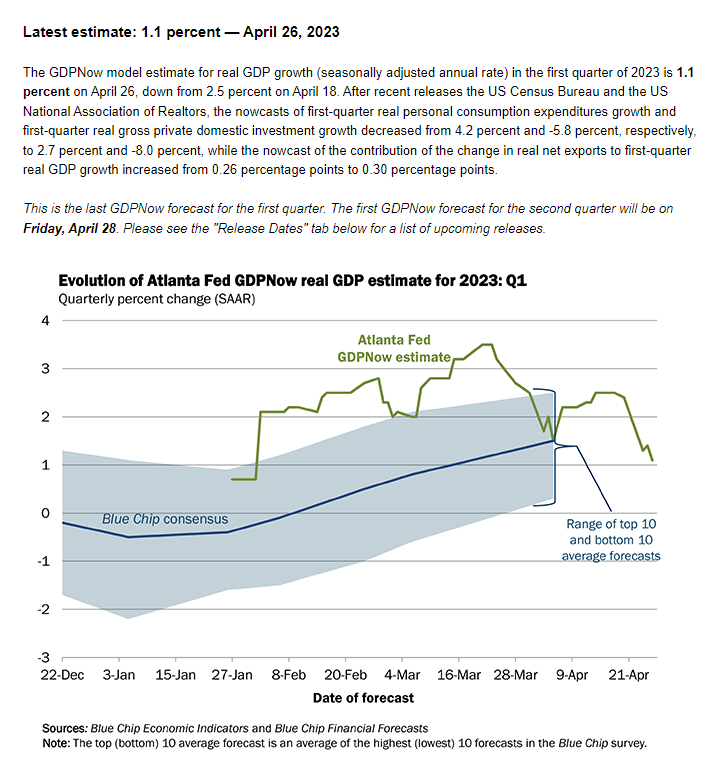

GDP Report Shows Economic Growth Slowed in First Quarter

The WSJ headline might have boosted expectations of Fed easing soon. Conventional media provided little details (!) however.

Fortune’s Allen Murray:

The most predicted recession of modern times has been delayed…again. Yesterday’s GDP report showed the economy grew at an annual rate of 1.1% in the first quarter—slow, but still positive. And while economists continue to see a downturn on the horizon, I’ve yet to encounter a single CEO who sees signs of it in his or her own numbers.

The GDP report also showed that inflation remains significantly above the Fed’s target. The PCE price index, excluding volatile food and energy prices, increased 4.9%. That suggests the Fed has more work to do to get inflation under control—which is why so many see a recession ahead. History offers little reason to believe that inflation can be brought down to the Fed’s 2% target without a recession.

The important details:

- During Q1, inventories declined $1.6 billion after soaring by $136.5 billion in Q4. That swing depressed real GDP 1.9%.

- Excluding inventories, real final sales jumped 3.4%, led by a 3.7% increase in real consumer spending.

- Business fixed investment increased 0.7% annualized.

- Residential fixed investment declined 4.2%.

- Net exports added 0.11pp to headline growth.

- Government spending was strong at +4.7%.

Advisor Perspectives provides the best overall coverage: note the strong goods consumption that helps reduce excess inventories, explaining the weak imports of goods.

The effects of the splurge on goods during the pandemic years is totally visible in this next chart. The contribution to GDP from personal consumption jumped from 69% to 71%, most of it goods consumption. Some 80% of goods are imported, explaining the declining contribution from net exports (declining imports) and flat manufacturing production since 2019. Americans supported world manufacturing in the last 3 years.

The reality is that the U.S. economy was quite strong in Q1: the +0.7% QoQ growth in real final sales was the strongest since Q2’21.

- “April’s average of the new orders indexes compiled in the regional surveys conducted by five Federal Reserve Banks rose in April suggesting that orders may be bottoming. If so, then inventories should be a positive contributor to real GDP during Q2.” (Ed Yardeni)

- This is supported by S&P Global’s April flash PMI: “growth in manufacturing new orders was only fractional, albeit returning to expansion for the first time in seven months”.

- Inflation-adjusted after-tax incomes were up 8% in the first quarter, compared to the last quarter of 2022, per the latest GDP data. (Axios)

Data: FactSet, Bureau of Economic Analysis; Chart: Axios Visuals

Data: FactSet, Bureau of Economic Analysis; Chart: Axios Visuals

On inflation:

- The GDP price index rose by +4.0% (QoQ ar), 0.3pp above consensus expectations.

- Core PCE prices rose +4.9% annualized in Q1 after +4.4% in Q4’22

ING sets the stage for next week’s FOMC:

(…) The minutes of the March Federal Open Market Committee (FOMC) meeting showed the Federal Reserve continuing to believe inflation was “unacceptably high” and that a “period of below trend growth [was] needed” to get it back to the 2% target. The prospect of a “mild recession” didn’t faze the central bank since unemployment at just 3.5% meant tightness of the labour market could keep wage pressures elevated and mean “slower-than-expected progress on disinflation” continued.

