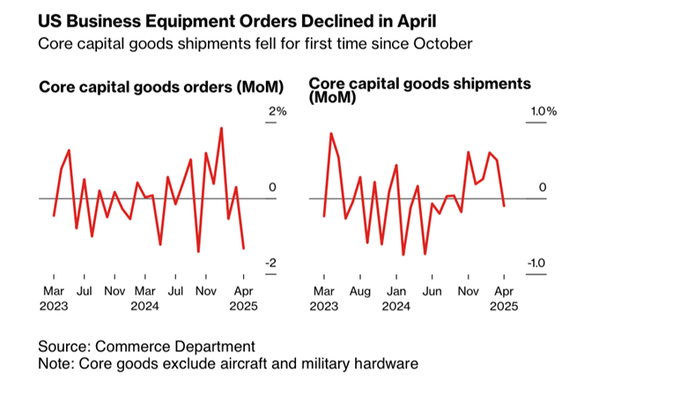

US Core Capital Goods Orders Decrease by Most Since October

The value of core capital goods orders, a less-volatile proxy for investment in equipment that excludes aircraft and military hardware, decreased 1.3% last month after an upwardly revised 0.3% gain in March, Commerce Department figures showed Tuesday. Such shipments fell 0.1%, the first decline since October. (…)

Orders for motor vehicles, electrical equipment and appliances, communications equipment and primary metals fell last month. (…)

New orders for nondefense capital goods ex-Air peaked in mid-2022 and remain 10% above pre-pandemic levels while spending on goods, nominal and real, keep rising. Americans splurge on goods with government money, significantly boosting imports with little sustained benefits to domestic manufacturers. Note also the strong goods inflation during and post pandemic.

Consumer Confidence: Not Optimistic, but Less Pessimistic

(…) For five straight months, consumer confidence had been heading lower. In May, consumer confidence rebounded a sharp 12.3 points to 98.0. The Present Situation Index rose a touch to 135.9, the highest reading in three months. Yet, the Expectations Index has jumped a stark 17.4 points to 72.8, highlighting increased consumer optimism about the outlook. This rebound is a welcome step in the right direction, but like the deal with China it may prove only a temporary reprieve until we get clearer long-term clarity on trade policy.

Given the ever-changing headlines pertaining to U.S. trade policy, the survey cutoff dates are important to take note of in each consumer confidence release. The May survey cutoff date was May 19, and the press release noted that close to half of the responses were collected after the May 12 announcement of a 90-day pause on the sky-high “reciprocal” tariff on China.

Relative to the April report, the survey period in May was a more ‘upbeat’ period for U.S. trade policy having covered a period of deescalation. Notably, the survey cutoff date came before recent announcements late last week proposing hiked tariffs on the European Union and Apple. (…)

Households’ assessment of business conditions and the labor market both improved in May. The share of households seeing worsening business conditions fell to 26.7%, down from 34.9% last month. Those expecting business conditions to improve rose to 19.7% from 15.9% previously. It bears noting that even with the improvement in May the situation is only less dire; more households see conditions worsening rather than getting better.

Income expectations rebounded with 18.0% of households expecting income to rise and 13.8% expecting income to fall over the next six months. The labor market remained a chief concern of households; the labor differential declined to an eight-month low of 13.2%. Furthermore, the share of consumers expecting fewer jobs over the next six months declined a bit to 26.6%, a month after it hit 32.4%, the highest since 2009. Although layoffs remain low, fears about inflation and trade policy are weighing heavily on their mindset.

Today’s consumer confidence numbers stand in contrast to the wilting sentiment already reported separately by the University of Michigan. The headline Consumer Sentiment Index dropped to 50.8 in May, the second-lowest point the index has ever reached going back to 1978. Inflation worries remained top of mind; median year-ahead inflation expectations jumped to 7.3%, while long-term inflation expectations (5–10 years ahead) rose to 4.6%, the highest long-term inflation expectations since 1991.

We tend to rely more heavily on the consumer sentiment release for consumers views of inflation, but according to this release, consumers’ inflation expectations came in a bit after spiking in April. On Friday we will get the latest read on the Fed’s preferred inflation gauge—the PCE deflator. For now, we estimate that inflation remained in check in April, but later this year, we look for expectations of today to become the price reality of the future with goods inflation as the key factor in preventing the Fed from getting inflation down to the 2.0% target.

