Powell Keeps Fed on Track to Lower Rates Again The central-bank leader also suggested the Fed could be close to ending a three-year campaign to passively reduce its $6.6 trillion asset holdings

(…) “There really isn’t a risk-free path now, since [inflation] appears to be continuing to increase quite gradually…but now the labor market has demonstrated pretty significant downside risks,” Powell said. “Both the supply and demand for labor has declined quite sharply.” (…)

He said the economic outlook hadn’t changed much since the Fed agreed to cut rates at its meeting last month.

Since a lapse in federal funding on Oct. 1, the Fed has been operating without access to the first-tier government statistics that it uses to refine its economic outlook, which in turn guides decisions on where to set rates. “We’ll start to miss that data,” Powell said. If the shutdown persists, evaluating how the economy is performing “could become more challenging.”

Data available before the government shutdown suggested economic activity might be “on a somewhat firmer trajectory than expected,” he said. (…)

Private data suggest that labor demand keeps declining:

“You’re at a place where further declines in job openings might very well show up in unemployment,” Powell said during a question-and-answer session following his prepared remarks. “You’ve had this amazing time where you came straight down, but I just think you’re going to reach a point where unemployment starts to go up.”

- Goldman Tells Staff It Will Cut More Jobs as AI Saves Costs

(…) In the note to staff, which announced the launch of the bank’s “OneGS 3.0” strategy, top executives touted the efficiency gains produced by AI as a path to more growth. They added that it would be a “multiyear effort” to implement AI in areas such as client on-boarding, lending processes, regulatory reporting and vendor management.

“While we are still in the early innings in terms of assessing where AI solutions can best be deployed, it’s become increasingly clear that our operational efficiency goals need to reflect the gains that will come from these transformational technologies,” Chief Executive Officer David Solomon, President John Waldron and Chief Financial Officer Denis Coleman said in the memo. (…)

A statement that will likely be widely used.

(…) The company said more than 12,000 customers are using Agentforce. For example, Reddit Inc. was able to cut customer support resolution time by 84%, Salesforce said. (…)

AI allows Salesforce to give attention to customers who weren’t getting called back by human employees, Benioff said. Over $60 million in potential business has been identified since the company rolled out the technology internally, he said.

During a podcast appearance in August, Benioff said Salesforce has reduced its customer support workforce by thousands of people.

Meanwhile:

