CONSUMER WATCH

Chicago Fed Advance Retail Trade Summary

The Chicago Fed Advance Retail Trade Summary (CARTS) tracks the U.S. Census Bureau’s Monthly Retail Trade Survey (MRTS) on a weekly basis, providing an early snapshot of national retail spending.

In the fourth week of February, the Weekly Index of Retail Trade decreased 1.5% on a seasonally adjusted basis after increasing 0.1% in the previous week. For the month of February, retail & food services sales excluding motor vehicles & parts (ex. auto) are projected to increase 1.6% from January on a seasonally adjusted basis and to increase 0.9% when adjusted for inflation.

If so, February + January would be up 4.6% following -2.8% in December, or +7.4% annualized in the last 3 months. However, the Bureau of Economic Analysis estimates that inflation was 9.5% a.r. in the last 3 months and that inflation-adjusted retail sales ex-autos were actually down 1.2% in those 3 months.

The good news id that if we eliminate December, real sales jumped 3.1% in the last 2 months.

The not so good news is that February was strong until the fourth week, down 1.5% in nominal terms. That was the first week of the war in Ukraine.

The agency says on a seasonally adjusted basis that household credit market debt as a proportion of household disposable income rose to 186.2 per cent in the fourth quarter, compared with a revised reading of 180.4 per cent for the third quarter. The reading means there was $1.86 in credit market debt for every dollar of household disposable income.

Statistics Canada says the ratio stood at 181.1 per cent at the end of 2019 before the pandemic, while the previous record high was in the third quarter of 2018 at 184.7 per cent.

The increase in the fourth quarter came as household credit market debt rose 1.9 per cent and household disposable income fell 1.3 per cent.

On a seasonally adjusted basis, households added $50.0-billion of debt in the fourth quarter including $46.3-billion in mortgages and $3.7-billion in non-mortgage loans.

The household debt service ratio, measured as total obligated payments of principal and interest on credit market debt as a proportion of household disposable income, rose to 13.84 per cent in the fourth quarter of 2021 compared with 13.55 per cent in the third quarter.

(…) Britons were already bracing for a 54% increase in the energy price cap from April, and now economists estimate the energy regulator will need to impose another similar rise from October, pushing average household energy bills to over 3,000 pounds annually, the FT said. (…)

The war looks set to push inflation up further as it sends key commodity prices higher, with the Times newspaper reporting British Steel lifted its prices by about 25%. Drivers are paying record levels for gasoline and diesel, taxpayers are due a 1.25 percentage-point increase in payroll taxes in April, and the Bank of England is expected to raise rates again on Thursday.

- Brazilians Are Spending More Than Half Their Income on Debt Payments An aggressive campaign of rate hikes is hitting consumption and choking off growth.

(…) Brazilians who took on debt during the pandemic are bearing the brunt of the central bank’s campaign to tame stubborn double-digit inflation. While policymakers in the U.S. and Europe dithered, monetary authorities in Latin America’s biggest economy were quick to respond to surging prices, prodded by memories of bouts of hyperinflation that stretched into the early 1990s.

Since March 2021, Brazil’s central bank has ratcheted up its benchmark interest rate, called the Selic, a total of 875 basis points. The strong medicine is starting to show results. Consumer prices rose 10.4% in January from a year earlier, an improvement on an 18-year high of almost 11% in November. (…)

Payments on consumer debt including mortgages, car loans, credit cards, and other types of revolving credit now gobble up about 52% of household income—a 9-percentage-point jump from 2020 and the highest rate recorded since the central bank began tracking the metric 17 years ago.

