Happy and Healthy New Year

Happy and Healthy New Year

Did you miss yesterday’s Daily Edge: Full Circle?

DECEMBER PMIs

USA: Manufacturing production growth remains constrained by shortages in December

December PMITM data from IHS Markit indicated a further subdued upturn in production across the US manufacturing sector. With the exception of October and November, the pace of output growth was the slowest since October 2020. At the same time, companies recorded the softest rise in new orders for a year and a further substantial deterioration in vendor performance amid severe material shortages. Longer lead times for inputs also led to another sharp increase in backlogs of work, albeit the slowest for ten months.

Meanwhile, cost burdens continued to increase markedly despite the rate of inflation softening to the slowest since June. Efforts to pass-through greater costs to clients were hampered by softer demand conditions, as charges rose at the slowest rate since April.

The seasonally adjusted IHS Markit US Manufacturing Purchasing Managers’ Index™ (PMI™) posted 57.7 in December, down from 58.3 in November but broadly in line with the earlier released ‘flash’ estimate of 57.8. The improvement in the health of the US manufacturing sector was the slowest in 2021 amid subdued output and new order growth. Ongoing efforts to build safety stocks and a severe deterioration in vendor performance, ordinarily signs of improving conditions, continued to lift the headline PMI, however.

The rate of output growth picked up slightly to the fastest for three months, but was much slower than those seen earlier in the year. Manufacturers noted further constraints on production due to severe material shortages and input delivery delays.

An inability to source key inputs also weighed on new orders, which expanded at the softest rate for a year. Although some firms stated that demand was sustained at a strong pace, many suggested that customers were working through their stocks of goods before placing orders. The rise in foreign client demand was only marginal overall.

Higher transportation and freight fees, alongside shortages of key items, led to a further marked increase in input costs during December. Although slowing to the softest for six months, the pace of increase remained among the quickest seen in the series history (since May 2007).

Reflecting a slightly softer uptick in cost burdens, firms raised their output charges at the slowest rate for eight months. Nonetheless, the pace of increase was marked as firms sought to partially pass on higher costs to clients.

Input delivery delays were extensive in December, albeit the least marked since May. Material shortages, port congestion and a lack of availability of trucking and shipping containers all reportedly led to a substantial deterioration in vendor performance.

As a result, backlogs of work rose sharply. That said, the pace of accumulation was the slowest for ten months. Some firms highlighted that this was linked to softer demand conditions. Others stated that a quicker upturn in employment had helped to ease pressure on capacity.

Amid severe material shortages, firms mentioned notable challenges building sufficient safety stocks as inputs were often required to supplement production and stocks of finished goods were depleted as sales were made from current holdings. Subsequently, input buying rose sharply.

Finally, output expectations for the year ahead strengthened to the highest since November 2020. Optimism stemmed from hopes of reduced supply disruption and a greater ability to hire suitable workers.

Actually, if we isolate output from all the PMI components (inventory build and deteriorating vendor performance push the PMI up), we can see that manufacturing production will likely decline in coming months. “With the exception of October and November, the pace of output growth was the slowest since October 2020”.

The details are clearly not bullish:

- severe material shortages and input delivery delays continue;

- new orders expanded at the softest rate for a year;

- foreign client demand was only marginal overall;

- clients are destocking;

- firms noted a further marked increase in input costs but raised their output charges at the slowest rate for eight months.

Eurozone: Stocks of purchases rise at survey-record rate as supply chain pressures ease

December PMI® data showed a further easing of the supply chain crisis as average lead times lengthened to the softest extent since February. Firms took advantage of this relative gain and added purchases to their inventories at the fastest rate ever recorded by the survey, outpacing the previous record set in November by a notable margin.

However, despite alleviating pressures on supply chains, manufacturing sector conditions continued to disappoint, with output growth remaining unchanged from that seen during November (which was the second-weakest seen since production growth resumed in July 2020).

