CONSUMER WATCH

Autos: How much gas is left in the tank?

One notable area where consumers appeared to be “buying ahead” before the imposition of tariffs, was autos. As we reported in the April Consumer Checkpoint, Bank of America data on consumer vehicle loan originations rose sharply in late March following the March 26 announcement of a 25% tariff on autos and auto parts imported into the US.

And, according to the Bureau of Economic Analysis data on auto sales for March and April showed a pronounced spike, with the seasonally adjusted annualized rate (SAAR) of sales peaking at 17.8m in March.

This increase in auto sales has moved the ratio of auto dealer inventories-to-sales lower over the past year, from an already depressed point compared to pre-COVID 19 levels. While Bank of America consumer vehicle loan originations indicate that demand for vehicles appears to be stabilizing – also evident in the drop back in auto sales data to 15.7m SAAR in May – the supply shock of tariffs means a further decline in inventory is likely, according to BofA Global Research.

This may leave consumers with fewer options and – while auto prices dropped in May according to the consumer price inflation data from the Bureau of Labor Statistics (BLS) – there remains a possibility of further pressure on car prices over time.

If auto prices rise due to tight inventory and tariffs, how much additional strain could be placed on consumers’ wallets? Bank of America payments data shows that overall median car payments are already more than 30% higher than the 2019 average and have now outpaced both new and used car prices, possibly as there is a push towards more expensive cars. In May, Bank of America monthly car payments accounted for 13% of households’ median deposit balances.

In fact, from June 2024 to May 2025, the share of households whose monthly average car payment increased by over $400 a month from the period two years earlier was 11 percentage points (pp) greater than those who saw a decline. And according to Bank of America data, of households who have a monthly car payment, 20% have one greater than $1000 a month.

According to data from the New York Federal Reserve, the contribution of auto debt to overall consumer debt balances actually fell quarter-over-quarter (QoQ) in Q1 2025, so the underlying pace of auto loan growth may be slowing even if buying ahead was a temporary upward pressure.

One reason for this may be a tightening in credit availability for auto financing, with the New York Fed’s most recent Credit Access Survey finding the average perceived probability of a rejection for an auto loan application reached 33.5% in February – the highest level since the start of the series.

Cooling auto loan growth alongside continued labor market strength and solid wage growth among younger households (see our June Consumer Checkpoint) is likely helping mitigate some of the risks from rising auto payments. And it appears a rise in newly delinquent auto loans may have levelled off. Still, in our view, there continues to be pressure on consumers’ finances and the situation warrants continued attention.

President Donald Trump said he may raise US auto tariffs in order to boost domestic auto manufacturing, a move that could further ratchet up tensions with trading partners.

Trump spoke Thursday at a signing ceremony for legislation terminating California regulations that would have banned the sale of gasoline-powered cars in 2035 — a long-sought victory for some carmakers and oil companies that attacked the rules as unachievable.

The president said raising auto tariffs from their current 25% level could offer further protection for the domestic auto industry, citing General Motors Co.’s plan to invest $4 billion in US plants over the next two years in order to avoid paying duties.

“I might go up with that tariff in the not too distant future. The higher you go, the more likely it is they build a plant here,” the president said.

The president’s latest threat comes more than a week after he doubled steel and aluminum tariffs to 50%, and as he faces negotiations with dozens of trading before his July 9 deadline for higher duties to take effect. (…)

The measures signed Thursday in the East Room of the White House revoke California clean air policies, including requirements that carmakers sell electric vehicles in greater numbers each year in the state.

“We officially rescue the US auto industry from destruction by terminating California electric-vehicle mandate once and for all,” Trump said. “They said it couldn’t be done, but boy it’s had us tied up in knots for years.”

The resolutions Trump signed Thursday repeal waivers granted under former President Joe Biden allowing California to set automobile pollution standards that are more stringent than federal requirements.

That power — enshrined in the Clean Air Act of 1970 — has helped the nation’s most populous state emerge as a global leader in setting industry-shifting clean-air and and climate policies.

Among the programs effectively voided by Trump on Thursday is a California initiative that compelled the sale of zero-emission vehicles over the next decade, ultimately banning the sale of conventional, gas-powered cars in 2035.