During the pandemic, more out-of-work or underemployed Brazilians began relying on credit cards or store cards to pay for such essentials as groceries and drugs. (…)

When Brazil’s central bank slashed the policy rate to 2% in August 2020 to support the economy during the Covid-19 crisis, many Brazilians jumped at the opportunity to sign up for credit cards or take out loans. A host of financial technology companies competed with banks to sign up new customers. By the end of 2020 there were 134 million active credit cards in circulation, according to the latest data available from the central bank, a 35% increase from 2018. (…)

Many Brazilians also took advantage of a three-and-a-half-year streak of single-digit interest rates, the longest in Brazil’s history, to buy a home. But because almost all mortgages in the country carry variable rates, many weren’t able to keep up with payments once the central bank began hiking. Brazil’s banking federation, known as Febraban, estimates that 18.7 million home loan contracts have been renegotiated since the beginning of the pandemic (…).

Rising interest rates helped tip Brazil into recession last year, and while the economy managed to eke out growth of 0.5% in the final quarter of 2021, tighter credit conditions will continue to act as a drag on the expansion. Economists are penciling in at least two more rate hikes in 2022, lifting the Selic to 12.25%. (…)

The West’s Economic War Plan Against Russia After invading Ukraine, Putin is now president of ‘North Korea on the Volga,’ says Edward Fishman, an expert on sanctions and a former State Department official.

(…) “The 2014 sanctions,” Mr. Fishman says, “may have made Putin complacent.” Imposed four months after Russia seized Crimea, they were “like a 2 out of 10 in intensity, whereas the ones that have been imposed in the last two weeks are more like an 8 out of 10.” Even the relatively mild 2014 sanctions “tanked the Russian economy. Although not as bad as it’s been in the last two weeks, the economy went into pretty steep recession.” Russia’s gross domestic product contracted by somewhere between 2.5% and 4% in 2015, and the ruble lost half its value. (…)

Mr. Putin was unprepared for the enormity of the hit on his central bank (…).

Mr. Fishman therefore expects sanctions to be ratcheted up. The U.S. has already banned Russian oil and gas imports, a potentially major escalation. “Oil is the lifeblood of Russia’s economy,” Mr. Fishman says. “It accounts for half of all export revenues. By banning Russian oil imports, the Biden administration has taken the first step in what I anticipate will be a global campaign to curb Russia’s oil sales.” The U.S. imports modest amounts of oil from Russia, so the significance “is in the signal—that Russia’s oil sales, like its central-bank reserves, will be in the crosshairs of Western sanctions so long as Putin’s war against Ukraine continues.”

Europe imports far more Russian energy than the U.S. Its reductions, Mr. Fishman says, “will, by necessity, need to come in phases. But the final destination is clear: The West is determined to wean itself off Russian energy in the months and years to come.”

The Iran oil sanctions offer a model for how sanctions against Russia might work, with the U.S. imposing so-called secondary sanctions against states that step in to buy oil from the targeted country. Washington could also insist that money due Russia for its oil be kept in escrow accounts in the purchasing country, putting it beyond the reach of Mr. Putin and his war effort.

(…) Could China come to Russia’s aid and buy all its oil, presumably at a significant discount? “This time, unlike with Iran—if it’s the U.S., Europe, Japan and other democratic powers jointly threatening consequences, I think the pressure would be pretty immense—even on China.”

It is “honestly shameful,” Mr. Fishman says, “to be seen to be paying Putin right now. There is the reputational cost to China. Does China want to be seen as bankrolling Russian imperialism in Ukraine? I think China is very cautious about being perceived as an imperialist power itself.”

But what if China and Russia collaborate to develop an alternative financial system that makes both countries sanctions-proof? Mr. Fishman thinks that’s unlikely. It would require a “dramatic reconfiguration” of the Chinese state and political economy, including the removal of capital controls. (…)

Russia, by contrast, has vulnerabilities the West has yet to exploit. Sberbank is Russia’s largest bank by far, the equivalent of “ Wells Fargo, Capital One, and Bank of America rolled into one.” Now it faces only the original debt sanctions from 2014, plus an additional transaction ban post-Feb. 24. Mr. Fishman foresees those being heightened to “full blocking sanctions in the weeks and months ahead.”