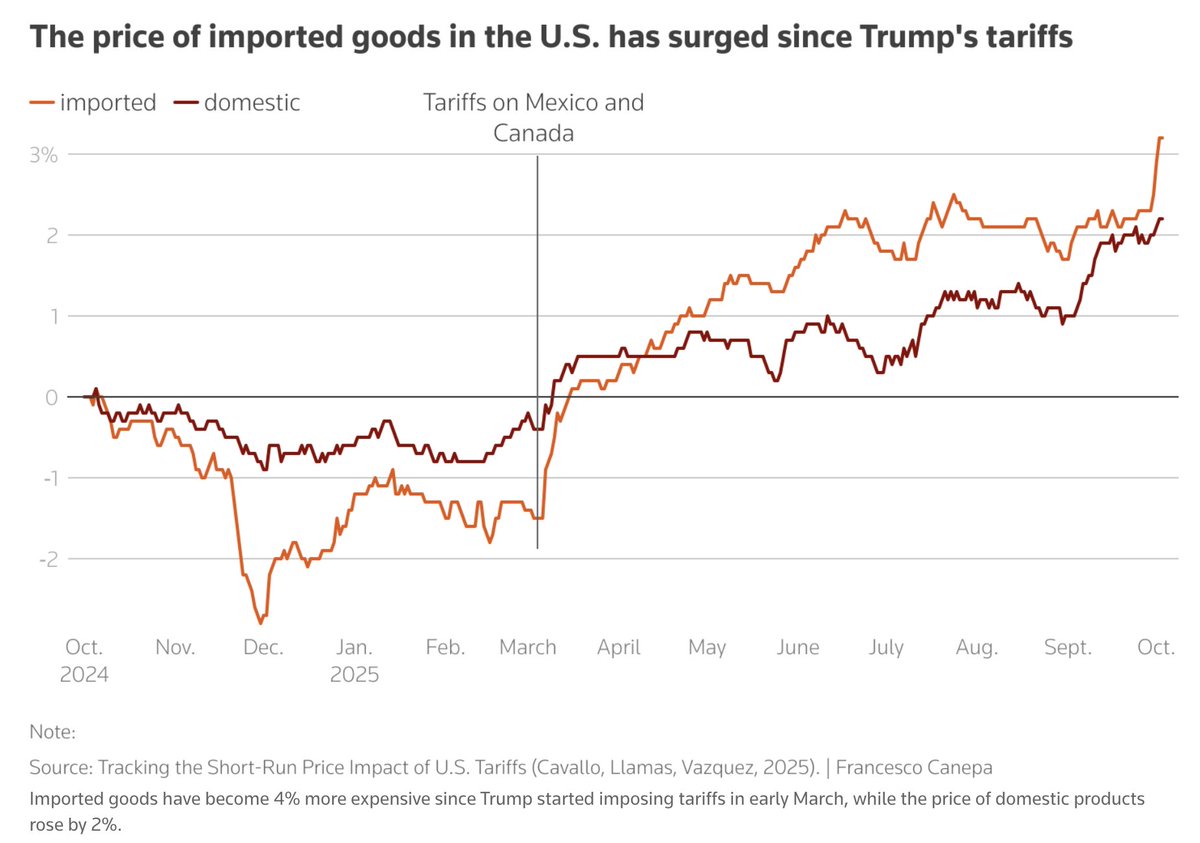

The US is now collecting tariffs on imported timber, lumber, kitchen cabinets, bathroom vanities and upholstered furniture, duties that threaten to raise the cost of renovations and deter new home purchases.

The import taxes — initially set at 25% for cabinets, vanities and upholstered wooden furniture — officially took effect on Tuesday at 12:01 a.m. New York time. Imports of softwood timber and lumber, meanwhile, are newly subject to 10% fees.

At President Donald Trump’s direction, most of the lumber and furniture tariffs are set to snap even higher in the new year — with upholstered wooden products subject to a 30% rate and kitchen cabinets and vanities at 50% as of Jan. 1. (…)

Roughly 7% of all goods used in new residential construction come from foreign suppliers, according to the National Association of Home Builders, which cited 2024 data. Even without new import taxes, the group has said the cost of building materials has risen by 34% since Dec. 2020. (…)

Trump also ordered administration officials to vigilantly monitor the price of imports and impose “specific, compound or mixed tariffs” when necessary to counter goods deemed to have unfairly low costs.

Unlike typical tariffs — expressed as a percentage and applied to invoiced prices — specific tariffs could be set in US dollars and applied against a select weight or other unit of measurement. (Bloomberg)

Chinese Deflation Eases Again Even as Pressure on Prices Lingers

Prices at the factory gate fell 2.3% from a year earlier after slipping 2.9% in August, the 36th straight month of declines that was in line with forecasts. Producer deflation moderated for a second month, though it remained unchanged at zero in month-on-month terms.

Under pressure from falling food costs, consumer prices dropped 0.3%, the National Bureau of Statistics said Wednesday, below the median estimate of minus 0.2% in a Bloomberg survey of economists. The core consumer price index, which excludes volatile items such as food and energy, rose to an 19-month high of 1%.

Morgan Stanley expects the comparison base for core CPI and producer prices to shift “from tailwind to headwind” in the fourth quarter, after they benefited from favorable statistical effects.

“An improvement in demand and supply has stabilized prices in some industries, such as coal mining and solar equipment,” Dong Lijuan, chief statistician at the NBS, said in a statement. (…)

A strong showing in the first two quarters likely means China will reach the official growth target of around 5%, with fresh stimulus probably not on the agenda for a meeting of the ruling Communist Party later this month.

Goldman Sachs chart is more telling: inflation on core goods and services is rising likely reflecting improving domestic demand. Core goods prices rose 0.5% MoM in September.

China, Betting It Can Win a Trade War, Is Playing Hardball With Trump Chinese leader Xi Jinping thinks the president will fold before launching new tariffs that would roil markets

In its trade standoff with Washington, Beijing thinks it has found America’s Achilles’ heel: President Trump’s fixation on the stock market.

China’s leader, Xi Jinping, is betting that the U.S. economy can’t absorb a prolonged trade conflict with the world’s second-largest economy, according to people close to Beijing’s decision-making. China is holding a firm line because of its conviction, the people said, that an escalating trade war will tank markets, as it did in April after Trump announced his so-called Liberation Day tariffs, prompting Beijing to hit back.

