Yesterday, I posted Power Play 2 about the drive to produce enough energy to power the AI revolution.

Another type of power play is happening between China and the US, with Europe in-between, that will likely accelerate deglobalization and disrupt supply chains strategies.

The evolving Nexperia saga coincides with China’s rare earths bombshell and is part of the bras-de-fer between the US and China. Nexperia puts the EU right in the middle of it.

Today’s WSJ article frames the economic/corporate effects. Next, I will describe the geopolitical aspects. Put together, it’s a real earthquake that adds to the rare earths bombshell.

The Auto Industry Is Panicking About Another Potential Chip Shortage Chinese-owned chip maker Nexperia has told suppliers it won’t ship product after Dutch government took control of company

The auto industry is digesting a new and potentially damaging supply-chain disruption from an unlikely source: a small Dutch semiconductor manufacturer with an outsize influence on how cars and trucks are made.

Nexperia notified customers last week that it was stopping shipments of parts, people familiar with the matter say. The company’s chips are used in everything from lights to electronics. The move came after the Dutch government wrested control of the company from its Chinese owner. Nexperia declared the continuing situation a “force majeure” event, the people say, citing a provision that generally can excuse companies from contractual obligations when facing an extraordinary situation.

While Nexperia is a small player in the automotive-chip market overall, it is the market leader for a basic category of chips mainly consisting of transistors and diodes, said Ian Riches, a vice president at TechInsights, a chip data and intelligence provider. In that category, Nexperia has about a 40% market share, he added.

“They go into everything and anything,” Riches said. “If you’re building a complicated product, it only takes a shortage of one basic component to stop the whole thing.”

Nexperia, whose parts end up in cars from BMW, Toyota and Mercedes-Benz, produces high volumes of semiconductors and basic transistors that are used in vehicle systems, including electronic control units. Car companies and parts makers are now racing to understand their exposure and find alternative sources of chips, saying that if Nexperia can’t ship then vehicle production could be affected in the next few weeks. (…)

Automakers have been monitoring a parallel threat in recent days over China’s rare-earth minerals, after the country tightened exports and increased tension with the U.S. Toyota heard last week from some suppliers that Chinese facilities were unable to ship products, a person familiar with the situation said. Toyota initially thought the delay was related to China’s limits on rare-earth minerals, but later found out it was tied to the Nexperia situation, the person said. (…)

In early October, the Chinese government ordered Wingtech to suspend Nexperia’s exports from China, where 80% of its products are processed before being delivered to customers. (…)

Nexperia has been sending most chips made at factories in Europe to facilities in China for packaging and testing before shipments go out to customers, leaving it exposed to significant disruptions, some of the people said.

Automakers and suppliers have alternative sources of the same type of chips, but the situation could result in production disruptions if Nexperia’s shipment stoppage is protracted, the people added. Companies with multiple sources can have their other suppliers increase production, but those who relied entirely on Nexperia for some components could take weeks to get a new part cleared for production by an automaker. (…)

What follows is my summary of the events as gleaned from various media following the release on Tuesday by the Amsterdam court of appeal of the proceedings between the Dutch economy ministry and Wingtech.

- Nexperia makes basic low-margin chips in vast quantities ($10B/year+) for consumer electronics and a broad range of industrial uses. It employs more than 12,500 people and produces about 3,000 semiconductors every second. It is an important supplier for Europe’s auto industry. Nexperia’s products make up a key part of the automotive supply chain, with hundreds of them in a single car. Automakers don’t necessarily source chips directly, but often buy finished parts with semiconductors in them from larger suppliers like Bosch and Aumovio, the car-parts business spun off by Continental. Those companies also get individual components from smaller suppliers, making it difficult to quickly assess the scope of potential supply-chain disruptions.

- The chips are not particularly high-end so this expands the trade brawl beyond, or below, the very sophisticated products made by Nvidia and ASML, also a Dutch company. That widens the field quite a bit.

- In 2017, Nexperia was sold to a state-sponsored Chinese consortium which subsequently sold it to Chinese group Wingtech, a listed company on the Shanghai exchange.

