delhi informed the WTO that the 25% US tariffs on imports of passenger vehicles and light trucks along with certain auto components are “safeguard measures” — trade restrictions — and affect its exporters, according to a notification. India has sought “consultation” with Washington on the tariffs.

In recent weeks, China’s ability to pull through a truce with the US despite defiance and the legal challenges to President Donald Trump’s trade tariffs back home have emboldened India to adopt a more assertive tone in its trade talks.

The move on auto tariffs comes amid the US doubling levies on steel and aluminum and coincides with the visit of a US trade team in New Delhi to advance the discussions.

Separately, India has threatened retaliatory duties on some US goods in response to Washington’s duties on steel and aluminum. (…)

Bessent Says China Has a ‘Choice’ on Whether or Not to Be a Reliable Partner

(…) “They either want to be a reliable partner to the rest of the world, or they don’t,” Bessent said via video link to the American Swiss Foundation Leadership Summit in Zurich on Tuesday. (…)

Trump “wants the US to become more of a manufacturing economy,” Bessent said. The US is trying to remain a destination for foreign and domestic investment with tax cuts, trade rebalancing and deregulation, adding that precision manufacturing is one of the goals of the Trump administration, he said. (…)

Look who’s talking about reliable partners!

Data:

Data: