Today: Fed stuff. Housing stuff. Chinese stuff. ECB stuff. Equities out of breadth?

Fed Plots Cautious Course on Rate Rises The Federal Reserve took two steps toward winding down the historic easy-money policies that have defined its response to the financial crisis but stopped short of the move markets are awaiting most: signaling when interest rates will start to rise.

(…) Rates will stay low for a “considerable time” after the bond-buying program ends, the Fed said, as the economy continues to face “significant underutilization of labor resources.” (…)

“I want to emphasize that there is no mechanical interpretation of what the term ‘considerable time’ means,” she said. “If the pace of progress in achieving our goals were to quicken, if it were to accelerate, it’s likely that the [Fed] would begin raising its target for the federal funds rate sooner than is now anticipated…and the opposite is also true.”

So, now we know that “considerable time” means whenever it is appropriate. As an economist said

“[Fed] policy is now running from data release to data release.” (…)

“On balance labor market conditions improved somewhat further, however the unemployment rate is little changed and a range of labor market indicators suggests that there remains significant underutilization of labor resources.” (…)

“There are still too many people who want jobs but cannot find them, too many who are working part time but would prefer full-time work, and too many who are not searching for a job but would be if the labor market were stronger,” she said, using the kind of expressive language that has been a hallmark of her early months as Fed chair.

The Fed said it would purchase $15 billion of mortgage and Treasury bonds in October and then stop its purchases. The Fed will then sit on its large portfolio. Eventually, after it starts raising interest rates, the Fed will allow the holdings to gradually shrink by allowing securities it holds to mature without reinvesting the proceeds. Ms. Yellen said the portfolio could remain large until the end of the decade. (…)

Dallas Fed President Richard Fisher and Philadelphia Fed President Charles Plosser dissented. Their reasoning was somewhat different but both officials indicated they believed the “considerable time” pledge overstates the amount of time the central bank will be able to wait before raising rates. (…)

Yellen fights a war against impatience Fed chair faces pressure from markets to take action

Ms Yellen had the tough task yesterday of explaining why the Fed’s policy statement and its forecasts were pointing in completely different directions.

The statement from the FOMC leaned towards easy monetary policy. It was somewhat downbeat on the economy, noting an unemployment rate that is “little changed”, and inflation running below the Fed’s long-run objective of 2 per cent.

The statement also kept unchanged the Fed’s forecast of low interest rates for a “considerable time” after it completes its programme of asset purchases – known as quantitative easing – in October.

Yet the forecasts of future interest rates submitted by members of the FOMC moved up quite a lot. For example, the median FOMC member now expects interest rates of 1.25 – 1.5 per cent by the end of 2015, up from a 1.125 per cent forecast in June.

Ms Yellen’s handled this contradiction – higher rates expected in 2015 but still no rise for a considerable time – by playing down both of them.

On one hand Ms Yellen significantly diluted the meaning of “considerable time” in her press conference. Many in financial markets have read the phrase as meaning interest rates will not rise for at least six months beyond October. Ms Yellen disavowed that.

While the wording stays in place, Ms Yellen’s words make clear that an interest rate rise in March next year is still definitely possible, provided the economic data between now and then are strong. (…)

But while Ms Yellen diluted “considerable time”, she also played down the higher interest forecasts, saying the changes were small and that they do not capture the full range of uncertainty anyway.

“I would say there is relatively little upward movement in the path,” said Ms Yellen, noting that it was still broadly in line with the Fed’s new projections for inflation and unemployment.

The bottom line was that Ms Yellen is not yet ready to move – and while that remains the case, the impatience of others is not going to press her into saying something precipitate.

Fed Walks the Expectations Line

(…) One possible factor behind the Fed’s decision to stay its hand: Inflation readings remain remarkably cool.

U.S. Stock-Index Futures Rise as Fed Words Boost Optimism

- Gold Falls to 8-Month Low in New York on Fed Rate Outlook

-

Emerging Stocks Drop on Fed Rate Outlook as Turkish Gauge Slides Emerging stocks declined for the 11th day this month on bets an increase in the Federal Reserve’s interest-rate target will spur outflows and as new home prices in China dropped. Turkish shares fell from a week-high.

-

Yen Weakens to Six-Year Low Against Dollar as Policies Diverge

U.S. Inflation Gauge Falls

The consumer-price index fell a seasonally adjusted 0.2% in August from a month earlier, the Labor Department said Wednesday. The index was unchanged after excluding volatile food and energy categories, the first time that measure didn’t record an increase since October 2010.

From a year earlier, the index was up 1.7% in August, a slowdown from the 2.0% annual rise recorded in July. So-called core prices also advanced 1.7% from a year earlier.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.5% annualized rate) in August. The 16% trimmed-mean Consumer Price Index was essentially unchanged (0.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.

Inflation Remains a No-Show

(…) Over the past five years, Milton Friedman’s dictum that ‘inflation is always and everywhere a monetary phenomenon’ hasn’t played out.”

