![]() Note: I am currently travelling. Hence the more limited postings.

Note: I am currently travelling. Hence the more limited postings.

CONSUMER WATCH

US Card Spending Rises Most Since Early 2024, BofA Data Show

US credit and debit-card spending climbed in October from a year earlier by the most since early 2024, reflecting strong demand from higher-income households as well as price increases, according to the Bank of America Institute.

Spending per household rose 2.4% last month on an annual basis, according to the study, based on Bank of America Corp. aggregated card data. Compared with September, card spending rose 0.3%, the fifth straight monthly increase. (…)

At the same time, some of the strength in retail spending likely reflected price increases rather than a pickup in volume. Headline inflation was 3% in September. While the number of retail transactions edged up in October, it remained lower than earlier this year, the BofA study found.

Meanwhile, spending by high-earning households outpaced that of those lower down the income ladder. The gap is largely due to stronger wage growth for upper-income individuals, while pay gains have generally trended lower for other groups, the institute said.

Bloomberg omitted some interesting facts:

Looking across categories, services spending (including restaurants) drove over half of overall spending growth, the largest contributor for the second month in a row (Exhibit 4). Meanwhile, retail (excluding gas and restaurants) spending made up around a quarter of growth.

Exhibit 4 shows that retail spending (goods) has stalled in the last 2months, probably even more in real terms:

However, some of the strength in holiday spend – and retail spending more broadly – likely reflects price increases as opposed to growth in the number of consumer purchases. Exhibit 8 shows that while overall retail (excluding food and gas) spending was up 2.0% in October 2025 compared to January, the number of transactions has actually declined since then.

Conversely, in services (including restaurants), spending growth has lagged transaction growth by over a percentage point. In our view, this may partly reflect consumers trading down to lower-ticket services (e.g., fast food instead of full-service dining), possibly to offset rising retail prices.

(…) 62% of shoppers surveyed reported they were feeling financial strain in Bank of America’s 2025 Holiday Spending Survey. Some 87% of those under strain plan to shop at discount stores to counteract rising prices. (…)

Bank of America deposit data also shows that households across the income spectrum continue to hold more in both nominal and inflation-adjusted terms than in 2019. And across all households, including lower-income ones, the rate of decline of deposits has flattened, suggesting to us that most consumers are not drawing down a significant portion of their savings.

This last chart suggests that high income Americans have actually exhausted their Covid bounty…

USDA data casts doubt on China’s soybean purchase promises

New data the Agriculture Department released Friday created serious doubts about whether China will really buy millions of bushels of American soybeans like the Trump administration touted last month after a high-stakes meeting between President Donald Trump and Chinese leader Xi Jinping.

The USDA report released after the government reopened showed only two Chinese purchases of American soybeans since the summit in South Korea that totaled 332,000 metric tons. That’s well short of the 12 million metric tons that Agriculture Secretary Brooke Rollins said China agreed to purchase by January and nowhere near the 25 million metric tons she said they would buy in each of the next three years.

American farmers were hopeful that their biggest customer would resume buying their crops. But CoBank’s Tanner Ehmke, who is its lead economist for grains and oilseed, said there isn’t much incentive for China to buy from America right now because they have plenty of soybeans on hand that they have bought from Brazil and other South American countries this year, and the remaining tariffs ensure that U.S. soybeans remain more expensive than Brazilian beans. (…)

Beijing has yet to confirm any detailed soybean purchase agreement but only that the two sides have reached “consensus” on expanding trade in farm products. Ehmke said that even if China did promise to buy American soybeans it may have only agreed to buy them if the price was attractive. (…)

The Chinese tariff on American beans remains high at about 24 per cent, despite a 10-percentage-point reduction following the summit. (…)

But farmers are dealing with the soaring cost of fertilizer, seed, equipment and labor this year, and that is hurting their profits. The Kentucky farmer who is president of the American Soybean Association, Caleb Ragland, has said he worries that thousands of farmers could go out of business this year without significant Chinese purchases or government aid. (…)

Ragland said that every vender he talks to has told him they are increasing their prices for next year, which will continue to put pressure on farmers.

“We’re still looking at sharp losses and the red ink as we figure budgets for 26 is still very much in play,” he said.