Trump applauded Congress for moving to strike the measures, saying it would prove longer lasting than if he acted on his own. (…)

The US Department of Transportation has separately signaled it plans to roll back Biden-era fuel efficiency rules that would require automakers reach a fleet average about 50 miles-per-gallon by 2031. (…)

The Atlanta Fed’s Wage Growth Tracker held steady in May at 4.3 percent. For people who changed jobs, the tracker declined to 4.1 percent in May from 4.3 percent in April. For those not changing jobs, the Tracker edged down to 4.3 percent in May from 4.4 percent the prior month.

That jibes with the BLS hourly earnings stable at the 4% YoY growth level. Crucially, overall inflation is now 2.4% with a rapid deceleration in CPI-Essentials, now 2.9%, down from 4.4% one year ago, mainly thanks to energy, down 3.1% YoY. Lucky break from the Saudis or slowing demand from weaker economies?

Meanwhile, unemployment claims are creeping up, particularly continued claims now at their highest non-pandemic level since March 2018. Job losses are not exploding but people losing their job have a hard time finding a new one.

Spiking oil prices could put sand in the gears of the Trump’s tariffed engine, eating into Americans’ discretionary income and quickly boosting costs throughout the economy, particularly in services which have nicely contributed, so far, to keeping overall inflation subdued.

Ed Yardeni:

May’s PPI inflation report, released today, was lower than expected as was May’s CPI inflation report yesterday. The PPI final demand for personal consumption edged down to 2.6% y/y in May, while the CPI rose only 2.4% during the month (chart). Both suggest that May’s PCED inflation rate might have dropped to 2.0%, which would finally be down to the Fed’s target for this inflation rate. The Cleveland Fed’s Inflation Nowcasting for PCED inflation is a bit higher at 2.3% for both May and June. Either way, the relevant data suggest that President Donald Trump’s tariff hikes have yet to boost consumer price inflation as widely expected.

The Case for Rate Cuts Is Growing Tariff inflation has been muted, and cracks are appearing in the labor market

(…) In May, the Treasury Department collected roughly $15 billion more in customs duties than in February. That is equal to about 3% of total consumer spending on goods. Some goods prices have risen, but not by that much. And in May, prices fell on some obvious tariff targets such as apparel and new cars.

This is a head scratcher. If consumers aren’t paying the tariffs, who is? Not foreign producers, at least through April, when import prices excluding fuel rose. Not, apparently, retailers and wholesalers, whose margins took a hit in April but bounced back in May, according to the producer price report released Thursday. (…)

Economists think tariff effects will become more apparent in coming months. But that alone isn’t reason enough for the Fed to stay on hold. Tariffs represent a one-time boost to the price level, which means after a year inflation should revert to its pre-tariff trend. The question is whether tariffs push the trend higher.

The good news is that in the last few months the trend has eased. A key reason inflation has been slow to return to the Fed’s 2% target had been stubborn service prices, and that can in great part be blamed on housing costs cooling more slowly than economists and the Fed expected based on private rent data. (…)

Services inflation has also been damped by plunging airfares, thanks to more empty seats and cheaper jet fuel.

Together, this is why excluding energy, services inflation fell to 3.5% in May, from 4.5% in December, which in turn has nudged core inflation (which excludes food and energy) to a four-year low of 2.8% in the last three months. Inflation according to the Fed’s preferred gauge, the price index of personal consumption expenditures, is also near its lowest since the pandemic, likely between 2.5% and 2.6% in May. It is running at around 1.3% annualized in the last three months. But for tariffs, the Fed would probably declare mission accomplished by year-end. (…)

The labor market today isn’t tight; it’s showing cracks. The unemployment rate, to two decimal places, has risen every month since January, by a quarter percentage point in all. At that pace it would reach 4.6% in the fourth quarter. This suggests the economy is growing slightly below its potential, which should keep a lid on price and wage pressures. (…)

Payroll growth looks healthy, at 139,000 in May. This, though, could be a head fake. From January through April. the Bureau of Labor Statistics initially reported hefty job growth only to revise that down sharply in later months. The same could happen with May data.