I also observed that in the US there is clearly less slack in the labor market and in the overall economy than a year ago. Yet both wage inflation and price inflation remain remarkably low. I noted that there are lots of reasons why this is happening and may continue to do so. Globalization continues to keep a lid on wages. Easy money has financed excess capacity around the world, which is keeping a lid on prices. There have been lots of technological innovations, which tend to be deflationary. Low price inflation is keeping a lid on wage inflation.

So inflation isn’t always and everywhere a monetary phenomenon. Furthermore, deflation may be a monetary phenomenon if ultra-easy monetary policy boosts production capacity more than it does demand. (…)

From Tuesday’s New$ & View$:

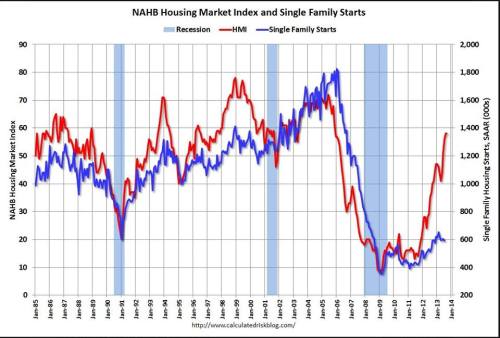

U.S. Home-Builder Optimism Surges Home-builder optimism surged in September to the highest level since 2005, a sign home construction could pick up in coming months.

An index of builder confidence in the market for newly built, single-family homes rose four points to 59 in September from August, the National Association of Home Builders said Wednesday.

Within the report, home-builder sentiment for present market conditions rose sharply, as did builders’ outlook on the traffic of prospective buyers.

“Since early summer, builders in many markets across the nation have been reporting that buyer interest and traffic have picked up, which is a positive sign that the housing market is moving in the right direction,” NAHB Chairman Kevin Kelly said in a statement. (Chart from Bespoke Investment)

But the optimism is not widespread…

… and has not transpired into more sales (chart from CalculatedRisk via Logan Mohtashami

Raymond James observes that:

- Mortgage rates highest in three months. The average contract rate on 30-year fixed conforming mortgages jumped 9 bp w/w to the highest level in three months and now stands at 4.36% (-39 bp y/y), leaving rates down 36 bp year-to-date. This was the largest w/w increase since December 2013.

- Mortgage credit availability down slightly. The Mortgage Credit Availability Index (MCAI) decreased slightly in August, down 0.3% compared to July’s reading. The index now stands at 116.1, up 4.1% y/y and 17% above the trough set in February 2012. Credit availability has seen little change since the beginning of the year (114.7 YTD average), creating a meaningful deterrent to a more robust housing recovery. We note, relative to credit standards prior to 2007, mortgage availability is roughly seven times more difficult today according to this index. In a recent Federal Reserve Bank of New York survey, 65.6% of renters in the sample said it would be somewhat or very difficult for them to get a mortgage while only 5.5% thought it would be very easy. A likely explanation is roughly 35% of renters in the sample believe their credit score to be below 680, likely creating a “discouraged” potential homebuyer (they assume that they would not qualify and as a result, may fail to apply for financing). Underwriting requirements remain unusually tight for borrowers with any credit blemishes, which continues to hinder the recovery of the first-time and entry-level homebuyer market.

This a.m.:

Wells Fargo eases lending requirements Less detail needed from borrowers with downpayments of 25%

Wells Fargo, the biggest originator of US home loans, is easing lending requirements for people buying certain types of homes, the latest in a series of moves by the bank to ramp up new mortgage lending.

“We’re tweaking our condo [condominium] approvals to make them more consistent with what Fannie [Mae] and Freddie [Mac] allow,” Franklin Codel, head of mortgage production at Wells Fargo, said in an interview. (…)

The changes come as more Americans are interested in buying a home. More than two-thirds of Americans think that now is a good time to buy a property, but many assume that they need higher downpayments than required, according to a Wells Fargo survey published this week alongside Ipsos Public Affairs.

Wells required much greater detail from borrowers applying for mortgages with downpayments of 25 per cent of the value of the property or less. However, the equivalent level of detail will now be needed from those with a downpayment of 10 per cent or less.

It comes as the bank and its rivals have reduced the lower end of the credit scores they are prepared to accept for loans and their loan-to-value ratios for borrowers. (…)

“The theme of this year is expanding our credit box, we want to offer lending to a broad set of consumers,” Mr Codel said. (…)

CHINA READY TO ACT

China Cuts Bank Borrowing Costs China’s central bank made a second surprise move this week to ease monetary policy with a cut in short-term borrowing costs for banks.

(…) It also fuels expectations for more aggressive monetary policy easing down the road, altering the dynamics of a fierce debate among economists over how far Beijing would go to counter slower-than-expected growth. Similar moves in the past by the People’s Bank of China have served as harbingers of adjustments to more widely used interest rates.

