![]() Note: I am currently travelling. Hence the more limited postings.

Note: I am currently travelling. Hence the more limited postings.

Nvidia’s Upbeat Forecast Soothes Fears of AI Spending Bubble

Nvidia Corp. delivered a surprisingly strong revenue forecast and pushed back on the idea that the AI industry is in a bubble, easing concerns that had spread across the tech sector.

The world’s most valuable company expects sales of about $65 billion in the January quarter — roughly $3 billion more than analysts predicted. Nvidia also said that a half-trillion-dollar revenue bonanza due in coming quarters may be even bigger than anticipated.

The outlook signals that demand remains robust for Nvidia’s artificial intelligence accelerators, the pricey and powerful chips used to develop AI models. Nvidia had faced growing fears in recent weeks that the runaway spending on such equipment wasn’t sustainable. (…)

Nvidia’s CEO had said last month that the company has more than $500 billion of revenue coming over the next few quarters. Owners of large data centers will continue to spend on new gear because investments in AI have begun to pay off, he said.

Chief Financial Officer Colette Kress went further on Wednesday, indicating that Nvidia would likely eclipse the $500 billion target.

“There’s definitely an opportunity for us to have more on top of the $500 billion that we announced,” she said on the conference call. “The number will grow.”

The growing role of AI will help maintain demand for Nvidia’s products, Huang said. The technology is helping speed up existing computing work, such as search. And it’s about to come to the physical world in the form of robots and other devices.

Nvidia’s third-quarter results also topped analysts’ estimates. Revenue rose 62% to $57 billion in the period, which ended Oct. 26. Profit was $1.30 a share. Analysts had predicted sales of $55.2 billion and earnings of $1.26 a share.

Nvidia’s main data center unit had revenue of $51.2 billion in the quarter, compared with an average estimate of $49.3 billion. Chips used in gaming PCs — once the company’s chief source of revenue — delivered sales of $4.3 billion. That compares with an average estimate of $4.4 billion.

The forecast for the latest quarter reflects a staggering run for the company. Sales will be up more than 10-fold from where they were in the same period just three years ago. (…)

“Our forecast for China is zero,” Huang said in a Bloomberg Television interview. “We would love the opportunity to be able to reengage the Chinese market with excellent products.” (…)

On the conference call, Huang was questioned about the deals with OpenAI and Anthropic. Huang said Nvidia’s investment in OpenAI, which still hasn’t been finalized, will provide a good return, he said. Backing Anthropic, meanwhile, will help establish ties with a company that hasn’t been a big user of Nvidia’s technology, he said. (…)

Huang said Wednesday that the competitive pressure remains low. More customers are coming to Nvidia after trying out alternatives than ever before, he said. The complexity of AI computer systems has put Nvidia in a strong position, Huang said.

The CEO is also pushing to spread the use of AI across more of the worldwide economy. The CEO has embarked on a globe-trotting tour to persuade government bodies and corporations to deploy his technology. (…)

The Santa Clara, California-based company still has more than 90% of the market for AI accelerator chips. It’s added other products to that lineup to help solidify its edge, including networking, software and other services.

“Business is very strong,” Huang said in the interview. “We have done a good job planning for a very strong year.”

Nvidia Corp. Chief Executive Officer Jensen Huang said his company has enough new Blackwell chips to meet increasing demand and that business is “very, very strong.”

Speaking on Bloomberg Television, Huang offered a new insight into comments made earlier during his company’s third-quarter earnings report. His reference to the Blackwell product line being “sold out” meant that existing chips were being used at maximum capacity by customers, he said.

“We’ve planned our supply chain incredibly well,” Huang said. “We have a bunch of Blackwells to sell.” (…)

Huang also said Nvidia is getting an increasing portion of data center spending because its products are adding more capabilities. The forthcoming Vera Rubin generation will deliver about $35 billion of revenue for Nvidia out of the roughly $55 billion spent on each gigawatt of computing power, Huang said.

“Look Ma, no China last quarter!”

