New feature: EDGE AND ODDS’ DaiLY CHAT.

Most days, I will provide a link to an AI generated chat on the day’s post courtesy of Google’s NotebookLM. Not totally satisfying but worth offering to readers on the go. No support charts however and some AI generated conclusions not really mine….

And there is much more on the blog itself.

And if you sense hallucinations, editorializing and patronizing, I will totally fault AI ![]() .

.

US Small-Business Optimism Little Changed Ahead of Election NFIB index restrained by pullback in capital spending plans

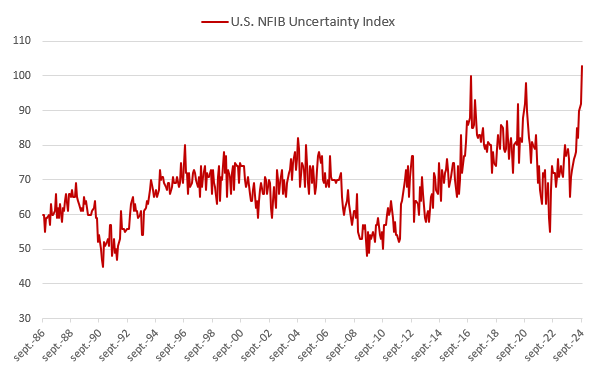

The National Federation of Independent Business optimism index edged up 0.3 point to 91.5 after declining in August by the most in more than two years. The group’s uncertainty index rose 11 points to a record high as small-business owners await the outcome of the November election.

Three of the 10 components that make up the optimism index fell, while five increased and two held steady. The share of firms planning capital expenditures slid by 5 points to 19%, the lowest reading since April 2023. Some 34% of firms reported job openings they couldn’t fill, the smallest share since the start of 2021.

While a net 15% of owners said they plan to create jobs in the next three months, up 2 percentage points from the prior month, hiring plans are still below the levels seen the last time the economy experienced solid growth, NFIB said.

Among those reporting lower profits, 37% blamed weaker sales and 14% said the decline was due to prices of materials. Labor costs were cited by another 13%, and 11% singled out lower selling prices.

-

The sales rating is still recessionary!

-

Comp and prices remain at the high end of the range.

-

Profits are plummeting.

-

Who would hire in these condition?

-

Great chart suggesting 4.5% wage growth ahead.

-

Inventories are very, very low. No confidence.

-

Inflation still the biggest problem.

-

Maximum uncertainty.

-

Same for consumers!!!

Meanwhile, as seen in most consumer spending data, demand is sustained. Large businesses keep ordering lots of goods … from abroad…

@RobinMacNab

-

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 3.2 percent on October 8, up from 2.5 percent on October 1.

-

After recent releases from the US Census Bureau, the Institute for Supply Management, the US Bureau of Labor Statistics, and the US Bureau of Economic Analysis, the nowcasts of third-quarter real personal consumption expenditures growth, third-quarter real gross private domestic investment growth, and third-quarter real government spending growth increased from 3.0 percent, 0.8 percent, and 1.7 percent, respectively, to 3.3 percent, 3.4 percent, and 2.2 percent.

Mexico Wants to Curb Chinese Imports With Help From U.S. Companies Government seeks to strengthen domestic supply chains amid rising trade tension between Washington and Beijing

Mexico wants to reduce its dependence on imports from China and is asking some of the world’s biggest manufacturers and tech firms operating in the country to identify Chinese products and parts that could be made locally.

The administration of leftist President Claudia Sheinbaum, who took office last week, wants U.S. carmakers and semiconductor manufacturers as well as global giants in the aerospace and electronics sectors to substitute some goods and components manufactured in China, Malaysia, Vietnam and Taiwan, said Deputy Trade Minister Luis Rosendo Gutiérrez.

“We want to focus on supporting our domestic supply chains,” Gutiérrez said in an interview. Talks with foreign companies have been informal, he said. (…)

The initiative comes as the Sheinbaum administration gears up for a review of the U.S.-Mexico-Canada Agreement in 2026. Consultations on the trade pact are set to begin in the second half of 2025, according to the document.

The talks among the three North American trading partners are expected to be more complex than in 2018 when the USMCA was signed to replace its forerunner Nafta, according to the presentation. Subjects to be discussed are expected to include trade with China and requirements for increased North American content in goods imported tariff-free into the U.S.