Chinese data shows momentum fading into the final stretch of the year

Chinese fixed asset investment slumped further to -1.7% year-over-year, year-to-date, marking the lowest level since June 2020. Once again, the data is falling well short of already downbeat forecasts.

By category, we saw infrastructure investment fall into contraction territory at -0.1% YoY ytd, contracting for the first time since 2020. Manufacturing investment, which had been a solid outperformer for several years, slumped to just 2.7% YoY ytd. Private sector investment fell to -4.5% YoY ytd, while even government investment slowed to 0.1% YoY ytd and looks likely to tip into contraction territory next month.

The only silver linings were seen in China’s recent growth areas, namely the auto (17.5%) and rail, ships, and aeroplanes (20.1%) categories.

While the magnitude of the declines was somewhat surprising, the continued weakness of investment itself was not. Anti-involution policies targeting excessive price competition and the shift toward reducing redundant investments could be adding to the downward pressure.

Yesterday’s poor credit data showed new RMB loans actually contracted by RMB 20.1bn in October. While October tends to be a seasonally weak month due to the Golden Week holidays, the lack of borrowing demand has been quite clear year-to-date, with new RMB loans down 7.4% year-to-date. All this suggests real interest rates remain too high to attract prospective borrowers.

FAI is slowing across the board

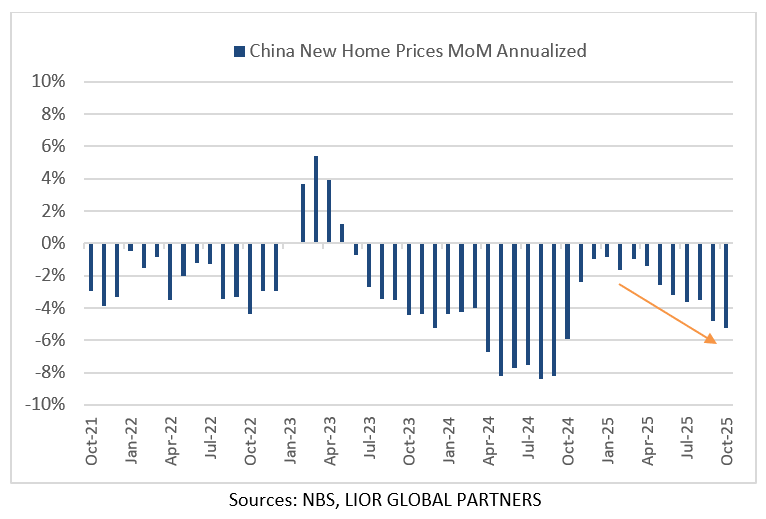

October’s 70 city property prices continued to show downward pressure. New home prices fell by -0.45% month-on-month, the steepest decline since October 2024. Used home prices fell by -0.66% MoM, the steepest decline since September 2024. After flatlining in the first quarter, prices have fallen at a faster pace. From the peak, new home prices are now down -11.8%, while used home prices are down -20.3%. Of the 70 cities, 45 have seen secondary market prices decline between 20% and 30% from their peak, while 3 have experienced price drops of more than 30% from the peak.

In the primary market, 6 of 70 cities saw prices stabilise or increase, the lowest proportion since September 2024. In the secondary market, we saw a second consecutive month without a single city seeing stable or rising price levels.

With falling prices and still elevated inventory levels, it is no surprise to see that property investment remains one of the biggest drags on the economy, with property investment now down -14.7% YoY ytd.

The recent downturn, with accelerating price declines, has yet to be adequately addressed. More policy support is needed to prevent the massive destruction of household wealth, which would significantly hinder efforts to transition toward a consumption-driven growth model.

October’s retail sales data slowed to 2.9% year on year, down only 0.1pp from September’s reading. That’s a little stronger than market expectations. Year-to-date, retail sales are up 4.3% YoY, and should still be able to close 2025 stronger than last year’s 3.5% growth. But the loss of momentum in the second half of the year nonetheless remains a little disappointing given the stated importance of domestic demand. (…)

October value added of industry growth slowed to 4.9% YoY, down from 6.5%. This came in below expectations for a smaller decline, marking the lowest growth since August 2024. The year-to-date growth edged down 0.1pp to 6.1% YoY as a result.