Goldman Sachs has the inflation charts:

The Atlanta Fed Survey of Business Uncertainty (SBU) is an innovative panel survey that measures one-year-ahead expectations and uncertainties that firms have over their own employment and sales. The sample covers all regions of the U.S. economy, every industry sector except agriculture and government, and a broad range of firm sizes.

Expectations on both sales and employment growth have declined YtD:

The latest job postings on Indeed (through May 16) are 3% lower than the latest JOLTS data for March:

John Authers: The TACO Trade Is On

This one was christened by friend and former colleague Rob Armstrong of the Financial Times. TACO stands for Trump Always Chickens Out. I wish I’d thought of that one. Traders have noted the president’s propensity to make threats, scare the market, and then pull back. Now they are skipping the selloff, and assuming that Trump always caves. The fast-disappearing 50% tariffs on the European Union was the greatest example, as we showed yesterday:

Adding ballast to the TACO case is the link between consumer confidence, angst over tariffs, and presidential approval. Voters approve of Trump chickening out on tariffs, and traders assume that the president has also noticed this. Maybe his improving approval rating emboldened him to threaten a new tariff on the EU:

The TACO assumption is that henceforward Trump 2.0 will be like Trump 1.0: tax cuts, deregulation, and fiscal largesse. One problem with this is that if the bond vigilantes have really been appeased, that implies no fiscal stimulus for everyone to feast on; two positive narratives are in direct conflict.

There is another problem. If his threats are merely negotiating tactics and seen as such, then they’re useless in a negotiation. Trump has broadcast his enthusiasm for tariffs for decades before he entered politics, and even after his climbdowns, tariffs are the highest in decades. It’s not clear he will always back off. Which leads to a third problem: that TACO traders are too confident by half. Peter Atwater of Financial Insyghts suggests the trade is now so brazen as to signal trouble ahead:

The open air grifting feels like it has now reached bubble status. The collective invulnerability is palpable with participants at all levels believing it is unstoppable. No one believes the crowd’s moral compass will swing back. Put simply, it feels like something big is about to happen.

Congress Sleeps Through an Economic Wake-Up Call

By Gerard Baker, Editor at Large of The Wall Street Journal:

(…) But the specifics of the measure are less important than the overall picture of political dysfunction and economic ineptitude. Instead of doing its part to facilitate the better parts of Mr. Trump’s economic ideas and acting as constitutional ballast against the bad parts, Congress is diluting the good stuff and doubling down on the madness. So bigger tax cuts driven by the pursuit of narrow short-term political advantage, allied to minimal spending restraint, are unfolding alongside the administration’s ruinous (and almost certainly unlawful) global trade and international economic policies.

All of this casts bigger doubt on the durability of America’s unique model of market-driven, innovation-led, private-sector-generated growth. We are witnessing all the signs of advancing economic derangement at the public-sector level: policy unpredictability, fiscal disorder and erratic interventionism on the shifting whims of a mercurial leader. This great republic is moving steadily up the steep curve of the banana.

We have a president who makes radical changes to tariffs based on economically dim views about international trade, who then changes and unilaterally changes them again with no notice or consultation, who believes he has the authority to tell companies like Walmart what they should be charging their customers and companies like Apple exactly where and how they should source their production, who seems intent on discouraging the brightest minds in the world from coming to the U.S., where they have contributed to America’s world-beating success in science, technology, innovation and entrepreneurship for decades.

We have a Congress that unilaterally surrenders its constitutional responsibility over much of this policymaking and weighs in happily to compound the problem with politically expedient and economically reckless contributions of its own.

And yes, before you object, this after four years of a Democratic administration with a complaisant Congress that seized the opportunity presented by a dementia-disabled president to advance its own radical and economically ruinous goals.

In 2025 the value of the U.S. dollar has declined by almost 10% against other currencies. Since “Liberation Day,” the interest rate investors demand to hold the safest of risk-free assets, 10-year U.S. government debt, has risen by half a percentage point to 4.5%. The spread between U.S. and German 10-year bond yields has increased by almost a full percentage point this year. This is a reflection of rising concern about U.S. fiscal sustainability as well as an attempt by markets to price the cost of policy uncertainty, capricious governing and instability.