U.S. legislators and industry groups have raised concerns about China using Mexico as a back door to circumvent U.S. import tariffs. Mexican officials say that there is no evidence supporting such claims. “Mexico isn’t a springboard from Asia to the U.S.,” Gutiérrez said. (…)

Another executive at one of the firms approached by Mexican authorities said there is one big challenge: Mexico lacks basic infrastructure to substitute some high-end Chinese goods and components. That includes securing enough water and electricity to power up industrial parks. (…)

Federal Deficit Hit $1.8 Trillion for 2024, CBO Says U.S. budget shortfalls fueled by interest costs, Social Security, Medicare

(…) In all, the government collected $4.92 trillion in revenue and spent $6.75 trillion, putting the deficit at $1.83 trillion for the year that ended Sept. 30, according to the Congressional Budget Office, which issued its estimates ahead of the official administration tallies expected later this month.

The deficit in 2023 was officially $1.7 trillion, but it was actually larger than that. That is because the government recorded more than $300 billion in spending for student-debt cancellation in 2022 and recorded a similar-size spending cut in 2023 when the Supreme Court blocked President Biden’s program.

After making that adjustment, the deficit was slightly smaller in 2024 than in 2023. Overall, the deficit was 4% smaller than CBO had projected in June. (…)

The latest deficit reading is about 6.4% of gross domestic product. The U.S. has run larger budget deficits before, both in dollars and as a share of GDP. But the country set those records during wars, economic crises and the coronavirus pandemic, not during a period like today’s low unemployment and solid growth. (…)

All estimates carry uncertainty, but Trump’s fiscal proposals would increase budget deficits by $7.5 trillion beyond what would happen if Congress does nothing, according to an analysis from the Committee for a Responsible Federal Budget, or CRFB, which favors deficit reduction. (…)

Democrats, including Harris, say they will use tax increases on top earners and corporations to pay for new programs and reduce deficits. But the CRFB estimated that Harris’s proposals would increase deficits by $3.5 trillion. (…)

China Finance Ministry Calls Press Briefing, Firing Up Stimulus Hopes Sentiment in Chinese equities markets had softened after an earlier briefing by the country’s top state planner offered few concrete measures

The minister will introduce measures to “intensify countercyclical adjustment of fiscal policy,” the notice said, without providing additional details. (…)

Fiscal packages in China are typically designed and announced by the Ministry of Finance and approved by the National People’s Congress rather than the NDRC, CreditSights analysts noted.

“We think that it is too early to rule out any additional fiscal stimulus, but the scale may again fall short of market expectations,” CreditSights’ Zerlina Zeng and Karen Wu said in a note.

In a nod to the concerns of the private sector and investors, Chinese Premier Li Qiang on Tuesday vowed to “listen to the voice of the market” when formulating economic policies. His remarks echoed recent calls by China’s top decision-making Politburo to “face the difficulties squarely,” underscoring Beijing’s renewed urgency to shore up confidence after the economy grew at its slowest pace in five quarters.

Keep in mind that declining government spending has been a drag on economic activity. China’s broad budget expenditure shrank 3% in the first eight months of this year from a year ago.

The problem in China is not a lack of credit, rather a lack of demand as consumers and corporations have very low confidence and are saving and deleveraging. Real estate prices need to clearly stabilize before any lasting recovery in consumption begins.

The Chinese government is clearly aiming at boosting confidence. State controlled media carry positive headlines such as:

- In another tentative sign of stronger consumer sentiment, retail sales during the National Day holiday rose 9% from the same period in 2023, the official Xinhua news agency reported Tuesday, citing data from the State Taxation Administration.

- “The pattern since reopening has been stronger consumption during holidays, only to fade afterwards,” he said.

- #China’s consumption vouchers are boosting spending and may lift retail numbers in October and through 4Q, according to a report in the Securities Daily. *Shanghai saw double-digit growth in offline catering spending during the Golden Week holiday following two rounds of dining voucher issuance, official data show.

But the reality is different when looked in the proper perspective:

Chinese tourists shelled out less money during their long holiday that ended Monday than before the pandemic, even as signs emerged that spending is stabilizing after a barrage of stimulus recently unveiled by the government.

While travelers made 10.2% more trips during the Golden Week break than in 2019, spending only increased by 7.9%, according to data released by Ministry of Culture and Tourism. That means per-trip expenditure actually dropped 2.1% from five years earlier, according to Bloomberg calculations based on the ministry’s figures.

Goldman Sachs illustrates how domestic tourism is rather stable:

Goldman also sets the record straight on recent housing trends:

Despite recent housing easing efforts, property transactions in large cities remained subdued during the National Day Golden Week, although property sales tend to be weak amid long holidays in China.