The latest attempt to boost lending and aid growth was in the money markets, with the central bank Thursday lowering the interest rate on the 14-day repurchase agreements, a short-term loan to commercial lenders, by 20 basis points to 3.50%. (…)

Chinese Borrowers Hold Back

(…) “Banks are willing to lend to me, but I’m borrowing less because I’m not expanding my business that much,” said Mr. Li, chairman of Jiangsu Haihao Agriculture Development Co. “The market is not looking good, which makes me more cautious.” (…)

China Home Price Drop Spreads to More Cities as Demand Weak

Prices dropped in 68 of the 70 cities in August from July, including in Beijing and Shanghai, the National Bureau of Statistics said in a statement today, the most since January 2011 when the government changed the way it compiles the data.

Home sales slumped 11 percent in the first eight months of this year amid an economic slowdown after banks tightened property lending to curb default risks. While 37 of the 46 cities that imposed limits on home ownership since 2010 have removed or eased such restrictions as of Sept. 3 to stem the decline in sales, a wait-and-see attitude is still prevalent among homebuyers, according to Centaline Group, parent of the nation’s biggest property agency.

New-home sales in the first 14 days of September in the 40 cities tracked by Centaline fell 4.7 percent, when measured by the combined space of homes sold, from the same period in August, trailing expectations for a traditionally strong month, the realtor said in a Sept. 15 report.

Prices fell in 19 cities from a year earlier, led by a 5.4 percent slide in Hangzhou, as compared to three cities in July, according to today’s data. (…)

Private data also point to continued price declines. The average new-home price fell 0.59 percent in August from July, the fourth consecutive month of declines, according to SouFun Holdings Ltd., the nation’s biggest real estate website that tracks 100 cities. (…) (chart from FT Alphaville)

ECB’s lending spree misses expectations First take-up of cheap four-year loans deals blow to Draghi

The European Central Bank’s first offer of cheap four-year loans has fallen short of expectations, dealing a blow to president Mario Draghi’s hope of sustaining the eurozone’s ailing economy by expanding the central bank’s balance sheet.

The ECB has announced that banks borrowed €82.6bn through the first of its Targeted Longer-Term Refinancing Operations, or TLTROs. A poll by Bloomberg earlier this week showed analysts, on average, expected banks to bid for €174bn of loans from a maximum of €400bn.(…)

Breadth By Market Cap

Technicians typically use market breadth as a tool to confirm the direction of the overall market. When the market is moving higher and breadth is positive, it serves as confirmation of the rally. Conversely, if the market is rallying but breadth is weak, it could spell trouble for the market. One of the most basic ways to measure market breadth is through the cumulative advance/decline (A/D) line. This indicator simply adds the net number of stocks (advancers minus decliners) in an index that traded higher on the day and then adds that number to a running total from a specific starting point.

(…) While breadth for all three indices started out the year on a similar path, things began to diverge in late March and early April when small caps (red line) started to show signs of faltering. Since then, breadth in small caps hasn’t rebounded and has remained stuck in a range all year. While breadth in small caps faltered, breadth in mid and large cap stocks kept chugging along through Spring and into Summer. As Summer approached, though, the strength of the breadth in mid caps showed signs of slowing early on and actually led breadth in the large caps lower from late June through the end of July. In the market rebound that followed, breadth in both indices rebounded, but while the S&P 500’s (large cap) cumulative A/D line handily made a new high, breadth in mid caps just barely exceeded its peak from 7/1.

Robots Work Their Way Into Small Factories New, relatively inexpensive collaborative robots—designed to work alongside people in close settings—are changing how some smaller U.S. manufacturers do their jobs.

Robots Work Their Way Into Small Factories New, relatively inexpensive collaborative robots—designed to work alongside people in close settings—are changing how some smaller U.S. manufacturers do their jobs.

The machines, priced as low as $20,000, provide such companies—small jewelry makers and toy makers among them—with new incentives to automate to increase overall productivity and lower labor costs. (…)

Collaborative robots can be set to do one task one day—such as picking pieces off an assembly line and putting them in a box—and a different task the next. (…)

Some are mobile and able to range freely inside a factory. The use of advanced sensors means they stop or reposition themselves when a person gets in their way, solving a safety issue that long kept robots out of smaller factories. (…)

Sensors are changing our lives in so many more ways.

The Federal Reserve Bank of New York indicated that its Empire State Factory Index of General Business Conditions for February fell to 4.48 from its two year high of 12.51 during January.The latest figure fell short of expectations for a level of 9.5, according to the Action Economics Forecast Survey.

The Federal Reserve Bank of New York indicated that its Empire State Factory Index of General Business Conditions for February fell to 4.48 from its two year high of 12.51 during January.The latest figure fell short of expectations for a level of 9.5, according to the Action Economics Forecast Survey.

More weather blaming. Look at the NAHB’s headline:

More weather blaming. Look at the NAHB’s headline:

First Mercedes, then Porsche, and now Ferrari and Maserati post record US sales in January…

First Mercedes, then Porsche, and now Ferrari and Maserati post record US sales in January…