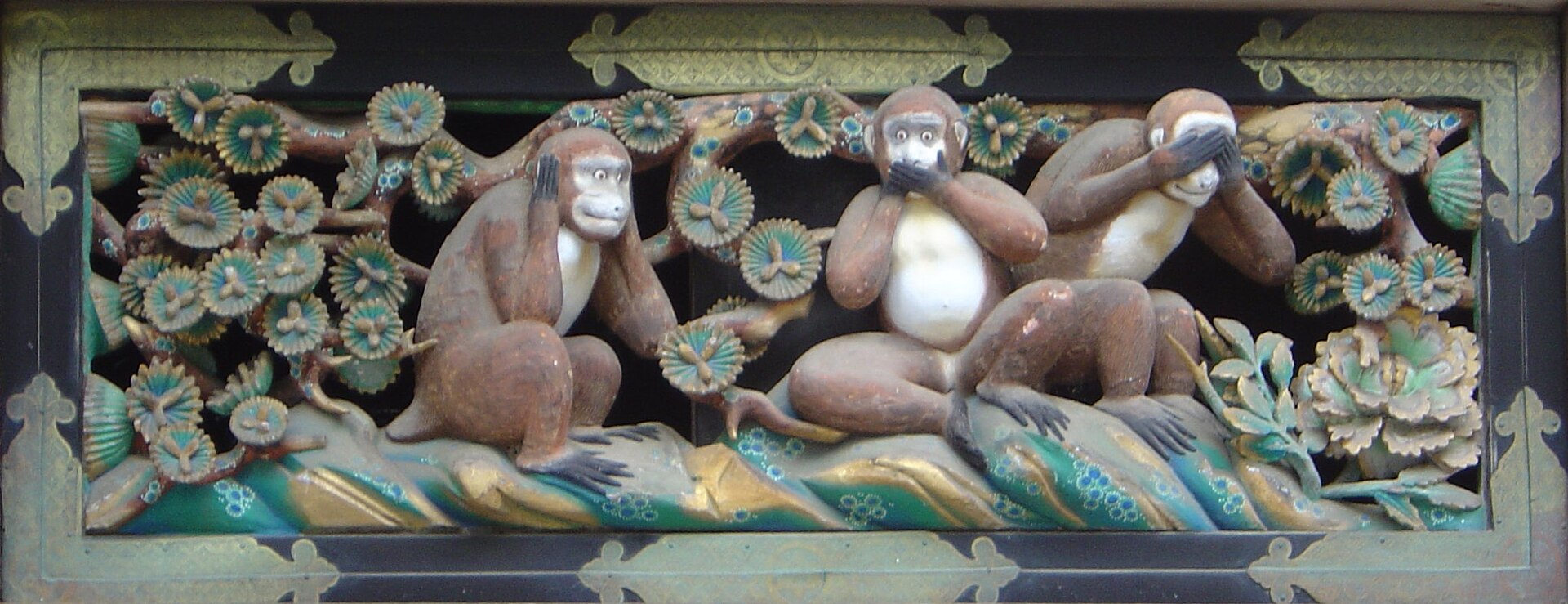

We are now in Nikko, Japan. Don’t know Nikko? You should, because you likely know, or at least heard about these guys. Nikko is where they come from:

Approximately 140 km north of Tokyo and 35 km west of Utsunomiya, the capital of Tochigi Prefecture, it is a popular destination for Japanese and international tourists. Attractions include the mausoleum of shogun Tokugawa Ieyasu (Nikkō Tōshō-gū) and that of his grandson Iemitsu (Iemitsu-byō Taiyū-in), and the Futarasan Shrine, which dates to the year 767. There are also many famous hot springs (onsen) in the area. The mountains west of the main city are part of Nikkō National Park and contain some of the country’s most spectacular waterfalls and scenic trails.

The Japanese saying “Never say ‘kekko’ until you’ve seen Nikko”—kekko meaning beautiful, magnificent or “I am satisfied”—is a reflection of the beauty and sites in Nikkō. (Wikipedia)

Well, Suzanne and I can now say “kekko”.