Meanwhile, rates of input cost and output price inflation eased, but remained among the fastest ever seen by the survey. The IHS Markit Eurozone Manufacturing PMI fell to 58.0 during December, down from 58.4 in November and its lowest reading in ten months. Sector data revealed that consumer goods makers drove the slower improvement in manufacturing conditions, with intermediate and capital goods producers registering marginally quicker upturns.

Survey data split by country showed Italy once again leading broad euro area manufacturing growth, despite the expansion here slowing. At the other end of the scale, France’s goods-producing sector remained the weakest-growing of the eight monitored eurozone nations.

The main highlight of the December survey centred on supplier performance, with the latest data showing average input lead times lengthening to the weakest extent since February. Times lengthened to lesser degrees in all monitored euro area countries except Italy.

In turn, eurozone manufacturers increased their purchases of raw materials and other semi-finished items at a sharp pace. The combination of these two factors enabled firms to stockpile inputs, with inventories rising at a rate which was unparalleled in over 24 years of data collection.

That said, despite a record surge in pre-production stocks, manufacturing output growth remained unchanged from November, which saw the second-weakest since the sector began its recovery in July 2020. Many firms continued to feel the impact of shortages at suppliers, while others noted subdued demand pressures.

New manufacturing orders increased at the joint-weakest rate since January, amid a slower expansion in international client demand*. Nevertheless, latest survey data pointed to an intensification of capacity pressures at eurozone goods producers, with backlogs of work rising at an accelerated pace.

Greater volumes of outstanding work coincided with a faster increase in employment during December. Overall, the rate of jobs growth was strong and above its historical average by a notable margin. Business confidence also strengthened slightly to a three-month high.

Lastly, December survey data showed easing rates of inflation across the eurozone manufacturing sector. Input costs increased at a pace that was substantial overall, but the slowest since April. Meanwhile, output charge inflation eased from November’s survey peak to a four-month low.

*Includes intra-eurozone trade

Details:

- output growth was unchanged from November which was the second-weakest seen since production growth resumed in July 2020;

- subdued demand pressures: new orders increased at the joint-weakest rate since January;

- input costs increased at a pace that was substantial overall, but the slowest since April. Output charge inflation eased from November’s survey peak to a four-month low.

China: Production increases at quickest rate for a year

Operating conditions across China’s manufacturing sector improved slightly at the end of the year, according to latest PMI data. Firms signalled the strongest increase in output for a year amid a renewed uptick in total sales. However, foreign demand remained lacklustre, with export orders broadly stagnant. Improved demand prompted a fresh rise in purchasing activity, but backlogs rose again amid a further drop in staffing levels.

Supplier performance meanwhile deteriorated at a softer pace, and inflationary pressures weakened. Notably, average input costs rose at the slowest pace for 19 months.

The headline seasonally adjusted Purchasing Managers’ Index™ (PMI™) rose from 49.9 in November to 50.9 in December, to signal a renewed improvement in the health of the sector. Though marginal, the rate of improvement was the strongest seen since June.

Helping to lift the PMI reading was a stronger increase in production at the end of 2021. Output rose at the quickest rate for 12 months and solidly overall, supported by improved market conditions and stronger customer demand.

New work rose for the third time in the past four months in December, albeit marginally. Underlying data indicated that subdued foreign demand weighed on overall sales, as export business was little-changed compared to November. A number of firms indicated that the global pandemic and difficulties in shipping items continued to impact external sales. The gauge for new export orders stayed in contractionary territory for the fifth consecutive month.

Greater amounts of overall new business exerted further pressure on capacity, as shown by a slightly quicker rise in backlogs of work. Firms also commented that insufficient staff numbers had led to increased amounts of incomplete business. Employment fell for the fifth month in a row, and at the fastest rate since February. Companies indicated that the non-replacement of voluntary leavers and retirees had contributed to lower workforce numbers.