- The acquisition was to have seen Nexperia run independently but chief executive Frans Scheper departed within months of the deal going through, and Wingtech founder Zhang Xuezheng swiftly assumed his seat.

- Nijmegen-based Nexperia began discussions with the Netherlands in early 2024 about “obtaining recognition” as a Dutch company to counter “negative” public perceptions about its Chinese ownership, the filing says.

- The documents show CEO Zhang resisted the carve-out and had tightened his control over the company since Wingtech acquired it in 2019.

- Washington last year added Wingtech to its entity list, saying it was helping China acquire sensitive semiconductor manufacturing technology. The list is used to impose controls on groups seen as acting against US national security or foreign policy interests. US companies must get a licence to sell to them, which is hard to obtain, in effect limiting access to advanced technology.

- Last December, the economy ministry told Nexperia it must ensure it has “operational independence from its listed shareholder” along with an effective policy on cyber security and “insider threats”.

- The company responded in March, saying: “A clear/unconditional guarantee in relation to the Dutch/European identity/presence cannot be given, since this would restrict the shareholder’s control rights too much” and would “limit the company’s flexibility in relation to its business needs/plans in an unreasonable manner”.

- US officials told the Dutch in June that a plan to ringfence its European operations from Chinese ones was moving too slowly.

- In September Zhang removed the bank authorisations of three of the company’s financial officers, prompting concerns from European members of Nexperia’s executive board about governance, the documents show.

- With Zhang resisting governance safeguards, Washington in effect upped the ante by making clear the blacklisting also applied to Nexperia, Wingtech’s subsidiary, threatening the business.

- Last month, the US commerce department in effect gave Nexperia an ultimatum when it said curbs on Wingtech under the US entity list designation would also apply to its Dutch subsidiary. According to minutes of a meeting between the Dutch foreign ministry and the US Bureau of International Security and Nonproliferation, the US was concerned that “the fact that the company’s CEO is still the same Chinese owner is problematic”. “It is almost certain that the CEO will have to be replaced to qualify for the exemption from the entity list,” the Dutch foreign ministry minutes said, according to the court documents.

- On September 30, the US expanded the list to include subsidiaries of companies, meaning Nexperia would face the same restrictions by the end of November. Washington said that the company would not be removed from its export control list if its Chinese chief executive remained in charge, according to court filings.

- The economy ministry this month removed the chief executive, Zhang Xuezheng — who was also the controlling shareholder of the chipmaker — in a rare move that brought the Netherlands into the escalating fight for technological dominance between Washington and Beijing.

- After the law was invoked, three European Nexperia executives called for a probe into the company, according to a regulatory filing by Wingtech. Its chief legal officer, supported by chief operating officer and chief financial officer, filed a petition to an Amsterdam court on Oct. 1 seeking an investigation into the firm, Wingtech said.

- On the same day Vincent Karremans, the Dutch economy minister, used the emergency Goods Availability Act, a 70-year-old law, for the first time to “preserve [Nexperia’s] business and means of production”, according to the documents. The Dutch government cited “serious governance shortcomings”. They did not seize the company but ensured that all the political and economic decisions guiding the company will now be made by European-based directors and by the government. The claim is that the company was being badly managed and decisions were being taken that would threaten the supply of chips to the European market. So the argument the Dutch government is making is this was vital to make this move in order to ensure that European manufacturers had access to Nexperia chips for the foreseeable future.

- The takeover of Nexperia is a drastic move that triggered instant retaliation from Beijing, with a ban on exports of Nexperia products assembled in China. China’s commerce ministry on October 4 prohibited Nexperia China and its subcontractors from exporting specific finished components and sub-assemblies manufactured in China.

