Durable Goods Orders Strengthened by Another Jump in Aircraft

New orders for durable goods rose 1.7% (5.0% y/y) during February following a 2.3% January gain, initially reported as 1.8%. A 1.2% increase in orders had been expected in the Action Economics Forecast Survey.

The headline rise in orders again reflected strength in the transportation sector where a 4.3% increase was driven by a 47.6% jump in orders for nondefense aircraft & parts. Bookings for defense aircraft declined 12.8% and orders for motor vehicles & parts eased 0.8%. Excluding the transportation sector altogether, orders increased 0.4% (4.6% y/y) and have been rising since June.

Nondefense capital goods orders increased 4.1%. Excluding the rise in aircraft, orders dipped 0.1%.

“The good news is that core orders seem to be on a steady uptrend,” said Stephen Stanley, chief economist at Amherst Pierpont Securities, in a note to clients. “The less-good news is that the trajectory of the uptrend is not especially exciting.” (WSJ)

See for yourself:

THE TRUMP RALLY: GETTING COMPLICATED

There are things that are better kept unsaid:

“As you know, I’ve been saying for years that the best thing is to let Obamacare explode and then go make a deal with the Democrats and have one unified deal. And they will come to us; we won’t have to come to them,” he said. “After Obamacare explodes.”

“The beauty,” Trump continued, “is that they own Obamacare. So when it explodes, they come to us, and we make one beautiful deal for the people.” (WaPo)

All political strategy, never mind real people challenges like Peggy Noonan explained in the WSJ:

(…) Because unlike such policy questions as tax reform, health care can be an immediate life-or-death issue for you. It has to do with whether, when, and where you can get the chemo if you’re sick, and how long they’ll let you stay in the hospital when you have nobody, or nobody reliable and nearby, to care for you. To make it worse, the issue is all hopelessly complicated and complex and pits you as an individual against huge institutions—the insurance company that doesn’t answer the phone, the hospital that says “I’m afraid that’s not covered”—and you have to make the right decisions.

Politicians don’t understand all this, in part because they and their families are well-covered on a government insurance policy, and they have staff to put in the claim and argue with the insurance company, which, when it’s a congressman calling, answers the phone in one quick hurry. They don’t know it’s not easy for everyone else. Or rather they know on some abstract level but forget in the day-to-day, as one does with abstractions. (…)

Trump is clearly no Reagan:

The failure of the bill demonstrated something no president, especially a new one, ever wants made public. That is that Republicans in the House do not really fear him.

When members of your party fear you, they are fearing one thing: your popularity. You can harness it to hurt them if they’re uncooperative. But Mr. Trump doesn’t have that much popularity, as they know. He’s at 40% or thereabouts in his approval numbers. And on this bill he couldn’t tell his supporters to go out and cream congressmen who would vote against him, because his own supporters don’t much like the bill.(…)

A mere poll probably contributed to the collapse of support. That would be the Quinnipiac survey published Thursday, just hours before the delay in the vote. It found the repeal-and-replace bill highly unpopular. Only 17% of respondents approved of the bill, with 56% opposed and 26% undecided. Bloomberg’s Sahil Kapur, reading the cross tabs, noted on Twitter that the bill was 26 points underwater among noncollege whites, and an astounding 46 points underwater among voters 50 to 64. “This is Trump’s base,” Mr. Kapur noted.

When your own base doesn’t like the bill on which you’ve staked your early legislative prestige, you have made a political error of the first order. (…)

Mr. Trump warned House Republicans they would lose their seats next year if they vote “no.” They judged they’d lose their seats in 2018 if they voted “yes.” (…)

Next major step, the tax reform. From Goldman Sachs via Zerohedge:

Preliminary discussions on tax reform could begin soon but we do not expect legislative action on tax reform until June. This week’s events do not change our expectation that tax legislation will be enacted within the next year and actually suggest that enactment could come slightly sooner than we previously expected.

(…) Tax reform will probably not begin to move through the legislative process until June. (…)The [House Ways and Means] Committee is unlikely to release a detailed proposal until they are ready to vote, so details regarding the House proposal may not be known for at least another two months or so.