So far, the most significant Russian bank to be fully blocked is VTB, the country’s second-largest. But it’s only half the size of Sberbank. Blocking the latter would beggar the Russian people, which may be why full blocking sanctions haven’t been imposed. “It’s also an important escalation step, an arrow to keep in the West’s quiver to use later if necessary.” Sberbank has about a third of the banking sector’s assets in Russia and about 60% of all household deposits. Half of Russia’s wages are channeled through the bank. “There could be very broad-based, microlevel financial and economic dislocation” were Sberbank to be hit, Mr. Fishman says.

The bank, like VTB and others, is “majority state-owned, so there’s a Putin connection and Putin taint to all of them.” Mr. Putin views them as “parts of the commanding heights of the economy and as elements of the state that need to be kept under close Kremlin control.”

Mr. Fishman lists a range of other companies that could be fully blocked: Rosneft, the largest petroleum company; Rostec, the defense behemoth; Gazprom, the gas giant; Alrosa, the world’s leading diamond-mining company by volume; Russian Railways; Sovcomflot, the largest shipping company; and Rostelecom, the largest provider of digital services.

Russia is becoming “North Korea on the Volga,” Mr. Fishman says. It will be “a pariah state,” completely isolated from global economic and financial markets. “It’s not just the reality of economic isolation, it’s the shame of transacting with Russia.”

The danger—and the tragedy—is that Mr. Putin’s goal may be to turn Ukraine into “Syria on the Dnieper.”

(…) “The total volume of our reserves is about $640 billion, and about 300 billion are in such condition that we can’t use them now,” he told state television in an interview on Sunday.

“We see what pressure Western countries put on China” to limit access to reserves in yuan, he said. “But I think our partnership ties with China will let us not just preserve it but expand it.” (…)

China’s move to double the yuan trading band for the ruble showed little sign of boosting activity in the pair, with liquidity tightening further on Friday. (…)

- Evergreen/Gavekal have this to says on Why China Will Not Save Russia:

(…) As sanctions threaten to reduce Russia to an economically isolated pariah, China will not ride to its rescue. The calculation for China is simple: its commercial ties with the US, European Union and their allies in Asia are much more important than those with Russia. (…)

Even though China’s government probably wishes to assist Russia, it cannot shield its companies from the potentially crippling punishments for violating sanctions. Officials are likely to follow their past practice of implicitly advising companies to obey sanctions by alerting them to risks. Beijing will not bust sanctions and risk losing access to markets in the developed world, which is united against Russia. (…)

The basic incentive for Chinese financial institutions to comply is the same as for their Western counterparts: self-preservation. The US Treasury Department has the legal authority through the Countering America’s Adversaries Through Sanctions Act to inflict secondary sanctions on non-US companies or individuals that “knowingly facilitate significant transactions” with blacklisted Russian entities. The US has repeatedly applied such secondary sanctions under other laws to enforce previous sanctions against North Korea, Iran, Russia or Venezuela. Losing access to the US financial system and the ability to conduct transactions with US counterparts is too big a risk for most Chinese banks. (…)

Chinese companies transacting with banned Russian banks still risk secondary sanctions no matter which settlement system or currency they use. Only institutions that have no need to transact with the US can actually ignore the risk of sanctions, and such institutions are few and insignificant (such as Bank of Dandong which deals with North Korea, and Bank of Kunlun which deals with Iran).

(…) if Russia deliberately cut down its natural-gas exports to squeeze Europe, China may be able to absorb some additional Russian supply at the margin, but not enough to offset the financial losses. China received roughly 10bn cubic meters of natural gas from Russia last year via the Power of Siberia pipeline, which began delivery late 2019 and is the sole natural gas route between the two countries.

That pipeline could theoretically carry as much as 38bn cubic meters per year—a fraction of sales to Europe, estimated to be about 175bn cubic meters in 2021 Furthermore, the pipeline is not connected to the fields that supply Europe, which makes it difficult in the short term for Russia to reroute to China natural gas previously intended for the West.

