Did you miss yesterday’s Daily Edge: Don’t Be Fooled!

Economists Say Bank of Canada to Begin Hiking Rates Next Week

(…) The central bank’s quarterly survey of executives paints a picture of an economy pressed up against its limits. Over two-thirds of respondents expect annual consumer price gains to surpass 3% over the next two years. Almost 80% say worker shortages are intensifying and their companies would have at least some difficulty meeting unexpected demand.

The capacity constraints are coming up against strong demand. More than two-thirds say indicators of future sales are improving, 62% anticipate they’ll increase investment in machinery and equipment over the next year and 80% plan to grow employment levels and wages. (…)

Markets are pricing in six Bank of Canada rate hikes this year, with a 70% chance of an increase Jan. 26, when policy makers led by Governor Tiff Macklem announce their first decision of the year.

A broad gauge of business sentiment reached its highest level on record. The central bank’s composite indicator of business conditions rose to 5.99, up from 4.56 in the third quarter. (…)

A separate survey of consumer expectations showed Canadian households also expect inflation to stay above 3% over the next couple of years. Asked what they expect the rate of inflation to be in the future, Canadians saw it at 4.89% in the next year, 4.12% in two years and 3.5% in five years. (…)

Still, expectations of wage gains for households remain moderate, according to the survey.

Firms also largely expect the high inflation levels to be transitory, the Bank of Canada said, based on a special question it posed in this survey. (…)

“A strong majority of firms intend to raise wages at a faster rate in the next 12 months,” according to the Bank of Canada.

There are also potential signs that companies are starting to compensate workers for rising cost of living, the central bank said.

- Canadian home prices jumped by record 26.6 per cent in 2021 The typical price of a home across the country rose to a high of $811,700 year over the year, according CREA’s index

U.K. Real Wages Are Falling Even Before Inflation Truly Bites

Europeans Rush to Reduce Energy Use as Household Bills Soar

China Seeks to Cushion Blow of Economic Pain as Momentum Slows The country’s leaders are hoping that they can put a floor under the economy, which expanded by 4% in the fourth quarter of last year, the slowest pace since the beginning of the Covid-19 recovery.

To do so, they are easing some of their earlier tightening policies, for example by increasing mortgage lending to home buyers. The country’s central bank on Monday cut two key interest rates that could pave the way for further cuts to the benchmark lending rate.

But they face rising uncertainty around the spread of the Covid-19 pandemic, as well as a continued property-market slump and what economists say is a looming drop-off in export demand during a politically important year. (…)

Monday’s data showed the number of newborns in China falling for a fifth straight year in 2021 to the lowest level in modern Chinese history, despite new measures unveiled last year by Beijing to encourage births.

“The more you emphasize stability, the more you emphasize avoidance of defaults, redistribution and paying the costs of indebtedness, the more it creates conditions for instability down the road,” said George Magnus, a research associate at Oxford University’s China Center. (…)

German exports to China declined 4.2% in November year-over-year, to €8.9 billion—equivalent to $10.1 billion—while its exports to the U.S. surged about 15% to €11 billion over the same period, according to the federal statistics agency.

At Volkswagen AG , global vehicle deliveries fell by almost one-third in the three months through December, to about 1.9 million. Sales in China, the company’s biggest single market, were particularly weak, declining about 37% year-over-year in the last quarter of 2021 to about 755,000. (…)

Another risk is Covid-19 and China’s zero-tolerance policies to contain the virus’s spread. Beijing has shown little appetite to change course on its “zero-Covid” approach, which economists say could mean more economic pain this year as consumers spend more frugally.

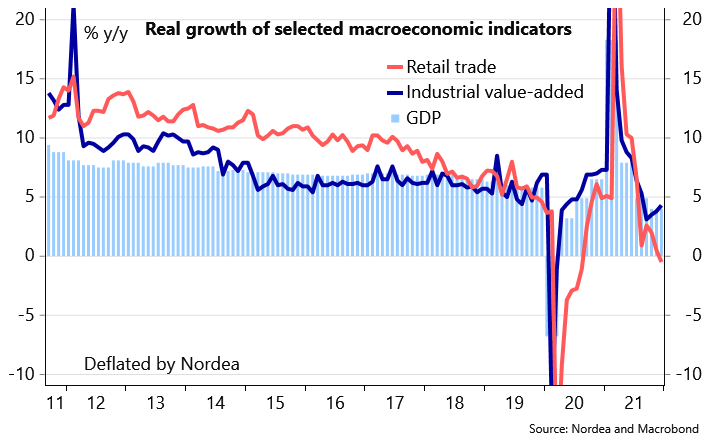

Monday’s data showed retail sales, a gauge of consumer spending, weakening further in December, rising just 1.7% from a year earlier. Over the past two years, monthly retail sales have increased just 3.9% on average in year-over-year terms, far below the roughly 8% level before the pandemic.

China’s headline measure of joblessness, the urban surveyed unemployment rate, rose to 5.1% in December, the third straight monthly increase. The jobless rate for the 16-24 age group remained unchanged at 14.3%. (…)

Latin America’s growth is projected to be 2.1% in 2022, down from 6.3% in 2021, partially driven by weaker economic activity in China, the region’s top trade partner, according to a recent report by the United Nations’ Economic Commission for Latin America and the Caribbean. That comes as metal prices are expected to fall more than 8% and agriculture and energy prices are projected to remain stable after double-digit growth in commodity prices last year, the U.N. says.

Also keep in mind that the Sinovac vaccine widely used in China is reportedly not so efficient against Omicron.

Xi at World Economic Forum via video Monday:

- “The fundamentals of the Chinese economy are unchanged — it remains resilient, has sufficient potential and its long-term prospects are positive,” he said.

- “If major economies slam on the brakes or take a U-turn in their monetary policies, there would be serious negative spillovers,” he said. “They would present challenges to global economic and financial stability, and developing countries would bear the brunt of it.”

- “We should coordinate the targets, intensity and rhythm of fiscal and monetary policies and major developed countries should control the spillover effects of their policies to avoid shocks to developing countries,” Xi said.

China’s economy is slowing and could slow even more if its major trading partners need to fight inflation. He’s worried.

Exports are supporting growth, for now.

Hawkish Central Banks Lead Investors’ Biggest Fears List

RISK DOWN

Going on for a while:

With Rate Increases Looming, Investors Dump Shares of Money-Losing Companies Cash-burning technology firms, biotechnology companies without any approved drugs and startups that listed quickly via SPAC mergers—some of which soared during the pandemic—have dropped sharply.

- US Treasuries sell off as markets price in four rate rises this year Policy-sensitive 2-year government debt yield tops 1% for first time in almost 2 years

A world without trust

Trust in governments around the world is collapsing, especially in democracies, Axios Media Trends author Sara Fischer writes from a new global survey. People don’t think government, business or the media are telling them the truth. This suspicion of societal institutions is pushing people into smaller, more insular circles of trust.

Government leaders and journalists are the least-trusted societal leaders, according to Edelman’s 2022 global “Trust Barometer,” a survey of 35,000 respondents in 28 countries.

- A majority of people globally believe journalists (67%), government leaders (66%) and business executives (63%) are “purposely trying to mislead people by saying things they know are false or gross exaggerations.”

- Around the world, people fear the media is becoming more sensational for commercial gain and that government leaders continue to exploit divisions for political gain.