U.S. Retail Sales Decline; Nonauto Sales Weaken

Still strong overall:

U.S. Consumer Prices Down 0.1% in May

Excluding the often-volatile categories of food and energy, so-called core prices rose only 0.1% from April.

From a year earlier, consumer prices rose 1.9%, the third straight month annual gains have eased and the lowest reading since November. Prices were up 1.7% on the year when excluding food and energy, the weakest mark in two years. (…)

Food prices climbed 0.2% last month and were up 0.9% from a year earlier.

Shelter costs—which account for about a third of the overall price index—increased 0.2% on the month and rose 3.3% on the year.

Elsewhere, inflation was weak. Monthly prices fell for apparel, airfare, communication and medical care services, the Labor Department said.

A separate Labor Department report showed average weekly earnings for private-sector workers, adjusted for inflation, increased 0.3% in May from the prior month. From a year earlier, inflation-adjusted weekly earnings were up 0.6%.

Haver Analytics’ rundown is pretty telling about demand:

- Prices for goods excluding food & energy declined 0.3% (-0.8% y/y), down for the fourth straight month.

- Recreation goods costs eased 0.2% (-3.7% y/y) after a 0.5% decrease..

- Apparel prices fell 0.8% (-0.9% y/y), down for the third straight month.

- Prices for household furnishings & supplies fell 0.2% (-1.4% y/y), down for the fourth straight month.

- New vehicle prices edged 0.2% lower (+0.3% y/y), the fourth consecutive monthly decline.

On the other hand, services prices remain firm, likely due to wage cost pressures:

- Services prices less energy increased 0.2% (2.6% y/y), the strongest change in three months.

- Transportation services prices rebounded 0.3% (2.9% y/y) following a 0.2% fall.

- Shelter costs rose 0.2% (3.3% y/y) following a 0.3% gain. Rent costs improved 0.2% (3.4% y/y) and the owners’ equivalent rent of shelter prices rose 0.2% (3.3% y/y), the same as in three of the prior four months.

- Recreation services prices improved 0.1% (3.1% y/y) following no change.

- But medical care services prices dipped 0.1% (+2.5% y/y) following one month of stability. Education & communication services prices held steady (-2.3% y/y) following three months of decline.

Prices for energy products fell 2.7% (+5.4% y/y), the third decline in four months. Gasoline prices were off 6.4% (+5.8% y/y), also the third decline in four months. Fuel oil prices declined 2.5% (+10.4% y/y), but natural gas prices jumped 1.9% (12.8% y/y). Electricity costs rose 0.3% (2.7% y/y).

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in May. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.2% annualized rate) during the month.

A big gap has developed since March between the median and the trimmed-mean CPI. The outliers are on the weak side:

The U.S. auto industry is bracing for a long, slow summer

General Motors Co. will extend its traditional seasonal shutdown at certain U.S. factories to deal with slumping sales and bloated inventory, the WSJ’s Mike Colias reports, the latest sign that the industry is shifting into a lower production gear. That’s tough news from a field that’s provided the U.S. industrial sector much of its engine power in recent years but now is clearly pulling back. U.S. car sales, after hitting a record in 2016, have fallen nearly 2% over the past three months and automobiles are piling up at dealer lots. GM, with its inventory almost 44% higher from a year ago, will idle a factory near Kansas City, Kan., for five weeks starting this month, and may face more job cuts. Auto-related shipments at U.S. railroads are down nearly 5% this year through May and the downshifting at factories suggest the traffic won’t pick up anytime soon. (WSJ)

![]() The stream of negative economic surprises sent the Citi US Economic Surprise Index to a two-year low. (The Daily Shot)

The stream of negative economic surprises sent the Citi US Economic Surprise Index to a two-year low. (The Daily Shot)

Fed Lays Out Plan to Unwind Years of Asset Purchases The Federal Reserve said it would raise short-term interest rates and spelled out in greater detail its plans to start slowly shrinking its $4.5 trillion portfolio of bonds and other assets this year.

(…) “The economy is doing very well, is showing resilience,” said Fed Chairwoman Janet Yellen at a news conference following the Fed’s two-day policy meeting.