The existing structure of global trade and the logic of self-preservation mean that, despite the political alliance that Xi and Putin celebrated not long ago, China in practice will offer Russia little more than rhetorical solidarity with its sanctions woes.

- J.P. Morgan Research forecasts that Russia’s economy will contract 35% quarter-over-quarter and seasonally adjusted in the second quarter, and for the year experience a GDP contraction of at least 7%. Inflation could end the year at around 14%, up from 5.3% forecasted before the crisis, with risks skewed heavily to the upside due to ruble depreciation and import shortages. (J.P. Morgan)

- Bloomberg Economics’ initial forecast is for Russia’s full-year GDP to slump about 9% in 2022.

- US to target banks and crypto exchanges that aid sanctioned oligarchs

- Deutsche Bank to wind down in Russia, reversing course after backlash

Deutsche joins the ranks of Goldman Sachs (GS.N) and JPMorgan Chase (JPM.N), which were the first major U.S. banks to exit after Moscow’s invasion of Ukraine. Those moves put pressure on rivals to follow. (…)

A day earlier, Deutsche Bank’s Chief Executive Christian Sewing explained to staff why the bank was not withdrawing.

“The answer is that this would go against our values,” he wrote. “We have clients who cannot exit Russia overnight.” (…)

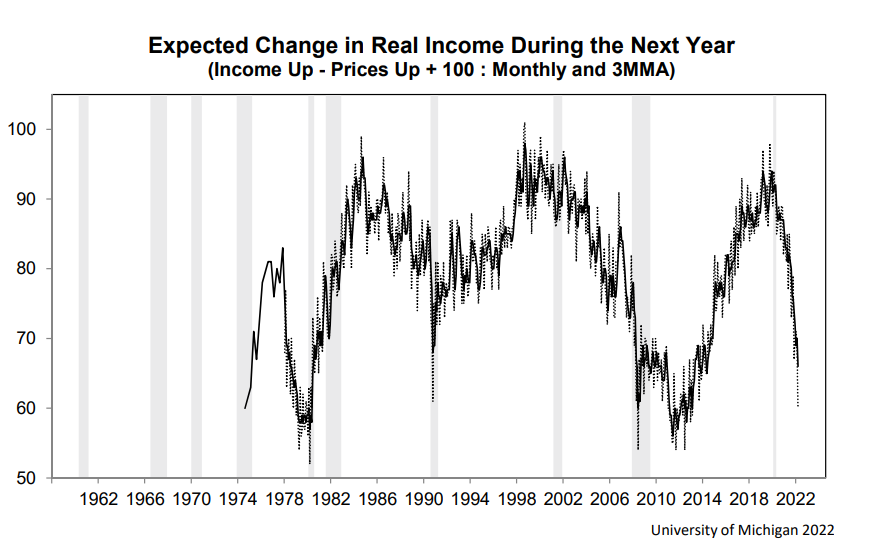

New index shows U.S. inflation expectations shifting higher

A new daily index released on Tuesday by the London-based ICE Benchmark Administration (IBA) showed the expected pace of consumer price increases over the next year rising from 3.5% on Feb. 1 to 5.24% as of March 7. The index is based on trading in the roughly $300 billion monthly market for inflation-protected U.S. Treasury securities and in the $100 billion monthly market for inflation swaps contracts.

Inflation anticipated over longer 10- and six-year horizons has also turned abruptly higher since the onset of the Ukraine war, with rates as of Monday around 2.43% and 2.73%, respectively, significantly above the Fed’s 2% annual price increase target, the index shows.