By industry, we continue to see the same themes outperform. Auto manufacturing (16.8%) and rail, ships, and aeroplane manufacturing (15.2%) remain clear outperformers. We’re still seeing strong growth in semiconductor (17.7%), industrial robot (17.9%), and service robot (12.8%) production. Advanced manufacturing was identified as one of the top priorities for China in the next Five-Year Plan and is expected to continue experiencing strong growth and investment.

Industrial production has been a key driver of growth, with manufacturing meeting external demand this year. Soft industrial production confirmed the weakness we saw earlier in the month with the steeper-than-expected downturn of the PMI.

While one month of soft data does not necessarily indicate a trend, the next few months appear to have a less supportive base effect. The deceleration of industrial production should be watched closely along with export data. Signs of external demand and manufacturing momentum slowing will represent significant risks to the overall outlook, given the softness of domestic demand.

Industrial production slowed in October

Following the continued softness of the October data and an uptick in inflation, which could reduce the tailwind from the GDP deflator, risks to our 2025 GDP growth forecast of 5.0% appear somewhat balanced to the downside heading into the final stretch of the year.

There’s reduced urgency for new policy support. Stronger-than-expected growth in the first three quarters of the year is likely keeping the economy on track to meet its 2025 growth target without requiring much additional intervention. With ambitious targets set by Premier Li for 2030, targeting a GDP of RMB 170tn, along with President Xi’s aim from 2020 to double growth by 2035, it will be a marathon, not a sprint.

As such, the recent lull in new stimulus is likely only a pause rather than a reversal of direction. Policymakers may opt to conserve ammunition for next year’s growth targets. We still see room for further monetary easing next year, and fiscal support for consumption and strategic industries will likely continue.

My sense is that Beijing will need to act more forcefully sooner than later.

House prices and transactions keep falling in spite of recent new stimulating measures. The wealth impact is getting too severe.