The Fed said it would increase its benchmark federal-funds rate on Thursday by a quarter percentage point to a range between 1% and 1.25% and penciled in one more increase later this year if the economy performs in line with its forecast.(…)

Plans revealed by the Fed on Wednesday would start reducing the central bank’s holdings gradually by allowing a small amount of net maturities every month. It would start by allowing up to $6 billion in Treasury securities and $4 billion in mortgage bonds to roll off without reinvestment, and let those amounts rise each quarter, essentially setting a speed limit for the wind-down.

The limits would ultimately rise to a maximum of $30 billion a month for Treasurys and $20 billion a month for mortgage-backed securities.

Ms. Yellen said if the economy performed in line with the central bank’s forecasts, the Fed could set those plans into motion “relatively soon,” which market strategists believe could mean September or October. (…)

“The plan is one that is consciously intended to avoid creating market strains and to allow the market to adjust to a very gradual and predictable plan,” Ms. Yellen said at a news conference Wednesday. (…)

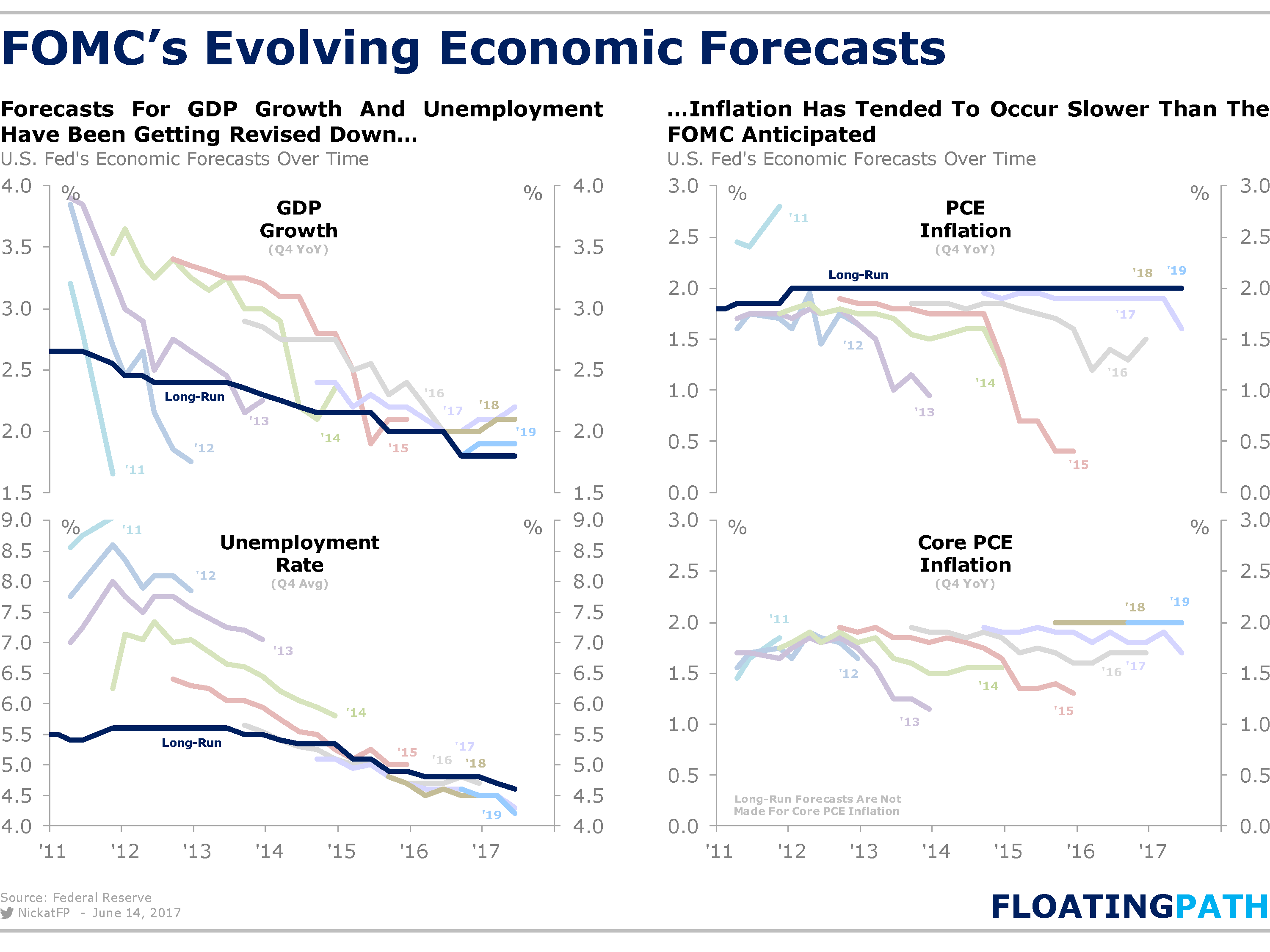

Officials now expect prices excluding food and energy to rise 1.7% this year, from a projection of 1.9% in March. They lowered their unemployment rate forecast to 4.3% for the end of 2017 and to 4.2% at the end of 2018 and 2019, down from March projections of 4.5% for each of those years. (…)