China expects that the prospect of another market meltdown ultimately will force Trump to negotiate at an expected summit with Xi late this month, the people said.

Beijing continued playing hardball this week, escalating the trade fight Monday by sanctioning the U.S. units of South Korean shipping company Hanwha Ocean. The move whipsawed U.S. markets on Tuesday, triggering a sharp early selloff as hopes for easing tensions faded, before major indexes partially rebounded and steadied in the afternoon. (…)

On his Truth Social platform, Trump said the U.S. is considering “terminating business” with China on cooking oil and other “elements of Trade,” because of China’s refusal to buy U.S. soybeans—a decision Beijing has said is retaliation for Trump’s own tariffs. (…)

“I have a great relationship with Xi,” Trump said, before quickly adding: “But sometimes he gets testy.”

Acknowledging the severity of recent Chinese actions ranging from its new rare-earth export controls to the latest shipping-related sanctions, Trump said, “We have a lot of punches being thrown.”

He then pivoted to defend his economic strategy against fears of a market downturn, portraying the U.S. as impervious to pressure. “We are the most successful we have ever been as a country,” Trump said. (…)

U.S. Trade Representative Jamieson Greer told CNBC on Tuesday that senior officials in Washington and Beijing held discussions about the latest trade tensions on Monday, saying both sides “will be able to work through it.”

People familiar with the matter said the U.S. ambassador to China, David Perdue, has been trying to arrange a phone call between Treasury Secretary Scott Bessent, who leads the U.S. negotiation team, and his Chinese counterpart, Vice Premier He Lifeng. (…)

President Trump directly tied the $20 billion lifeline the U.S. is extending to Argentina to President Javier Milei’s success in the upcoming midterm elections.

“If he loses, we are not going to be generous with Argentina,” Trump said, sitting across a table at the White House from the visiting South American leader, who he also endorsed for re-election in 2027. “If he doesn’t win, we’re gone.” (…)

Trump didn’t specify what he would consider a “win” for Milei’s party in the legislative elections. (…)

Former IMF executive director Hector Torres called Trump’s blunt statement in support of Milei “a life preserver made out of lead.”

Trump praised Milei as “MAGA all the way” and said the bailout was “really meant to help a good financial philosophy where Argentina can be successful again.” (…)

Officials from both countries emphasized that the deal isn’t only an economic one, but a broader effort to bolster ideological allies in the region and counter China. (…)

Treasury Secretary Scott Bessent said that it is “much better to form an economic bridge with our allies” and “end up with people who want to do the right thing” than have to be “shooting narco gunboats,” an apparent reference to the boats that the U.S. has targeted off the coast of Venezuela. As the two leaders met, the White House announced that the U.S. military had struck a fifth alleged drug-smuggling vessel, killing six. (…)

Milei frequently cited Trump during his unlikely rise, adopting the American leader’s slogan and lavishing him with praise. For his part, Trump has taken credit for Milei’s electoral success. “He ran as Trump,” he said in 2023. “Make Argentina Great Again. It was perfect.” (…)

Ahead of the meeting, Milei had hailed the U.S. deal as a turning point that would bring “an avalanche of dollars,” promising “we will have dollars pouring out of our ears.”

Why do I link Argentina with the trade war?

Because China bought a lot of soybeans this year but none from the US. Argentina cut its export taxes on grains, including soybeans, prompting China’s increased purchases while the peso was tanking.

The Trump administration is going out of its way to justify this unusual bailout. Scott Bessent, the architect of the bailout, said that American business leaders have told him that they want to deepen ties with Argentina.

The United States is Argentina’s third-largest trading partner, behind Brazil and China. The trade balance remains chronically in deficit for Argentina, which averaged USD 3.666 billion annually between 2014 and 2023.

Some media found another angle. Here and there:

- Major hedge funds, including those led by friends of Mr. Bessent, stand to benefit financially from an Argentina economic lifeline. Funds at investment firms including BlackRock, Fidelity and Pimco are heavily invested in Argentina, as are investors such as Stanley Druckenmiller and Robert Citrone, both of whom worked with Mr. Bessent when he was an investor for George Soros.

- The bailout would deliver a major windfall to Rob Citrone, a billionaire hedge fund manager with significant investments in Argentina. “Bessent’s personal and professional relationship with Citrone has spanned decades,” according to independent journalist Judd Legum.