Enactment of tax legislation looks just as likely as it did before this week. The health bill faced much different challenges than tax legislation will face. While the health bill would have reduced benefits (tax credits and Medicaid eligibility) and the deficit, the tax bill is likely to provide new benefits (tax cuts) and will probably increase the deficit. Ultimately, we believe that there will be broad support among Republicans in Congress for legislation that reduces the corporate tax rate and cuts personal taxes modestly.

However, the defeat of the health bill indicates that complex and controversial tax reforms are likely to be difficult to pass and we note that the “Freedom Caucus” that opposed the health bill also opposes some of the most controversial aspects of the House Republican tax blueprint, like the border-adjusted tax (BAT). This suggests congressional Republicans might scale back their ambitions on tax reform, and pursue a simpler tax cut that includes selected reform elements (e.g. changes to the taxation of foreign profits of US multinationals and profit repatriation).

When complicated issues get really complicated:

-

Republicans Turn Eyes to Tax Overhaul A chorus of Republicans said Friday they would turn their attention to overhauling the U.S. tax code after their health-care bill fell short, a plan Treasury Secretary Steven Mnuchin said would face smoother sailing in Washington.

(…) “Health care is a very, very complicated issue,” Mr. Mnuchin said. Redesigning the tax code “is a lot simpler.”

A lot simpler? Hmmm…

There has not been a comprehensive overhaul of the U.S. tax code since 1986, when it took 4 years to President Reagan to complete it.

The stalled effort to replace Obamacare creates new challenges for the Trump administration and congressional Republicans, a point Mr. Ryan conceded Friday. GOP leaders had said the health bill would pave the way to a major tax bill. Repealing Obamacare would cut spending on health-care subsidies and cut $1 trillion in taxes.

Mr. Ryan said Friday the health bill’s taxes would now remain and that they wouldn’t be repealed as part of the broader tax effort. The upshot is that levies on health-care providers and high-income individuals would remain in place for the foreseeable future.

“Defeat on health care is a blow that could make it harder to pass a more ambitious tax plan such as the one proposed by House Republicans,” said Andy Laperriere, a policy strategist at research firm Cornerstone Macro LP. He said it has become more likely the ultimate product “tinkers around the margins and is a disappointment to the market.” (…)

As on health care, Republicans already have faced some divisions on taxes, including over how much they should be allowed to add to deficits, and whether they should come up with new sources of revenue to make up for lower tax rates.

The House Republican plan includes a border-adjustment provision that would tax imports and remove taxes from U.S. exports to raise nearly $1 trillion in new revenue, but the provision has met fierce resistance from some Republican lawmakers in the Senate.

Mr. Mnuchin said the administration has reservations about the border-adjustment provision and said he was worried about how currency movements that result from those tax changes could create headwinds for U.S. exporters.

“It is a very complicated issue,” he said. “Whatever we do, we want to make sure it’s simple and it works.”

Today’s WSJ editorial

-

The Tax Reform Damage The GOP health debacle makes pro-growth reform more important but also much harder.

(…) The large complication is that the Freedom Caucus’s ObamaCare preservation act has also made a tax bill much harder politically even as it makes reform more essential to salvaging the Trump Presidency and GOP majorities in 2018.

(…) The legislative failure is obvious, but less appreciated is that House Speaker Paul Ryan’s reform included a pro-growth tax cut and major improvements in work incentives. The 3.8-percentage-point cut in taxes on capital income would have been a substantial increase in after-tax return on investment, nearly half of the eight-point cut in the capital-gains tax rate that helped propel growth after 1997.

Now that’s dead, and so is the replacement for the especially high marginal-tax-rate cliff built into ObamaCare’s subsidies. These steep tax cliffs as subsidies phase out are a major hindrance to work, as University of Chicago economist Casey Mulligan has shown. The Ryan bill would have been a significant boost to economic growth and labor participation. (…)

This lost opportunity now makes tax reform even more important as a growth driver, but the health-reform failure also hurt tax reform in another major way. The Ryan bill would have reduced the budget baseline for tax reform by some $1 trillion over 10 years. This means that suddenly Republicans will have to find $1 trillion more in loopholes to close or taxes to raise if they want their reduction in tax rates to be budget neutral.

