US Services PMIs

S&P Global: Business activity growth softens, while selling prices rise at weakest rate in five months

The headline S&P Global US Services PMI Business Activity Index recorded 54.2 in September, down from 54.5 in August. Remaining above the critical 50.0 no-change mark, that separates growth from contraction, the index has now signaled continuous service sector expansion for 32 months. Furthermore, over the third quarter, average monthly growth was the best recorded over a calendar quarter in 2025 so far.

That said, the index has now fallen for two months in a row, representing a slowdown from July’s year-to-date peak. This reflected a similar softening of sales growth to a three-month low amid some reports that tariffs and broader uncertainty had limited gains in overall market demand. Foreign sales were a bright spot, however, with new export business up modestly and for the first time since March.

Despite evidence of ongoing capacity pressures – backlogs of work rose solidly for a seventh successive month in September – slightly softer rates of demand and activity growth led to some reluctance amongst US service companies to add to their staffing levels. The net result was only a marginal overall increase in employment, albeit still extending the current period of continuous payroll expansion to seven months.

Business confidence also improved in September, strengthening to its highest since May. Whilst there remains some uncertainty in the outlook, especially around tariffs, lower interest rates in some instances were reported to have boosted optimism by adding to hopes of a pickup of demand in the year ahead. Several panelists also linked their positive sentiment to expectations that federal government policies will support economic growth in the year ahead.

Tariffs remained a key source of cost pressures in September, which overall rose sharply and to a slightly faster degree than the previous month. Higher supplier charges and payroll expenses also added to upward pressure on company operating expenses.

Although overall costs again rose at an above trend pace, selling prices increased to the slowest degree since April (albeit also still higher than the historical rate). Whilst firms sought to pass on their higher input costs to clients, in some instances slower demand growth and competition limited pricing power.

The S&P Global US Composite PMI recorded 53.9 in September. That was down from 54.6 in August and represented the slowest growth for three months. Both sectors covered by the survey recorded weaker output expansions in line with slower gains in new business.

Employment meanwhile barely rose, but confidence in the outlook strengthened noticeably. Cost pressures remained elevated, although inflation softened to a five-month low. A similar trend was seen for output charges.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

“Service sector growth softened slightly in September but remained strong enough to round off an impressive performance over the third quarter a whole. Combined with sustained growth in the manufacturing sector, the expansion of service sector activity is indicative of robust third quarter annualized GDP growth of around 2.5%.

“Growth is being fueled principally by rising financial services and tech sector activity, though we are also seeing more signs of improving demand for consumer-facing services such as leisure and recreation, likely linked in part to lower interest rates. Lower borrowing costs have also fed through to a broad-based improvement in business optimism about the outlook for the next 12 months.

“Disappointingly, the improvement in business optimism failed to spur more jobs growth, with hiring almost stalling in a sign of further labor market malaise as companies often focused on running more efficiently amid uncertain trading conditions.

“A further ongoing source of concern from the surveys are heightened cost pressures which survey respondents have attributed to tariffs. Input costs rose sharply again in September as import levies were seen to have again fed through from goods to services. However, rates charged for services rose at the slowest rate for five months in a welcome sign that some of these tariff price pressures in supply chains are starting to moderate.”

ISM: Services activity cooled as hiring slides

ISM services index for September has come in weaker than predicted, dropping from 52 (growth territory) to 50 (consistent with flat activity). The consensus prediction was 51.7, but the outcome was actually below all individual survey responses provided to Bloomberg.

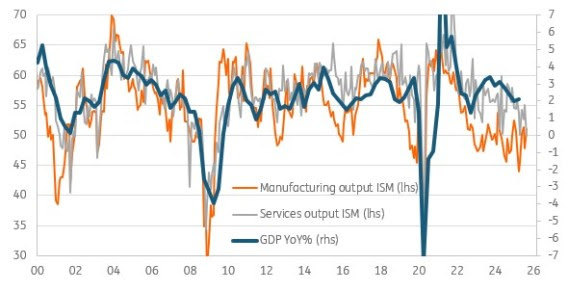

The details show business activity dropping to 49.9 from 55.0. This is the worst outcome since the shutdown period of the pandemic in May 2020, while new orders fell from 56.0 to 50.4. The employment component rose to 47.2 from 46.5, but because it remains below 50, this increase merely means that the pace of job losses slowed last month. The chart below shows the output measures of both the services and manufacturing ISM series versus annual GDP growth, and based on the historical relationship, points to the risk of slowing growth in the coming quarters.