In line with the trend for total sales, purchasing activity also returned to growth at the end of the year. Though modest, the upturn was the quickest seen since June. Stocks of inputs and finished goods meanwhile rose slightly, as some firms noted efforts to build up their inventory levels amid firmer demand conditions.

Although the time taken for purchased items to be delivered to manufacturers increased again in December, there were signs of supply chains moving closer to stabilising. Average lead times lengthened at the slowest rate for nine months and only modestly overall.

Average input costs rose at the weakest rate for 19 months in December, with the rate of inflation having fallen further from October’s recent peak. Panel members indicated that lower prices for some raw materials, such as steel, helped to dampen cost inflation. Prices charged meanwhile fell for the first time since April 2020, albeit marginally.

Although business confidence remained strong overall in December, the degree of optimism slipped to a 20-month low. The ongoing global pandemic, and its uncertain trajectory, as well as strained supply chains were cited as key challenges for the year ahead.

Japan: Softer increase in manufacturing output inDecember

The Japanese manufacturing sector registered a solid, albeit slightly softer improvement in operating conditions at the end of 2021, according to December PMI® data. Firms reported slower expansions in both production and incoming business, though the rates of growth remained moderate overall and stronger than the average seen over the year as a whole. Notably, as demand conditions continued to improve, manufacturers reported the strongest rise in employment levels since April 2018. Yet, firms noted a softer degree of optimism as supply chain disruption and material shortages continued to hinder output and sales.

At 54.3 in December, the headline au Jibun Bank Japan Manufacturing Purchasing Managers’ Index™ (PMI) dipped from 54.5 in November. This indicated a softer improvement in the health of the sector, but was well above the average seen in 2021 as a whole (52.7).

The lower reading of the headline index was partly the result of a softer rise in output levels. Production increased for the third consecutive month, though growth eased to a more moderate pace overall. Firms linked ongoing growth to a sustained rise in new orders, which was particularly evident in the automotive sector.

New orders also rose at a softer pace at the end of 2021. That said, the average rate of growth seen over the fourth quarter was the strongest final quarter performance seen since 2018. According to anecdotal evidence, client confidence was supported by the launch of new products as well as a steady recovery from the impacts of COVID-19. Concurrently, new export sales growth eased in December, amid a rise in COVID-19 cases in South Korea in particular.

More positively, employment rose for the ninth month running in December. The rate of job creation quickened from November and was the fastest recorded since April 2018. Firms noted that headcounts were increased in response to higher production requirements. Reflecting increased new orders, outstanding business rose at the fastest pace for eight months. Manufacturers also commented that a lack of raw materials had disrupted the ability to complete existing orders.

In response to ongoing supply chain disruption, buying activity rose at the sharpest pace since May at the end of 2021. Japanese manufacturers noted ongoing difficulties in sourcing and receiving inputs due to material shortages, while stronger demand placed additional strain on suppliers. Moreover, supplier delivery times lengthened to a greater degree in December, with average vendor performance over the fourth quarter the worst in the survey history. As a result, businesses aimed to build greater inventories of pre- and post-production goods.

December data signalled that rising raw material prices placed further pressure on average cost burdens at Japanese goods producers. Input prices rose for the nineteenth month running and, while the rate of inflation softened from November, it remained rapid overall. Output prices meanwhile increased for the thirteenth consecutive month, though the pace of inflation was the slowest since September.

Business confidence regarding activity over the coming year eased in December. The degree of positive sentiment was strong overall, yet was the weakest since August. Firms cited hopes that the end of the pandemic would trigger a broad-based recovery in demand.

Near record uplift in ASEAN manufacturing conditions during December

The ASEAN manufacturing sector rounded off 2021 with another solid performance. Business conditions continued to rebound, with the PMI ticking up on the month to produce an average reading for the fourth quarter that was the highest on record.