(…) They flopped even though it’s unheard of for a new President to lose on his top priority so early in his term. That’s when his political capital is highest and his own party has the most incentive to deliver on its promises.

The risk now is that the health failure will make the GOP Congress even less cohesive and less likely to follow its leaders. Freedom Caucus Members sit in safe seats and don’t need achievements to win re-election. They are almost happier in the minority where they can more easily vote no on everything.

But 23 Republicans hold seats in districts that Hillary Clinton carried, another 10 where she narrowly lost, and that’s where the GOP majority is vulnerable. Those Members will want some record of accomplishment in 2018, but they also won’t want Wal-Mart or industries protecting tax preferences to spend millions for their Democratic opponents. They will now take fewer risks than if they had been able to point to a health-care victory.

The other big risk is that Republicans will now settle for a modest tax cut without a fundamental reform that clears out special-interest favors. That is better than nothing but would diminish the effect on economic growth and incomes. Treasury Secretary Steve Mnuchin is already saying that he wants only a token cut in the tax rate on individual wages and salaries, and some in the White House are tempted by Democratic income-redistribution schemes.

Mr. Trump lacks the political base of most Presidents, so he is hostage more than most to performance. Above all that means presiding over faster growth, which is the only real way to help Trump voters. If the GOP can’t deliver on tax reform, the Freedom Caucus will have done far more harm than saving ObamaCare.

It will be interesting to see how the failed repeal of Obamacare will impact Trump’s approval rate. Not delivering on something so crucial to people, and giving up on it hoping that it will eventually “beautifully explode”, might not foster much popular sympathy if tax reform does not go smoothly. And we know it won’t go smoothly. And now we know Trump’s Art of the Deal does not apply to this GOP.

Some of President Donald Trump’s supporters say they are disappointed by the implosion of a health-care bill on Friday, but the political fallout for him may be limited as they blame House Speaker Paul Ryan more than the president for failing to deliver on a central campaign promise. (…)

Interviews with several of them over the weekend found that Mr. Trump’s handling of the health-care bill hasn’t rattled their support for him, given the strength of his appeal as an outsider determined to transform the status quo. But this episode has shown them that for changes that require passing legislation, he and others have a lot to learn about managing the GOP majority in Congress. (…)

This morning:

-

Republicans Could Have Another Fight Over Tax Overhaul After a battle within the Republican party over its health-care bill, the GOP plans on moving on to something simpler: rewriting the U.S. tax code. But it might be heading right into another minefield.

It’s getting more complicated, just as we are getting to the meat, i.e. forward earnings which are estimated anywhere between 5% and 10% higher post tax reform.

EARNINGS WATCH

Factset says that Q1’17 S&P 500 EPS will rise 9.1% (Thomson Reuters is at +10.4%), nearly half of the growth stemming from Energy:

(…) On a dollar-level basis, the Energy sector is projected to report earnings of $7.7 billion in Q1 2017, compared to a loss of -1.5 billion in Q1 2016. Due to this projected $9.2 billion year-over-year increase in earnings, the Energy sector is expected to be the largest contributor to earnings growth for the S&P 500 as a whole for Q1 2017.

If the Energy sector is excluded, the estimated earnings growth rate for the index for Q1 2017 would fall to 5.2% from 9.1%.

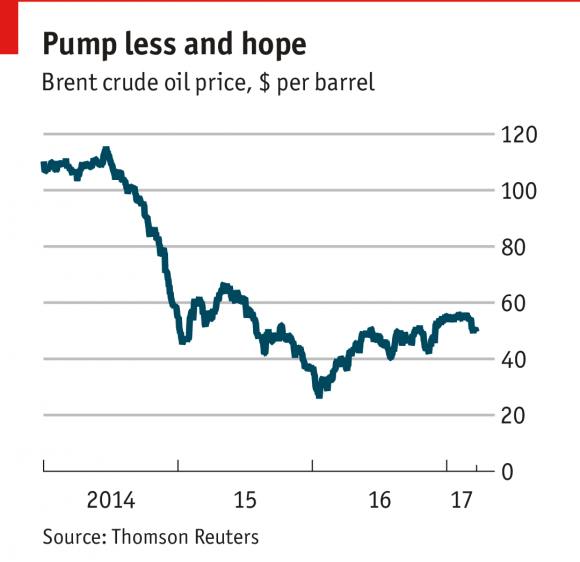

Energy companies earnings are expected to triple in 2017 but this assumes that oil prices keep rising towards $60. The average price of oil to date for Q1’17 is