- Wingtech CEO Shen cited Wingtech’s Dutch counsel as advising them that the Dutch economic ministry was “a meek little lamb following behind the US government”. Shen said Wingtech had been preparing for the US rules by pushing “initiatives to advance domestic substitution” of foreign parts. Wingtech chair Yang Mu said that in a worst-case scenario Wingtech would “prioritise safeguarding our Chinese assets and operations”. Executives noted that about half of Nexperia’s business was done in China and that 80 per cent of its chips were packaged and shipped from mainland China. Zhang’s company Wen Tianxia Group, Wingtech’s controlling shareholder, has also poured Rmb12bn (£1.27bn) into building a semiconductor fabrication plant in Shanghai that is set to start making Nexperia’s products. The Dutch government fears Zhang was preparing to transfer assets and intellectual property to his Chinese entities.

The US expansion of its entity list to include subsidiaries was cited as one of the reasons Xi moved on rare earths. The Trump-Xi meeting will no doubt be very crucial.

Nexperia was one of many large-scale strategic takeovers by Chinese investors of western companies in critical technologies or infrastructure during the middle of the last decade. It is the first to be fully clawed back by a western government. It may not be the last.

“If the situation is not resolved quickly at the political level, there is a risk of a standstill in large parts of global automotive production and in numerous other industrial sectors,” said Wolfgang Weber, who heads Germany’s electrical and digital industry association ZVEI.

The old assumption that complex interdependencies force countries in the supply chain to work together no longer applies.

Nothing from all this is positive, unless it leads to a major and broad change of attitudes. I’m not holding my breath. There are no friends, no allies anymore.

After export controls of Nvidia chips failed to impact China, the main US weapon is tariffs while China’s is now clearly supply chain disruption. Who’s got more power? Who’s more fearful?

Who’s facing elections next year?

(…) Caught flat-footed by Trump’s first-term trade war, Xi ordered the development of what he called “assassin’s mace” technologies that would provide an asymmetrical advantage, including making international supply chains dependent on China to provide a “deterrent capability against foreigners who would artificially cut off supply.” In 2020, China passed an Export Control Law that gave Xi a similar ability to restrict sensitive items like rare earths and put US companies on an “unreliable entities list.”

Although the world appeared surprised by China’s most recent curbs, they had been telegraphed ever since Deng’s 1992 proclamation: “The Middle East has its oil, China has rare earths.” In 2010, Beijing deployed a stealth rare-earth embargo against Japan over a territorial dispute. The move showed the world the dangers of relying too heavily on China for supplies and prompted Japan, the US and the European Union to file a WTO case against China. (…)

A Bloomberg analysis last year found that China has achieved a global leadership position in five of 13 key technologies and is catching up fast in seven others, including artificial intelligence and robots. It has obtained a clear lead in electric vehicles, automotive software and lithium battery technology, produces the world’s most efficient and lowest-cost solar panels, and is developing innovative drugs — rendering obsolete the old punchline “the US innovates, China replicates.” (…)