For the past decade, American business has enhanced its advantage over the rest of the world, innovating in artificial intelligence, biotech and finance, boosting its productivity. Most of that has been achieved not because of policy but in spite of it. If investors begin to see American private-sector Gullivers tied down by political Lilliputians, our economic powerhouse constrained by erratic, unstable and obstructive government, the threat to American supremacy is real. Lawmakers may want to stay awake for that.

Asia’s $7.5 Trillion Bet on US Assets Is Suddenly Unravelling

For decades, Asia’s export powerhouses had a simple financial strategy: Sell goods to the US, then invest the proceeds in American assets.

That model is now facing its biggest threat since the 2008 global financial crisis as Donald Trump tries to remake global trade and the US economy — upending the logic behind $7.5 trillion of investments from Asia. Some of the world’s biggest money managers say an unwind is just getting started.

For those caught flat-footed by the shift, the pain has already been severe. A selloff in the dollar after Trump slapped tariffs on most of the world had Taiwanese insurers reporting a $620 million loss in April alone. Then, a surge of as much as 8.5% in the value of the Taiwan dollar over two days in early May raised the prospect of $18 billion in currency losses for their unhedged US investments.

Even before Trump’s second presidency, capital flows from Asia to the US were off their historic peaks. There are now signs the trend will accelerate, with Japan’s largest life insurer looking for alternatives to US sovereign bonds, family offices cutting or freezing investments, and a $96 billion Australian pension fund declaring a peak in its allocation. The latest data show China shrank its Treasuries holdings in March.

“We are in a shifting world order and I do not believe that we will go back to the state of things as we had before,” says Virginie Maisonneuve, London-based global chief investment officer equity at Allianz Global Investors, which oversees €571 billion ($649 billion) in assets. “It is an evolution from the World War Two order and is partially triggered by China rivaling the US in economic and technology terms.’’ (…)

The switch from hoarding dollar assets to doubting US exceptionalism may send $2.5 trillion or more cascading through global markets, according to Eurizon SLJ Capital Chief Executive Officer Stephen Jen. In that scenario, emerging-market currencies will soar against the dollar, equities from Europe to Japan will benefit from inflows, while new capital swells debt markets in countries including Australia and Canada, asset managers and analysts said. (…)

In the early 2000s, almost every dollar earned by the largest Asian exporters to America was reinvested back into its equity and bond markets given the high returns and growth seen in the world’s biggest economy.

The Global Financial Crisis of 2008 was a “major wake-up call,” exposing the fragility and risks in US markets, says David Gibson-Moore, president and chief executive officer of Gulf Analytica, a Dubai-based wealth advisory firm with Asian clients. Over the last decade, “sovereign wealth funds, family offices and institutional investors across Asia have gradually been rebalancing their portfolios to reduce overexposure to US assets.” (…)

By 2024, Asia’s capital inflows into the country had dropped to $68 billion, making up just 11% of trade surpluses with the US that had continued to expand. Exports had ballooned in the past few years, aided by a strengthening dollar and a rebound in American consumption after Covid. (…)

The president’s pledge to bring manufacturing back to the US, along with his frequent complaints about how other countries weakened their currencies to gain a competitive edge, was directly in opposition to the Asian export-growth model. (…)

In early May, speculation built that Taiwan would be asked to strengthen its currency as part of US trade talks. A two-day surge in the Taiwan dollar shocked traders and companies alike. The speed of the advance — unseen since at least the 1980s — threatened to sink the value of the $294 billion of Treasuries held by Taiwan, some of it by the island’s life insurers, which hadn’t hedged for such a development. After all, the currency had weakened against the dollar in the prior three years. Its government said later that more than 90% of the companies’ overseas investments were dollar denominated.

