INFLATION WATCH

The U.S. CPI is out tomorrow.

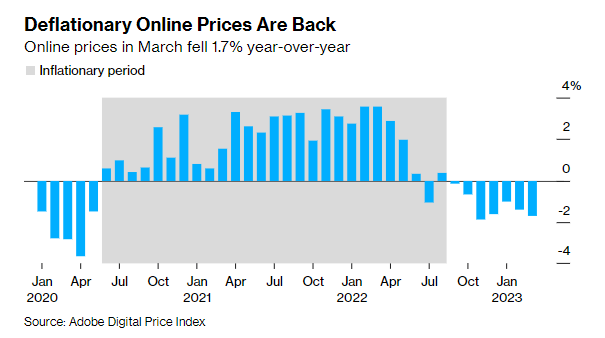

US Online Prices Decline for a Seventh Month on Annual Basis

Online prices in the US dropped 1.7% in March from a year earlier, the seventh-straight decline and the sharpest retreat in four months.

More than half of the 18 categories tracked by Adobe Digital Price Index showed annual price declines, data released Monday showed. Compared to the prior month, online prices were flat in March. (…)

Meanwhile, grocery prices remain a tough spot for household budgets. While price gains have moderated over the past six months, they were up 10.3% in March from a year ago. Online grocery prices track the food category in the government’s consumer price index. (…)

More than 85% of the top 100 US Internet retailers are tracked by Adobe.

Goods deflation is back and is about to show up in official YoY stats.

-

Manheim used car auction prices increased 1.3% to 40% above the pre-pandemic level in March (after adjusting for depreciation) and are now down just 11% from their peak (vs. a trough of 18% below their peak and consumer prices now 12% below their peak). We expect Wednesday’s CPI report to show that used car prices for consumers increased by 0.5% month-over-month in March. (GS)

But the main concern is with services with much hope on rent, still rising 8.8% YoY.:

This chart from Tricon Residential which rents 36,000 single family homes in the U.S. Sun Belt says that rent growth on new leases has indeed slowed from 16-20% during the pandemic to 9-11% since last fall. But renewals are still done at +6-7%, up from +4-5% pre-pandemic.

Tumbling Money Supply Alarms Economists Who Foresaw Inflation

Britain’s money-supply economists, who emerged from obscurity in the pandemic by correctly anticipating sky-high inflation before anyone else, are sounding the alarm again.

Money supply growth is collapsing in the UK, eurozone and US, and they read that as a warning of recession and deflation. Central bankers have raised interest rates too far and, if the so-called monetarists are proved right again, they say there should be a “clear out” of officials.

(…) for monetarists, growth and inflation are a function of the quantity of money in circulation and its velocity — the number of times it changes hands. Those measures are now pointing to a slump. (…)

Today, money supply is plummeting. In the eurozone, the six month rate of change of M3 broad money, which measures deposits and cash equivalents of up to three year maturities, is the weakest since the aftermath of the financial crisis in 2010. M1 narrow money, cash and overnight deposits, is negative for the first time since the currency bloc’s birth in 1999, RBC Capital Markets strategists said. (…)

“Annual broad money growth rates in the UK and Eurozone are well below their 2010s averages – associated with below-target inflation,” Ward said by email. “This is extremely worrying and suggests recession, disinflation and deflation.” (…)

Trends are more concerning in the US, it added, where deposits are “exiting the banking system” and putting “liquidity pressures” on the banks. (…)

What matters? Quantity or flow? Growth (flow) has slowed, but only because the quantity of money has stabilized at a very high level.

Here’s M2 per unit of nominal GDP (the inverse of velocity). Post GFC, the quantity of money rose rapidly, and exploded during the pandemic:

Yet, real GDP growth slowed since 2010 and is now 15% below trend. But the S&P 500 Index is 110% above trend (charts from Advisor Perspectives). That’s where money inflation went.

- BofA’s Regime Indicator suggests that the economy has entered a downturn. (The Daily Shot)

In Europe:

Bank lending survey: banks tightening of lending conditions not seen since 2009.

Macrobond (via The Market Ear)

Yesterday, I had these charts relating to the U.S.:

New loan program expected to put homeownership within reach for more Californians

(…) Cal HFA has been providing down payment assistance for low- and moderate-income first-time home buyers for years. But now, a new program is set to supercharge their ability to help. It’s called the California Dream For All Shared Appreciation Loan program.

