NFIB

The May Index continues the remarkable surge in small business optimism that started the day after the election. Small-business confidence shot up to near record levels last November and still hasn’t come down. The Index for May matched its strong performance in April of 104.5. The Index has been at a historically high level for six straight months. In May, five of the Index components posted a gain, four declined, and one remained unchanged. Labor market indicators remained strong, capital spending remained high, and reports of improved sales trends also increased in frequency.

U.S. Wholesale Inventories & Sales Decline

Inventories at the wholesale level fell 0.5% during April following a 0.1% March uptick, revised from 0.2%. It was the second decline in the last four months, and halved the y/y increase to 1.6%.

Wholesale sales dropped 0.4% (+7.3% y/y) following a 0.2% decline, revised from no change. A 0.3% rise was expected in the Action Economics Forecast Survey.

Nondurable goods sales were off 1.1% (+7.3% y/y as petroleum sales fell 1.5% (+33.2% y/y).

Wholesalers’ inventory-to-sales ratio held steady at 1.28, down sharply from the 1.36 average in Q1’16.

Loonie Surge on BOC Bets Signals Break From Commodities

The loonie’s June 12 rally showed it’s breaking free from commodity prices, which tumbled. The currency surged after Bank of Canada Senior Deputy Governor Carolyn Wilkins signaled in a speech that economic growth is broadening and that the central bank, when it comes to stimulus, may need to let up on the gas. “The hawkish nature of the speech is the first acknowledgment from the bank that the next move is likely to be a hike,” CIBC’s Avery Shenfeld wrote. (Bloomberg Briefs)

-

Time for a more hawkish Bank of Canada

In its May rate-announcement press release, the Bank of Canada described the Canadian economy’s adjustment to lower oil prices as “largely complete.” That in itself should

be enough to call into question the current overnight rate of 0.50%. The justification for the Bank’s policy stance seems even more questionable at a time when full-time employment is surging among prime-aged workers (those most likely to borrow money). A total of 196,000 full-time jobs have been added in this age group over the last seven months, the best such run in 20 years. This is an environment supporting credit growth, consumer spending and the housing market. (…)We now expect the Bank of Canada to raise the overnight rate 25 basis points in October, three months earlier than previously assumed. (NBF)

Saudi Arabia Cuts U.S. Oil Exports to Ease Supply Glut The kingdom is slashing its U.S. oil exports to a near three-decade low for this time of the year, intensifying its efforts to reduce bloated inventories that have been pummeling crude prices.

The state-owned Saudi Arabian Oil Co. expects its sales to the U.S. will drop below one million barrels a day in June, then slide to about 850,000 barrels a day in July, according to people familiar with the matter. Saudi Aramco expects its August exports to decline by another 100,000 barrels a day, these people said, which would be the lowest export amount for that month since 2009. (…)

The fall in Saudi exports could reflect a number of other factors. Rising U.S. production means domestic refiners need less of Saudi Arabia’s crude, and the end of Aramco’s refining joint venture with Royal Dutch Shell PLC leaves the Saudi company with fewer buyers of its crude output. Saudi exports usually fall during the hot summer months because the kingdom requires more crude to generate electricity. (…)

U.S. imports from Saudi Arabia declined to 1.17 million barrels a day in March from 1.34 million barrels a day in January. ClipperData, a vessel tracking firm, said they averaged about 1.1 million barrels a day in April and May. (…)

OPEC’s output rose 1% to over 32.14 million barrels in May, led largely by increases from three of its 14 members: Libya, Nigeria and Iraq, according to the cartel’s closely watched monthly market report.

The increase from Libya and Nigeria wasn’t a surprise because those countries were exempted from any obligation to cut as they try to come back from sabotage and violent disruptions to their supplies.

But Iraq agreed last December, and again in May, to some of the largest production cuts undertaken by the cartel. Instead its output increased over 44,000 barrels a day to over 4.4 million barrels a day. (…)

Saudi Arabia, OPEC’s biggest producer and the world’s biggest exporter, raised its production slightly to 9.94 million barrels a day in May from 9.938 million barrels a day a month earlier, according to OPEC, citing sources such as shippers, analysts and industry executives.

The Saudi kingdom itself told OPEC its production fell by 66,200 barrels a day last month to 9.880 million barrels a day. (…)

What, Me Worry?

The accident-waiting-to-happen follow up, from John Mauldin:

If you missed the April 21 Daily Edge:

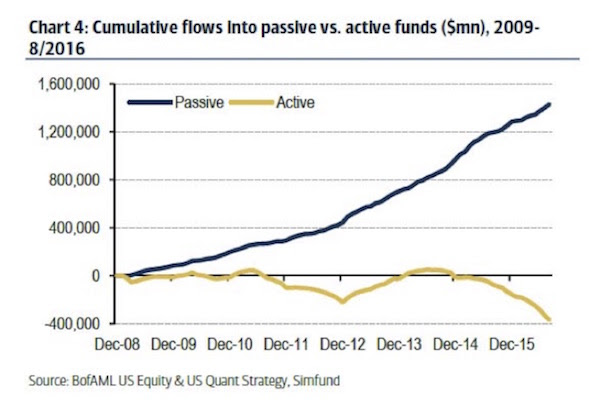

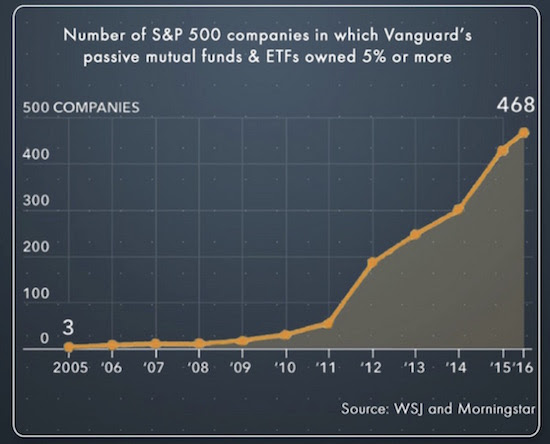

Please take the time to watch and analyse the accompanying charts if you are even remotely serious about investing. The video is courtesy Steven Bregman and Horizon Kinetics. The chart book is courtesy Steven Bregman and Horizon Kinetics as well as Grants Financial Publishing via Valuewalk.