GDP growth (YoY%) versus ISM output metrics advanced 6 months

Source: Macrobond, ING

While we didn’t get the jobs report [Friday], the ADP private payrolls numbers earlier in the week suggest the jobs market continues to cool, while the job openings numbers within the JOLTS report show there are now more unemployed people in America than there are job vacancies.

At the same time, a slowing quits rate – a measure of job turnover – is pointing to wage growth dropping below 3% in early 2026. This combination of sub-trend growth and weakening jobs numbers will, we believe, drive the Fed’s interest rate decisions.

There are lingering concerns about tariffs pushing up prices and inflation, with today’s ISM prices paid series doing nothing to dispel them – it rose to 69.4 from 69.2, so well above the 50 break-even level. However, tariffs have come through more slowly than feared in the key inflation metrics the Fed focuses on, of CPI and the PCE deflator.

As such, the balance of risks to the Fed’s dual mandate of price stability and maximum employment justifies the central bank moving monetary policy closer to neutral with 25bp interest rate cuts at the October and December FOMC meetings expected.

WHAT RESPONDENTS ARE SAYING

- “We are beginning to see the impact of the tariffs impact our business, particularly for food products from India, China, and Southeast Asia, coffee from South America, and apparel and electronics from Asia. Our year-over-year cost increases are getting progressively greater.” [Accommodation & Food Services]

- “New residential construction continues to struggle in a tough market. Housing values remain high, and tariffs are beginning to be passed through on materials that are metal based. The pace of housing starts has been stagnant to slightly declining, as we head out of the summer building season.” [Construction]

- “Pharmacy costs continue to rise, and medical devices are being held at bay mainly due to contracts and continued negotiations where we have two to three sources for a given product.” [Health Care & Social Assistance]

- “Demand for artificial intelligence (AI) and cloud infrastructure remains very strong. Our primary focus this month was on increasing production throughput to begin clearing the significant order backlog built up over the summer. While new order intake has stabilized at a high level, the overall business outlook remains positive. We are still facing significant supply chain challenges, especially for advanced semiconductors and power components, with lead times remaining extended. Price pressures are still present but have not worsened compared to the previous month.” [Information]

- “Client demand in professional services remains steady, though decision-making timelines are lengthening due to continued economic uncertainty and interest-rate concerns. We are also seeing modest upward pressure on labor costs, which impacts both our internal resourcing and supplier pricing.” [Professional, Scientific & Technical Services]

- “The overall housing market remains stagnant, which has forced our company to be hyper-vigilant about costs. However, we are growing and increasing our market share despite the headwinds. Tariffs continue to inject an unnecessary level of uncertainty across the broader economy, and costs are now beginning to increase with the full effect of the tariffs now coming into play.” [Real Estate, Rental & Leasing]

- “Costs overall have stabilized, and we’ve not seen any interruptions in sourcing or shipments.” [Retail Trade]

- “We’ve had more tariff charges last month than in previous months.” [Utilities]

- “Business conditions continue to soften, even in markets that have historically been more resilient. Demand is simply weak.” [Wholesale Trade]

S&P Global sees GDP growth of 2.5% in Q3 but notes that the index has fallen in the last 2 months of the quarter with sales growth a three-month low, supported by a wholesaler saying “demand is simply weak”.

S&P also notes that “overall costs again rose at an above trend pace”, rising “sharply and to a slightly faster degree than the previous month”, supported by several ISM comments about tariffs increasingly biting.