“It’s available to low- and moderate-income. So the upper income limit is $211,000,” Martin said.

The loans pay for a down payment and closing costs. (…)

“The state of California can give up to 20% for a down payment and closing costs. It’s a 0% interest rate. The payments are deferred for the entire life of the loan,” explained Evans.

Evans said the new loan program has a shared equity program.

“When you sell the property or refinance the loan, they take up to 20% of the appreciation. The homeowner gets to keep 80%,” he said. (…)

The state only has $300 million in the program and with thousands of Californians expected to apply, that money is expected to go fast.

A blueprint for other states?

China Consumer Price Growth Eases, Reflecting Caution on the Economy Inflation in China eased for the second straight month in March despite signs of a pickup in the economy.

Consumer prices rose just 0.7% in March from a year earlier, China’s National Bureau of Statistics said Tuesday, the lowest annual rate of inflation since September 2021.

March’s reading was weaker than the 1.0% annual rate recorded in February and the 0.9% rate expected by economists polled by The Wall Street Journal. (…)

Unemployment in China is stubbornly high—especially among young people—with just over 18% of those aged 16 to 24 out of work in February. (…)

While signals from business surveys, cinema box-office receipts and traffic and public transit data suggest China’s economy bounced back in the first quarter of the year as consumers flocked back to stores and restaurants, other data imply consumers are wary about spending on cars and other big-ticket items while continuing to sock away cash rather than run down savings. (…)

Tuesday’s data showed the slowdown in inflation was driven by weaker food-price inflation, with prices for vegetables tumbling 11.1% from a year earlier. Nonfood inflation also slowed.

Prices charged by producers at the factory gate, meantime, fell 2.5% from a year earlier, another sign that inflationary pressures in China are weak. That was a steeper fall than the 1.4% decline recorded in February.

China Auto Parts Makers Join Apple in Offshore Factory Push

Chinese car parts makers are facing growing pressure from overseas customers to set up factories outside the country as mounting trade tensions and three years of Covid lockdowns make them wary of relying too heavily on China.

Carmakers from Europe and elsewhere are making direct overtures to manufacturers of everything from cooling components to brake systems and auto charging parts, pressing them establish plants in places like Vietnam and Indonesia so they can still benefit from their expertise and long-held relationships but avoid the risks China poses right now, according to a number of suppliers interviewed by Bloomberg News. (…)

It’s not just auto parts makers feeling the pressure of what has come to be known as China+1: the push to establish at least one factory outside the home base of China. Most notably, Apple Inc. and its suppliers are moving production out of the country. Foxconn Technology Group plans to invest about $700 million on a new plant to make iPhone components in India, while AirPods maker GoerTek Inc. is plowing an initial $280 million into a new Vietnam facility and considering expanding in India.

“Firms are moving away from a cost-driven strategy to a resilience-driven strategy,” said Ben Simpfendorfer, a partner at Hong Kong-based consultancy Oliver Wyman. “The resilience is by adding an extra factory or more in a different part of the world,” he said, adding that the pandemic and trade tensions have brought into sharper focus the fragility of global supply chains. (…)

For the first time in about 25 years, China isn’t a top three investment priority for a majority of US firms, an American Chamber of Commerce in China survey showed. The survey also found the proportion of companies moving supply chains elsewhere, or considering doing so, had almost doubled from a year ago. (…)

A survey it [the European Chamber of Commerce in China] conducted last year showed that 23% respondents were considering shifting their current or planned investments out of China, the highest on record. (…)

New Bank of Japan Chief Says He Will Maintain Easy Money Kazuo Ueda said he would maintain monetary easing and negative interest rates despite expectations for an early policy change.

“We will continue the monetary easing adopted by the previous leadership,” Mr. Ueda said at a news conference Monday night after finishing his first weekday on the job. He became governor on Sunday, succeeding Haruhiko Kuroda.

Mr. Ueda said that achieving sustainable and stable 2% inflation was “the project of many years” and he wanted to finish it. It is also “not an easy goal,” he said. (…)

Inflation reached 4% late last year mainly because of higher costs of imported energy and food, but it slowed to 3.3% in February, and the central bank forecasts that the rate will fall below 2% later this year. (…)

“There are also positive signs in wages. This could continue and lead to achieving stable and sustainable 2% trend inflation.” (…)