Reuters Graphics

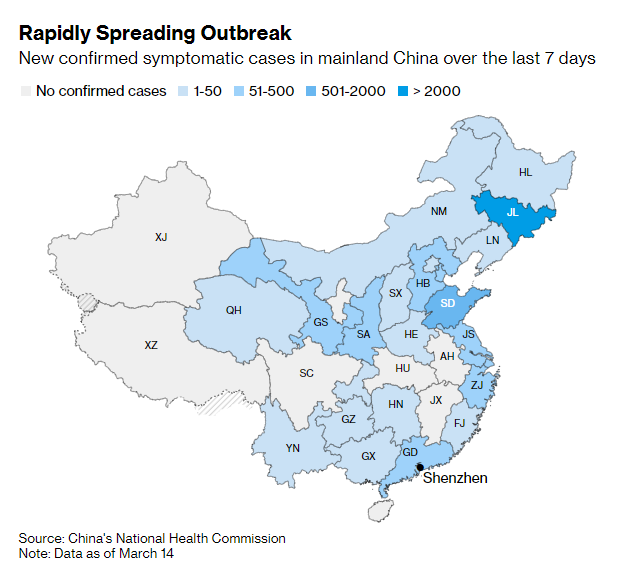

Container Freight Rates Set to Rise on More China Lockdowns

- Covid-19 Outbreak Shuts Down Some China Factories, Including Apple Supplier Chinese rules aimed at stopping a coronavirus outbreak in Shenzhen have led to production halts, in the latest hit to global electronics supplies.

- China Locks Down Shenzhen, Entire Jilin Province as Covid Swells

- Lockdowns Could Threaten Half of Economy – Bloomberg

U.S. Housing Affordability Declines Sharply in January

The National Association of Realtors’ Fixed Rate Mortgage Housing Affordability Index fell 2.8% in January to 143.0 from 147.1 in December. Affordability has fallen 22.2% since its recent high of 183.8 in January 2021, which was revised from 187.8. The Housing Affordability Index equals 100 when median family income equals the amount required for an 80% mortgage on a median-priced existing single-family home.

In January, a 1.2% decline (+15.9% y/y) in the median sales price of a home to $357,100 was accompanied by a rise in mortgage rates to 3.51% in January, up from 2.79% twelve months earlier. As a result, the monthly mortgage payment rose 3.4% to a record $1,284 (27.0% y/y) from $1,242 in December.

Median family income in January rose 0.5% (-1.2% y/y) to $88,114 from $87,683 in December. Consequently, the standard mortgage payment as a percent of income rose to 17.5%, the highest level since August 2018. These figures are up from a recent low of 13.6% in January 2021.

A longer-term chart from Political Calculations:

- Rent-Control Measures Are Back as Home Rents Reach New Highs Proposals that would generally allow landlords to boost monthly rents by no more than 2% to 10% are on the legislative agenda in more than 12 states.

(…) the concept saw a major resurgence in the 1970s, a period marked by high inflation. Its resurgence was somewhat short-lived, and many lawmakers adopted the view that rent controls hurt housing markets more than they helped tenants, by discouraging new development and disincentivizing apartment maintenance.

More recently, some economists and politicians have reconsidered that thinking, pointing to rent control as one of the few ways to protect low-income renters, who often face the greatest hardships. In 2019, New York Congresswoman Alexandria Ocasio-Cortez proposed a national rent-control law. California and Oregon advanced rent-control bills the same year, now laws in both states. (…)

Federal Reserve Faces a Policy Dilemma of Its Own Design The central bank dug itself into a hole, and the way out means risking either a recession or future price and financial instability. (Mohamed A. El Erian)

(…) Finding itself far away from the world of first best policy responses — for that, the Fed should, and could, have started easing its foot off the stimulus accelerator last summer, as some of us advocated — the options that the central bank has are far from straightforward and satisfactory.

Just consider the two main policy alternatives for the Fed.

By taking bold actions upfront, it would minimize the risk of de-anchored expectations joining an existing set that is already driving up inflation (from higher commodity prices and rising wages to disrupted supply chains and costly transportation). This would involve starting the rate-hiking cycle with an increase of at least 50 basis points — signaling an aggressive set of increases to follow — and initiating the balance sheet runoff in the next couple of months.