But S&P also reports that “selling prices increased to the slowest degree since April” because “slower demand growth and competition limited pricing power.”

If ING is right and wage growth drops below 3% in early 2026, one better hopes inflation slows down materially, particularly with employment growth stalling.

Then demand could get worse than “simply weak” or profit margins will also become “simply weak”.

- Impact of Trump tariffs is beginning to show in US consumer prices Trade levies are starting to drive up costs for goods from cans of soup to car parts

(…) Since April, leading retailers have raised prices on 11 of 29 “soft line” products, such as T-shirts and shoes; 12 or 18 “hard lines,” such as bicycles and dishwashers; and five of 16 sporting goods items, according to a sample of imported goods tracked by Telsey Advisory Group, a Wall Street research firm. (…)

Ashley Furniture, the world’s largest furniture manufacturer, plans to raise prices for the majority of its products by 3.5 to 12 per cent starting on Sunday, according to a notice to customers first reported by Home News Now, an industry publication. “The ongoing tariff situation has created significant challenges with cost impacts across our industry,” said the notice from Todd Wanek, chief executive. (…)

Ashley’s notice came before Trump’s announcement this week of a new 25 per cent on upholstered furniture, to take effect on October 14.

At car parts retailer AutoZone, “there probably will be more” price rises as the full impact of tariffs becomes felt, Philip Daniele, chief executive, told analysts late last month. He said many customers would be willing to pay.

“If the starter breaks, your car is not going to start,” Daniele said. Drivers are faced with a choice: “Either bum a ride or get your car fixed or take an Uber,” he added.

Coffee prices have been surging, in part because of 50 per cent duties on Brazil, the world’s largest coffee exporter. Tariffs on imported tin-plate steel has also driven up the price of food cans. (…)

More tariffs to hit:

Invasion of the Killer Ikea Sofas There’s nothing Trump won’t call a ‘national security’ threat to justify a punitive tariff.

The WSJ Editorial Board

(…) The President on Monday announced 10% tariffs on lumber as well as 25% on upholstered wooden furniture, bathroom vanities and kitchen cabinets. This follows last week’s announcement of tariffs on heavy-duty trucks (25%). All of these tariffs are being imposed under Section 232 of the 1962 Trade Expansion Act to—get this—protect national security. (…)

The trouble is that his metal tariffs, which he made even more punitive this year, are hurting U.S. manufacturers of hundreds of products. Furniture manufacturers are having to pay more for imported steel, aluminum, timber and upholstery. Trucking companies are placing fewer orders for new big rigs because of the slowdown in trade. Building permits for new housing units have fallen 11% over the last year, which home builders attribute to tariff uncertainty. That means less demand for kitchen cabinets.

Mr. Trump’s household remedy is always more tariffs to counter the damage from his previous tariffs. So in August he broadened his metal tariffs to include some 400 “derivative” products, including butter knives, spray deodorants and baby strollers.

His Administration has launched sweeping 232 investigations into pharmaceuticals, trucks, timber and lumber, semiconductors, polysilicon and its derivatives, drones, jet engines and more. Mr. Trump’s latest tariffs flow from those investigations. With his trade officials as rubber stamps, there are no imports that Mr. Trump won’t declare a threat to national security.

A Supreme Court decision striking down the IEEPA tariffs is vitally important to the rule of law. But Mr. Trump is showing he will then use Section 232 to damaging effect, much as Joe Biden turned to new authorities to forgive student debt after the Justices blocked his first forgiveness plan. This is another reason for Congress to rein in Section 232.

Bipartisan Senate legislation in 2021 to subject 232 tariffs to Congressional approval had 11 GOP co-sponsors. Republicans in Congress have been reluctant to limit Mr. Trump’s tariff power, or anything else he does for that matter. But they might note that his border taxes are broadly unpopular and could boomerang on the party during the midterm elections.

Software and AI’s contribution would not be enough to keep the economy strong absent a supportive consumer (chart via GaveKal).

Tight correlations. Odds?