RBC Capital Markets recently noted that a string of negative revisions like this is common around recessions. Another hint: payroll processor ADP estimates that, based on a survey of its clients, private job growth was just 37,000 in May. (…)

Though not as out of whack as last September, rates are still roughly 0.5 to 1.5 percentage points above what Fed officials consider “neutral,” the level that keeps growth, inflation and unemployment stable. That restrictive stance make sense so long as inflation is all the Fed has to worry about. It no longer is.

Grep Ip wrote this before Israel attacked Iran’s nuclear facilities…

- The Latest Casualty of the Tariff War: Free Shipping Retailers are raising the bar for free delivery—or eliminating the perk—as they seek to mitigate tariff costs

Some online merchants are eliminating free shipping, while others are raising the amount customers must spend to qualify for the perk as part of broader efforts to pass along higher costs to consumers. (…)

The average cost to ship a parcel including surcharges is $12.50 today, up from $9.53 in 2019, according to ShipMatrix. Parcel carriers United Parcel Service and FedEx this year raised their average prices 5.9%. (…)

Cass Freight Index® – Shipments

The shipments component of the Cass Freight Index was down 0.4% m/m in May.

- Since volumes usually rise seasonally in May, shipments fell 3.4% m/m in SA terms.

- The y/y decline in shipments was 4.0% in May, after a 3.6% y/y decline in April.

The trade war is having a variety of effects, with pre-tariff consumer spending still supporting freight demand. The negative consequences of tariff effects are partly reflected in May data, as pre-tariff inventory stocking has started to turn to destocking, and those stocks will start to thin in the coming months.

After rising 13% in 2021 and 0.6% in 2022, the index declined 5.5% in 2023 and 4.1% in 2024. So far, it is trending toward another decline in 2025.

In June, the shipments component of the Cass Freight Index would decline 2% y/y on the normal seasonal pattern.

GOP Megabill Boosts Wealthy Households While Hurting Poor, CBO Says Middle-income Americans also would see gains from Trump’s agenda of tax reductions and spending cuts

Republicans’ tax-and-spending megabill would give more money to middle-income and high-income households while taking benefits away from low-income people, according to a Congressional Budget Office analysis released Thursday. (…)

The bill’s benefits increase steadily with income. Households near the middle of the income distribution would see their resources increase because of the bill by an annual average of $500 to $1,000, providing a boost worth 0.5% to 0.8% of their income. The top 10% of households would see a gain of about $12,000, or about 2.3% of income, largely because of tax cuts. That is all compared with current law, a scenario in which Trump’s 2017 tax cuts expire as scheduled Dec. 31.

On average, according to CBO, the bottom 30% of households would come out worse off, losing household resources. Income groups above that get more resources than they would under current law, on average. The bottom 10% of households would lose about $1,600 because of benefit cuts, equal to about 3.9% of income. (…)

The tax cuts do relatively little for lower-income people who don’t work or who pay federal payroll taxes but not income taxes. But many of them would be affected by the proposed changes to the Medicaid and food-aid programs, changes the Republicans have hailed as a major step toward lowering federal spending. Medicaid, a joint federal-state program, provides health insurance to more than 70 million low-income and disabled people.

The CBO analysis examines only the House version. Overall, the bill would increase budget deficits by $2.4 trillion over a decade. It also includes money for border security and national defense. Republicans say that estimate misses the economic growth the bill would create, and they contend that the growth would raise wages and help middle-income households.

They are also pointing to trillions in tariff revenue that isn’t in the bill but could help cover its costs, though most analyses say that middle-income consumers would bear much of the burden of tariffs.

Republicans say that their bill is essential to preventing a tax increase in 2026 and that the economy and working households would suffer if the tax cuts all expire.

“It would be what is known in economics as a sudden stop. It would be cataclysmic,” Treasury Secretary Scott Bessent told the Senate Finance Committee on Thursday, warning of significant job losses. “Working Americans would bear the brunt.”

Republicans say many of the people losing benefits under the bill are those who are in the country illegally or who otherwise should be ineligible. (…)

How many is “many”?