Even before that shock, Taiwanese life insurers — which were in effect recycling the trade surplus earned from the island’s semiconductor exports to the US — had posted a $620 million loss in April from the market volatility triggered by Trump’s tariffs. Goldman Sachs Group Inc.’s analysts estimated that a 10% appreciation in the Taiwan dollar could lead to $18 billion in unrealized currency loss for insurers, wiping out capital reserves. (…)

“The Taiwan dollar episode is not an isolated event — it was a wake-up call for markets. The question now is: who’s next?”

There are indicators suggesting that Asian currencies are severely undervalued.

On average, the region’s major currencies — including the yen and yuan — are trading at 57% weaker than exchange rates that take into account differences in the costs of living, according to data compiled by Bloomberg News going back to 2007. That’s close to an all-time low of 59% set in mid-2024.

Even though Washington has denied it plans to include currency policy pledges in trade agreements, the meetings have prompted strategists to raise the specter of Asian companies racing to unwind dollar positions. Eurizon’s Jen, known for his “dollar smile” framework predicting gains for the currency when the US economy is either booming or slumping, suggested that Asian capital outflows could hit like an avalanche, with many missing warning signs.

“They’re symptomatic of the structural shift that is ongoing,” Gavekal’s Sikand says, referring to the strengthening of the yen and Taiwan dollar. “You have to diversify risk and the best way to diversify risk is to bring capital closer home.”

China had already been cutting back on its investments given a worsening relationship with the US.

Data from the US Treasury show that the Asian nation sold a net $172 billion worth of American equities and bonds last year, adding to the $64 billion in 2023. The data may be incomplete, with some analysts pointing out that Chinese funds could have masked purchases of those securities through proxies in other countries. Still, the years of reductions and a decline in Treasury holdings in March indicate that the risks of such a historic readjustment aren’t one-sided. There’s danger for US markets, too.

China and Japan hold a combined $1.7 trillion of Treasuries. During the April bond rout sparked by the tariffs, speculation was rife over whether either of these two countries were selling or will use their holdings as leverage given how Trump’s decision to scale back tariffs later was influenced by soaring yields. Even if they didn’t, the possibility that the Asian nations will buy less debt in the future is alarming as proposed US tax cuts are expected to expand the budget deficit.

Nippon Life Insurance’s headquarters in Tokyo. Japan’s largest life insurer is looking to diversify away from US sovereign bonds.Photographer: Kiyoshi Ota/Bloomberg

Many in Asia are now planning for a fundamental shift in the global trading regime, even if Trump reduced tariffs and embarked on talks. The unpredictability of his administration adds to the worry, according to Gulf Analytica’s Gibson-Moore, added that the US has gone from a haven to a source of volatility for many family offices in Asia.

Nippon Life Insurance Co., Japan’s largest life insurer, is looking for alternatives to Treasuries in Europe, Australia and Canada because the “US makes up a lot of our sovereign bond portfolio,” said Chief Investment Officer Keisuke Kawasaki.

UniSuper, one of Australia’s biggest pension funds with A$149 billion ($96 billion) of assets, said in early April that its investments in the US have probably peaked and plans to cut exposure as Trump “is turning out to be horrible for business.” This marked an about-turn from February when it was part of an industry road show looking for ways to invest more. (…)

About 10 family offices and advisers who oversee billions of dollars have also said they’re cutting exposure or freezing investments, mostly in US equities and Treasuries. (…)

“For this to be structural, you should know where to go,” says Alicia Garcia Herrero, chief Asia-Pacific economist at French bank Natixis SA in Hong Kong, who instead posits that this is so far a cyclical shift. “Nobody gives the return that the dollar has been giving. Nobody.” (…)

Data show money is already flowing into Japan, as its economy recovers from deflation and 30-year bond yields touched a record high. Foreign investors bought a net ¥8.2 trillion ($57 billion) of Japanese bonds and stocks in April, preliminary data from the nation’s Ministry of Finance showed. That’s a record based on balance-of-payments data going back to 1996.

