Federal Reserve Beige Book gives the greenlight to further rate cuts

The Federal Reserve isn’t directly impacted by the government shutdown, and they have just released their Beige Book report, which is an anecdotal survey on the state of the US economy. It suggests there has been a slight loss of momentum in activity over the past eight weeks, which supports the messaging from Fed Chair Jerome Powell yesterday that the economic situation hasn’t improved since the Fed cut rates 25bp on 17 September.

The report suggests that, on balance “economic activity changed little” since the last report, with 3 of 12 Fed districts reporting slight to modest growth, five reporting no change and four reporting a slight softening. This is a loss of momentum relative to the August report, which had indicated 4 of 12 Fed districts reporting “modest growth” with the other eight indicating “little or no change in economic activity”.

In terms of the jobs market, it was suggested that “demand for labour was muted across districts and sectors”. The August report had stated 11 of 12 districts reported flat employment with the other one reporting a “modest decline”. More specifically on jobs “in most Districts, more employers reported lowering headcounts through layoffs and attrition, with contacts citing weaker demand, elevated economic uncertainty, and, in some cases, increased investment in artificial intelligence technologies”.

With regard to prices, the August Beige Book indicated all 12 Fed regions saw “moderate or modest” price growth, but in two that growth was less than the rising input cost, suggesting squeezed profit margins. The assessment that corporate profits were bearing the brunt of higher costs was reaffirmed in today’s report with “several Districts” indicating that input costs rose at a faster pace than selling prices, with tariffs, insurance, health care and technology all cited as pressure points.

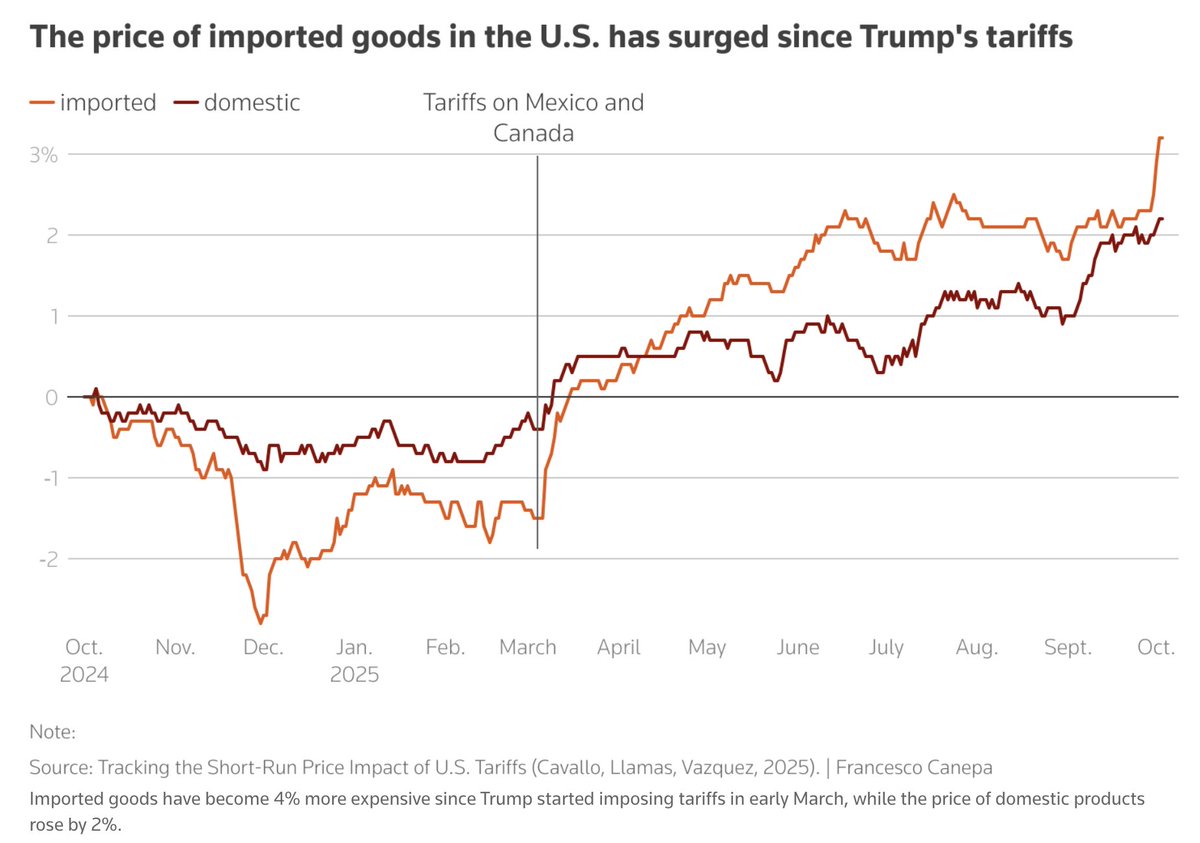

Private Inflation Data Shows Some Goods Are Getting More Expensive Due to Tariffs

Prices for goods like household equipment and furniture rose firmly, pushing up annual inflation to the highest level in two years, according to PriceStats data that’s based on products sold by online retailers. Another metric from OpenBrand showed the strongest monthly price growth since June, driven by personal care products and communications devices.