President Donald Trump plans to roll out a “Genesis Mission” as part of an executive order to boost US artificial intelligence efforts on Monday at the White House, according to a Department of Energy official.

The effort is intended to signal that the Trump administration sees the coming AI race as important as the Manhattan Project or space race, Department of Energy Chief of Staff Carl Coe said Wednesday at the Opportunities in Energy Conference in Knoxville, Tennessee.

“We see the Genesis Mission as equivalent,” Coe said.

Coe declined to provide additional detail, but said the order would likely direct national labs to do more work on emerging AI technologies and could involve public-private partnerships.

The Trump administration is also preparing a separate executive order for the president’s signature that would allow the Department of Justice to sue states over artificial intelligence regulations it deems unconstitutional, and threaten funding cuts to states with AI laws considered too burdensome or restrictive. (…)

At a Saudi investment conference on Wednesday, Trump said he would work with partners “to build the largest, most powerful, most innovative AI ecosystem in the world.”

“And we are going to work it so that you’ll have a one approval process to not have to go through 50 states,” Trump said, adding that a patchwork of state-level regulations would be “a disaster” because business could be derailed by “one woke state.”

On Tuesday, Trump called on lawmakers to pass a federal standard governing artificial intelligence either in an upcoming defense spending bill or as standalone legislation.

“If we don’t, then China will easily catch us in the AI race,” Trump said in a social media post. (…)

Trump in July unveiled a sweeping AI policy blueprint designed to make it easier for AI companies to grow in the US, and easier for US allies to acquire crucial hardware and software.

That blueprint encouraged the Department of Energy and other agencies to invest in “automated cloud-enabled labs for a range of scientific fields, including engineering, materials science, chemistry, biology, and neuroscience” in collaboration with the private sector and national laboratories. It also directed the administration to expand AI research and training at the labs. (…)

That sounds smart and serious enough. Hopefully, there will be enough American scientists with sufficient research budgets …

White House officials are urging members of Congress to reject a measure that would limit Nvidia Corp.’s ability to sell AI chips to China and other adversary nations, according to people familiar with the matter, dimming prospects for legislation opposed by the world’s most valuable company.

The so-called GAIN AI Act would create a system that requires chipmakers to give Americans first dibs on AI chips that are controlled for export to China and other arms-embargoed countries — an “America first” framing designed to appeal to the Trump administration. That would effectively bar Nvidia and Advanced Micro Devices Inc. from selling their best products to the Asian country, making GAIN AI something of a bipartisan congressional pushback to President Donald Trump’s suggestions that he is open to such shipments. (…)

Killing GAIN AI would not, however, mean the end of China chip curb efforts on Capitol Hill, where there is broad bipartisan support for limiting Beijing’s AI ambitions. Lawmakers have separately begun working on a measure that would codify existing limits on AI chip sales to the Asian country. That simpler legislation, which has not previously been reported, would require the Commerce Department, which oversees approvals of restricted technology shipments, to deny all applications for sales to China of any AI chips that are more powerful than what the US currently allows, effective for 30 months.

The fate of both bills remains undecided. Lawmakers are still considering whether to include GAIN AI in an annual defense bill that’s under discussion, while also determining when to introduce the second bill, which is called the Secure and Feasible Exports, or SAFE, Act of 2025. All told, the situation makes clear the significant appetite in Congress to play a bigger role in the wonky world of semiconductor export controls, a national security policy area that’s risen to the forefront of the tech and trade war between Washington and Beijing. (…)

Xi’s administration has discouraged Chinese companies from using even the AI chips that the US has permitted Nvidia to sell. (…)

Every company would be affected if the AI bubble were to burst, the head of Google’s parent firm Alphabet has told the BBC.

Speaking exclusively to BBC News, Sundar Pichai said while the growth of artificial intelligence (AI) investment had been an “extraordinary moment”, there was some “irrationality” in the current AI boom.

It comes amid fears in Silicon Valley and beyond of a bubble as the value of AI tech companies has soared in recent months and companies spend big on the burgeoning industry.