U.S. Inflation Remains Tame Consumer prices rose slightly in September, the latest sign of modest U.S. inflation pressures amid concerns of a global slowdown.

The consumer-price index, which measures how much Americans pay for everything from cars to doctor’s visits, rose a seasonally adjusted 0.1% in September from a month earlier, the Labor Department said Wednesday. When excluding volatile food and energy categories, prices also increased 0.1%. From a year earlier, consumer prices were up 1.7%, matching last month’s annual reading.

The mild inflation also means Social Security and disability payments will increase just 1.7% for 2015. The government uses the figures from Wednesday’s report to calculate the annual cost-of-living increase for payments made to nearly 64 million Americans. The increase the Social Security Administration announced matched an earlier Labor Department estimate. (…)

Wednesday’s report showed energy prices fell 0.7% in September, the third straight decline. Prices for gasoline and electricity both fell last month. Food prices rose 0.3% in September, led by higher costs for meat and dairy products.

Shelter costs, which rose 0.3% for the month, are up 3% from a year earlier. Housing costs account for almost a third of consumer expenditures.

Medical-care services prices were up 0.1% in September and rose 1.7% from a year earlier, matching the pace of broader inflation.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.8% annualized rate) in September. The 16% trimmed-mean Consumer Price Index also rose 0.1% (1.8% annualized rate) during the month.

U.S. inflation slowed down markedly since May. Core CPI and all Cleveland Fed measures have been rising at annualized rates near 1.2% during the last 4 months.

ISI expects core CPI to be +1.3% YoY in October.

Why Rising Rents Haven’t Pumped Up Inflation “Owners’ equivalent rent” accounts for 24% of the total consumer price index and 31% of the core. So why isn’t its acceleration pushing up the core? Because other factors are offsetting the upward push.

(…) Excluding fuel (which has been falling on its own), the average price of imports hasn’t increased since March, according to Labor Department data. That reflects the stronger dollar, falling commodity prices, as well as foreign producers guarding U.S. market shares as their domestic demand flags. In turn, the CPI for all core goods is down 0.3% for the 12 months ended in September.

On the service side, other major categories have seen a slowdown in markups. Prices of medical services are up just 1.7% year over year, versus 3.1% a year ago. Education and communication services increased 1.8%, down from 2.0% a year earlier. Recreation services are rising 1.3% versus 1.7%.

Altogether, service prices less the rent of shelter increased 2.0% in September, down from 2.6% in September 2013. The disinflation among services coupled with outright price cuts in goods has overwhelmed the upward push from rents. These trends are likely to continue until global economies are growing in better sync.

Rising shelter costs, however, put a crimp in the outlook for U.S. consumer spending. Households are paying more to keep roofs over their heads, leaving less money to spend elsewhere. Luckily, falling gasoline prices will ease some of that squeeze as consumers head into the important year-end holiday shopping season.

Architecture Billings Index Shows Robust Conditions Ahead for Construction Industry

With all geographic regions and building project sectors showing positive conditions, there continues to be a heightened level of demand for design services signaled in the latest Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending.

The American Institute of Architects (AIA) reported the September ABI score was 55.2, up from a mark of 53.0 in August. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.8, following a mark of 62.6 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in August was 56.8.

“Strong demand for apartment buildings and condominiums has been one of the main drivers in helping to keep the design and construction market afloat in recent years,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “There continues to be a healthy market for those types of design projects, but the recently resurgent Institutional sector is leading to broader growth for the entire construction industry.”

CalculatedRisk has the long-term chart:

U.S. Existing-Home Sales Hit Highest Level of Year

Sales of previously owned homes climbed 2.4% from a month earlier to a seasonally adjusted annual rate of 5.17 million in September, the National Association of Realtors said Tuesday. That marked the fifth increase in six months. (…)

Sales in September were down 1.7% compared with a year earlier. (…)

Tuesday’s report showed housing inventory loosened. The number of for-sale homes rose 6% in September compared with a year earlier. At the latest sales pace, it would take 5.3 months to exhaust the housing supply

Home prices, meanwhile, continue to climb. The median sale price for a home last month stood at $209,700, up 5.6% from a year earlier. Prices have risen year over year for 31 consecutive months.