Chinese consumption amid the new reality

Much like the US economy, China’s economy needs a strong and active consumer in order to sustain acceptable GDP growth rates.

In the US, housing is both a source of strength (wealth effect) and restraint (affordability).

In China, where housing can impact more than 20% of the economy, the main handicap is confidence that house prices will not collapse.

At the end of 2024, McKinsey’s Consumer and Retail Practice in China completed a nationwide survey covering more than 17,000 Chinese consumers.

Based on an analysis of our survey findings, along with macroeconomic analysis of consumption and urbanization trends provided by the McKinsey Global Institute, we highlight three key trends shaping the new reality of China’s consumer market:

- Consumers are accepting the new reality and moving on: After several challenging years that have dampened their confidence and willingness to spend, Chinese consumers are starting to move past this phase and are adjusting their shopping behavior.

- Confidence has stabilized: Consumer confidence has stabilized, though urban confidence has experienced a slight decline.

- Consumers are prioritizing personal fulfillment: Consumers are shifting their spending toward products and services that help them achieve personal fulfillment.\

Our survey shows that the consumer outlook for consumption growth in 2025 remains at a similarly cautious level as the previous year. Growth of annual consumption is expected to rise by 2.3 percent in 2025, roughly level with the 2.4 percent growth seen in 2024. This number is driven by a few key factors, such as China’s continued pace of urbanization, which expanded from 65.2 percent in 2022 to 67 percent in 2024. This is driving a rise in the growth of urban households in China, from 0.4 percent in 2024, to an expected 0.9 percent growth in 2025. (…)

Chinese consumers, on average, expect to grow their household income by 1.4 percent in 2025, down from 2.5 percent in 2024, and keep their savings rate unchanged.

The cautious attitude that persists among Chinese consumers is driven largely by their uncertainty regarding future financial prospects, which is driven by concerns over job security and the depreciation of their real estate holdings. Thirty-six percent of respondents in our survey reported experiencing “job anxiety,” aligning with broader data from the People’s Bank of China (PBOC) Q2 2024 survey, which found that 48 percent of urban residents viewed the job market as “challenging/uncertain.” Depreciation of real estate assets remains a key factor restraining consumption for those who hold a pessimistic outlook toward their financial future.

My reading of McKinsey’s data makes me concludes that confidence actually looks worse this year than last: city consumers, the largest spenders, are actually significantly less confident than at the end of 2023. Rural people help keep the overall confidence level constant.

And while McKinsey says that “Chinese consumers continue to increase their spending across most product categories”, I only see them increasing their spending on services while intentions on goods are negative.

In the first quarter of 2025, services accounted for 43.4% of total per capita consumer spending in China, with goods making up the remaining 56.6%. Kuang Xianming, vice president of the China Institute for Reform and Development, projected that services consumption will exceed 50% of China’s total consumption by 2030.

Trump Vows to Shield Farmers From Deportations That Are Depleting Workforce

President Donald Trump conceded that his immigration crackdown was hurting US businesses and said policy changes covering farmworkers and the hotel industry will be made to address worker shortages.

“Our great Farmers and people in the Hotel and Leisure business have been stating that our very aggressive policy on immigration is taking very good, long time workers away from them, with those jobs being almost impossible to replace,” Trump said in a post on Truth Social. “Changes are coming.”

The post seemed to mark a rare acknowledgment by Trump about risks to the world’s biggest economy as he seeks to fulfill his campaign pledge to undertake the biggest deportation operation in history. Data last week showed the US workforce shrunk in May, partly because of the largest back-to-back decline in the number of foreign-born workers in the labor force since 2020. (…)

Trump told reporters at the White House on Thursday that he was going to issue an order soon to help shore up the workforce. He said farmers have told him that some employees, while not citizens, “turned out to be, you know, great, and we’re gonna have to do something about that. We can’t take farmers and take all their people and send them back.”

“So we’re going to have an order soon,” he said. “I think we can’t do that to our farmers and leisure to hotels.” (…)

Almost half of the more than 850,000 crop workers in the US are undocumented, the Department of Agriculture estimates. (…)

Some 5.8 million immigrants — both undocumented and legal — joined the US workforce during former President Joe Biden’s term in office. There are now 32.7 million estimated immigrants in the labor force, accounting for nearly one in five workers.