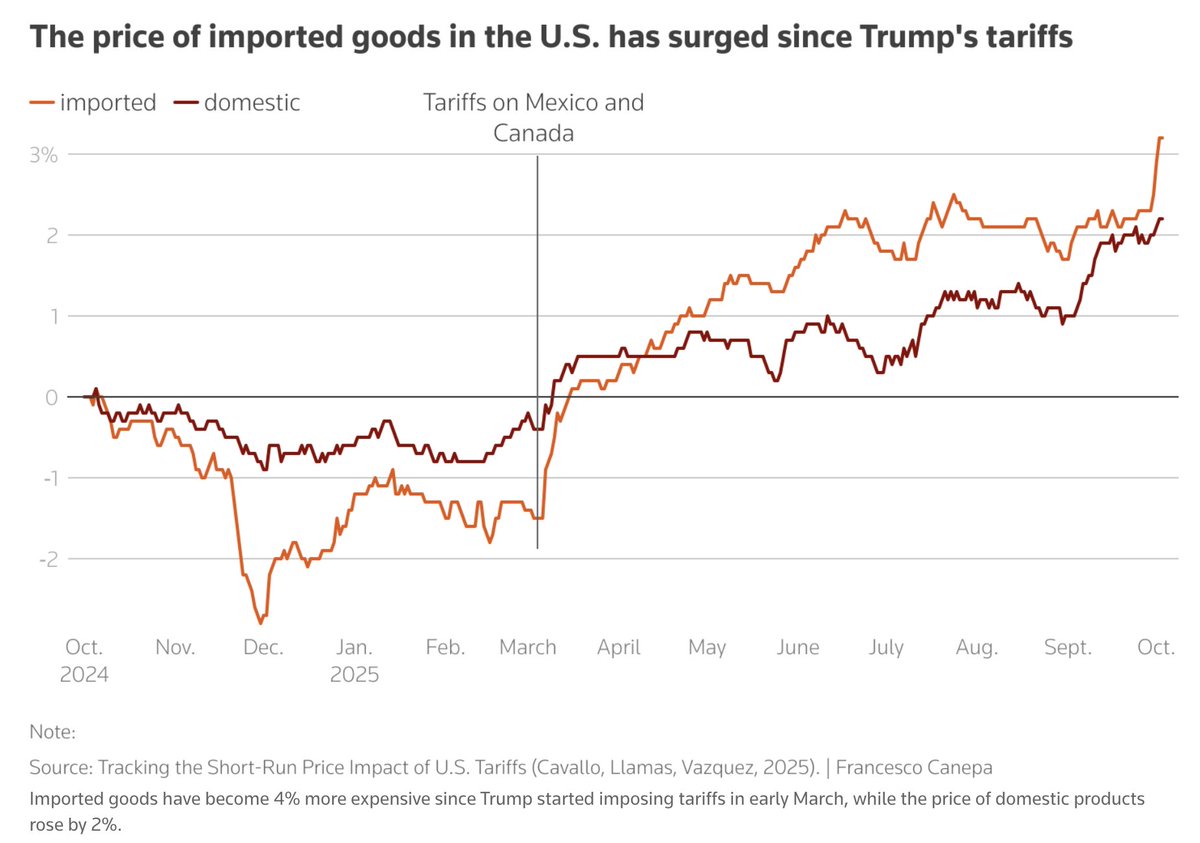

Trump has spent much of this year trying to rebuild the American manufacturing base, pushing tariffs up to the highest level since the 1930s and pressuring countries to commit hundreds of billions of dollars in investments to avoid even more astronomical rates. (…)

Yet beyond the big-number announcements, plenty of obstacles remain — including Trump’s own policies. That contrasts with China’s top-down central planning model, where bureaucrats meticulously map out targets like “Made in China 2025” and coordinate across government agencies to hit them.

Besides higher wages and a difficult regulatory environment, American manufacturers face heightened tariffs on inputs, fewer incentives for new technology like EVs, and stricter immigration policies that are scaring away top foreign talent. (…)

The US still retains key leverage against China, as Trump repeatedly points out. When Xi blocked rare-earth magnets earlier this year, the US president in turn stopped China from buying chip design software, ethane, jet engines and aircraft spare parts until they reached a truce. He’s now threatening to restore those curbs as both sides spar ahead of a planned meeting between the leaders at a summit in South Korea later this month.

But by hitting Xi’s government so hard and then backing down, Trump has only shown how strong China has become.

In Beijing, authorities have a renewed confidence that their policies are working. Exports have stayed robust despite tariffs exceeding 50%, DeepSeek showed it can achieve AI breakthroughs, and China has deployed an army of engineers in a bid to build high-end chips that rival Nvidia’s.

At the same time, China’s world-beating manufacturing sector has the potential to backfire. Just when middle powers and US allies began leaning toward Beijing to derisk from Trump, Xi’s overly broad use of rare earths as a geopolitical weapon reminded them that China could crush their economies whenever it wants.

Nations were already mulling whether to follow the US in taking action as Chinese goods flood the world, including a 56% jump in shipments to Africa last month. Mexico is weighing tariffs of as much as 50% on cars and other products, while the EU is considering forcing Chinese firms to hand over technology if they want to operate locally. (…)

West will sacrifice cheap power if it spurns Chinese tech, says turbine maker Goldwind’s vice-president Kai Wu says the country’s cost advantage has become ‘huge’

The west must be prepared for higher wind energy costs if it rejects Chinese companies from its industry, said an executive at one of China’s biggest turbine manufacturers.