Based on our estimates, daily average primary market (new) home sales volume was 64% below year-ago level during the National Day Golden Week, and daily average secondary market (existing) home sales volume was 11% below year-ago level during the National Day Golden Week, although anecdotal evidence pointed to an improving sentiment in some cities.

We caution the data quality issue for home transactions during long holidays as some local housing authorities may publish their data in a delayed manner.

Young Chinese found confidence in last week’s vows to stimilate.

- “It’s absolutely going nuts today,” said Liying Wang, director at a local stock brokerage firm in the southern city of Chengdu, who started working in the industry in 1994.

- Her brokerage floor was packed with people rushing to open new accounts, many of whom were born in the late 1990s and early 2000s, and with little patience to wait.

-

The outstanding amount of margin debt in Shanghai and Shenzhen exchanges rose to 1.54 trillion yuan ($218 billion) on Tuesday, up 7.4% from the last trading session on Sept. 30, according to data compiled by Bloomberg. That’s the fastest pace since at least 2013, when data shows an abnormal spike.

-

A gauge tracking transfers from savings accounts into stock accounts by the Industrial & Commercial Bank of China more than tripled on Tuesday from Sept. 30 levels, media reports show.

That was before yesterday’s re-opening.

AI CORNER

Google Talks to Utilities About Nuclear Power for Data Centers AI boom has caused demand for energy to surge globally

Google is working with utilities in the US and other countries to assess nuclear power as a possible energy source for its data centers, underscoring surging interest in using atomic energy to feed the artificial intelligence boom.

“In the US, in highly regulated markets where we don’t have the opportunity to directly purchase power, we are working with our utility partners and the generators to come together to figure out how we can bring these new technologies — nuclear may be one of them — to the grid,” said Amanda Peterson Corio, global head of data center energy at Alphabet Inc.’s Google. (…)

For Google, having round-the-clock energy that isn’t intermittent is “critically important as we think about long-term growth,” Corio said.

If you missed that: Power Play

This could also prove nuclear for GOOG:

Antitrust Officials Weigh Splitting Google, Others Antitrust enforcers search for tough remedies to counteract alleged monopoly abuses

U.S. antitrust enforcers haven’t broken up a company in 40 years. Several high-stakes cases, including two involving Google, could determine whether that dormant period comes to an end.

The Justice Department submitted a filing Tuesday that presented a federal court with a range of potential options—from conduct restrictions to a breakup—aimed at ending what a judge said was Google’s unlawful monopoly in search.

The filing said the government is considering a “full range of tools” to restore competition, including “structural” changes to Google’s business that would prevent it from using products such as its Chrome browser or Android operating system to advantage Google’s engine search.

Google responded in a blog post that the Justice Department’s initial proposal for reforming the search engine market is “radical and sweeping” and could have “negative unintended consequences for American innovation and America’s consumers.”

U.S. District Judge Amit Mehta in August found that Google ingrained its monopoly by paying billions of dollars to operators of web browsers and phone manufacturers to be their default search engine. Mehta will now spend the better part of a year deciding what to do about it.

Google also faces the threat of breakup in a separate government lawsuit targeting its online-advertising business. And Ticketmaster-owner Live Nation and Meta Platforms are defendants in antitrust cases that could lead the Justice Department and Federal Trade Commission to ask courts to unwind the megamergers that helped forge their corporate empires.

The agencies alone can’t order a breakup; that power lies with courts. But there is little modern precedent to guide judges on when such a forceful remedy is appropriate. The last major ruling came in 2001, when a federal appeals court in Washington, D.C., found a trial judge overstepped in ordering the breakup of Microsoft. (…)

The last major one came with the 1984 breakup of AT&T, which then controlled long-distance and local phone service and had the telephone equipment market locked up. The telecommunications company negotiated the split with the Justice Department instead of waiting for a judge’s ruling on whether it had violated antitrust laws. (…)

Judges view breakups as an extreme remedy that could have unintended consequences, such as creating a new stand-alone company that later fails, said Cornell University law professor Erik Hovenkamp.

“Breakups are surprisingly hard from a practical standpoint,” Hovenkamp said, citing the challenge of divining how precisely to split a company apart. (…)

The Justice Department has until Nov. 20 to decide the specific fix it will propose in the Google search case. Mehta’s August ruling found that Google “has no true competitor” in mobile search. While its search engine is the best, he wrote, Google foreclosed competition by cutting off rivals from accessing the mobile devices where competing search engines could develop and grow. (…)