Asked whether Google would be immune to the impact of the AI bubble bursting, Mr Pichai said the tech giant could weather that potential storm, but also issued a warning.

“I think no company is going to be immune, including us,” he said.

In a wide-ranging exclusive interview at Google’s California headquarters, he also addressed energy needs, slowing down climate targets, UK investment, the accuracy of his AI models, and the effect of the AI revolution on jobs. (…)

Mr Pichai said the industry can “overshoot” in investment cycles like this.

“We can look back at the internet right now. There was clearly a lot of excess investment, but none of us would question whether the internet was profound,” he said.

“I expect AI to be the same. So I think it’s both rational and there are elements of irrationality through a moment like this.”

His comments follow a warning from Jamie Dimon, the boss of US bank JP Morgan, who told the BBC last month that investment in AI would pay off, but some of the money poured into the industry would “probably be lost”. (…)

Mr Pichai said action was needed, including in the UK, to develop new sources of energy and scale up energy infrastructure.

“You don’t want to constrain an economy based on energy, and I think that will have consequences,” he said. (…)

Power consumption has grown 20 gigawatts from the previous winter, the North American Electric Reliability Corp. said Tuesday in its winter assessment. A gigawatt is the typical size of a nuclear power reactor. Supply hasn’t kept up.

As as result, a repeat of severe winter storms in North America that unleash a polar vortex, of which there have been several in recent years, could trigger energy shortfalls across the US from the Northwest to Texas to the Carolinas. All regions have adequate resources in normal conditions.

“Data centers are a main contributor to load growth in those areas where demand has risen substantially since last winter.” Mark Olson, manager of the reliability assessment, said in an emailed statement. (…)

From John Authers’s column:

(…) the Bureau of Labor Statistics announced Wednesday. September unemployment numbers will belatedly be available a few hours after this newsletter is published, but October’s will never appear. November’s will be published only after the Federal Open Market Committee meeting in December.

As the case for lowering rates rests on rising unemployment, and the Fed is data-dependent, this sharply reduces the chances of a cut.

A cut next month is unlikely but not impossible. Really poor data over the next couple of weeks might just sway enough votes on the committee. But recent comments from members make it look less likely. That point was amplified by Wednesday’s publication of the minutes for the last FOMC meeting, which confirmed that it had been very divided and revealed that “many” thought a December rate cut would not be appropriate. It made clear that the drift toward giving unemployment greater importance relative to inflation had halted.

China Weighs New Property Stimulus Package as Crisis Lingers

China is considering new measures to turn around its struggling property market, as concerns mount that a further weakening of the sector will threaten to destabilize its financial system, according to people familiar with the matter.

Policymakers including the housing ministry are considering a slew of options, such as providing new homebuyers mortgage subsidies for the first time nationwide, said the people, asking not to be identified discussing a private matter. Other measures being floated include raising income tax rebates for mortgage borrowers and lowering home transaction costs, one of the people said.

“The relaxation of fiscal policy is in line with our previous expectations, and reducing taxes and fees will moderately boost home buying activities,” said Jeff Zhang, a property equity analyst at Morningstar Inc. “We believe that the confidence of homebuyers still needs further stabilizing property prices to recover.” (…)

The dim outlook for the property market, coupled with households’ weakened ability to repay mortgages and other personal loans, means that banks’ asset quality could deteriorate next year, Fitch Ratings analysts warned last month. Chinese banks’ bad loans surged to a record 3.5 trillion yuan ($492 billion) at the end of September.

The plan to subsidize interest costs on new mortgages is intended to lure back homebuyers, who have been reluctant to enter a free-falling market.

While they may give a short-term boost, the steps are “probably not bold enough” to fix the supply-demand imbalance in the property market, Eric Zhu of Bloomberg Economics wrote in a note. “Cheaper mortgages may not help much if people don’t want to borrow.”

The average mortgage rate for buyers’ first homes in 42 big cities has hovered around 3.06% in recent months (…).

Meanwhile, Chinese consumers remain firmly in deleveraging mode, hindered by soft income expectations and growing uncertainties in a slowing economy. Outstanding residential mortgages shrank in the second and third quarter to 37.4 trillion yuan and are now down 3.9% from a peak in early 2023.

