U.S. Retail Sales Fell in September Sales fell 0.3% from August in first monthly decline since February

Retail sales decreased a seasonally adjusted 0.3% in September from a month earlier, the first monthly decline since February, the Commerce Department said Wednesday. Excluding vehicles and gasoline, categories that can be volatile, September retail sales were flat. (…)

September’s decrease in retail sales was driven in part by a 0.9% decline in spending on vehicles, which reflects a pullback from a strong 1.9% gain in August. Lower fuel prices weighed on sales at gasoline stations, which fell 0.7%. (…)

Sales increased 1.5% in the July-through-September period compared with the previous three months. (…)

Forecasting firm Macroeconomic Advisers predicted U.S. gross domestic product grew at a 1.3% seasonally adjusted annual pace in the third quarter, compared with a 2.0% annual rate in the second quarter and a 3.1% pace in the first. (…)

On important note is that August was revised up from +0.4% to +0.6%. Here’s the MoM and QoQ trends. While September was weak, Q3 was quite solid. Good back-to-school sales are generally positive for the rest of the year.

-

Heard on the Street: The American Consumer Needs Some Help Softening retail sales strengthen the case for rate cuts

(…) overall consumer spending looks to have grown at a 2.4% annual rate in the third quarter, according to Barclays, which is basically in line with the previous four quarters’ average pace. (…)

The risk is that, in the months ahead, people could get more cautious. With corporate-profit margins coming under pressure, employers appear to be ratcheting back hiring plans. Income gains could slow as a result, taking away people’s wherewithal to keep spending. The constant drip of unsettling geopolitical news, and the risk that trade tensions could flare up yet again, could also wear down people’s willingness to shop. (…)

U.S. Home Builder Sentiment Posts Solid Gain, Led by South and West

The Composite Housing Market Index from the National Association of Home Builders-Wells Fargo rose for the fourth consecutive month to 71 in October from 68 in September. This is the highest reading since January 2018. (…) Over the past ten years, there has been a 62% correlation between the y/y change in the home builders index and the y/y change in new plus existing home sales.

The index of present sales conditions rose to 78 this month from 75 in September, its third consecutive increase and well above the recent low of 61 reached last December. The index of expected conditions in the next six months jumped up to 76 in October from 70 in September, its largest monthly increase since December 2016. The index measuring traffic of prospective buyers rose to 54 in October, the highest reading since February 2018, from 50 in September.

Regional readings showed modest monthly declines in the Northeast and Midwest more than offset by solid monthly increases in the South and West. (…)

Economic Outlook from Freight’s Perspective

(…) With the -3.4% drop in September, following the -3.0% drop in August, -5.9% drop in July, -5.3% drop in June, and the -6.0% drop in May, we repeat our message from the previous four months: the shipments index has gone from “warning of a potential slowdown” to “signaling an economic contraction.”

• We acknowledge that: all of these negative percentages are against extremely tough comparisons, and the Cass Shipments Index has gone negative before without being followed by a negative GDP. However, weakness in demand is being seen across most modes of transportation, both domestically and internationally, with many experiencing increases in the rates of decline.

• We know that freight flows are a leading indicator, so by definition there is a lag between what they are predicting and when the outcome is reported. Nevertheless, we see a growing risk that GDP will go negative by year’s end.

• The weakness in spot market pricing for many transportation services, especially trucking, is consistent with the negative Cass Shipments Index and, along with airfreight and railroad volume data, strengthens our concerns about the economy and the risk of ongoing trade policy disputes. Weakness in commodity prices, and the ongoing decline in interest rates, have all joined the chorus of signals calling for an economic contraction. (…)

Beyond our concern that the Cass Freight Shipments Index is negative on a YoY basis for the tenth month in a row:

• We are concerned about the increasingly severe declines in international airfreight volumes (especially in Asia) and the ongoing swoon in railroad volumes, especially in auto and building materials;

• We see the weakness in spot market pricing for transportation services, especially in trucking, as consistent with and a confirmation of the negative trend in the Cass Shipments Index;

• As volumes of chemical shipments have lost momentum, our concerns of the global slowdown spreading to the U.S. (confirmed by the recent deterioration in the ISM to 47.8), and the trade dispute reaching a ‘point of no return’ from an economic perspective grow. (…)The Consumer Economy – We should note that dry van trucking volume has historically been a fairly reliable predictor of retail sales (container volume serves a similar role). When studied using the DAT Dry Van Barometer, current demand is at levels in line with capacity, which suggests that the consumer economy is still relatively healthy and that retail sales are not contracting. That said, this is a period that seasonally should be seeing much stronger volumes, which makes us cautious about the outlook for demand for 4Q.