This approach would allow the Fed to regain some of its inflation-fighting credibility and have better control of the policy narrative. I say only “some” because markets would still need to see follow-through, having witnessed the Fed grossly mischaracterize inflation as “transitory” until the end of November, continue to miss on its inflation estimates, repeatedly revise up forecasts (which it will still need to do again this week) and, as absurd as this sounds given how high inflation has been for many months, waiting until last week to halt completely its emergency liquidity injections.

The problem with this approach is that it risks sending the U.S. economy into recession. This is not a risk to be ignored, especially given that the most vulnerable segments of the population would be most at risk. Having already experienced a significant erosion of purchasing power because of significantly higher prices on food and gas, they could now face both the fear and reality of further income losses.

The other option is a “dovish tightening” cycle.

In this scenario, the Fed would raise rates by only 25 basis points on Wednesday, leave rather vague its forward policy guidance and retain flexibility on how and when it will embark on reducing its bloated $9 trillion balance sheet.

Again, this is not a highly attractive policy option. It would do too little to contain inflationary expectations, increasing the likelihood that workers and companies would seek to compensate more fully for past price increases and also start to take preemptive steps to protect against future inflation. (…)

The one certainty in this is that, even after the FOMC meeting concludes on Wednesday, the Fed will continue to find itself in the deep hole it has dug for itself.

Data: FactSet; Chart: Axios Visuals

PRICE = EPS x P/E

Goldman Sachs’ David Kostin:

A surge in commodity prices and a weaker outlook for US and global economic growth lead us to lower our EPS estimates. Our new 2022 EPS estimate of $221 reflects 5% year/year growth compared with our prior estimate of 8% growth to $226. Our forecast 2023 earnings growth rate remains unchanged at 6% but the EPS level is trimmed to $233 (from $240). A 12% upward revision to Energy sector EPS partially offsets headwinds to profits in other sectors from decelerating consumer spending and increased input cost pressures. Excluding Energy, we expect S&P 500 EPS will grow by just 2% in 2022 vs. 6% for consensus.

Nothing surprising there. In fact, this downward revision in growth and earnings could be the first of many. Who really knows?

But this part surprised me (my emphasis):

Our 4700 target embeds an expectation that the forward P/E multiple will rebound from 19x today to 20x by year-end as the Equity Risk Premium (ERP) compresses. Our year-end 2022 implied absolute valuation represents a 5% P/E decline from the 21x multiple at the start of 2022. In our base case, real yields climb from recent lows but remain negative through 2022 despite Fed tightening. At the same time, decelerating growth and inflation and reduced political uncertainty should compress the ERP from today’s elevated level.

The current 620 bp gap between the S&P 500 earnings yield and the real 10-year US Treasury yield is the widest since March 2020 and matches levels in 4Q 2018, underscoring the potential value opportunity in US stocks if the growth outlook improves. Because we expect the various sources of current investor uncertainty will take time to be resolved, most of the equity upside should come later in 2022. Our 3- and 6-month S&P 500 targets are 4300 and 4400, respectively.

Kostin is in a “business as usual” mode here. But this is not Syria, it’s not Afghanistan, it’s not even Irak. Ukraine is much more than a local conflict that will eventually pass et be forgotten in economic and financial history books.

Actually, history is being rewritten, backwards. Hopefully, soldiers and weapons will soon be withdrawn. But the world has just changed significantly, more so than after 9-11. The economic and financial warfare does not seem just passing. Trust and global cooperation are no more. Entering Cold War II featuring a modern day Russia befriended with dominant China.

If globalization has been so positive for growth, inflation, margins and profits, can we reasonably assume that regionalization and isolation will be similarly positive?