Sales in September rose in every region but the Midwest.

Investors made up 14% of home purchases in September, down from 19% a year earlier. Meanwhile, purchases by first-time buyers have yet to climb significantly after falling earlier in the recovery.

U.S. Agencies Approve Relaxed Mortgage-Lending Rules Three U.S. agencies signed off on relaxed mortgage-lending rules, helping complete a long-stalled provision of the 2010 Dodd-Frank financial law.

The rules are intended to improve the quality of loans by giving banks a financial incentive to ensure mortgages can be repaid. The initial rules required that banks hold 5% of the risk of mortgages packaged and sold to investors or require a 20% borrower down payment. But regulators, concerned that overly stringent rules would harm the housing market’s recovery, backtracked on the 20% down payment.

Instead, banks will be able to avoid the 5% risk-retention requirement if they verify a borrower’s ability to pay back the loan and comply with other requirements, such as a requirement that a borrower’s debt payments not exceed 43% of their income. (…)

The rule, which goes into effect in fall 2015, will be reviewed for its impact on the economy four years later, and every five years after that.

U.S. to Expand Student Loan Access The federal government will expand access to student loans to more Americans with poor credit histories under new rules to be announced by the Obama administration Wednesday.

China’s Slowdown Raises Pressure on Beijing Analysis: China’s economic slowdown is widely expected to continue into next year, increasing pressure on Beijing to take more powerful measures to spur growth.

(…) On Tuesday, China reported that gross domestic product expanded at 7.3% in the third quarter from a year earlier, the slowest rate of growth in more than five years, as deepening problems in the housing market, sluggish retail sales and expanding debt weighed on the economy. Many analysts were expecting weaker growth and greeted the results as positive news, but few predicted a pickup in the coming quarters. (…)

The prospect of GDP expansion in the 7% range comes after a report released Monday from the Conference Board, the New York-based business-research group, which forecast growth slowing to an average of 5.5% from 2015 to 2019, and an average of 3.9% from 2020 to 2025. (…)

Premier Li Keqiang told a delegation attending an Asia-Pacific Economic Cooperation finance ministers’ meeting in Beijing on Tuesday that growth during the first three quarters remained within a “reasonable range” according to the official Xinhua news service. “It takes time for China’s reformative measures to be fully effective,” the premier added, according to Xinhua.

The effects of the slowdown are evident throughout China. Factories are churning out steel, concrete and other commodities well beyond local demand and are kept alive by local governments arranging emergency loans. Debt levels are rising at a clip that rivals the U.S., Japan and South Korea before they tumbled into recession. About 20% of apartments are vacant, according to a Goldman Sachs report, and Chinese cities are chockablock with empty apartment towers. Much of Chinese consumer wealth is tied up in housing. (…)

Housing sales declined by 10.8% in the first nine months of 2014, the National Bureau of Statistics reported, while retail sales decelerated. One bright spot: industrial production picked up in September, year-over-year, from August’s pace. (…)

Andy Rothman, who knows more about China than most mediatized people and now at Matthews Asia is not too worried:

First, last quarter’s growth rate came despite a very high base, as GDP growth was 7.8% in the third quarter of 2013—marking the fastest rate of growth last year.

Second, final consumption, which includes household and government spending, accounted for about 49% of GDP growth in the first three quarters of this year, compared to about 41% from investment. Net exports—the value of exports minus the value of imports—accounted for about 10% of GDP growth, up from small negative contributions during the past two years. But this was likely due in large part to lower import prices rather than a revival of exports.

Third, the added value of the tertiary part of the economy (services, retail and wholesale trade in addition to finance and real estate) rose faster than the added value of the secondary part (manufacturing and construction). Furthermore, for the second consecutive year, the tertiary industry accounted for a larger share of GDP than secondary, providing further evidence of significant economic restructuring.