Recent migrants are more likely to take jobs in industries that face chronic labor shortages, which also include construction and food processing, data show. In places like New York and Texas, for instance, more than half of construction workers are foreign-born.

“With foreign-born workers having been an outsized driver of labor force growth in recent years, sharply lower net immigration — let alone an outright decline — stands to weigh heavily on labor force growth,” Wells Fargo & Co. economists Sarah House and Nicole Cervi wrote Thursday in a note before Trump’s comments. (…)

Morgan Stanley economists estimate policy changes could sharply reduce net immigration to 300,000 this year and 200,000 in 2026, down from 2.9 million last year. In the longer term, a smaller contribution of foreign-born workers to the labor supply will magnify the challenges posed by the aging native-born population, they wrote in a note Thursday.

This chart illustrates the contribution to employment, and to the economy, and to inflation through lower wages, that foreign born workers have had in the last 10 years, even more so in the last 5 years. Native Americans in the labor force have barely increased since 2019 while the total labor force rose by 12.5 million, virtually all foreign born. That is truly part of American exceptionalism, isn’t it?

Trump is now considering shielding farming, hotel and leisure sectors, but how about construction, so crucial for MAGA plans, and all others listed in the above chart?

Gosh, the economy is so complicated!

US Wine Exports to Canada Fall by Most in Over 20 Years

Wine shipments from the US to the northern nation fell 93%, the largest year-over-year decrease in monthly data from the US Census Bureau going back to 2002. The next two biggest wine markets for US producers — the UK and China — also imported less in April.

The collapse contributed to a 41% global decline in US wine exports in the month, following a 28% drop in March. (…)

Canada was the largest buyer of US wine in 2024, data from the United Nations show, accounting for about a third of total export value.

In March, Canadian provinces began removing US-made alcohol from government-run stores in response to US tariffs on Canadian goods — though some have recently resumed buying again. Canada still has a 25% import tax on US wine, which it implemented after the Trump administration started the tariff war. (…)

US 30-Year Bond Sale Spurs ‘Sigh of Relief’ After Weeks of Angst

The $22 billion sale followed weeks of fretting over whether spiraling budget deficits and President Donald Trump’s trade war would deter buyers from lending to the US for such a lengthy period. But it drew a yield of 4.844%, below the yield around the auction deadline. That was a sign of solid appetite, and 30-year bonds proceeded to extend their gains, leaving the yield down about 8 basis points at around 4.84% in late afternoon New York trading. (…)

Underscoring the buying interest, the group of primary dealers that underwrite US Treasury debt offerings were awarded 11.4% of the sale, the lowest amount they’ve been left with since November. The result followed a well-received sale of 10-year notes on Wednesday. (…)