Growth in December was again driven by sustained rises in output and new work, the rate of growth in the former accelerating notably to a near-record pace.

At the same time, inflationary pressures intensified slightly, as cost burdens were again pushed up by ongoing supply problems, with the rates of cost and average charge inflation amongst the steepest on record.

Nonetheless, firms’ expectations for output over the coming year improved on the month, with sentiment the strongest since May 2019. Indeed, the ASEAN manufacturing sector remains in a strong position as we enter 2022, with the latest rebound showing little-signs of slowing.

Meanwhile, the latest Chase consumer spending tracker, through December 26 (including Boxing Day), reveals a pretty weak December. Given rising goods prices, there is a risk of nasty surprises from retailers. Since many of them boosted inventories, with many more goods still floating offshore L.A., a lengthening consumer buying strike could create chaos in the retail trade, reverberating to wholesalers and manufacturers in the first half of 2022. With Omicron impacting services demand, such a scenario would surely complicate the FOMC’s reading of the economy and its resolve to begin normalizing its monetary policy.

No End in Sight for Auto Sales Slump on Chip-Constrained Output

(…) Carmakers likely sold a seasonally adjusted annual rate of about 12.5 million new vehicles in December, down 23% from a year earlier, according to the average forecast of six market researchers. (…)

For the full year, auto sales likely came to 14.9 million vehicles, a 2.5% jump from the Covid-stricken days of 2020, according to Cox Automotive. The 2021 total is historically low for an industry that’s used to selling about 16 million vehicles annually. The slowdown reflects a global microchip shortage that forced automakers to limit output or ship some vehicles without fully functioning features. (…)

“It’s not a demand problem. It’s a supply problem,” she said. “We’re at least 1.5 million units of inventory behind 2020 and 2.5 million units behind 2019.”

Industrywide, carmakers had about 18 days of inventory in December, according to TrueCar, an automotive pricing website. That’s up slightly from the end of the third quarter, when automakers had 16 days worth. But it’s still less than half what they had a year earlier. (…)

Consumers who are able to find the vehicles they want are being forced to pay up. Automakers are using the semiconductors they get to build more-profitable models and those with the most options packed in, according to car shopping research firm Edmunds. All those high-trim level pickups and sport utility vehicles resulted in a record average price of $45,872 in November, 15% more than a year earlier. (…)

Carmakers have said there’s been some relief in chip supplies and that they’re starting to boost production. Inventory even inched up slightly in late November, reaching 1 million vehicles for the first time since August, Krebs said. (…)

Edmunds predicts 15.5 million vehicles will be sold in 2022 and RBC Capital Markets analyst Joe Spak sees 15.8 million as output ramps up. (…)

Evergrande’s 2021 Sales Plunge 39% as Home Sales Almost Frozen

Contracted sales last year plunged 39% to 443 billion yuan ($70 billion) from the previous year, according to Bloomberg calculations based on preliminary company data. It met about 60% of a 750 billion yuan target set at the start of the year.

The preliminary results suggest sales at the world’s most indebted developer have been almost frozen since October, when its liquidity woes intensified. Annual sales was almost the same then, with 442 billion yuan sold year to date as of Oct. 20. (…)

JPMorgan Strategists Say Global Stock Market Party Far From Over

“Stay bullish — positive catalysts are not exhausted,” strategists led by Mislav Matejka wrote in a note to clients on Tuesday. Downside risks — including a hawkish turn by central banks, a slowdown in China’s economy, or more significant coronavirus restrictions — will either fail to materialize or are already priced in to stocks, they said. (…)

Credit Suisse Group AG this week reiterated a bullish view on U.S. stocks, while Societe Generale SA on Tuesday repeated a forecast for a 6.6% return for European stocks this year, writing that “this bull market is not over.” Strategists at Goldman Sachs Group Inc. and the BlackRock Investment Institute also see upside, albeit at a more muted pace. (…)

Among JPMorgan’s key calls is an overweight position on U.K. and euro-area equities, as well as on banks, miners and autos. The strategists see a good entry point in emerging-market stocks, with China deceleration “by now largely behind us.” They also like reopening trades.