$52.07, more than 50% higher than the average price of oil in Q1’16 ($33.69). But oil prices dropped 11% in March and are now below $48.

Continued positive economic surprises help sustain high P/E ratios.

Technically speaking, for what it’s worth, Lowry’s Research says that their work “continues to suggest a healthy bull market”. That said, it also says that small caps are generally first to crack and that this segment of the market is showing “somewhat of a lag”.

Where small caps are not lagging is in downward EPS revisions for Q1 as Ed Yardeni illustrates:

S&P 600 EPS growth rate for Q1 collapsed from +13% to +3.9% in just a few weeks. But small cap stocks overall have stayed the course:

Insider Sentiment

(…) Figure 1 shows the NDR insider score* is quite negative now, implying that more insiders are selling than buying. Is this cause for concern? Perhaps, but the numbers in Figure 2, which show S&P 500 performance when NDR’s insider score is in their bullish (buying) zone, the bearish (selling) zone or neutral, should help ease concerns. As you can see, stocks fare better when the reading is positive. However, the weakness following negative readings has historically been minimal.

![]() Hmmm…”the weakness following negative readings has historically been minimal”. Beware of averages.

Hmmm…”the weakness following negative readings has historically been minimal”. Beware of averages.

FLASH PMIs

- Flash U.S. Composite Output Index at 53.2 (54.1 in February). 6-month low.

- Flash U.S. Services Business Activity Index at 52.9 (53.8 in February). 6-month low.

- Flash U.S. Manufacturing PMI at 53.4 (54.2 in February). 5-month low.

- Flash U.S. Manufacturing Output Index at 54.4 (55.6 in February), 6-month low.

Mirroring the overall trend for business activity, latest data signalled that manufacturing new order volumes expanded at the slowest pace for five months. This contributed to more cautious purchasing activity in March, alongside renewed efforts to streamline inventories. Reflecting this, preproduction stocks were accumulated at the weakest pace since last September, while finished goods inventories dropped for the first time in six months.

Input cost inflation meanwhile picked up in March, which survey respondents attributed to rising commodity prices (particularly metals). The overall rate of input price inflation was the fastest for two-and-a-half years. Efforts to pass on higher costs contributed to an upturn in factory gate price

inflation to its strongest since November 2014.(…) Some firms commented on greater caution among clients, despite a supportive economic backdrop so far in 2017.

Staff hiring continued to ease from the 15-month peak recorded last December. Moreover, the rate of service sector job creation in March was one of the weakest reported over the past three years.

The rate of [services] prices charged inflation remained only modest in March, with some service providers commenting on the need to absorb higher costs.

“The US economy shifted down a gear in March. A slowing in the pace of growth signalled by the PMI surveys for a second straight month suggests that the economy is struggling to sustain momentum.

The survey readings are consistent with annualized GDP growth of 1.7% in the first quarter, down from 1.9% in the final quarter of last year.

“The employment readings from the survey have also deteriorated, suggesting private sector hiring is running at a reduced rate of around 120,000 per month.

- Flash Eurozone PMI Composite Output Index at 56.7 (56.0 in February). 71-month high.

- Flash Eurozone Services PMI Activity Index at 56.5 (55.5 in February). 71-month high.

- Flash Eurozone Manufacturing PMI Output Index at 57.2 (57.3 in February). 2-month low.

- Flash Eurozone Manufacturing PMI at 56.2 (55.4 in February). 71-month high.

Inflows of new work and backlogs of work also both grew at the fastest rates since April 2011, underscoring the recent strengthening of demand. The upturn was broad-based. Growth of service sector activity accelerated to the highest since April 2011, and manufacturing output growth eased only marginally from February’s near six-year peak.