While the September data showed a notable increase in some prices, particularly on imported merchandise, economists see inflation starting to abate somewhat next year. Key to this development will be services costs. Unlike the private-sector reports, these are more fully represented in consumer price index data that have been delayed until later this month because of the government shutdown. (…)

“We’re beginning to get a little bit more concerned about the trend,” said Michael Metcalfe, head of macro strategy at State Street Markets, which analyzes and distributes the PriceStats data. “We’re currently getting into a period where prices are supposed to be really quite soft and the PriceStats data is not currently showing that normal softening.” (…)

“I think a lot of people expected one big change, and that driving inflation a lot. That’s not how it has happened,” he said. “It’s more like a gradual pass-through that is slowly putting upward pressure on prices.”

US Small-Business Optimism Falls to Three-Month Low on Economy

The National Federation of Independent Business optimism index declined 2 points to 98.8, according to data out Tuesday. Five of the 10 components that make up the gauge decreased, while three were unchanged.

A net 23% of small-business owners surveyed said they expect better business conditions in the next six months, down 11 percentage points from August. The net share of firms that viewed their inventories as too low sank last month by the most since 1997, which was accompanied by a smaller percentage expecting higher sales.

Owners also grew more anxious about inflation, with 14% of owners reporting that rising costs were their biggest problem in operating their business, up 3 points from August. A net 31% plan to raise prices in the next three months, up 5 points and the largest share since June.

The group’s uncertainty index rose 7 points from August to 100 — the highest since February, reflecting a decline in the share of owners saying now is a good time to expand. according to NFIB.

Still, overall business health was generally unchanged compared to August, with 68% of owners rating their business as excellent or good, compared with 27% who said it was just fair.

USA: Empire Manufacturing Well Above Expectations

The Empire manufacturing index increased by 19.4pt to 10.7 in October, well above consensus expectations for a negative reading. The composition of the report was strong, as the new orders (+23.3pt to 3.7), shipments (+31.7pt to 14.4) and employment (+7.4pt to 6.2) components all increased and returned into expansionary territory.

The prices received (+5.6pt to 27.2) and the expected prices received (+0.6pt to 43.7) components both increased, reaching their highest level since April. The prices paid (+6.3pt to 52.4) and the expected prices paid (+7.2pt to 65.0) components also increased.

The 6-months-ahead business conditions index increased by 15.5pt to 30.3, its highest level since January. (Goldman Sachs)

Eurozone industrial production slumps in August despite previous optimism

Despite a boost in industry optimism about production in August, according to the PMI, the reality turned out to be much less positive. A big decline in capital and durable consumer goods production caused overall production to tick down to the lowest level since January.

And this was despite a surge in production in Ireland – which is notoriously volatile – of 9.8% month-on-month. Without Ireland, the reading would have been much weaker as Germany, Italy and Greece all posted sizeable declines of more than 2%, while France and Spain posted smaller declines of under 1%. Dutch production was a bright spot among the larger industrial countries, with a 2.3% increase.

Despite optimism among manufacturers returning, the hard data is telling a different story at the moment. After a peak in production related to the US frontloading of European goods, the past few months have shown a declining trend again. Production is still elevated compared to late-2024 levels, but is quickly moving back in that direction.

Sizeable eurozone investment plans will take time to materialise, which means that while optimism about the medium-term outlook for the eurozone industry has become brighter, there is no immediate reason for short-term optimism as trade with the US settles into a new regime. For the third quarter, this means that manufacturing is unlikely to have contributed positively to GDP growth, keeping expectations for growth very muted.

POWER PLAY 2

On September 24, 2024, I wrote Power Play, highlighting the huge acceleration that AI would have on power demand, particularly electricity.

Today’s WSJ provides a good update.

AI Data Centers, Desperate for Electricity, Are Building Their Own Power Plants

(…) With the push for AI dominance at warp speed, the “Bring Your Own Power” boom is a quick fix for the gridlock of trying to get on the grid. It’s driving an energy Wild West that is reshaping American power.

Most tech titans would be happy to trade their DIY sourcing for the ability to plug into the electric grid. But supply-chain snarls and permitting challenges are complicating everything, and the U.S. isn’t building transmission infrastructure or power plants fast enough to meet the sudden surge in demand for electricity.