They recommend a neutral position on U.S. stocks, saying they “could stall relatively if the tech outperformance starts to wane.” Still, the overall technical picture is positive for equities, as inflation should peak in the first half, the Fed is unlikely to become more hawkish, and consensus earnings growth projections “will again prove too low.”

These are all sell-side views. KKR sees U.S. equities return 6.7% in 2022 including dividends (+5.4% ex-d to 4,900). Its forecast ranges from 4,150 to 5,600. Fiera Capital, another smart buy sider, has a target of 4,400 for the S&P 500 Index under its Reflationary Recovery scenario (50% probability) and 4,000 under its Stagflation scenario (40%).

The big difference between the two strategists is in their profits outlook. KKR thinks EPS could reach $241 in 2022 (range $223-251) while Fiera expects profits of $220 in its 50% scenario and $205 in its Stagflation scenario. The sell side consensus is $223, up 8.4% from $205.79.

U.S. Sets Global Daily Record of Over 1 Million Virus Cases Monday’s number is almost double the previous record of about 590,000 set just four days ago in the U.S., which itself was a doubling from the prior week. The stratospheric numbers being posted in the U.S. come even as many Americans are relying on tests they take at home, with results that aren’t reported to official government authorities. That means the record is surely a significant under-estimate.

- Omicron Cases Are Hitting Highs, But New Data Put End in Sight Data suggest hospitalizations are now decoupled from case numbers, and the variant causes less severe disease

“We’re now in a totally different phase,” said Monica Gandhi, an immunologist at the University of California, San Francisco. “The virus is always going to be with us, but my hope is this variant causes so much immunity that it will quell the pandemic.” (…)

“It seems to prefer to infect the upper respiratory tract rather than the lungs.”

This, Burgers said, could mean less severe infection, but also more transmissibility as the virus replicates more often in the upper respiratory tract, from which it can more easily spread.

While omicron may be good at evading the attacks of antibodies, recent studies have also shown that it has far less success avoiding the second-line defenses of vaccines and prior infections: T-cells and B-cells. (…)

“When your denominator is very large because many, many people are getting infected, you still wind up having many people going to the hospital who need care,” Justman said. Higher case numbers will also still create disruption in work, travel and schooling. (…)

She pointed to another study out last week from Hong Kong, which showed that vaccinated patients infected with omicron generated strong immune responses against other versions of the virus as well. This, she said, might explain why case numbers peaked quickly in South Africa. (…)

- State of Affairs: Jan 4 (Katelyn Jetelina)

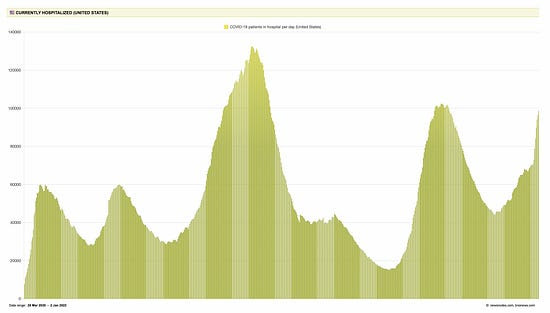

(…) As expected, hospitalizations are increasing (+35% in the past 14 days), and we are currently hospitalizing 93,322 people per day in the United States. We are close to reaching Delta’s peak and have some time until we reach last winter’s peak.

In certain jurisdictions, though, we’ve met or exceeded last winter’s hospitalization peak. We can see this in many states in the Northeast, including New York. Other states that are just beginning the Omicron wave, like Florida, aren’t close yet.