Were it not for the banking stresses experienced earlier in March, “many participants” felt “the appropriate path for the federal funds rate as somewhat higher than their assessment at the time of the December meeting” with “some” willing to consider the possibility of a 50bp hike in March. In the end, the Committee unanimously opted for 25bp with the “dot plot” signalling one further 25bp was likely this year with rates staying at 5-5.25% through year-end.

Since then, inflation has continued to run hot and the jobs market is tight while first-quarter GDP was headlined by strong consumer spending. Moreover, Federal Reserve officials’ comments have changed little over the past month, other than hints that the impact on credit conditions is being more readily acknowledged, with some officials, including the likes of Atlanta Fed President Raphael Bostic, openly talking about one more hike and then a pause.

The graphic above shows the different scenarios that are likely in play for the May FOMC meeting and what we expect to happen. A no-change decision would be seen as very dovish given the Fed commentary over recent weeks. It would suggest that the Fed has received news that the latest banking stresses are causing major issues and this would be the catalyst for a sharply weaker dollar and lower Treasury yields. We don’t believe we are there yet. Nonetheless, the uncertainty and nervousness that banking stresses are causing rule out a very hawkish 50bp hike.

We are forecasting a 25bp hike on 3 May, which is the consensus view.

We do think this will mark the end of the Fed’s tightening cycle, but the central bank will be reluctant to explicitly state that. Last month it switched its language from February’s “ongoing increases in the target range will be appropriate” to “some additional policy firming may be appropriate” [our emphasis].

We doubt it will switch fully to the idea that future moves will be “data dependent” given inflation is still running well above target and it doesn’t want to give the market further ammunition to anticipate a turn in policy. Instead, we expect it to adopt its 2006 pathway and with an incremental step, suggesting “additional policy firming may yet be appropriate”.

It is possible that Fed Chair Jerome Powell’s press conference may see him admitting a degree of data dependency and a pause at the next meeting can’t be ruled out. However, he will not suggest rate cuts are on the agenda for later in the year as this would be viewed very dovishly by markets and undermine the bank’s efforts to tame inflation. It would give the all-clear for the dollar to sell off and Treasury yields to plunge. (…)

Some other news yesterday:

- Sales in Amazon’s online stores category — the company’s original business — were flat compared with a year ago, and down about 4% from the same period in 2021.

- AWS revenue rose 16% to $21.4 billion in the first quarter, the weakest growth rate since Amazon began breaking out the unit’s sales.

Data: Google, Amazon and Microsoft; Chart: Axios Visuals

Data: Google, Amazon and Microsoft; Chart: Axios Visuals

- The latest week’s jobless claims data declined to 230K from the previous week’s upward revision to 246K. The dashed line below is where claims were at the end of 2019.

- Continuing claims totaled 1.858 million in the most recent week, down from 1.865 million.

Pending Home Sales Decreased 5.2% in March

Pending home sales decreased in March for the first time since November 2022, according to the National Association of REALTORS®. Three U.S. regions posted monthly losses, while the South increased. All four regions saw year-over-year declines in transactions.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – waned by 5.2% to 78.9 in March. Year over year, pending transactions dropped by 23.2%.

“The lack of housing inventory is a major constraint to rising sales,” said NAR Chief Economist Lawrence Yun. “Multiple offers are still occurring on about a third of all listings, and 28% of homes are selling above list price. Limited housing supply is simply not meeting demand nationally.”

The consensus expectations for a 0.8% increase!!

Europe’s Economy Avoids Recession—Just About A rebound in factory output and falling energy costs helped drive a modest rebound, but further interest-rate rises will test the region’s resilience.

(…) The European Union’s statistics agency said the combined economic output of the 20 eurozone countries rose at an annualized rate of 0.3% in the first three months of 2023, after shrinking by 0.2% in the final quarter of last year. (…)

The stronger economic output is in part due to a drop in energy prices from their summer peaks, due to an unusually warm winter and an influx of liquefied-natural gas from the U.S. and elsewhere. This was reflected in a rise in imports from the U.S., which were up a fifth in the first two months of 2023 against a year earlier. (…)

Separate data also released Friday pointed to a rise in annual rates of inflation in France and Spain in April. ECB policy makers have signaled they will raise their key interest rate again next week in a further effort to cool demand. (…)

France’s statistics agency said factory output in the eurozone’s second-largest member grew at a strong pace, having contracted in the final quarter of last year. That turnaround helped the economy grow despite the disruptions caused by a wave of protests and strikes in opposition to President Emammuel Macron’s plan to extend the retirement age.