Earnings multiples are discount factors, influenced by interest rates but also by growth, confidence and visibility. Anybody currently displaying confidence about any economic and financial scenario lives in a fantasy world where sales and profits grow linearly and equities trade on wishful P/Es irrespective of how economic agents and investors behave.

Because nobody (other than Putin, maybe) has any clue on how and when (even where) this nonsense will stop, it would be futile to discuss commodity prices, inflation, supply chains and profit margins at this stage.

Let’s just simply use Goldman’s EPS numbers even if they assume that “decelerating growth and inflation” will unleash “value opportunity in US stocks if the growth outlook improves”.

Sell-side narrative to keep dance floors busy.

But we can discuss P/E multiples, this elusive component of stock prices that incorporates objective and subjective factors to compound earnings, more or less. Not totally trivial considering that 20 rather than 19 is actually a +5.3% difference.

The simple truth is that nobody really knows. All we can do is objectively look at the past (which rhymes as Mark Twain said) and try to rationally and reasonably apply our findings to the future to assess our investing odds.

A quick glance at this chart reveals the impact of inflation on earnings multiples. Between 1957 and 1995, the correlation between core inflation and earnings multiples was a very strong -0.77.

- When inflation was below 6%, trailing P/Es hovered between 13 and 21. The median P/E was 17 and the median inflation 3% (17 + 3 = 20, the Rule of 20).

- When inflation rose above 6% between 1974 and 1995, P/Es ranged between 7 and 13 (median = 10) with inflation between 6.5 and 13.5 (median = 10). The R20 again.

The Rule of 20 simply observes that, historically, the S&P 500 median (“fair”) P/E is 20 minus inflation with a very stable range of 15 (extreme undervaluation) to 25 (extreme overvaluation). The “20” equilibrium simply means that the 25% potential valuation upside (20 to 25) is equal to the valuation downside (20 to 15).

Since 1957, there have only been two periods of truly excessive valuations, the dot.com period and the recent QE-sponsored frenzy. The downside has been rather consistent at 15, with short-lived lows of 14.

Note that even in the most recent lowflation years the Rule of 20 successfully identified periods of attractive and less attractive equity valuations. Like all valuation tools, the Rule of 20 is not a timing aid. But it is a useful, objective measure of valuation risk, particularly since it always returns to its median.

As it stands at 4200 with Goldman’s EPS estimate of $221 and 6.5% inflation, “fair or equilibrium” value is 2983. If longer-term inflation is assumed at 3.5%: 3646. For 4200 to be “fair” value (R20 of 20), one need to assume 1.0% inflation. Can we get EPS of $221 then?

It has been suggested to swap inflation for 10Y Treasury yields to “better reflect today’s reality” of very low interest rates. On that basis, the S&P 500 has corrected to its 22 historical median within a 17-27 range and could be assessed “fair value”.

The problem is that “today’s reality” is significantly influenced by the Fed’s QE programs keeping real rates unusually low absent a recession. That influence will soon diminish as QE presumably becomes QT amid high inflation and great uncertainty. Can we see fair value in equities using real rates that look anything but fair value? I think not.

EARNINGS WATCH

Perhaps the only positive last week is that there have been no new pre-announcements following the 3.7 N/P ratio of the previous 2 weeks.

Trailing EPS are $209.50 while full year 2022 estimates are $226.38, 8% higher (GS is at $221, +5.5%).

- Musk says Tesla, SpaceX see significant inflation risks, article with video Musk said on Sunday the U.S. electric carmaker and his rocket company SpaceX are facing significant inflationary pressure in raw materials and logistics. The electric-car maker last week raised prices of its U.S. Model Y SUVs and Model 3 Long Range sedans by $1,000 each and some China-made Model 3 and Model Y vehicles by 10,000 yuan ($1,582.40).

- Hedges Give Companies Temporary Relief From Surging Energy Prices Companies that previously locked in energy prices are being shielded from surging gas, oil and electricity markets, but that protection will fade as hedges expire and the costs of new ones catch up with today’s higher energy prices.