- Mr. Druckenmiller was a mentor to Mr. Bessent at Soros Fund Management. A government filing in June of this year indicated that the Duquesne family office, which he runs, was the second largest investor in Argentina’s principal exchange-traded fund, a pool of Argentine stocks.

Mr. Citrone, the founder of Discovery Capital Management, has made Latin America his biggest bet in the world, and Argentina is the fund’s biggest investment in the region. Mr. Citrone has said that when he worked with Mr. Bessent under Mr. Soros in 2013, he convinced them to make their now famous bet against the Japanese yen and that he was responsible for most of the bonus that Mr. Bessent earned.

Two people familiar with the deal said Mr. Citrone was in close contact with Mr. Bessent in the lead-up to the Treasury announcement last month, arguing that if Argentina’s currency crashed, so too would the political fortunes of Mr. Milei.

Mr. Citrone told Mr. Bessent that if Mr. Milei were to lose the upcoming elections, Argentina would pivot to China for more economic assistance, according to one of the people familiar with the contacts. Mr. Citrone also apparently told Mr. Bessent that such an outcome would mean the United States could lose one of its most steadfast Latin American allies.

Hence: Bessent this week: “What we’re doing is maintaining a U.S. strategic interest in the Western Hemisphere.”

Maintaining (???) a strategic (???) interest. Really?

In negotiations over the terms of a support package, U.S. officials have been pushing for Argentina to scale back ties with China and have been seeking access to its uranium and lithium supplies, according to a person familiar with the matter.

But in Argentina, legislators and governors have more say in those contracts than Mr. Milei does, and the U.S. Treasury’s support for the Argentine president may not translate into more American companies securing mining rights.

Also this from Bloomberg:

“You can do some trade, but you certainly shouldn’t be doing beyond that,” said Trump, seated in front of Milei, referring to Argentina’s ties to the Asian giant. “Certainly shouldn’t be doing anything having to do with the military with China and if that’s what’s happening, I’d be very upset about that.”

Trump’s comments about Chinese activity in Argentina happened during the same meeting where he insisted Milei will need to perform well in the nationwide Oct. 26 vote in order to receive a $20 billion currency swap line, something US Treasury Secretary Scott Bessent had already said was finalized last week.

The remarks all but point to China’s space observation center in Argentina’s Patagonia region, and they build on previous comments that Milei is “committed to getting China out” of Argentina. Last weekend, China’s embassy in Argentina fired back at Bessent for “bullying” Latin American nations while pushing a “Cold War-era mentality.”

In 2012, Argentina’s then-leftist government granted China the rights for 50 years to build a 494-acre space station in the Patagonian province of Neuquen. Milei’s predecessor, Alberto Fernandez, renewed a joint venture agreement with China to collaborate on space exploration.

Past US administrations have speculated that China’s Patagonia space station is covertly conducting military activities. The administration of former US President Joe Biden called on Milei to inspect the site, but it’s unclear to what degree local authorities did so last year.

What Does China Want? It’s Too Soon to Tell Whether playing from a position of strength or weakness, Beijing’s timing is excellent.

(…) Robin Brooks of the Brookings Institution argues that China is dealing from weakness. It’s managed to replace exports lost to the US by increasing the products it sells to everyone else, but can only have done this by price-cutting, or “dumping.” He said:

Margins are getting hit, which means there’s a big negative shock lurking beneath the surface of these data… China is an export-dependent economy that’s on borrowed time. It’s hardball tactics on rare earths stems from weakness, not strength.

These export tactics risk a coordinated response from China’s trading partners. Speaking in Washington, former EU Trade Commissioner Cecilia Malmstrom warned that anti-dumping measures against China would increase further, “as China is trying to dump its goods on markets and diversify.”

An alternative take comes from Peter Tchir of Academy Securities, who notes that this episode of the trade war, unlike its predecessors under Trump, was initiated by Beijing. He argues that China believes that its rare-earths dominance will never be greater, and that it might be well served by reducing its own dependence on US chips (arguably the single greatest US point of leverage, which Trump has threatened to deploy):

China’s bargaining chip is declining in value and they think they can actually benefit from restricted access to chips. That would support an argument that China has analyzed the situation and is prepared for a full-on trade war.