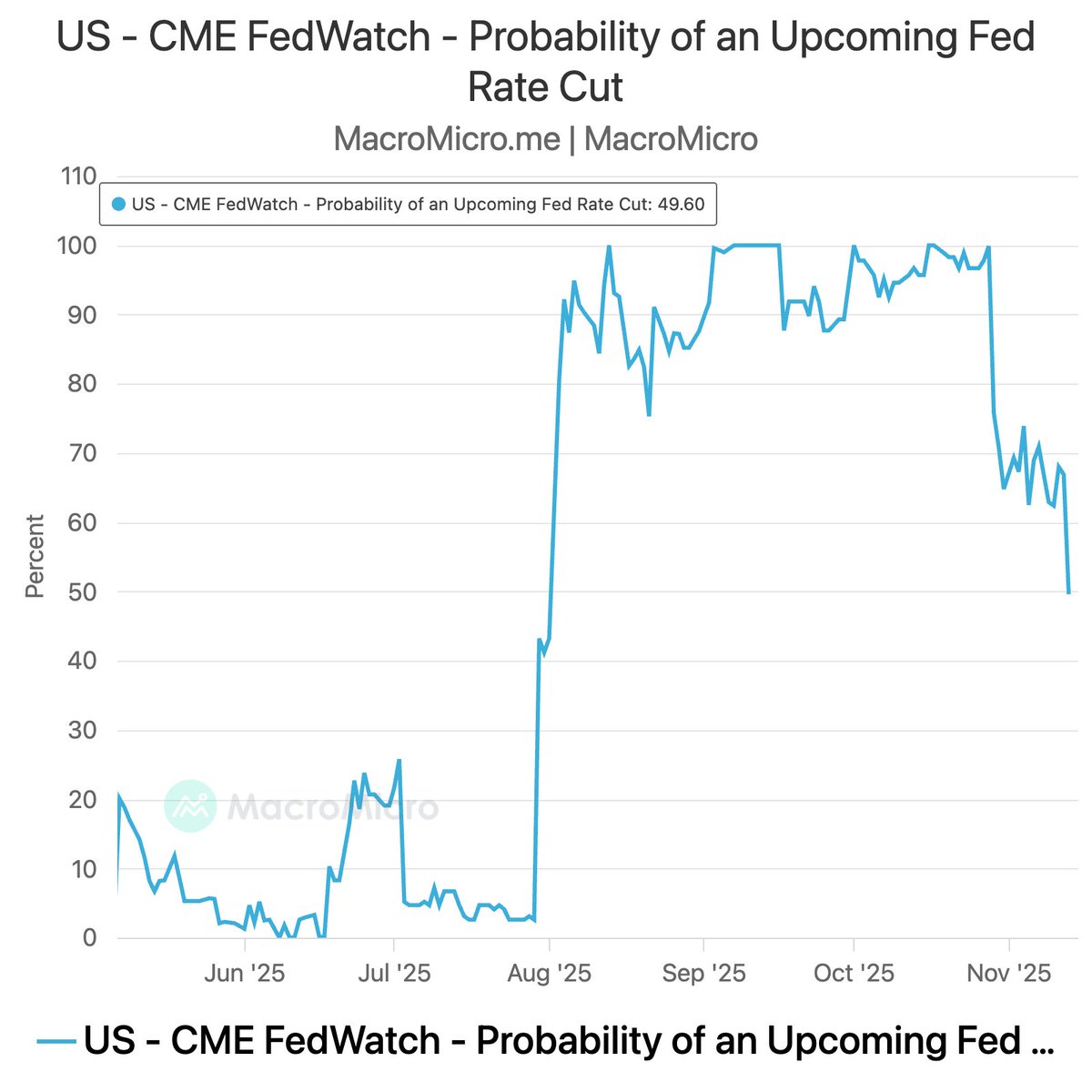

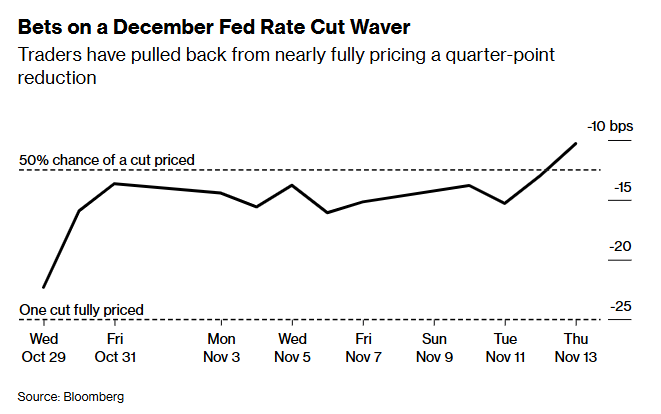

Fed may soon start buying bonds to manage market liquidity, Williams says

New York Federal Reserve President John Williams reiterated on Wednesday the time is getting closer when the U.S. central bank will have to restart bond purchases as part of a technical effort to maintain control over short-term interest rates.

Williams, in the text of a speech to be delivered to a conference at his regional Fed bank, noted that when these purchases happen they have no implications for monetary policy. He did not comment on the outlook for short-term interest rates in his prepared remarks.

Instead, the New York Fed chief tackled the implications of the central bank’s decision late last month to stop the drawdown of its balance sheet at the start of December. Williams said the Fed, by way of “inexact science,” is looking for the level of reserves it considers to be “ample,” which allows for firm control of the central bank’s interest rate targets as well as normal money market trading conditions.

“The next step in our balance sheet strategy will be to assess when the level of reserves has reached ample,” Williams said. “It will then be time to begin the process of gradual purchases of assets that will maintain an ample level of reserves as the Fed’s other liabilities grow and underlying demand for reserves increases over time.” (…)

QT had been allowing Treasury and mortgage bonds owned by the Fed to run off and not be replaced, in a bid to remove the sea of liquidity that was added during the COVID-19 pandemic. That effort took the Fed’s balance sheet from its overall $9 trillion peak in 2022 to the current overall level of about $6.6 trillion. (…)

AI CORNER

When AI Hype Meets AI Reality: A Reckoning in Charts Record capital expenditures and data-center planning run up against the ground truths of physical infrastructure

(…) There is effectively “infinite” money available right now to build out new data centers, says Jim Schneider, a senior research analyst at Goldman Sachs. All this investment has translated into record spending on the stuff that goes into data centers—aka “AI supercomputers”—all those chips, servers, HVAC systems, transformers, gas turbines, power lines and power plants.