Hundreds of billions of yuan of mortgages are likely in negative equity — a trend likely to intensify — which will weigh on buyers’ confidence and contribute to further home-sale declines. That risks deeper erosion of Chinese property developers’ inventory as well as the recovery value for bondholders.

They really need to get serious soon…

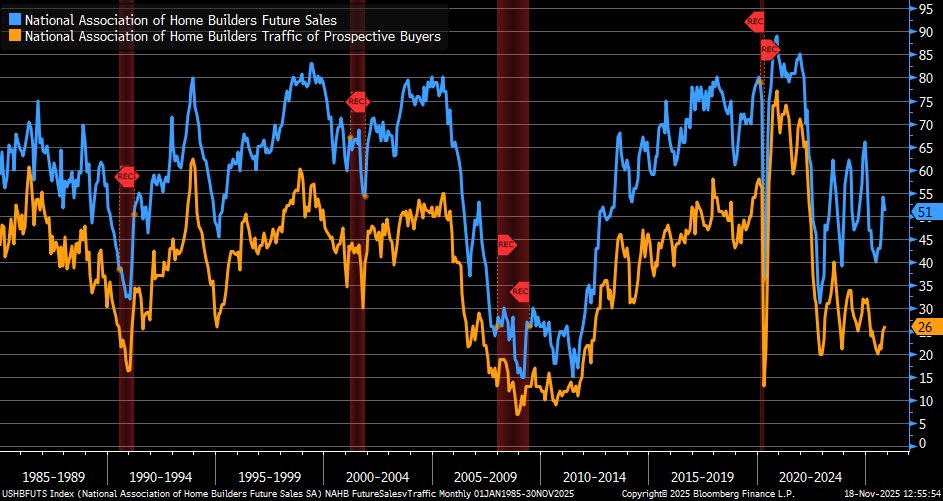

The USA also has its own housing challenges. The yellow line on this chart from Liz Ann Sonders shows the continued lack of interest in new housing, much like in 2006-10.

Shale Oil’s Next Revolution Should Worry OPEC

Even after years of technological breakthroughs, the shale industry still leaves most of the oil underground. At best, American drillers siphon away 15% to 10% of what’s potentially available; the rest has remained thousands of feet under the surface. Until now.

The next phase of the revolution — call it shale 4.0 — is an engineering arms race to improve the so-called recovery factor. Increasing the ratio even by a single percentage point is a prize worth billions of dollars over the lifetime of thousands of wells in Texas, New Mexico, North Dakota and Colorado. “The best place to find oil is where you already know you’ve got oil,” Chevron Corp. Chief Executive Officer Mike Wirth tells me in an interview in New York. “We know where the oil is. If we left 90% of the oil behind, it would be the first time in history that we didn’t figure out how to do it.”

If engineers are successful, it would turn shale from a sprinter into a marathon runner. The impact won’t be another gusher, but a steady flow of barrels far longer into the future than the industry anticipated. And the more the US provides, the less other sources — above all, the OPEC+ cartel — can pump without undermining prices. (…)

Lightweight proppants help, but until recently their high cost, at roughly $1 million per well, outweighed the profit of the extra oil. Exxon is experimenting with a new formula that the company says is cheaper, using particles of petroleum coke, a byproduct of its own refineries. The company claims that well recovery can improve by as much as 20%; the industry remains skeptical. Exxon is using its newly patented proppant in a quarter of all its wells in the Permian basin, and plans to expand it to roughly 50% by the end of next year. Others are playing with their own lightweight formulas, hoping to mirror the results.

Chevron, meantime, is trying a form of soap. The company already has a big business making petrochemicals such as lubricants. Thus, it’s tapping its in-house engineering talent to find cheap surfactants that can reduce friction inside the oil reservoirs. As with proppants, the problem in the past has been cost. But Chevron believes it’s developing formulas that work and are cheap. (…)

It’s not “if” but “when”. Shale 4.0 will happen.