UAW, GM Reach Tentative Labor Deal The United Auto Workers struck a tentative labor deal with General Motors, a critical step in ending a monthlong strike that has brought more than 30 GM factories to a standstill.

(…) As part of the new deal, GM has committed to invest around $7.7 billion in its U.S. factories over the four-year contract period, which would create or preserve about 9,000 jobs, according to people familiar with the agreement.

The company also separately has joined with outside companies to invest another roughly $1.3 billion in facilities near its Lordstown, Ohio, assembly plant, which the company hopes to sell to a startup electric-truck maker, the people said.

Those investments would create more than 1,000 additional jobs, including a new facility that would make battery cells for electric cars, they said.

The Detroit auto maker, in return, will move forward with plans to close or sell three now-idled U.S. factories, including the Lordstown plant, under the proposed terms. (…)

A fourth assembly plant in Detroit that was without future work will get a new electric pickup truck within the next four years to keep it open, the people said.

Additionally, the agreement includes wage increases of 3% in two years of the contract and 4% bonus payments in the other two years; a path to full-time employment for temporary workers; and no changes in the amount workers contribute toward their health-care benefits, the people said—all major wins for the union.

The UAW was also successful in getting improved pay for newer hires, who under this latest deal would reach the top wage of about $30 an hour faster than the eight-year period now, the people said. The pay disparity between veteran workers and those with less seniority has long been a sore point for UAW members, who say it is unfair to pay different wages for the same factory job. Any deal to move newer workers up in pay faster would be a gain for the UAW but could increase the company’s labor costs without other offsets. (…)

-

Chicago Cancels Thursday School Classes as Strike Begins The Chicago Teachers Union will begin a strike Thursday over demands going well beyond pay, following a national wave of teacher strikes that have brought raises and other benefits in recent years.

Global economic policymakers are playing with fire Too much of what ails the world economy is the result of ‘stupid stuff’

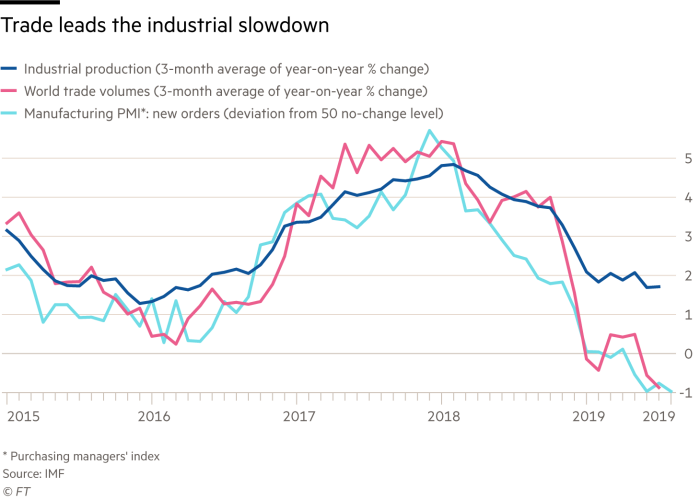

The FT’s Martin Wolf cites the latest IMF World Economic Outlook downgrading world growth to 3% this year, from 3.6% in 2018. “In the high-income countries, aggregate growth is forecast at 1.7 per cent, down from 2.3 per cent last year. In emerging economies, the decline is from 4.5 per cent to 3.9 per cent this year. Growth of the volume of world trade is forecast at just 1.1 per cent this year, down from 3.6 per cent last year. This is far below the growth of output: it signifies deglobalisation, with respect at least to trade.”