There are absolute, physical limits to how quickly all of that can be delivered. As a result, some projects are already being delayed.

There are huge numbers of AI data centers in the planning stage, which means developers are in the process of securing land and getting permits, says Steve Tusa, a managing director at JPMorgan Chase.

Today’s record number of data centers at the planning stage is indicative of what Raymond James managing director Frank Louthan calls “kind of a gold rush mentality.” Connecting these planned data centers to power and fiber, and finding a buyer or tenant who wants one, in that particular location is another matter.

“A lot of people who have some land think they’re going to get into this industry and make some money, and they didn’t understand the risks,” he adds.

Despite these challenges, the biggest tech companies are spending more than ever on AI infrastructure. It’s claiming an ever-larger share of their revenue.

An increasing share of that investment is fueled by debt. OpenAI, Anthropic and other startups continue to lose money, and must fund most of this investment by selling off pieces of themselves to investors and by issuing this debt. A recent Goldman Sachs report projected that OpenAI alone could spend $75 billion in 2026. Even cash-flush Meta Platforms is signing complicated debt deals involving private-equity firms.

Any key component of an AI supercomputer that is in short supply will determine how much AI infrastructure can actually be built. For example, even if there were enough power available for every new data center envisioned, there is currently a shortage of transformers, those gray, house-size boxes that connect buildings to the power grid, says Schneider of Goldman Sachs.

As a result, his projection for how much new data-center capacity will actually be built across the world through the end of 2027 is relatively conservative compared with other Wall Street and real-estate industry estimates.

Scott Strazik is chief executive of GE Vernova, one of the biggest U.S. manufacturers of equipment to generate electricity, such as transformers and natural-gas turbines. Strazik recently said on The Wall Street Journal’s Bold Names podcast that nearly all of the company’s output is booked through 2028.

Translation: There’s no spare manufacturing capacity to build that equipment any faster.

Strazik says that meeting the projected demands for U.S. electricity production isn’t something his industry can solve in the next five years, but rather in 10 or 15. Meanwhile, there are other bottlenecks, such as securing construction permits and connecting turbines to natural gas.

All that spending by the big AI and cloud-computing firms—which is translating into real estate, construction, energy and other massive costs—will have to be recouped somehow. The expectation is that increased spending by consumers and businesses on AI-powered products will make that happen. Today’s chatbots and image generators will, companies hope, become pricier AI agents that act on our behalf, and even humanoid robots.

In such a future, AI’s cloud-service providers could see rapid revenue growth. Based on best-case scenarios, the financial-services firm Raymond James projects that AI cloud revenue will explode in the next half-decade, to almost nine times its current value.

Recently, analysts at JPMorgan Fundamental Research created a financial model that projects total investment in global AI infrastructure through 2030, taking physical limitations into account. That figure is $5 trillion.

Then they calculated how much new revenue these companies will have to generate to justify that $5 trillion investment in AI supercomputers. The result: AI products would have to create an additional $650 billion a year, indefinitely, to give investors a reasonable 10% annual return. That’s more than 150% of Apple’s yearly revenue, and a far cry from OpenAI’s current revenue of about $20 billion a year.

This equates to every iPhone owner in the world paying an extra $35 or so a month for products and subscriptions, according to the JPMorgan analysts.

While these per-user revenue figures sound unlikely, there will be many ways to make money from AI, including advertising and specialized AI for high-paying enterprise customers, says Louthan of Raymond James.

The takeaway: The projections of AI companies and their partners don’t reflect shortages of equipment. At the same time, these projections assume a gargantuan market for AI-powered products and services. Analysts can’t agree whether that market will materialize as quickly as promised.

AI is already dramatically transforming our lives and businesses. But the real world limits how quickly companies can scale up these next-level supercomputers, and it’s unclear who will pay for all the resulting services.

It would be wise to moderate our expectations—or at least adjust the timetable—for the AI revolution.

Yet again, not a word on competition from Chines models and companies.

Did you miss last week’s Towers and Porticoes?