(NYT)

While digesting hospitalizations in the coming weeks, it’s important to keep five things in mind:

Decoupling. This is the first thing you should notice: Hospitalizations are not increasing at the rate of cases. This phenomenon is due to immunity and, possibly, less severe Omicron. We are VERY lucky this kicked in now. However, the question remains: What is the health and societal impact of a 50% reduction in hospitalizations among a virus that is probably as contagious as measles? TBD.

Delta. Ohio has one of the highest hospitalization rates right now (50 per 100,000 people), but only has modest case growth (+90% in past 14 days). Indiana is showing a similar pattern. This is an indication that hospitalizations in some states are still from Delta not Omicron. Whether Delta sticks around (or comes back after Omicron) is yet to be determined.

(NYT)

For vs. with COVID. The U.S. is notoriously bad at tracking real-time data, so almost all hospitalization records pool “with COVID19” and “for COVID19.” Jackson Health System, though, has been doing a fantastic job differentiating between the two. Today they reported 50% of their hospitalizations are “for COVID.” Other systems are reporting much higher rates of hospitalization for COVID, like 4/5. While this distinction is important for understanding Omicron severity on an individual level, it doesn’t really matter to the health system (see “Disruptions” section below for more).

Unvaccinated. It’s clear that hospitalizations continue to be largely driven by unvaccinated cases. The CDC hasn’t published stratified data since mid-November, so we rely on smaller jurisdictions to monitor the relationship between severe disease and vaccination. Spectrum Health (a hospital system in Michigan) published a really nice graphic below. You’ll notice there are some vaccinated people in the hospital and ICU, albeit at a much smaller rate. An important caveat is included in the red circle: the vaccinated people are older and have more comorbidities than the unvaccinated. The state of New York is also doing a great job keeping track of this (but a bit more lagged).

Pediatric hospitalizations. Kids in hospitals also continue to increase because, well, they’re unvaccinated. We can see this easily in many graphs (like on the CDC website) but I found the one below from Florida most useful because it compared Delta to Omicron. Get your kids vaccinated! Those aged 12+ can now get boosted, too.

We are starting to see the highly transmissible variant impact almost everything else in our community, too: food supply (agriculture, grocery stores, truck drivers), travel (air, train, bus), essential services (healthcare, emergency services), and education (teachers, bus drivers).

For example, the number of healthcare workers out sick with COVID19 continues to increase. Below is a graph from London displaying the number of staff absent due to COVID19 (orange) compared to other reasons (blue). It’s important to recognize that this is where hospitalizations “with COVID” vs. “for COVID” doesn’t matter: Patients in the hospital, regardless of what they are there for, are infecting the workforce (and other patients).

Number of staff absent due to COVID19 in London. Data from NHS England Data: Chart by Bob Hawkins

A strong and resilient health system is crucial not only for treating the onslaught of COVID19 but for many other health concerns, too. Here is some anecdotal evidence from those on the front line:

Another example is education disruption. Burbio, a database of K-12 schools across the nation, just updated their data and found the 2022 year isn’t off to a great start for schools. Many schools in places like NYC are closed this week due to staffing shortages. Schools in Seattle are delaying reopening so students can test for COVID19 before returning. Others, like schools in Atlanta, are temporarily going virtual. Schools in Iowa were cancelled because of lack of bus drivers.

We saw the Omicron surge coming, but to see the situation unfold in real time is mind blowing, exhausting, and epidemiologically fascinating. The tsunami of cases is something we’ve never seen before. And while we are very lucky hospitalizations have decoupled, the vast spread has yet to show its colors in terms of morbidity and mortality. I hope this is also a reminder to all that a healthy economy is based on healthy people. Those that silo the two are gravely mistaken.

P.S. You’ll see another variant pop up in the news called B.1.640.2. This variant arrived before Omicron, as the WHO classified it as a “Variant Under Monitoring” in November. It hasn’t done much (there are only 20 cases sequenced worldwide compared to more than 120,000 Omicron cases in less time). We are not worried about it at this time.