Pretty scary chart above! The OECD Composite Leading Indicators (CLI) for October points to continued weakness. Note how the U.S. CLI’s downtrend has now extended below its 2016 low and that China’s has changed direction:

Fed Paper Says Negative Rate Policy Can Provide Real Stimulus Negative interest rates are a viable tool to provide stimulus to economies that need it, and the U.S. might have benefited from using it during the financial crisis, a new report from the San Francisco Fed said.

Negative interest rates are a viable tool to provide stimulus to economies that need it, and the U.S. might have benefited from using it during the financial crisis, a new report from the San Francisco Fed said Tuesday.

“Analyzing financial market reactions to the introduction of negative interest rates shows that the entire yield curve for government bonds in those economies tends to shift lower,” writes bank economist Jens Christensen. “This suggests that negative rates may be an effective monetary policy tool to help ease financial conditions.” (…)

“If we were to find ourselves at some future date again at the effective lower bound—again, not something we are expecting—then I think we would look at using large-scale asset purchases and forward guidance” as the main sources of stimulus, Fed Chairman Jerome Powell said at his press conference after the Fed’s September policy meeting. “I do not think we’d be looking at using negative rates.”

But that isn’t a universally held view. In an interview with the Wall Street Journal on Thursday, Minneapolis Fed leader Neel Kashkari said “we’d have to consider negative rates, if we were in the same position as Europe.” He added that when it comes to negative rate policy, “nobody could ever completely rule it out. But I don’t think it would be one of the first things we do.”

EARNINGS WATCH

As of Wednesday morning, we had 43 reports in, an 86% beat rate, a +4.5% surprise factor and a –3.0% blended growth rate for the quarter, down from –2.2% on Oct. 1. Actual earnings growth for the 43 companies having reported is –0.4% on revenue growth of +3.8%.

By comparison, after 43 reports during Q2, the beat rate was 84%, the surprise factor +4.9% and the blended growth rate +0.4%, up from +0.3% on July 1. Actual earnings growth for the 43 companies having reported was +8.8% on revenue growth of +2.6%.

Trailing EPS are now $162.61, down 1.0% from $164.31 at the end of September and down 0.4% from $163.24 after 43 reports during Q2.

Investors reacted positively to Financials’ earnings releases (85% beat rate, +4.5% surprise factor) but analysts have actually downgraded their estimates from +4.1% on October 1 to +2.6%. Goldman calculates that “large banks reported average loan growth of 1% YoY, consistent with 2Q19.” GS adds that “net charge offs were effectively flat YoY, provisions beat expectations by 2% and management commentary remains benign.”

Overall, the Q3 earnings season is not off to a great start.

TECHNICALS WATCH

Last Monday, I noted that Lowry’s Research warned that we needed stronger demand to confirm recent equity gains. Its last 3 daily analysis indicate that demand has in fact been fairly tepid this week. Yesterday: “With short-term indicators climbing further toward overbought levels, the drop in Demand over the past couple of days likely leaves the market vulnerable to a near-term pullback.”

However, the 13/34–Week EMA Trend remains positive (CMG Wealth):

SENTIMENT WATCH

The Renaissance IPO ETF has delinked with the S&P 500:

- The proportion of unprofitable IPOs has reached 70%, the highest level since the tech bubble 20 years ago. Picture source: BofA Merrill Lynch (via Isabelnet)

WE’re of no help on the above:

-

WeWork Bonds Fall to New Low The debt has been volatile following news reports about a looming cash crunch and strategies for raising money

WeWork’s 7.875% unsecured bonds due in 2025 traded as low as 79 cents on the dollar, according to MarketAxess, translating to a yield of around 13.2%. That was down from 87 cents at the end of Friday and below its previous low of 81.25 cents reached earlier the same day. (…)

Unrelated but still very important:

Youth Suicide Rate Rises 56% in Decade Suicide and homicide rates have risen in recent years among young people in the U.S., the Centers for Disease Control and Prevention reported.

Youth Suicide Rate Rises 56% in Decade Suicide and homicide rates have risen in recent years among young people in the U.S., the Centers for Disease Control and Prevention reported.

(…) “The chances of a person in this age range dying by suicide is greater than homicide, when it used to be the reverse,” said Sally Curtin, a statistician at the CDC and an author of the report. “When a leading cause of death among our youth is increasing, it behooves all of us to pay attention and figure out what’s going on.” (…)