Goldman Sachs:

Company commentary this quarter shows a continued focus on AI adoption. 47% of S&P 500 companies have discussed AI during 3Q earnings calls specifically in the context of productivity and efficiency. These discussions have been most prevalent within the Communication Services (74%) and Financials (66%) sectors. The most common use cases remain coding and call centers/customer support.

A recent survey of GS investment bankers found a 37% corporate adoption rate.

Despite ongoing adoption, returns within the AI complex have remained concentrated in the infrastructure complex rather than the application or productivity layer. A basket of AI infrastructure stocks (“Phase 2”) has outperformed the equal-weight S&P 500 by +27 pp YTD compared with -1 pp for AI enabled-revenue stocks (“Phase 3”) and -12 pp for AI productivity stocks (“Phase 4”). Investors continue to focus on near-term tangible earnings tailwinds from AI, and consensus EPS revisions during the 3Q reporting season have aligned with these share price dynamics.

Recent revisions to consensus earnings forecasts have been consistent with these performance dynamics. Since the start of 4Q 2025, consensus revisions to 2026 EPS estimates have been strongest for NVDA (revision of +6%) and the Tech Hardware stocks within our Phase 2 list (+4%). Earnings revisions have been de minimis for the list of Phase 4 productivity stocks.

What the U.S. Government Can Do to Help Win the AI Race Michael Kratsios on how the Trump administration views the government’s role in promoting AI—and where regulation fits into that vision

Michael Kratsios is director of the White House Office of Science and Technology Policy.

The first big thing we have to do is make sure that we lead on innovation. We need a regulatory system that can allow our greatest technology companies and innovators to deploy those technologies.

Married with all that innovation, you have to have the infrastructure to drive an AI revolution. We need the power and we need the data centers. The third point, which ties to global adoption, is all about diplomacy. How do we make sure that we are proactively exporting our great American technologies to all these countries that want to use this tech?

Right now, the U.S. is lucky. We have the best chips, we have the best applications with the best models. We should be getting those out in the hands of all these different countries and different people that want to get the benefits of AI. If you follow that, we’re ultimately going to have widespread adoption of American tech, and that’s what winning looks like. (…)

If you look at the totality of the U.S. chips and what percentage are actually exported, it’s quite small. It’s just the very high-end chips. That’s something that the president reaffirmed when we were on our trip to Asia. Those chips were not on the table for the Chinese now. (…)

The government has a very important role. The best approach to AI regulation is for it to be use-case and sector specific. There are AI-powered medical diagnostics, there are drones, there are self-driving cars. And there are already regulatory agencies that exist that regulate those technologies. The Food and Drug Administration regulates medical diagnostics whether or not they have AI in them. The National Highway Traffic Safety Administration regulates safety of vehicles whether or not they’re autonomous. The Federal Aviation Administration regulates air travel whether it’s autonomous drones or not.

The best path forward is for those regulatory agencies that already have jurisdiction over a particular type of technology to continue to expand the way that they think about regulation.

The general rule of thumb around AI regulation is that before you create any new law, think about what rules are already in the book. Fraud is illegal. If I call someone and I defraud them and I use a telephone, that is illegal. If I meet them at a coffee shop and I defraud them in person, I’ve committed fraud, that is illegal. If I use artificial intelligence to do that, I have defrauded someone and it is illegal. We don’t need a new fraud rule on the books because you’re using AI.

A big part of the AI action plan is to charge our Labor Department and Education Department [?] to go forth with retraining and reskilling programs for Americans to allow them to better be able to succeed in an AI-powered economy.

Over time, there’s going to be incredible new jobs that are created by an AI economy. Jobs that we never thought of, never imagined, never heard of, are going to come to fruition. These new opportunities are going to present themselves partnered with the retraining, reskilling programs that we as an administration are pushing.

We’re trying to accelerate the timeline of adoption as quickly as possible. You could see Americans connected to new nuclear power at the beginning of the next decade. In the meantime, we’re doing everything we can to bridge the gap with other sources of fuel. (…)

FYI:

(…) American students’ literacy scores are tragic. Less than a third of fourth-grade students are proficient at reading, according to the NAEP. The share of students testing below basic level is at quarter-century highs. (…)

This evidence should lay to rest to the argument that learning to spell is obsolete in a world of spellcheck and autocorrect. By that same logic, I don’t need to know math, because I have a calculator. I don’t need to learn how to read music, because I have Spotify. I don’t need to read, because I have podcasts. And as technology rapidly advances, I won’t need to think because I have ChatGPT.