- Hundreds of Planes Are Stranded in Russia. They May Never Be Recovered. Western companies that own the planes face little prospect of getting them back, meaning billions of dollars in losses.

(…) As of Thursday, there were 523 aircraft leased to Russian carriers by companies outside the country, according to IBA, a consulting firm. Of those, 101 are on lease to S7 Airlines and 89 to Aeroflot. Both airlines have stopped flying internationally, eliminating any chance of repossessing the planes on foreign soil.

“The general consensus is: That’s it, we will not be able to recover them,” said Vitaly Guzhva, a finance professor at Embry-Riddle Aeronautical University.

Dr. Guzhva and others who attended a recent industry conference in San Diego said the predicament for the leasing companies was the talk of the event, held by the International Society of Transport Aircraft Trading. Experts there generally aligned around the view that the companies were facing the possibility of huge losses, they said. All told, the planes are worth as much as $12 billion, according to Ishka, an aviation consulting firm. (…)

The financial consequences of the planes’ being held in Russia could be far-reaching, too. Such aircraft are financed in a variety of ways, including funding from banks, leasing companies themselves, and investors in securitized debt.

Insurers and reinsurers may be on the hook, too, experts said. Aviation war insurers, in particular, are concerned and facing their biggest potential losses since the Sept. 11 terrorist attacks, according to Russell Group, a data and analytics company. Aircraft insurance premiums have been on the rise for years as the industry struggled to counter recent annual losses. (…)

There will be lasting consequences for Russia, too. The crisis is likely to drive up the cost of doing business there generally and may cause some leasing companies and insurers to swear off the Russian market.

And while nationalizing the planes may provide a short-term benefit to Russia in keeping domestic flights moving, it won’t be long before carriers there grow desperate for spare parts. With Boeing and Airbus refusing to offer parts and support to Russian airlines, those carriers are likely to start cannibalizing the planes they have on hand, devaluing those aircraft. (…)

TECHNICALS WATCH

The S&P 500 is clearly in a downtrend with lower highs and lower lows so far this year. Its 200dma has flattened while its 13-14 EMA trend is 0.2% from flashing a cyclical bear signal. Most other technical indicators are also negative, including the critical measures of supply.

(…) But the two-week slump since the war started hasn’t deterred retail investors from trying to time the end of the market’s drop. In the week up to March 9, Investors poured $8.8 billion into U.S.-focused equity funds, the most in a month, EPFR Global data compiled by Bank of America Corp. show. Retail investors purchased a net $1.7 billion of stocks in the week ended Thursday, extending a two-month spree that according to JPMorgan Chase & Co. was the largest at this point in at least five years. (…)

It seems that retail buying continues to be overwhelmed by widespread selling.

The only recent positive is that small caps (S&P 600 and the Russell 2000) have stabilized. The Russell 2000 is now down 18.9% from its November 8 peak after having lost 22.5%.

- Panic Selling Grips Chinese Stocks in Biggest Plunge Since 2008 Concerns over Beijing’s close relationship with Russia and renewed regulatory risks sparked panic selling.

US officials say Russia has asked China for military help in Ukraine White House fears move is sign of ever closer ties between Beijing and Moscow

Chile’s Boric Becomes President With Vow to Redistribute Wealth

(…) Boric’s speech heralds the start of Chile’s most left-wing government in half a century that will be led by its youngest president ever. It is also the most feminist, with women taking charge of 14 of the 24 ministries. The former student protest leader won a decisive victory in December’s runoff on pledges to promote a more equal, tolerant and greener future for one of Latin America’s richest nations. Investors are hoping that doesn’t come at the cost of fiscal stability.

More broadly, his victory has galvanized the political left across Latin America, tapping into demands for a stronger government presence in the region that arguably suffered the most during the pandemic. Later this year, Colombia and Brazil will hold presidential elections and currently have leftist front-runners. (…)