The FOMC dot plot shows that the central bank expects another hike this year. The futures-based probability of a third rate hike is 43%.

About that “predictable plan”:

-

The Fed Is Flying Blind The U.S. central bank isn’t sure why inflation is staying so low—but it’s raising rates anyway, risking a recession.

-

Investors wary of Fed’s newfound assertiveness Markets and policymakers are split over where they see monetary policy heading

-

The Fed’s perception flaw

-

A long-expected central bank mistake

-

Five reasons to doubt Yellen and the Fed’s wisdom

-

Cudmore: Yellen Just Made A Big Mistake

-

Will Economy Absorb Fed’s Aggressive QE Unwind?

BI Economics is impressed by the aggressiveness of the Federal Reserve’s intentions, as the cap will start at $10 billion per month and accelerate to $50 billion per month. The Fed previously indicated that it wanted balance-sheet policy to operate quietly and passively in the background — as one member quipped, it should be “like watching paint dry.” This intention may be jeopardized by such a rapid intensification. Although, depending on the market reaction, the reinvestment phase-out could be watered-down at some future date.

CANADIAN DOLLAR

The loonie is so dirt-cheap that domestic industry unit labour costs, in U.S. dollar terms, are now 26% below the levels stateside. The implications of this gap for foreign direct investment into Canada and manufactured exports are hugely bullish. (…)

I don’t ant to get ahead of myself here, but the last two times Canada had such a cost advantage over the United States was in late 2008 and before that the spring of 2005 – in the former, the Canadian dollar rallied from C$1.21 to C$1.06 within the span of a year; in the latter period, the loonie went from C$1.24 to C$1.12. (David Rosenberg)

OPEC Stumbles in Face of Oil Glut Production cuts aren’t drawing oil out of storage and U.S. shale producers are humming, fueling the idea that OPEC and its allies missed the mark.

(…) In the U.S., the Energy Information Administration said Wednesday that crude stockpiles fell last week by 1.7 million barrels, less than the 2.6 million drop forecast by a Wall Street Journal survey. At the same time, gasoline inventories rose by 2.1 million barrels, compared with the survey’s expectation of a 700,000 decline, underlining worries about the oversupply extending to crude oil’s products. (…)

The IEA said U.S. crude supply will grow almost 5% on average this year [480,000 bbls/d], and nearly 8% [780,000 bbls/d] in 2018, potentially vaulting American producers ahead of Saudi Arabia in daily output. (…)

In 2018, non-OPEC production is set to increase by 1.5 million barrels a day, the IEA said, more than the 1.4 million barrels of growth forecast for world consumption. That means OPEC could have to sacrifice more market share over a longer period to maintain its output cuts.

-

Gasoline stockpiles are now above the 5-year high for this time of the year. (The Daily Shot)

ANIMAL SPIRITS

-

Investors Play the Risky Role of Lender Desperate to increase returns, some of the world’s most conservative investors are taking bigger risks by aping banks and lending directly to companies.

-

Hong Kong parking space sells for record $664,300.

U.S. and Qatar Move Toward $12 Billion Arms Deal The U.S. and Qatar signed a preliminary agreement for the sale of dozens of Boeing Co. F-15 fighter jets to the Persian Gulf monarchy, in a transaction that risks further ensnaring the Trump administration in an escalating dispute between leading Arab countries.

U.S. and Qatar Move Toward $12 Billion Arms Deal The U.S. and Qatar signed a preliminary agreement for the sale of dozens of Boeing Co. F-15 fighter jets to the Persian Gulf monarchy, in a transaction that risks further ensnaring the Trump administration in an escalating dispute between leading Arab countries.

By one definition, the GOP baseball shooting is the 154th mass shooting this year

By one definition, the GOP baseball shooting is the 154th mass shooting this year