Durable Goods Orders Up 3.2% in March, Better Than Expected

March’s new orders for manufactured durable goods came in better than expected at $276.4B, a 3.2% jump from last month and higher than Investing.com’s 0.7% forecast. The series is up 4.6% year-over-year (YoY). If we exclude transportation, “core” durable goods were up 0.3% from last month and up 0.5% from last year, the smallest annual change since November 2020. (…)

The high monthly volatility in durable goods hides the real trends. It’s been a bad quarter however one looks at it.

Manufacturers’ shipments were still up 4.4% YoY in February but the poor showing in the Cass Freight Shipments index, -4.0% in March, means the goods recession is continuing.

Trucking company TFI International’s CEO yesterday said that industry shipments were down 10% YoY in Q1 with most of the damage in March, continuing in April.

Hope comes from S&P Global’s April flash PMI: “growth in manufacturing new orders was only fractional, albeit returning to expansion for the first time in seven months”.

Transports and Small Caps stumble as the S&P holds steady This is one of the widest divergences between the market and those indexes since 1928

(…) It turns out that the fears triggered by lagging cyclical indexes like Transports and Small-Caps were not consistently justified. Over the next six months, the S&P rose 80% of the time, with an impressive average return and decent risk/reward profile. The biggest concern is that the few losses were double-digit, and two were sustained for months afterward.

It was more of a worry for Small-Cap stocks, even using total return. Over the next couple of months, Small-Caps showed a negative median return, with risk well above reward. They recovered quite a bit over 6-12 months, but average returns were still at/below random.

For the Transports, it was more of a mixed bag. They continued to lag over the next month or so, then returns rebounded to above-average levels. They tended to show positive returns less consistently than did the S&P 500, however.

Small U.S. domestic businesses will likely be more impacted by more frugal regional banks.

Bank Turmoil Seen Crimping Credit at Double Powell’s Estimate

US bank stress will tighten credit by twice as much as expected by Federal Reserve Chair Jerome Powell, said economists surveyed by Bloomberg, tipping the economy into recession.

Almost all of the economists expect the Federal Open Market Committee to hike interest rates another quarter percentage point at its May 2-3 meeting, to a target range of 5% to 5.25%.

But the higher borrowing costs will be amplified by the fallout from the March collapse of two US banks, which a majority of the economists found to be equivalent to a Fed hike of about half a percentage point or more. Powell has estimated the impact at roughly a quarter point. (…)

The Fed’s H.8 report shows total loans and leases dropping abruptly in the last 2 weeks of March but turning back positive in the first 2 weeks of April. CRE loans also declined in late March but are flat so far in April.

- Banking Problems May Be Tip of Debt Iceberg ‘Shadow banks’ have grown rapidly and, like banks, are exposed to risk from higher interest rates

(…) The fastest-growing segment is private credit—loans to companies generally too small to issue bonds but who want to avoid more restrictive bank loans. Since the start of 2008, private credit has grown almost sixfold, to $1.5 trillion, according to the IMF—bigger than the high-yield bond or leveraged-loan markets. At $4.4 trillion, those three markets are worth more than all banks’ commercial and industrial loans, at $2.7 trillion.

Private credit is issued by funds managed by firms such as Ares Management Corp., HPS Investment Partners LLC, Blackstone Inc., BlackRock Inc., Apollo Global Management Inc., Carlyle Group Inc. and Goldman Sachs Asset Management, many of whom are also prominent private-equity managers. (The IMF’s $1.5 trillion figure also includes business-development companies and middle-market collateralized loan obligations.)

Private credit is mostly financed with investor capital that is locked up for a few years, “so there is no run risk” as with deposits, commercial paper and repo loans, the IMF said. And while some private credit is subject to interest-rate risk, the loans are often floating-rate and thus adjust upward with interest rates. Fund managers can compensate by charging more on new loans, financed out of maturing loans or capital that investors are obligated to supply when asked, dubbed “dry powder.”

But the IMF does cite several risks. Private credit often funds leveraged buyouts of companies more vulnerable to economic slowdowns, competition has led to laxer loan terms, and “managers of private-credit deals often finance deals of other managers, which concentrates risk,” it said. The investors who commit capital to private-credit funds also do so for private equity and other alternative assets, the sort of “interconnectedness” that has amplified stress in the past.

So even if private credit doesn’t have the sort of runs that befell banks last month, it could face the same pressure to retrench that banks do, aggravating the credit crunch and worsening the economic downturn. Fundraising by private-credit funds fell 42% last year from 2021, according to PitchBook Data. (…)

But there is little regulators can do about the underlying problem: Interest rates are likely to stay high because of stubborn inflation and an economy weakened by those high rates, which boosts loan defaults. As a result, strains will continue percolating through the financial system, though maybe not with the drama of a bank failure.

- A jump in US tax inflows reduced the likelihood of a default in June, Goldman said. Tax receipt data for Tuesday—when paper checks for tax payments came in—outpaced the comparable 2022 day by 14%. (Bloomberg)

We Love Our Junk Food and Are Willing to Pay Up for It

As we approach the midway of this quarterly earnings season, it is normal to search for themes that can define our views about the economy and guide our thinking about what to expect from those companies who are yet to report. Yet one theme seems to underlie the results, and that could bode poorly for investors who are hoping for rate cuts in the coming months (and our health). The US consumer seems more than willing to pay more for their favorite brands, especially if they sell, um, comfort foods.

Consider some of the winners that we have seen over recent sessions. Today’s big gainer, even more than Microsoft (MSFT), is Chipotle Mexican Grill (CMG). CMG is up about 14% this morning, setting a new all-time high after beating estimates and offering positive guidance. The company’s CFO stated that lower-income customers are returning to the restaurants even as prices have risen by about 10%. In short, CMG has found that they can pass along price increases to their customers without penalty.