Importantly, growth of new orders gathered pace in both sectors to reach near six-year highs. Goods producers saw the largest increase in export orders (including intra-eurozone trade) since April 2011.

Employment showed the largest monthly improvement since July 2007 as firms sought to boost capacity in line with the recent improvement in demand. Service sector job creation was the best seen since October 2007, and factory payrolls were added to at a pace not seen since April 2011.

Stronger demand also allowed increasing numbers of firms to raise prices. Average prices charged for goods and services rose at the steepest rate since June 2011.

Both service sector and manufacturing input costs and selling prices were found to have been rising at the steepest rates since the first half of 2011 during the first quarter.

In many cases, higher prices were charged in order to pass increased costs on to customers. March’s rise in average input prices was the highest since May 2011. The weakened euro was widely reported to have exacerbated the impact of increased global prices for many commodities, notably oil and energy as well as food and metals.

Some evidence of rising wage growth and supply chain price pressures was also seen. A lengthening of supplier lead times, indicating that demand was often outstripping supply, allowed suppliers to push up prices. Labour markets were also reported to be tightening in some countries.

- Flash Japan Manufacturing PMI™ slips to 3-month low of 52.6 in March (53.3 in February).

- Flash Manufacturing Output Index at 53.4 (54.1 in February). Growth eases but remains marked.

- Business confidence softens to four-month low.

Although signalling a slower rate of expansion during March, the latest PMI data again point to a Japanese manufacturing economy expanding at a decent clip.

Indeed, the data are consistent with manufacturing output expanding at an underlying trend rate of just below 2.0%.

New order books remain in solid growth territory, with gains seemingly supported by the weaker yen. However, this comes at the cost of ongoing marked rises in purchase costs: input price inflation remained close to a two-year high in March.

Foreign Robots Invade American Factory Floors The U.S. is losing the battle to supply the kind of cutting-edge production machinery behind the new automated factory floor, from digital machine tools to complex packaging systems and robotic arms. The equipment increasingly has to be imported from Europe or Japan.

(…) Commerce Department data show the U.S. last year ran a trade deficit of $4.1 billion in advanced “flexible manufacturing” goods with Japan, the European Union and Switzerland, which lead the industry. That is double the 2003 deficit. It was down from $7 billion in 2001, but much of the decline came from foreign equipment suppliers expanding in the U.S., not from an American comeback.

U.S. firms are also losing market share at home, according to Germany’s VDMA industrial-machinery trade group. In 1995, they satisfied 81% of domestic demand for factory equipment. In 2015, the most-recent data, that had slipped to 63%.(… )

OPEC Warns Members to Comply With Oil-Production Cuts OPEC officials urged member nations to cut their oil production in line with last year’s agreement, warning that the petroleum market will remain depressed if they don’t. Oil prices have fallen in recent weeks as doubts grow that OPEC’s cuts are enough to bring a vast oversupply of petroleum back in line with demand.

Why China’s Latest Cash Crunch Is Scarier This Time

(…) Banks have become more reliant on wholesale funding since 2013, with their claims against other financial institutions up threefold to more than $4 trillion.

Adding to the complexity is the inexorable rise of so-called wealth-management products, which offer customers much higher returns than ordinary deposits. Last year alone, the number of these that banks sold rose by 30% to 26 trillion yuan ($3.775 trillion). Their trick: Borrow heavily in the short-term money markets, investing the proceeds in highly leveraged bets on assets like bonds and other credit products. Their risk: a rise in short-term rates, like the one seen this week, which could leave many of these WMPs underwater and struggling for funding. If the WMPs are forced to sell assets, or stop buying, that could remove a key support for Chinese markets. (…)

Some wealth-management products are now borrowing to invest in other WMPs, a doubling-down that is reminiscent of how some financial derivatives ballooned out of control ahead of the global financial crisis. Meanwhile bonds bought with short-term funds are being pledged as collateral for yet more borrowing elsewhere, adding to the leverage in the bond market. (…)

- Below is a great chart demonstrating China’s debt level, which remains an outlier in the emerging markets universe. (The Daily Shot)