Preemptively:

Trump’s Team Hones a New Message Pledging Economic Gains Next Year Advisers work to ease voter anxiety about weak jobs growth and stubborn inflation

Their new mantra: Just wait until next year.

In private conversations with the president, Trump’s advisers, rather than dwell on shaky economic data, have painted a rosy outlook, insisting that data will begin to improve in the first quarter of 2026, according to people familiar with the matter, including senior administration officials.

(…) advisers told Trump it was up to him how to publicly address the weak jobs data and he could just breeze past the information by pointing to the future, according to a senior administration official. They assured him the economic indicators will show improvements as 2025 comes to a close, the official said. (…)

Public opinion of Trump’s leadership on the economy has turned more negative in recent months. Just 37% of adults polled in September approved of Trump’s handling of the economy, according to an AP-NORC survey, while 62% disapproved. In a recent New York Times survey, 45% of voters said Trump had made the economy worse since taking office, while 32% said he had made it better. (…)

Mid-terms coming rapidly…

- Federal-Worker Buyouts Are Kicking In, Darkening the U.S. Employment Picture About 100,000 federal workers came off the payroll this week, adding strain to an already weakening labor market

The departures coincide with the government shutdown, which could bring another round of cuts.

The trims stem from the Trump administration’s deferred-resignation plan, launched earlier in the year, which allowed staff to leave the government and keep their paychecks and benefits for months. About 154,000 employees took the deal, according to the Office of Personnel Management, and two-thirds were paid through Sept. 30, the end of the fiscal year.

Overall, the administration expects the federal workforce to end the year with hundreds of thousands fewer employees, attributed to a hiring freeze, layoffs and voluntary departures. Trump has also threatened to permanently lay off additional workers in connection with the shutdown, which temporarily furloughs an estimated 750,000 people, according to the nonpartisan Congressional Budget Office. (…)

Though some federal workers in high-demand occupations have gotten jobs quickly, many others face a crowded market and slow searches in a tough white-collar hiring market.

Federal workers’ job applications on Indeed rose 41.2% from January to September, according to the platform. But Frank Grossman, a Philadelphia-based career coach working with federal workers, said many who took the buyout options haven’t looked for jobs in earnest.

“Reality hasn’t hit for a lot of people yet,” he said.

The government shutdown could soon darken the job picture even more.

Furloughed federal workers may show up as unemployed in the part of the jobs report used to calculate the unemployment rate, Sweet said. Any new layoffs tied to the shutdown combined with the workers who took the deferred resignation program could mean “a hideous employment report could be coming,” he said. (…)

BTW: The nonfarm jobs not report last Friday would not yet have captured those 100k whose last day on the payroll was September 30. The November 7 report (??) would include those 100,000.

BTW #2: Trump last week again floated the idea of sending tariff rebate checks to U.S. Citizens, telling the New York Post that “we’re thinking maybe $1,000 to $2,000 — it would be great.”

Saudi Arabia Takes a Risk in Boosting Oil Production—and Gives Trump a Win Crude prices have fallen this year as Riyadh raises output, but risks abound

Crude prices have fallen this year as a result of what Riyadh has officially cast as routine oil-market management. In reality, strategists say the kingdom is trying to achieve several objectives: claw back market share lost to Brazil, Guyana and U.S. shale producers; rein in members of the cartel it dominates that routinely exceed quotas; and raise cash for massive infrastructure projects now beset by cost overruns and delays.

Whatever Riyadh’s goals, the gambit has benefited the Trump administration. More Saudi crude has helped lower gas prices at the pump, something Trump has repeatedly called for. (…)

Falling oil prices are helping to blunt the inflationary effects of Trump’s tariffs and boost the U.S. economy just as households and businesses grow cautious. Average gas prices were $3.16 a gallon recently, according to AAA, down slightly from a year earlier. (…)

Saudi Arabia can pump crude oil at a cost of less than $10 a barrel, analysts estimate—a huge cost advantage over U.S. shale producers. But the International Monetary Fund estimates the kingdom’s fiscal break-even oil price is $92 a barrel, meaning Saudi Arabia needs to sell oil at that level or higher to bring its fiscal deficit down to zero.