Spain’s economy picked up as tourism continued to revive, while Italy’s economy grew again after contracting at the end of last year. Germany’s economy stagnated, having shrunk by half a percentage point in the final quarter of 2022 according to revised official figures. (…)

China Ratchets Up Pressure on Foreign Companies Surprise visits, probes and detentions come just months after Beijing’s open-for-business message to global investors.

(…) In recent weeks, Chinese authorities have questioned staff at consulting firm Bain & Co.’s Shanghai office in a surprise visit, launched a cybersecurity review of imports from chip maker Micron Technology Inc., detained an employee of Japanese drugmaker Astellas Pharma Inc. and raided the Beijing office of U.S. due-diligence company Mintz Group.

The government has broadened its spy law to counter perceived foreign threats, including allowing for the inspection of baggage and electronic devices of those suspected of espionage, significantly raising the risks for Western companies operating in China. (…)

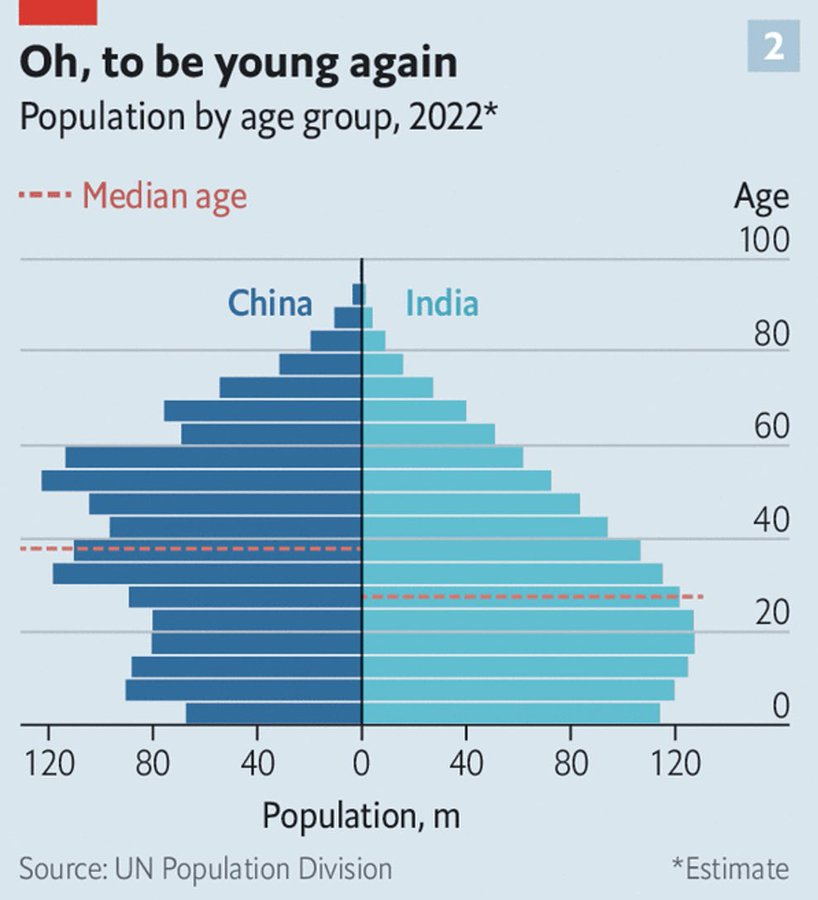

As China gears up for greater competition with the U.S., the government is now shifting its focus to make American and other foreign companies fall in line.

Business executives who have consulted with Chinese authorities say a central tenet of the effort is the desire to more tightly control the narrative about China’s governance and development, and limit the information collected by foreign companies such as auditors, management consultants and law firms that could influence how the outside world views China. (…)

“The business community necessarily needs information,” said Lester Ross, a Beijing-based lawyer and chair of the policy committee at the American Chamber of Commerce in China. “There is therefore a risk that people will be unable on behalf of their companies to gather sufficient information for fear of being branded an espionage agent.” (…)

The push is driven by a deepening conviction within China’s leadership that foreign capital, while important to China’s economic rise, isn’t to be fully trusted, say people familiar with the government’s thinking. That view has gained traction over the past year, especially since the U.S. in October passed a ban on selling high-end chip-making technology to China, with Chinese officials believing certain companies, such as Micron, were behind the U.S. action. (…)

A survey conducted by the American Chamber of Commerce this month shows that about 27% of its respondents are shifting priorities to countries other than China when making their investment decisions. That figure was 6% in a poll conducted late last year. (…)

(…) The environment had already been getting worse before the latest disclosures. Authorities have urged state-owned firms to phase out using the four biggest international accounting firms, Bloomberg News reported in February. The country is no longer a top three investment priority for a majority of US firms, according to an AmCham business climate survey published earlier this year. (…)

“The Chinese government has continuously said it welcomes foreign investment,” said Hart from Amcham. “However, a flurry of recent actions taken again US enterprises in China has sent the opposite message.”