America should be adding about 80 gigawatts of new power generation capacity a year to keep pace with AI as well as cloud computing, crypto, industrial demand and electrification trends, according to consulting and technology firm ICF. It’s currently building less than 65 gigawatts. That gap alone is enough electricity to power two Manhattans during the hottest parts of summer. (…)

One data center can devour as much electricity as 1,000 Walmart stores, and an AI search can use 10 times the amount of energy as a google search.

The growth is intense, too. The U.S. had around 522 hyperscale data centers at the end of the second quarter, which account for around 55% of global capacity, according to Synergy Research Group. Another roughly 280 are expected to come online through 2028 in the U.S.

Data centers consumed less than 2% of U.S. electricity before about 2020, but by 2028 could use as much as 12% of U.S. electricity, according to the Energy Department and Lawrence Berkeley National Lab. (…)

Note that just one year ago, forecasts were 8-9% by 2030!

This is on top of increasing electricity demands from EVs, heat pumps, electrification in industry, and the onshoring of manufacturing incentivized by the CHIPS Act, Inflation Reduction Act (IRA), and Infrastructure Investment and Jobs Act (IIJA), all placing both immediate and sustained pressure on the electric grid to accommodate new loads.

President Trump in January declared a national energy emergency, in part to keep the U.S. from falling behind China in the AI race. He has issued a series of related executive orders including one that aims to fast-track data-center construction and needed power infrastructure.

The U.S. appears to have a lot of catching up to do.

China will invest twice as much as the U.S. this year in power plants, storage and the grid, according to the International Energy Agency. It added about 429 gigawatts of new power generation last year, according to the think tank Climate Energy Finance, while the U.S. built about 50 gigawatts. (…)

Most U.S. data-center developers cited grid access as their top concern.

Project developers and utilities are trying to pick up the pace. ICF forecasts the U.S. will deliver almost 80 gigawatts of new generation starting in 2027, doubling the average pace of the past five years.

Even so, in some locations, data centers won’t be able to plug into the power grid until the 2030s because of the sheer backlog of projects and the fact that the nation’s high-voltage electric wires are running out of room. (…)

Many of the data-center developers scrambling for electricity intend to use on-site power for a few years until the grid infrastructure can catch up. A few plan to bypass the grid indefinitely, and others expect to split the difference, using a mix of grid and on-site power.

Ultimately, most data centers and tech customers will want to connect to the grid. It offers reliability and diversification with its mix of power plants—when one power source goes down, another can pick up the slack, said Andy Power, chief executive of Digital Realty, which has 300 data centers globally. He views on-site power as a stopgap. (…)

Planning and building large-scale power plants or expanding grid infrastructure takes years. The process, normally gummed up, is even more difficult lately. Projects of all kinds face hurdles obtaining permits, equipment shortages, a labor crunch and rising costs, exacerbated by Trump’s tariffs on steel and aluminum, as well as some copper products.

Orders for transformers began climbing just as global supply chains became snarled at the start of the Covid-19 pandemic, according to data from energy consulting firm Wood Mackenzie. Data-center demand for the equipment is up 10-fold since then. It’s expected to quintuple next year. New factories and utilities’ efforts to replace aging or damaged equipment have added to the order backlog.

Transmission construction, too, has been bogged down. The U.S. added 888 miles of new high-voltage transmission lines last year, and 450 miles the year before, according to a report from Grid Strategies. That’s down from an average of more than 900 miles a year between 2015 and 2019, and more than 1,700 miles a year on average for the five-year period before that.

As utilities push to increase supply and access, data centers are pulling in resources wherever they can, with natural gas the clear winner.

Massive turbines for large power plants have a yearslong backlog. But smaller turbines, reciprocating engines or fuel cells that also can use natural gas remain available—for now. Companies are snatching them up, adding them to data-center sites like Legos. Enough of them equal the output of utility-sized power plants or nuclear reactors. (…)

Billy Sorenson, Lightfield’s founder, has developed and built solar projects for the past 15 years but said only natural gas has the power density to meet AI demand.

“All roads point to natural gas,” he said. The site design will include a lot of smaller turbines, battery storage and diesel generators for backup in case there’s ever a problem with the gas supply, he said. (…)

Years of flat power-demand growth mean the number of natural-gas projects in the construction pipeline is small. The cost of building a new natural-gas power plant, meanwhile, has tripled over the past few years by some estimates.

Developers plan to deliver fewer than 20 gigawatts of natural-gas-powered projects this year through 2027, according to a Wall Street Journal analysis of data reported by power generators to the federal government.

Hugh Wynne, an analyst with Sector & Sovereign Research, predicts the dearth of construction will limit data-center growth.