Brent trades around $65 a barrel, down from around $75 at the end of last year, and considerably below the kingdom’s fiscal break-even price. Some think that is still too high. (…)

Despite years of trying to diversify its earnings, the kingdom still derived 53% of revenue from the oil sector in the first half of this year, according to the Saudi Finance Ministry. In the three months through June, total revenue fell 15%, as a 29% plunge in oil revenue wasn’t fully offset by a modest rise in other income.

Riyadh has sold assets and loaded up on debt to ensure it can still fund its spending ambitions. Last year, it sold shares in the crown-jewel oil company, Aramco, and issued $65 billion of debt—up 30% from 2023, according to budget documents. Its Finance Ministry expects public debt to total nearly 32% of gross domestic product by year-end, up from 5.8% a decade earlier.

Bloomberg:

While prices have held up relatively strongly to the supply added so far, there are now signs that the market is starting to shift. Unsold cargoes from the Middle East are accumulating and the futures forward curve is showing signs of near-term weakness. The International Energy Agency anticipates that inventories will pile up rapidly this quarter and that a record surplus will emerge in 2026 as global demand cools and supply across the Americas booms.

Tariffs Threatened to Be a Third Inflation Shock for Europe, But Have Had Little Impact What seemed set to follow Covid-19 and Russia’s invasion of Ukraine as a major inflation shock hasn’t materialized, at least not yet

(…) In a speech in Finland, President Christine Lagarde laid out the ECB’s understanding of what just happened, or didn’t happen. Most importantly, European governments decided not to retaliate when Trump imposed tariffs. If they had, prices of goods imported from the U.S. would have risen, fueling inflation.

The other thing that didn’t happen was a depreciation of the euro. Ahead of their imposition, most economists predicted that the euro would lose ground after tariffs were applied, since the demand for eurozone exports would cool, as would demand for the currency in which they were sold. Instead, the euro has gained significantly since the start of the year.

“All in all, with no retaliation and an appreciating exchange rate, tariffs have had little inflationary impact so far, with their adverse effects mainly limited to growth,” said Lagarde. “Those effects, however, have been relatively moderate thanks to the domestic response.”

Included in that response has been a series of trade deals with economies around the world, most recently with Indonesia. The ECB calculates that deals sealed to date cover 3% of eurozone exports, and those in the pipeline a further 6%. In 2024, 21% of EU exports went to the U.S., and most of those are now subject to higher tariffs.

For Lagarde, EU governments chose not to retaliate against Trump’s tariffs partly because it was more important to them to retain his support for Ukraine in its defense against Russian invasion. And the dollar’s weakness largely reflects doubts about whether the currency “would continue to warrant its status as the ultimate safe-haven currency,” Lagarde said.

In sum, various Trump effects have cancelled each other out as far as inflation in Europe is concerned. (…)

The impact of tariffs on inflation may not be complete.

In particular, Chinese businesses facing high duties in the U.S. could seek new customers in Europe, and lower their prices to acquire them, putting downward pressure on inflation as well as economic growth. At least one ECB rate setter thinks it likely that supply chains will be disrupted, leading to a repeat of the pickup in inflation that accompanied the second year of the Covid-19 pandemic, if on a smaller scale.

But the ECB’s economists reckon either development would have a very modest impact on prices, with inflation in 2027 coming in as high as 2.1% or as low as 1.7%, compared to the 1.9% now forecast.

That is not a rate-changing deviation from the target, and it may take an entirely different shock to really change the outlook for European policy rates.

EARNINGS WATCH

The official Q3 earnings season launches soon but we already have the usual 19 early reporters in:

- 74% beat rate.

- +4.6% surprise factor, including +10.6% for the 6 Consumer Discretionary companies. Their surprise was +5.2% in Q2.

- Earnings up 14.2% on revenues up 7.2%. In Q2: +6.5% and +6.5% respectively.