The brain is like a muscle; if we don’t use it we lose it. We know this. Technology works best as a tool, an extension of our human abilities, not as a replacement of them. This is especially the case for our youngest kids whose brains are rapidly developing.

Many parents are unaware of why spelling remains so important — and oblivious to schools’ drift away from teaching it. It’s easy to rely on what report cards say and the seemingly endless number of state and district tests that children take. (…)

In fact, a gap in parent perception and student achievement is pernicious across subjects: Most parents report that their children are doing great in school. In reality, most kids in Kindergarten through 8th grade aren’t proficient in reading and math. (…) (Bloomberg)

- He’s Been Right About AI for 40 Years. Now He Thinks Everyone Is Wrong. Yann LeCun invented many fundamental components of modern AI. Now he’s convinced most in his field have been led astray by the siren song of large language models.

Despite worldwide renown as one of the godfathers of artificial intelligence, he has been increasingly sidelined as the company’s approach diverged from his views on the technology’s future. On Tuesday, news broke that he may soon be leaving Meta to pursue a startup focused on so-called world models, technology that LeCun thinks is more likely to advance the state of AI than Meta’s current language models.

Meta Chief Executive Mark Zuckerberg has been pouring countless billions into the pursuit of what he calls “superintelligence,” hiring an army of top researchers tasked with developing its large language model, Llama, into something that can outperform ChatGPT and Google’s Gemini.

LeCun, by his choice, has taken a different direction. He has been telling anyone who asks that he thinks large language models, or LLMs, are a dead end in the pursuit of computers that can truly outthink humans. He’s fond of comparing the current start-of-the-art models to the mind of a cat—and he believes the cat to be smarter. Several years ago, he stepped back from managing his AI division at Meta, called FAIR, in favor of a role as an individual contributor doing long-term research.

“I’ve been not making friends in various corners of Silicon Valley, including at Meta, saying that within three to five years, this [world models, not LLMs] will be the dominant model for AI architectures, and nobody in their right mind would use LLMs of the type that we have today,” the 65-year-old said last month at a symposium at the Massachusetts Institute of Technology.

LeCun has been talking to associates about creating a startup focused on world models, recruiting colleagues and speaking to investors, The Wall Street Journal previously reported. A world model learns about the world around it by taking in visual information, much like a baby animal or young child does, versus LLMs, which are predictive models based on vast databases of text. (…)

Jeffrey Gundlach Warns of ‘Garbage Lending’ as Private Credit Booms

In markets awash in “garbage lending” and unhealthy valuations, Jeffrey Gundlach is keeping his strategy simple: load up on cash and stay away from private credit.

One of Wall Street’s bond kings is spotting overpriced assets almost everywhere he looks. In an episode of the Odd Lots podcast recorded to mark the show’s 10-year anniversary, Gundlach called out nosebleed valuations in the equity market and warned investors against “incredibly speculative” bets.

The DoubleLine Capital founder recommends a 20% cash position to hedge against a market implosion — one he sees brewing in unsafe lending to private companies and overblown hopes for artificial intelligence.

“The health of the equity market in the United States, it’s among the least healthy in my entire career,” Gundlach said. “The market is incredibly speculative and speculative markets always go to insanely high levels. It happens every time.”

The veteran debt investor is concerned the $1.7 trillion private credit market is engaging in “garbage lending” that could tip global markets into their next meltdown. The collapse of auto lender Tricolor Holdings and car-parts supplier First Brands Group has lent new urgency to what’s an oft-repeated narrative for Gundlach.

“The next big crisis in the financial markets is going to be private credit,” he said. “It has the same trappings as subprime mortgage repackaging had back in 2006.”

That warning sets the stage for Gundlach’s broader critique of market excess, which stretches from risky loans to frothy tech stocks. He sees the clearest signs of speculative behavior in bets on AI and data centers. (…)

“Financial assets broadly should have a lower allocation than typical,” Gundlach said. “The trouble always comes in financial markets when people buy something that they think is safe. It’s sold to them as safe, but it’s not.”