Kai Wu, Goldwind’s vice-president, said it was “fully understandable” that foreign governments want to deepen their local supply chains and create employment opportunities.

But he warned that China’s cost advantage in turbine manufacturing had grown “huge” at about “40 per cent, at least” compared with western rivals. Greater turbine costs result in higher electricity prices as the cost of installation is passed on to consumers. (…)

China’s clean energy investment reached more than $625bn last year, almost doubling since 2015, according to International Energy Agency data. Companies in the country produce more than 80 per cent of the world’s wind turbines, solar panels and energy storage batteries. State support, fierce local competition and technological breakthroughs have resulted in steep falls in costs. (…)

Wu said that, compared with China, wind projects in the west took longer to develop and were more expensive to build. He noted that, while some western engineering graduates seek a salary as high as $140,000, he could hire “at least three” for the same rate in China. (…)

The LCOE represents the average revenue per unit of electricity generated that would be required to recover the costs of building and operating a generating plant over an assumed financial life and duty cycle.

On average, China can produce electricity from major power-generating technologies at a cost that is 11% to 64% lower than in other markets . New renewable energy projects in China, as in most parts of the world, are now more cost-competitive than new coal and gas plants.

The following table compares the unsubsidized LCOE for new-build energy projects in the U.S. and China. The U.S. figures are from Lazard’s 2025 analysis, while the China estimates are based on reports from BloombergNEF (BNEF) and other energy analysts. All figures are in U.S. dollars per megawatt-hour ($/MWh).

Note that the US costs for onshore wind and solar energy is now substantially lower than for natural gas. Yet Trump’s policies keep focusing on gas while deemphasizing renewables.

One day, the US could find itself low on gas.

Oil Prices Drop to the Lowest Level in Nearly Five Years A glut of crude has pushed U.S. oil futures 19% lower over the past year

Most actively traded U.S. oil futures ended Thursday at $56.99 a barrel, down 2.2% on the day and 19% from a year ago. That marked the lowest price since February 2021. Declines this week bring prices below the depths of the spring selloff when President Trump unleashed a barrage of tariffs and sparked worries of economic turmoil.

The decline is good news for American consumers because cheaper crude portends lower prices for gasoline, diesel, jet fuel and heating oil. But it is an alarming situation for a U.S. oil industry already beset by narrowing profit margins and shedding jobs by the thousands.

U.S. drivers, who were already expected to spend the smallest portion of their disposable income on gasoline in years, are seeing reduced prices thanks to the glut. The average retail prices for regular unleaded gasoline was $3.057 a gallon on Thursday, about 15 cents less than a year earlier, according to AAA.

In many states, including Michigan, Ohio, Texas and Colorado, the average price has already dropped below $3 a gallon. The Energy Information Administration earlier this month forecast a national average of $2.90 a gallon next year. (…)

Once again, a flood of fuel is being stashed offshore. The volume of oil at sea swelled by about 3.4 million barrels a day in September, the greatest increase since the pandemic, according to the International Energy Agency.

The IEA is among the energy-market forecasters anticipating that the glut will grow in the coming months given that producers from the Middle East to Midland, Texas, are pumping oil as though prices were climbing toward highs rather than tumbling to multiyear lows.

U.S. oil producers notched a fresh output record of more than 13.6 million barrels a day in July, according to the most recent data available from the EIA. The federal agency’s weekly petroleum report, which has continued to be published despite the government shutdown, suggests that production has remained around that level. (…)

Earlier this month, Saudi-led OPEC said it would boost production by 137,000 barrels a day in November, as it has this month. It added back a bigger chunk of its curtailment in September, a year ahead of schedule. OPEC said earlier this week that it expects demand to rise next year and balance the market. (…)

Energy data-firm East Daley Analytics expects U.S. oil production to end this year around the record 13.6 million barrels a day.