Ed Yardeni expects Q3 earnings up 10.7% vs consensus at +6.4%.

S&P 500 forward earnings per share for the S&P 500 rose to another new record high during the week of October 2. That puts the forward P/E at 22.7 based on Friday’s close. (The recent downticks in the 2025 and 2026 earnings estimates reflect changes in the constituents of the S&P 500.)

Callum Thomas averages the trailing P/E, forward P/E and the Shiller P/E:

Source: Topdown Charts Professional

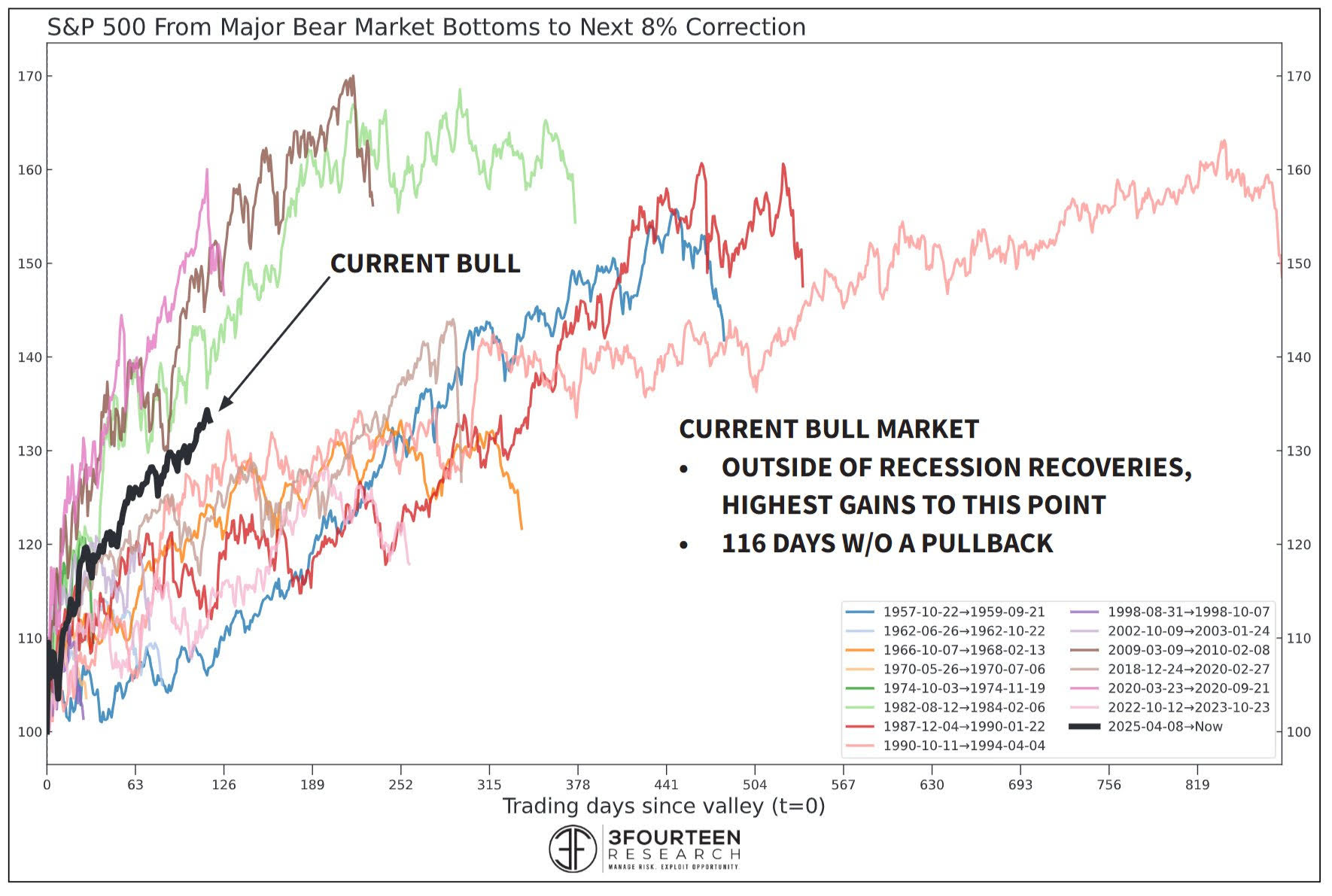

How does the rally compare to history?