This argument is possibly strengthened if China believes, as Brooks contends, that its position is weak. Developments over the last few days, with the US making threats, backpedalling somewhat, and then watching as China ups the ante by restricting shipping, tends to support this interpretation. (…)

Perhaps, yesterday’s threat from Trump to ban cooking oil illustrates the hand each side has:

The US is just seventh in the pecking order, with about 1.9 million tons of reserves. It also has little capacity to refine them. In fact, the few countries that can mine rare earths often still need to send them to be refined in China.

The US relies on China for 70% of its rare-earth imports. It’s a dependency that leaves the American military-industrial complex vulnerable, as the F-35 fighter jet requires more than 900 pounds (408 kilograms) of rare earths, according to the US Department of Defense.

Trump wants to increase domestic supply of rare earths. In March, he signed an executive order invoking wartime emergency powers to expand American production and processing of critical minerals and rare earths. The aim is to provide more financing, loans and other investment support, and accelerate the permitting process for new projects.

The president then launched a probe into the US critical minerals supply chain in April, ordering Commerce Secretary Howard Lutnick to determine whether the country’s reliance on imports poses a threat to national security and if tariffs need to be applied. The results of the investigation must be delivered within 270 days.

Import taxes wouldn’t translate to an immediate surge in US supply. There’s only one operational rare-earths mine in the country at present: MP Materials Corp.’s Mountain Pass mine, reopened in 2018, in California’s Mojave Desert. Getting other projects up and running would be a yearslong and expensive process. In the meantime, American businesses that need rare earths would likely pay more for their imports if new tariffs were introduced — assuming China allows these materials to be exported. (…)

Trump is looking beyond US shores for rare earths as well. He’s homed in on the mineral riches of Greenland, which has the eighth-largest reserves of rare earths in the world, mooting a potential takeover of the Danish territory.

The US has also signed an agreement to exploit Ukraine’s critical minerals. Trump has pointed to the European country as a source of rare earths but it doesn’t have any major reserves that are internationally recognized as economically viable. (Bloomberg)

The FT’s Ed Luce:

(…) China has shown that it can innovate rapidly on semiconductors and other dual-use technologies. The US, by contrast, has had 15 years to make up for its lack of rare earths and processing capabilities and has done almost nothing to fix it. China’s ability to damage the US economy is more potent for the time being than vice versa. Which means Trump is again likely to blink first. (…)

Why are Republican hawks so muted in their criticisms of Trump on China? Only partly because of fear. Mostly it is because he is giving them what they want on AI. Trump has done away with the few guardrails that existed. In Silicon Valley they extol AI’s many benefits to humankind. Their Washington lobbyists chiefly cite the race with China.

Either way, Trump’s administration is a field day for Palantir, OpenAI, xAI, Anduril and others. Trump may think he is the ultimate peacemaker. But his actions are stoking China’s self-belief and elevating America’s military-AI complex. It would be eccentric to assume he knows what he is doing.

Jeep Maker Stellantis Plans $13 Billion Investment to Boost U.S. Manufacturing Automaker says that American production will grow by 50% with 5,000 new jobs at plants across the Midwest

Stellantis said Tuesday that it would spend $13 billion through the end of the decade as it launches five new vehicles and a new four-cylinder engine, creating more than 5,000 jobs at plants across the Midwest. Suppliers providing parts for those models may add 20,000 jobs, Chief Executive Antonio Filosa said in an interview.

“The most important and relevant objective that we have with this investment is to grow in this market,” Filosa said.

The plan could help one of the country’s largest car manufacturers defray costs from tariffs imposed by President Trump’s administration. The company has said it expects a total tariff impact of $1.5 billion for the year. (…)

In 2024, Stellantis imported roughly 45% of cars it sold in the U.S.

The investment plans include a mix of gas-powered vehicles and electrified models at plants in Michigan, Indiana, Illinois, and Ohio. In the interview, Filosa said additional plans will be announced in the future for the company’s other key American brands, including Chrysler and Dodge. He declined to provide specifics. (…)

More than $600 million will be spent to reopen the Belvidere factory to build the Jeep Cherokee midsize SUV and Compass SUV in the U.S. Both Jeeps are currently assembled in Mexico. Production is expected to begin there in 2028. (…)

- Canadian Jeep Plant At Risk in Stellantis’ $13 Billion US Plan Stellantis NV said it’s halting plans to manufacture the Jeep Compass SUV at its factory in the Toronto region, throwing into doubt the future of one of the company’s two major assembly plants in Canada.