Jurrien Timmer, Director of Global Macro @Fidelity

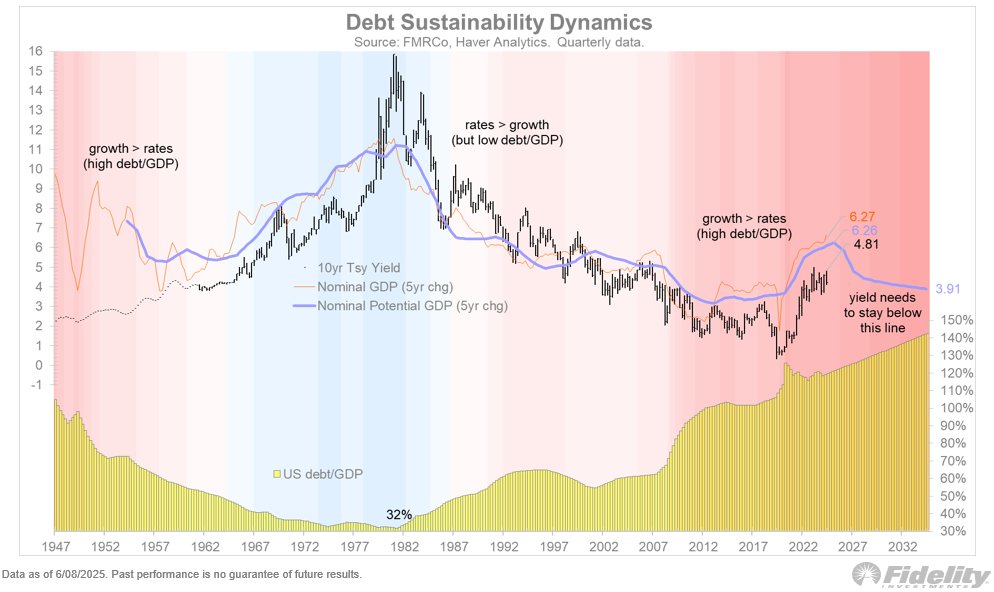

The chart illustrates the math: as long as the funding rate (10-year yield) remains below the nominal growth rate of GDP, the rising debt burden can be considered sustainable.

If it rises above the growth rate while debt levels are high and rising, we fall into a debt spiral. Makes sense, right?

If an entrepreneur takes out a loan to start a business, and that business grows faster than the interest cost, it’s a good use of leverage. But if a loan is taken out just to stay afloat, it’s not a good use of leverage.

The same applies to governments. We see that the nominal growth rate has generally been above the borrowing rate (…).

Now debt levels are at 117% and rising to 140% (per the CBO), while at the same time the 5-year annualized growth rate in potential nominal GDP is peaking at 6% and is projected (by the CBO) to fall to 4% in the coming years. That means that barring renewed growth in the labor force or a lasting burst in productivity (from AI?) the 10-year yield needs to stay at or below 4% in order to avoid a debt spiral.

That might be a tall order without help from the Fed. The math is very challenging here and suggests that the Fed Model will be a significant driver for equity returns in the years ahead. Less beta.

AI CORNER

Tech war: Nvidia CEO says Huawei has everyone ‘covered’ if US chip ban on China stays

Nvidia founder and CEO Jensen Huang said his company’s technology remained a generation ahead of those developed by China, but warned that Huawei Technologies was in a position to expand its semiconductor business should US chip export curbs stay in place.

In an interview with US broadcaster CNBC on Thursday, Huang appeared to echo recent published remarks made by Huawei founder and CEO Ren Zhengfei, who said the Chinese company’s Ascend artificial intelligence (AI) processors lagged behind those from the US “by a generation”.

Ren, however, added that using methods like “stacking and clustering [on Ascend-powered machines], the computing results are comparable” to the most advanced systems in the world.

“AI is a parallel problem, so if each one of the computers are not capable … just add more computers,” Huang said in response to a question about Ren’s comments. “What he’s saying is that in China, [where] they have plenty of energy, they’ll just use more chips.”

“He was saying that China’s technology is good enough for China. If the United States doesn’t want to participate in China, Huawei has got China covered,” Huang added. “Huawei [also] has got everybody else covered.”

The 62-year-old Nvidia CEO’s televised comments, made on the sidelines of the annual VivaTech conference in Paris, reflect his concerns about Huawei’s growing AI chip capabilities, which he earlier raised during a closed-door meeting last month with the US House of Representatives Foreign Affairs Committee.

Remember my June 11 post in which I discussed the US energy problem vs China’s abundant energy.

(…) Energy has become a key ingredient in AI investments, themselves key factors in overall economic growth. The US economy is clearly facing energy bottlenecks ahead while China has been aggressively investing in its energy production infrastructure while reducing dependance on coal. (…)

China delays approval of $35bn US chip merger amid Donald Trump’s trade war Beijing’s antitrust regulator postpones sign-off on Synopsys and Ansys deal

A $35bn US semiconductor industry merger is being delayed by Beijing’s antitrust regulator, after Donald Trump tightened chip export controls against China in a move that exacerbated trade tensions between the world’s two largest economies.

China’s State Administration for Market Regulation has postponed its approval of the proposed deal between Synopsys, a maker of chip design tools, and engineering software developer Ansys, according to two people with knowledge of the matter.

The transaction between the American groups, which has received the blessing of authorities in the US and Europe, had already entered the last stage of SAMR’s approval process and was expected to be completed by the end of this month, said the people. (…)