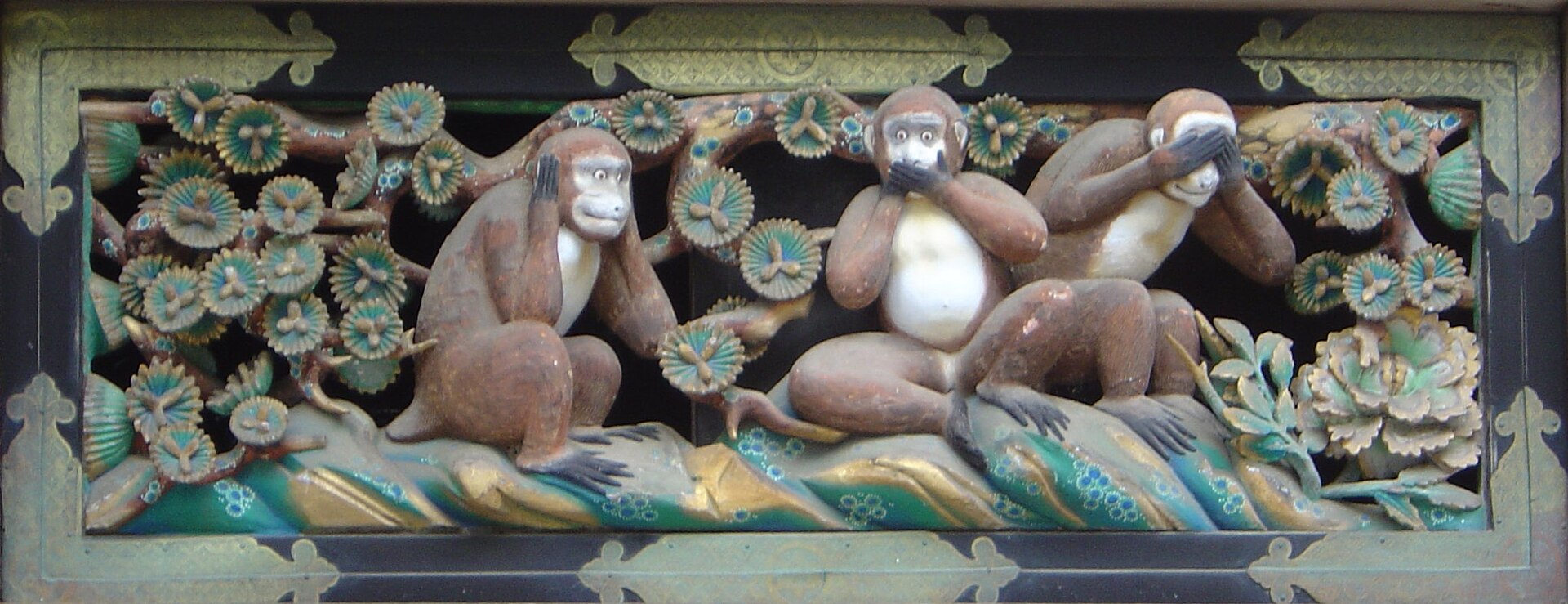

This will likely be the last post from Japan. Back to normal next week.

U.S. LEI suggests strong growth ahead

The just-released leading economic indicator (LEI) from the U.S. Conference Board suggests a good economic performance in the months ahead. The LEI surged 0.8% in September, with nine of its ten components up on the months. That was the best diffusion in four years for the LEI, indicating broadbased improvement. For Q3 as a whole, the LEI rose a very robust 8.2% (annualized).

As today’s Hot Charts shows, that was the best showing since 2004 at this point in the economic cycle (the expansion phase that is measure off the coincident indicator). Interestingly, we note that the Federal Reserve began its interest rate normalization campaign in the following six months. While we are well aware that the LEI will soften in October due to the stock market correction, the quick rebound in equity indices should mute the negative impact on the economy. Bottom-Line: With the U.S.

economy still on track to grow above potential in the quarters ahead, we continue to expect a fed rate hikes in 2015. (NBF)

Doug Short’s charts lead to the same conclusion: no recession in sight.

Eurozone Businesses Cutting Prices The European Central Bank’s increasingly desperate battle to prevent the eurozone from sliding into deflation suffered a fresh setback in October, as businesses cut their prices at the fastest rate since early 2010.

Some of Europe’s biggest companies have been roiled by weak pricing power, noting that as one factor that has contributed to generally weak profits in recent earnings statements. Those reports were given substance by a survey of 5,000 manufacturers and services providers across the eurozone conducted by data firm Markit.