There’s room for a reallocation given bets on US exceptionalism — that its economy will outperform peers — have led to a dominance of its markets. For example, Japanese stocks make up just 5% of the MSCI global equity gauge, while China accounts for about 3%. Their markets, including Hong Kong, have a combined market capitalization 1of around $23 trillion. The US accounts for 64% of the gauge, with a value of around $60 trillion. (…)

“The extreme concentration has probably peaked for now,” says Shaniel Ramjee, co-head of multi asset at Pictet Asset Management in London. “Stabilization in China will mean that the emerging markets, especially Asia in general, will attract a lot more capital, especially domestic capital.” (…)

“Trump-era tariffs and policy volatility have reshaped risk frameworks,” says Steve Alain Lawrence, chief investment officer of Balfour Capital Group, a $400 million investment manager based in Switzerland. “He’s accelerating preexisting de-dollarization and decoupling moves.”

Also (via Perplexity.ai):

The data shows that while the yuan’s share on SWIFT appears modest, China is indeed conducting substantial yuan transactions outside the SWIFT system and actively building alternatives to reduce dependence on the US-dominated network.

China’s domestic cross-border payment data reveals a dramatically different picture. The yuan surpassed the US dollar to become China’s most-used cross-border payment currency over a year ago. By March 2025, yuan’s cross-border usage reached a record $724.9 billion, representing 54.3% of all China’s cross-border transactions. In comparison, the US dollar accounted for only 43% of China’s cross-border payments, with the yuan at 53%.

China has been building the Cross-Border Interbank Payment System (CIPS) as a direct alternative to SWIFT. Unlike SWIFT, which is primarily a messaging network, CIPS provides actual clearing and settlement services for RMB transactions. As of May 2024, CIPS has over 1,530 direct and indirect participants across major global cities and regions.

The Chinese government has explicitly stated its intention to reduce dependence on the dollar-dominated system. In April 2025, China released an action plan to enhance CIPS functionality and expand its global coverage, specifically aiming to reduce reliance on SWIFT amid escalating trade tensions with the US5.

China has further advanced its SWIFT alternative through digital currency initiatives. Reports indicate that China’s digital RMB cross-border settlement system is now fully connected to 10 ASEAN nations and six Middle Eastern countries, potentially allowing about 38% of global trade to bypass the US dollar-dominated SWIFT network. Test transactions have demonstrated remarkable efficiency improvements, with payments settling in as little as 7 seconds compared to SWIFT’s 3-5 day timeframe, while reducing fees by up to 98%.

GM Invests in V-8 Engines as It Backpedals on EVs New $888 million plan marks GM’s largest investment in an engine plant

General Motors has abandoned a plan to pump $300 million into electric-vehicle motor production at its upstate New York plant and will instead invest $888 million to make the latest V-8 engines. (…)

The company said Tuesday its new plan marks its largest single investment in an engine plant and makes Tonawanda its second propulsion plant to produce the sixth generation of V-8 engines. (…)

The investment shows the company’s commitment to strengthening American manufacturing and supporting U.S. jobs, Chief Executive Mary Barra said.

Just 4 days ago, also in the WSJ:

(…) In 2024, GM hired one of the most experienced battery geeks on the planet to head its battery and sustainability efforts. Kurt Kelty is a 30-year veteran of the industry who spent 11 years at Tesla leading the company’s pathbreaking efforts to perfect this most critical EV component.

“I’m a firm believer,” in the global shift to EVs, says Kelty. Switching to an electric powertrain means better performance, less maintenance, more space inside the vehicle, a lower center of gravity and a higher crash rating, he adds. Evolution away from fossil fuels is “unstoppable.”

Worldwide, EV sales rocketed 30% in March of 2025 compared with the year before. (…)

GM recently unveiled a new type of battery the company has been working on for a decade called lithium manganese-rich batteries, or LMR. These batteries combine the low cost of LFP batteries with the longer range of conventional, expensive lithium-ion batteries.

What makes LMR batteries more affordable is that they use far less nickel, cobalt and other minerals that have become increasingly expensive. Instead, they use more manganese, a common element.

LMR batteries have been a laboratory curiosity for decades, with a number of shortcomings that GM’s engineers had to overcome. A change in the shape of the battery—big rectangles instead of flat pouches—has proven particularly amenable for trucks and other larger vehicles. This could give such vehicles nearly the range of today’s most expensive, energy-dense battery packs at around 70% of the cost. Ford is also working on this same kind of battery. (…)

Today, the biggest threat to the EV future is the tremendous uncertainty caused by the current administration. What hangs in the balance are incentives for manufacturing and purchasing EVs, and how tariffs will affect the import of raw materials critical for their manufacture, says Whiston.