Texas is seeing such rapid data-center, crypto and industrial growth that its grid operator expects peak electricity demand to increase 62% by the end of the decade—roughly the equivalent of adding all of California. The state is trying to persuade power companies to come to the Lone Star State to build or upgrade reliable generation, especially natural gas.

So far projects that would add more than a gigawatt of power have taken up officials’ offer of low-interest state-backed loans, but several others dropped out this year citing rising costs and supply-chain delays.

The gas projects moving forward in Texas and elsewhere are ones that likely secured equipment and locked in prices years ago, said Corianna Mah, an analyst with Enverus.

Complicating the picture further, most of the recent investment nationally has focused on renewable energy. About 214 gigawatts of large-scale solar, wind and battery projects are under construction or in various stages of planning, about two-thirds of what is currently operating in the U.S. for those technologies, according to government data.

Analysts, however, expect spending on wind and solar to drop and project cancellations to rise because they are set to lose key federal tax benefits under Trump’s tax-and-spending law. The president and his team argue clean-energy projects don’t provide the round-the-clock power generation needed to meet AI demand and have promised to make permitting more difficult for wind and solar. Wind and solar developers say every available electron will be needed to help meet demand, and they can deliver quickly.

Already, at least $22 billion in new factories and electricity projects have been canceled or scaled back this year, according to data tracked by advocacy group E2, including everything from offshore wind to battery factories. The Energy Department is slashing another nearly $24 billion of funding for early-stage climate projects.

Instead, the administration is boosting fossil fuels by opening swaths of federal land to oil and gas drilling and coal mining, approving new terminals to export natural gas, proposing to ax environmental regulations and offering $625 million to upgrade coal plants. (…)

Data centers and the companies giving them a power boost are preparing for a supply crunch that could last a while.

Equinix has been signing agreements in the U.S. and Europe with developers of small modular nuclear reactors, which haven’t yet delivered projects.

“We don’t know exactly where we’re going to use it, but we know we have a multigigawatt planned development for the coming handful of years,” said Raouf Abdel, executive vice president of global operations at Equinix. “We want as much flexibility in our power supply as we can get.”

Caterpillar, which has long provided power in remote locations for mining and oil-field operations, is seeing rising demand for its smaller turbines and reciprocating engines.

“Customers are saying, ‘Hey, can you help us bridge the two to three years until we can get a utility connection?’” said Jason Kaiser, group president of energy and transportation at Caterpillar. “That’s a new and growing opportunity for us.”

The company is spending $725 million to increase capacity at a large engine factory in Indiana, as power generation makes up the biggest part of company growth. The engines have traditionally been used for backup or emergency power, while the smaller turbines have been used at power plants, for pumps and compressors in the oil field and as jet, marine or train engines. (…)

Declaring a national energy emergency was smart, what followed not so much. Consider:

- tariffs on copper, steel and aluminum;

- reducing or eliminating incentives for renewable energy;

- gas pipeline capacity;

- LNG exports;

- cancelling what would have been the largest solar project in North America. “The Bureau of Land Management scrapped approval for Esmeralda 7, a 6.2 gigawatt project that could have powered nearly 2mn homes. It had begun the permitting process under the Biden administration.”

In my July 30, 2025 post, I wrote:

- China generated over 10,000 TWh (terawatt-hour) of electricity in 2024. That’s more than the combined output of the U.S., EU, and India—the next three biggest producers.

- China’s capacity, already more than 2x the US, is growing very rapidly and at lower costs.

From other Daily Edge posts:

-

Renewables are expected to provide over one-third of China’s electricity generation globally by early 2025. The expansion of renewable energy sources is expected to meet all of China’s additional electricity demand.

-

In 2024, China installed 277 GW of new solar capacity, bringing its total to 900 GW, which is as much as the rest of the world combined.

-

China also controls the solar supply chain:

- As well as battery storage technologies, increasingly critical when using renewable energy.

FYI:

G7 accounted for 25% of China’s exports year to date, down from 48% in 2000. Only about 11% of PRC exports are going to the US this year, down from a peak of 21%.

AI Stocks Are in a Bubble, Most Investors Say in BofA Survey

About 54% of participants in the October poll indicated tech stocks were looking too expensive, an about-turn from last month when nearly half had dismissed those concerns. Fears that global stocks were overvalued also hit a peak in the latest survey. (…)

The BofA survey showed exposure to US stocks rose to the highest in eight months

— stretching back to before tariff anxieties took hold. Worries about a recession subsided to the lowest since early 2022. (…)

The BofA survey showed an AI bubble was viewed as the biggest tail risk, followed by a resurgence in inflation and worries about the loss of Federal Reserve independence and dollar debasement.

The poll was conducted between Oct. 3 and Oct. 9, and canvassed 166 participants with $400 billion in assets.