On the surface, that survey offered some rare good news for the currency area, with the headline measure of activity pointing to a slight pickup in October. But the details were anything but encouraging. New orders barely grew, and businesses started firing workers again after almost a year of slowly adding to payrolls.

What pickup in output businesses were able to report came at a cost: heavy discounting. Markit reported that its measure of output prices—the prices charged by businesses—fell sharply.

For those keeping a close eye on eurozone inflation outcomes and expectations, the shape of the chart below will have a familiar look: that dip since June is steepening. And June is exactly when the ECB rolled out its first wave of stimulus measures, announcing a second wave in September.

The two waves appear to have had little immediate impact on prices, and most surveys and hard data suggest the central bank may have to do more if it is to prevent widespread declines in consumer prices.

EARNINGS WATCH

EARNINGS WATCH

- 50.6% of the S&P 500’s market cap (191 companies) has reported. So far, earnings are beating by 4.2% while revenues have surprised by 0.7%.

- Expectations are for revenue, earnings, and EPS growth of 3.8%, 6.3%, and 8.4%, respectively. Assuming an historical beat rate, EPS is on track to come in near 10%.

- With oil down ~23% since June, the impact on expectations has been meaningful. 4Q EPS estimates for the Energy sector have fallen 13% over this period and 2015 has declined 8%. This represents a 1.2% and 0.8% hit to overall market earnings in 4Q and 2015, respectively. (RBC Capital)

It has been a while since the last good FT in depth analysis.

Unintended stimulus: Commodity price falls aids global economy

Unintended stimulus: Commodity price falls aids global economy

(…) Across a wide range of commodities, prices are falling and sometimes falling fast. The Bloomberg commodity index – which acts as a benchmark for commodity investments – fell to its lowest level in five years this week. Prices are being pushed down by the increasing supply of most commodities and a weakening global economy, including a slowing China, the world’s largest consumer for many of these raw materials. Whether it is oil, corn, iron ore, coal, cotton or copper, prices are falling quickly.

The International Monetary Fund estimates that global commodity prices are 8.3 per cent lower than at the start of the year. In its recent World Economic Outlook report, the IMF demonstrated how a $20-a-barrel oil price decline would increase the real income of consumers, boosting domestic demand and growth in consuming countries and hitting exports and demand in producer nations. The fund estimated the net effect would increase world gross domestic product 0.5 per cent alone, and if economic confidence were improved as a result, that figure could rise to about 1.2 per cent.(…)

Andrew Kenningham, economist at Capital Economics, has calculated that an equivalent change would transfer $640bn – or nearly 1 per cent of world GDP – from oil producers to consumers. “Our rule of thumb is that consumers typically spend half of their windfall. This is $320bn or around 0.5 per cent of world GDP, ” he says.

With other commodity prices falling alongside oil, the effects can be expected to amplify, benefiting global growth but also creating losers as well as winners. (…)

(…) In parts of Asia currencies are falling relative to the dollar. As a result says Jeff Currie, head of commodities research at Goldman Sachs, consumers in India are not seeing big gains because oil prices in rupees are not falling fast, and in countries such as Indonesia, the government is offsetting lower fuel prices with cuts in fuel subsidies so, again, consumers have not seen the full benefit. After taking account of currency and tax changes, Mr Currie says the US is the only country in which consumers are likely to see a big benefit.

As a big consumer and importer, the eurozone will benefit from the turndown in commodity prices, but economists warn Europe must avoid getting too much of this good thing. Falling commodity prices could tip the eurozone into outright deflation, potentially delaying consumer purchases on the expectation of even lower future prices. (…)

Corn is the world’s most widely grown grain. Harvested on 180m hectares, it turns up in products from tortillas to toothpaste, writes Gregory Meyer.

The price of corn has declined by more than 15 per cent this year and is less than half of the highs reached in mid-2012. But do not expect a dash to consume more of it. (…)

One area where cheap corn will probably induce more consumption is in the meat industry. Enticed by high prices for steaks, bacon and chicken, livestock and poultry companies are expanding. The US agriculture department anticipates animal feed demand for corn will total 5.4bn bushels in the crop year that began last month – up more than 1bn bushels from two years ago. (…)

Iron ore has been the standout performer in commodities this year – but for all the wrong reasons, writes Neil Hume.

The price of the key steelmaking ingredient has plunged by almost 40 per cent and recently hit a five-year low of $77.50 a tonne. Benchmark Australian iron ore for delivery into China was trading at $80 a tonne yesterday, according to The Steel Index.