Since Trump took office, around three dozen separate tariff policy announcements affecting autos have been made, says Mika Takahashi, an automotive technology analyst at IDTechX.

When I ask Kelty when the average American will be able to walk into a dealership and see no difference at all between the price of electric and gas vehicles, Kelty emphasizes that fluctuating material prices are the big unknown.

“If you can tell me where nickel and lithium prices are going to be in three or four years, I can give you a better answer,” he says. “But we just don’t know. There’s lots of volatility in these costs, and that’s probably the biggest question mark.”

Merz says Germany, France, U.K., and U.S. have lifted range limits for weapons sent to Ukraine

Germany, the U.K., France, and the U.S. have lifted restrictions on how far the weapons they supply to Ukraine can reach, German Chancellor Friedrich Merz said on Monday.

“There are no longer any range limits on the weapons being sent to Ukraine — not from the U.K., not from France, not from us. And not from the Americans either,” Merz said, speaking at a forum hosted by the public broadcaster WDR.

The chancellor also said that Germany would “do everything it can” to continue supporting Ukraine. He added that this was one of the reasons he recently traveled to Kyiv with U.K. Prime Minister Keir Starmer, French President Emmanuel Macron, and Polish Prime Minister Donald Tusk as part of the so-called “coalition of the willing.”

According to Merz, lifting the restrictions means Ukraine can now defend itself “by, for example, striking military targets in Russia.” He said that until recently, this had not been happening, except in very rare cases.

Game changer for Ukraine, risk changer for the world.

US vows to use ‘every tool’ in crackdown on international students

The US government says it will use “every tool” to evaluate visa applicants, amid reports that the Trump administration will restrict applications from foreigners seeking to study in the country.

Secretary of state Marco Rubio sent a diplomatic cable on Tuesday ordering US embassies to halt scheduling interviews for new student visa applicants, according to Politico, as the administration tightens screening of applicants’ social media activities. (…)

Studyportals projected that if the current pattern continued, demand for US places could drop 70 per cent year on year in 2025. “Every student who decides against America isn’t just lost tuition money — it’s lost talent,” said Edwin van Rest, co-founder of Studyportals.

- Alice Fishburn in today’s FT:

(…) There’s a certain kind of courage required in packing up your life as a young person and moving to another country. The education you receive is not just of the intellectual variety. You become a hybrid, a person for whom some of your most formative years bear the fingerprints of a culture that is not your own. A person who, regardless of where you ultimately end up, holds an enduring fondness for a place that you chose rather than one you were born in simply as part of the strange genetic lottery. Like all good relationships, this goes two ways. International students may go home but the Americans they live, study and party with do not. The influence of those different to yourself lingers on both sides, a life-long reminder that more is out there, that ideas flow from everywhere.

(…) you don’t have to be an economist to know that these students are also spending their money elsewhere. Their contribution was estimated at $43bn in the last academic year. Some of this boost to the US economy will last beyond graduation. Many will meet romantic or business partners and remain. But stay or go, the lives they build will all owe something to America, whose soft power only grows as a result. (…)

America is a goal, an escape, a meal ticket, a chance, a refuge, an adventure and a challenge — often all at the same time. But few will want to go somewhere where they may be snatched off the streets or turned away at the airport. And so they will look elsewhere and the US will lose out. Meanwhile, academic freedom — that precious, historic, intangible driver of progress that has been part of the American dream for so long — will slowly wither.

Ideas may not be subject to border control but the people who have them surely are. Innovation requires freedom to explore, to roam, to bring in the best the world has to offer and capitalise on it. The ability to invent a life-saving drug or create the next tech giant is hard enough to find without stepping back from the global community. Just ask Elon Musk.

Journalism under pressure amid fear of retribution

Executives at major media outlets are reportedly instructing their newsrooms to temper their coverage of President Trump and his administration amid growing fears of political retribution.

President Trump may not have the political power to pass laws that hurt the press, but his threats of regulatory scrutiny and private lawsuits have proven just as damaging in silencing his critics. (…)