It would be one thing if a single company made comments like that, but we have heard something similar from Coca-Cola (KO), Pepsi (PEP), McDonalds (MCD) and Procter & Gamble (PG) all beat analyst consensus estimates and cited their ability to pass along price increases during their earnings calls. For better or worse, we’re willing to pay up for our favorite hamburgers, soda, potato chips, and burritos. Health ramifications aside, if the Federal Reserve’s goal is to combat inflation, this is a clear sign that their fight is far from over.

To be sure, it is not at all a bad thing that consumers have the means to afford their favorite brands. An unemployment rate of 3.5% means that the vast majority of people who want a job have one. The tight labor market means that people can afford their favorite goods and services and have the means to pay more for them if necessary. It’s not only food. We heard something similar from Kimberly-Clark (KMB), whose stock was boosted by brand loyalty to tissues, toilet paper and diapers)

Consumers make up the bulk of the US economy. When they feel economic stress, they cut back and trade down to lower cost brands. One could assert that MCD is the lower cost alternative when it comes to dining out, and the CMG CFO theorized that some of their growth could be coming from customers trading down from higher-end restaurants, but that doesn’t explain the resilience of other consumer products. People who feel flush will feel ok about paying up for better-quality toilet paper.

The strong performance of consumer staples may be a key “tell” about why it seems that there is a huge divergence in the economy, and in the markets too. There is no shortage of economists and pundits who are concerned about a recession on the horizon. The persistent yield curve inversions tell us that is a key worry of bond investors. On the equity side, we see institutional investors expressing pessimism about stocks, yet money continues to flow into individuals’ favorite names.

We are back at another “careful what you wish for” moment. Fed Funds futures show an 83% chance for a hike at next week’s FOMC meeting, but also anticipate 3-4 cuts over the coming months. If the consumer remains this solid, it is tough to imagine what sort of economic forces would justify an “about-face” from the Fed in a matter of months. Unless there is a banking crisis that metastasizes beyond what we have seen so far or some other sort of financial accident, it is hard to see the consumer sector slamming on the brakes sufficiently to cause the FOMC to cede its fight against inflation. If you like the idea of healthy consumers, it is hard to have it both ways.

Summers Says Inflation Won’t Get Back to 2% Without Downturn The former Treasury secretary said he is ‘not that optimistic’ about the fight against rising prices and that the Federal Reserve lost credibility by acting too slowly.

- Summers said the right thing for the Fed to do at next week’s policy meeting is to raise rates by 25 basis points.

- Regarding the recent banking crisis, he said that the fallout is leading to a “constriction of credit” that is doing some of the work of the Fed’s rate hikes. “We don’t need as much interest-rate increases as we would if the banking system were working smoothly,” he said.

- Summers said the Federal Reserve has a tendency “to groupthink” especially around macroeconomic models. (…)

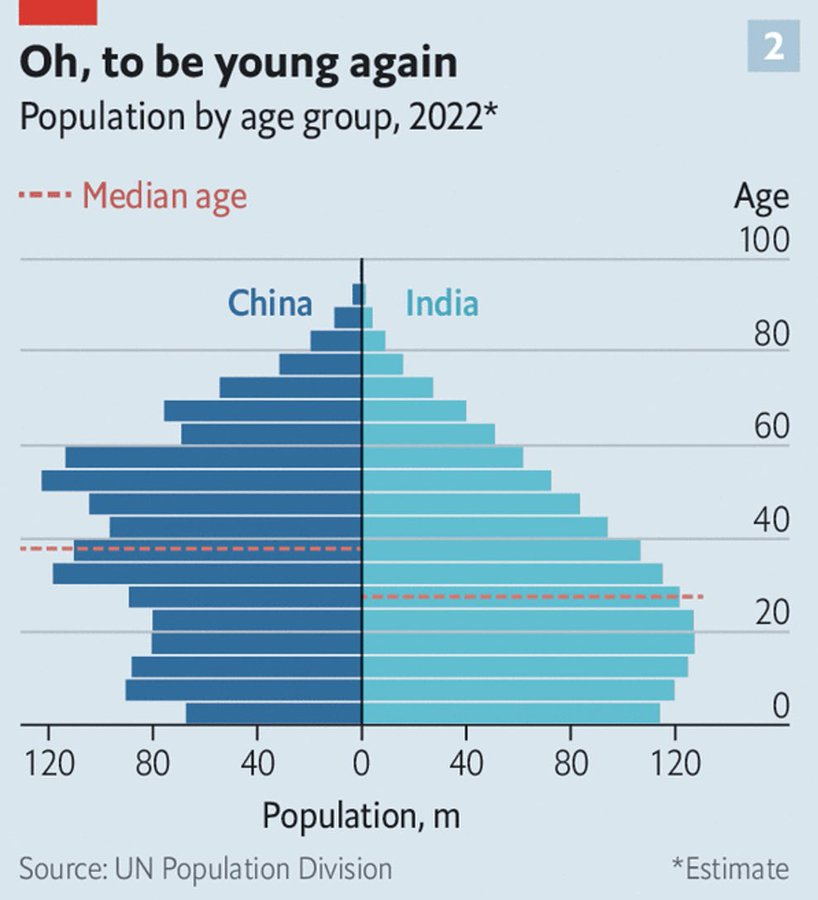

India’s Population Surpasses China, Shifting Global Order China has been the most populous nation in the world since at least 1750. But in April, India’s population is set to surpass China’s.

China’s growth and productivity will be challenged by its aging and slow growing population with fewer young workers to support them.

@Noahpinion