The reason for the sharp fall is twofold. Vale, Rio Tinto and BHP Billiton , the big three global producers, have dramatically increased production and shipping volumes in 2014. The other big factor is slowing demand in China, which consumes about two-thirds of global seaborne iron ore.

A falling steel price will help reduce costs for many industries, including oil and gas. Steel accounts for about 30 per cent of the cost of a large oil project, according to McKinsey, the consultancy.

Ominously for the sector, more supply is set to come on stream in the coming year. BHP Billiton, the world’s largest natural resources group, estimates supply growth of 400m tonnes in the next three years, about twice its forecast level of increased demand. (…)

The past several years have been traumatic for the cotton industry, writes Gregory Meyer.

An abrupt price rise in 2008 bankrupted some of the biggest global merchants. After another spike three years later, exasperated clothiers chose fabrics with more man-made fibre such as polyester. Cotton had a 27.5 per cent share of the global fibre market last year, from a historical norm of about 40 per cent, according to Cotton Inc, a US industry body.

Now the spindles are turning in cotton’s favour. Prices have fallen by more than 25 per cent this year to 63 cents per lb, less than a third of the 2011 peak. As China sells off a mountainous state reserve, prices are expected to remain low and steady for a long time.

The International Cotton Advisory Committee, a research group, forecasts global cotton consumption will this year rise by 3.9 per cent, well above the average annual increase. (…)

One challenge cotton suppliers are set to face is cheaper polyester on the back of the fall in oil prices.

Concerns about a slowdown in China’s economic growth are weighing on copper prices, pushing them down more than 9 per cent this year, writes Henry Sanderson. (…)

Lower prices could also help the car and renewable energy industries, which account for about 7 per cent of global copper demand, according to Metal Bulletin. (…)

Coal provides about 40 per cent of the world’s electricity needs, according to the International Energy Agency, writes Neil Hume.

The funk in the market can be traced to the shale gas revolution, which has led to increased US coal exports, and growing output from the big rival exporters such as Australia and Indonesia, which have continued to churn out more volumes in spite of low prices. This has overwhelmed demand.

Analysts say India is the big growth market for thermal coal. The country has 145 gigawatts of installed coal-fired capacity and is targeting 214GW by 2020, according to Glencore, the commodities company.

In Europe, weak thermal coal prices – as well as rising solar and wind power – have left German households better off than their Dutch counterparts. Large coal-fired power plants generate more than 40 per cent of German electricity, whereas the Netherlands’ gas-fired plants account for about 70 per cent of installed capacity.

Coal for delivery into Europe within 90 days was quoted at $74 a tonne by Argus yesterday, close to a four-year low.

According to the Agency for the Co-operation of Energy Regulation, at the end of last year average German day-ahead power prices were €35 a megawatt hour compared with more than €50MW/h in the Netherlands.

Democrats feel Senate is slipping away Disillusionment with Obama and tepid economic recovery fuel race

Democrats fear Republicans are on the verge of regaining control of the US Senate and with it command of both houses of Congress, as conservatives ride a wave of disillusionment with Barack Obama and a tepid economic recovery.

With just over a week to the congressional midterm elections, the Republicans hold leads in the six Democratic states they need to gain a majority in the 100-seat chamber and are slightly favoured in two others. (…)

The race for the Senate remains close, with the election looking less like a wave than a trickle despite the multiple advantages running in the Republicans’ favour.

The result may not be known until early next year, as an expected run-off in the state of Georgia would not be held until early January. Louisiana is also tipped to go to a run-off, in December.

But Democrats are increasingly resigned to the Republicans gaining control of Congress for the final two years of the president’s second term. The Republicans already hold the House of Representatives. (…)

(…) On Tuesday, China reported that gross domestic product expanded at 7.3% in the third quarter from a year earlier, the

(…) On Tuesday, China reported that gross domestic product expanded at 7.3% in the third quarter from a year earlier, the

(…) At a conference in London Wednesday, Sergei Shvetsov, first deputy chairman of the central bank, said rising inflationary expectations would force the bank to “seriously consider” another increase in interest rates. The central bank has already done so three times this year, raising the cost of credit for Russian companies just as they’ve faced a shut-off of lending from the West due to sanctions.

(…) At a conference in London Wednesday, Sergei Shvetsov, first deputy chairman of the central bank, said rising inflationary expectations would force the bank to “seriously consider” another increase in interest rates. The central bank has already done so three times this year, raising the cost of credit for Russian companies just as they’ve faced a shut-off of lending from the West due to sanctions.