GDP growth is on target despite a significant negative drag from the residential property sector. New home sales declined 10% year-on-year (YoY) during the first three quarters (vs. +24% during the same period last year), leading residential investment to rise by only 11%, down from a 20% increase a year ago.

Slower housing sales also resulted in slower sales growth for cars and home appliances, putting a small dent into industrial output and retail sales.

But I believe the property market will soon stabilize, following the government’s recent decision to lift the obstacles for people wishing to upgrade to a nicer primary residence. (That move included lowering the cash down payment requirement to 30% from 60% for those who pay off their first mortgage and wish to buy a second house.) Although that change was made just late last month, the month-on-month growth rate of new home sales rebounded to 41% in September, compared to an average of 32% for that month during the previous seven years.

Healthy growth also came without significant stimulus from the government. None of the aspects of the economy where stimulus should be visible—growth in credit, infrastructure construction or fiscal spending (all of which are government-controlled)—reveal an effort to reflate growth. Rather, the clear signal is that the Communist Party leadership is comfortable with the fact that on a YoY-basis, most aspects of China’s economy will continue to grow more slowly every year, on average, for the foreseeable future. This is a very positive development, one which investors also need to embrace. Investors should also remember that because of the much larger base, 7% growth today generates a much larger incremental increase in economic activity than 10% growth did a decade ago.

![]() Good piece from Markit: Is the German economy growing or stalling?

Good piece from Markit: Is the German economy growing or stalling?

OIL PRICES: WHERE’S THE FLOOR?

-

Falling oil price to cut shale costs US production expenses are a critical question for investors

(…) The median North American shale development needs a US crude price of $57 a barrel to break even today, compared with $70 a barrel in the summer of last year, according to IHS, the research company. (…)

Melissa Stark, a managing director at Accenture, the consultancy, says the industry still has a lot of room for improvement.

With more than 18,000 horizontal wells set to be drilled in the US this year, she argues that improving the “manufacturing model” of repeated similar projects could deliver large savings.

Accenture believes the average cost of a US shale well could be cut by up to 40 per cent by better management of factors such as planning, logistics, and relationships with suppliers. (…)

Downward pressure on costs will heighten if the oil price continues to fall. Drilling rigs and other equipment such as pumps for fracking tend not to be tied up on long-term contracts, meaning that producers can adjust their spending quickly in response to oil price movements.

In a deepening slump, the service companies providing services such as drilling and hydraulic fracturing are likely to come off worst, according to Steve Wood of Moody’s, the rating agency.

- And about Saudi Arabia’s budget (from the FT)

Saudi Arabia has doubled government spending since 2008. Revenues have only risen 7 per cent in the same period, notes Bank of America. It certainly sounds like Riyadh cannot push one button for October’s volatility – cutting prices to retain its market share – much further without forcing itself into a budget deficit. But look outside the question of oil revenues, and government assets of $450bn would be enough to cover eight years of deficits if required, says Deutsche Bank.

FYI:

Russian Economy Stalls Russia’s economy—battered by Western sanctions and falling prices for oil, its main export—stalled in September even as inflation hit the highest levels in months, data showed Wednesday.

(…) At a conference in London Wednesday, Sergei Shvetsov, first deputy chairman of the central bank, said rising inflationary expectations would force the bank to “seriously consider” another increase in interest rates. The central bank has already done so three times this year, raising the cost of credit for Russian companies just as they’ve faced a shut-off of lending from the West due to sanctions.

Mr. Shvetsov said the central bank remains committed to allowing the ruble to float more freely starting in January, noting that “politically, it is easier to work with a decreasing than an increasing ruble, as a strengthening ruble is a problem.” (…)

The central bank has intervened heavily this month to slow the ruble’s slide. Wednesday, the Finance Ministry announced it would soon begin offering foreign-currency deposits to banks in an effort to ease a shortage of dollars and euros on the market.