One reason the firm doesn’t expect U.S. producers to slow down is that they often have obligations to supply other fuels, including natural gas and propane, that flow from the same wells as oil. (…)

Analysts say the oversupply of oil has been partly masked this year by China’s stockpiling of crude. The country’s oil imports in September were 3.9% higher than a year earlier, Commerzbank said, citing Chinese customs data.

Escalations in the trade war between China and the U.S. this month have added fuel to forecasts for slowing economic growth in the world’s two largest economies and therefore weaker oil demand.

There is a link between the last two articles:

In the United States, a large share of natural gas comes directly from oil-producing wells — a type known as associated gas. This gas is produced as a byproduct of crude oil extraction and has become a major component of total U.S. gas output due to the expansion of shale oil production, particularly in the Permian Basin, Eagle Ford, and Bakken regions.

Across all oil-producing formations (Permian, Eagle Ford, Bakken, Niobrara, and Anadarko), the EIA estimates that associated gas accounts for approximately 12–15% of total U.S. natural gas output.

Were oil producers to find it uneconomical to produce oil at current levels, the supply of natural gas would decline, potentially impacting the availability and cost of natural gas for all the AI related data centers being built and announced.

In 2025, the average cost to produce oil in the U.S. ranges between $35 and $75 per barrel, depending on basin, well age, and infrastructure, with a national weighted breakeven near $70 per barrel. The Permian remains the most economical ($35-61), while higher‑cost basins like the Bakken and Niobrara ($55-75) face tighter margins amid falling global crude prices.

On average, U.S. shale oil wells require $65–70 per barrel to cover full-cycle breakeven costs, meaning the minimum price at which new drilling projects remain profitable.

These costs take no account of Trump’s tariffs.

EU Exports to U.S. Drop Sharply Exports to the U.S. fell 26% on month in August and 22% on year

(…) Seasonally adjusted exports overall from the European Union decreased by 1.2% on month in August compared with July, statistics agency Eurostat said Thursday. Imports fell by a larger 2.1%, suggesting the trade environment is weakening. (…)

New Credit Fraud Fears Raise More Worries About Regional Banks Bank shares were hammered Thursday after ties emerged between several banks and borrowers accused of fraud

Regional banks came under renewed scrutiny Thursday after Zions Bancorp said it would take a large loss and revealed accusations of fraud against a set of borrowers who had ties to a number of other lenders in the industry.

The disclosures helped send bank stocks reeling to their worst day since President Trump’s tariffs hammered the market in April, evidence of how on edge Wall Street is after the recent high-profile bankruptcies of auto supplier First Brands and auto lender Tricolor.

It wasn’t clear how widespread any pain would be from the new allegations, which center on a set of investment funds that are now being sued by several banks.

Salt Lake City-based Zions said it has filed a lawsuit to recover more than $60 million it had lent to investment funds Cantor II and Cantor IV. The funds had used the revolving credit facilities to purchase distressed commercial mortgage loans, Zions said.

Phoenix-based Western Alliance Bancorp is seeking to recover roughly $100 million from Cantor Group V, an entity managed by the same leadership team, according to Zions’s lawsuit. (…)

Bankers have maintained there is no wider reason for concern, though JPMorgan Chase Chief Executive Jamie Dimon has warned he is watching.

“When you see one cockroach, there are probably more,” Dimon said.

In third-quarter results, large banks reported that consumers have continued to spend and borrow at a healthy clip. Executives contended that the recent credit blowups were isolated one-offs, rather than signs of broader systemic problems. Regional and community banks are set to report over the next few weeks. (…)

Ed Yardeni:

We are not too concerned about cockroaches in the private credit market. Loan losses in that market reduce the rates of return on diversified portfolios of such loans. They don’t trigger an economy-wide credit crunch, which has often occurred when bad loans hit the banking system hard.

The bad news about the cockroaches pushed the S&P 500 back down near its 50-day moving average today. We still expect it to hold, though we can’t rule out a test of the 200-day moving average [6060] if the 50-dma fails to support the index. Widespread expectations of another two Fed rate cuts before the end of this year suggest that further downside should be limited.