Source: @WarrenPies

KKR:

Capital markets in Asia are outperforming, challenging global investors’ assumptions that it’s still all about the U.S.

Indeed, after several years of collective performance that has badly lagged that of the S&P 500, Asia markets certainly have perked up in 2025. Korea’s equity markets have appreciated 59%, China is up 38%, and Japan has risen by 22% in total return USD terms. During this period, the S&P 500 has appreciated 14%, marking the first time it has lagged Asia nine months into the year since 2019.

Such strong performance has caught many allocators by surprise, and many are now wondering whether their large overweight to U.S. assets is still the ‘right’ call. (…)

What’s different now is that structural reforms are taking place in cheap markets, such as Japan and Korea, while a falling dollar is occurring amidst a long-tailed Fed easing cycle. Bottom line: most investors are significantly underweight the region, and the earnings growth rate relative to rest of world is compelling.

Bigger picture, Asia is insulating itself more from Western policy, including trading more with itself. All told, intra-Asia trade rose to 58 percent of regional flows in 2021, compared to 46% in 1990. Importantly, we think that this ratio is headed towards 67% in 2029.

For investors, this means that logistics, manufacturing, and consumer sectors tied to local demand are enjoying better momentum than expected. Moreover, Asia’s 822 million millennials, 6x those of Europe and the U.S. combined,care seeking consumption upgrades as their GDP-per capita ratios increase. India and Vietnam represent prime

examples, we believe.While history does not always repeat itself, Fed easing cycles are particularly constructive for the region’s performance if there is no U.S. recession (which is our base view). Thus far, this cycle has been no different. Asia typically performs quite well when the Fed eases and there is no recession. We also see local currency gains ahead. Importantly, over time, currency appreciation is typically one third of all EM Equity total return, and this easing cycle is occurring when the U.S. dollar is already expensive.

Demographic shifts amidst both young and old are surging. All told, the 65+ age group will be 18% of the Chinese population by 2030; already in Japan 30% of the population is over 65, and in Korea that percentage is 20%.

Not surprisingly, this slowdown in population growth is leading to a surge in productivity-enhancing capex. One can see the surge in software demand in key markets such as Japan. At the other end of the spectrum, our research shows Asia has six times more millennials than the U.S. and Europe combined. For this demographic, consumption upgrades—including savings/brokerage, wellness/healthcare, and leisure—represent major investment themes amid ongoing urbanization. (…)

Within Korea, despite corporate reforms and shareholder activism driving +50% gains so far in 2025, 70% of the market still trades below book value, compared to 40% in Japan and less than seven percent in the U.S (…)

China too is cheap, especially if one compares China AI stories relative to their global counterparts in the U.S. Moreover, the dividend and buyback yield now exceeds the 10-year government bond yield by 1.5-2.0%.

Unfortunately, KKR does not relate P/B with ROEs, a must for a complete assessment of value. Paying 2x book value (equity) when the return on equity is 20% is as good as paying 1x BV when ROE is 10%. How much do you pay per unit of ROE?

Fortunately, Aswath Damodaran, Professor of Finance at the Stern School of Business at New York University computes many country ROEs (though his sample may no exactly match others’). Note that Damodaran shows 2 P/B values, one for “complex” organizations and one for “simple” organizations.

- USA: 15.9%

- India: 15.5%

- Europe: 11.3%

- Japan: 9.9%

- All EM: 9.7%

- China: 8.3%

While investors are enamored with the US, the WSJ informs us that “Nearly 70% of people said they believe the American dream—that if you work hard, you will get ahead—no longer holds true or never did, the highest level in nearly 15 years of surveys.”