Economy Minister Alexei Ulyukaev said GDP growth in the first nine months of this year was 0.7%, unchanged from the rate reported for the first eight months of the year, Russian news agencies reported Wednesday. That result would keep Russia’s economy on track for its weakest performance since the recession of 2009.

Though Mr. Ulyukaev didn’t provide monthly figures, the latest result suggests that the economy stagnated or even contracted in September from the month before. In September 2013, GDP contracted 0.1% from the previous month.

The government’s forecast calls for growth of 0.5% this year, down from 1.3% in 2013, but many economists expect the 2014 result to be weaker.

EARNINGS WATCH

A look at all NYSE companies from Bespoke Investment:

Just over 300 companies (around 15% of all companies) have reported earnings so far this season, giving us enough data to go ahead and take a look at the earnings and revenue beat rates for the quarter. So far this season, 64.9% of companies have beaten bottom-line consensus analyst earnings estimates, while just 49.3% of companies have beaten top-line revenue estimates. As shown in the charts below, the earnings beat rate looks strong compared to past quarters during this bull market, while the revenue beat rate looks very weak.

Investors would rather see top-line revenue numbers come in stronger than bottom-line earnings numbers, because revenue numbers are more difficult for companies to work around. So far this earnings season, the opposite has occurred.

I don’t agree with the last statement on investors’ preference. Short term swings in aggregate revenues are often a function of commodity prices or other short term factors. While revenue trends are important, equities are priced on earnings.

More than a third of S&P 500 companies have reported. Here’s RBC Capital’s tally:

- 115 companies (35.3% of the S&P 500’s market cap) have reported. So far, earnings are beating by 4.4% while revenues have surprised by 0.8%.

- Expectations are for revenue, earnings, and EPS growth of 3.8%, 5.9%, and 7.9%,

respectively. Assuming an historical beat rate, EPS is on track to come in near 10%.

Clouds Darken for Blue Chips Blue-chip companies are posting poor growth as their once-reliable formulas for success left them too big to switch tack quickly when market conditions changed.

(…) The list of stumbling stars is remarkable: AT&T Inc., which on Wednesday lowered its revenue forecast; Coca-Cola Co. , which posted flat sales; International Business Machines Corp. , which threw out its profit forecast; Wal-Mart Stores Inc., whose same-store sales haven’t increased in the U.S. since 2012; General Electric Co. , whose stock price hasn’t topped $30 since the financial crisis.

A third of the companies in the Dow Jones Industrial Average have posted shrinking or flat revenue over the past 12 months, according to data from S&P Capital IQ. Revenue growth for nearly half the industrials didn’t outpace the U.S. inflation rate of 1.7%. (…)

The industrial average is down 0.7% this year. Meanwhile, the broader S&P 500 index is up 4.3%.

(…) Coke fell short of its volume goal for the second time in three quarters and lowered its long-term revenue target. The company said that it expected to miss its year-end earnings goal and that next year wouldn’t be much better.

(…) U.S. soda-industry volume has fallen for 10 straight years as Americans have scaled back on sugary drinks. Zero-calorie Diet Coke and Coke Zero helped ease the downturn, for a while, but diet-soda sales have been falling twice as fast as full-calorie sales as consumers fret about artificial sweeteners. Sales in formerly fast-growing overseas markets including China, Brazil and Russia have slowed or reversed since last year. Soda consumption fell in Mexico after the government in January began taxing sugary beverages. (…)

IBM has been buying its own shares for decades. It currently has fewer than one billion outstanding, compared with 2.3 billion in 1993. And yet the company’s stock fell sharply Monday after IBM reported its 10th straight quarter of flat or declining revenue and ditched its long-term profit forecast. That left the stock down 14% this year, making it the worst performer in the Dow industrials.

The shares IBM repurchased for $11.2 billion early this year were valued at $10 billion at Wednesday’s close.

(…) today, customers increasingly are choosing simpler services in which software and computing power is rented over the Internet. IBM is in that field, but the shift means less work for IBM’s legions of consultants and the company’s new cloud business isn’t large enough to compensate. (…)