Manufacturing Sputters as Broader U.S. Economy Slows A loss of momentum in U.S. manufacturing aligns with weakening factory output overseas

Manufacturing output, the biggest component of industrial production, fell 0.5% in September from a month earlier, the Federal Reserve said Thursday. Production at factories was in part dragged down by a strike at General Motors , but showed broad-based fragility.

Overall industrial production, which includes output at factories, mines and utilities, dropped 0.4% in September and declined 0.1% from a year earlier, the first year-over-year decrease since 2016. Mining production pulled back, helping further drag down demand for manufactured parts. (…)

Weakness across the whole manufacturing sector as this Have Analytics table show:

The CAB is a composite index which is comprised of indicators drawn from a range of chemicals and sectors, including chlorine and other alkalies, pigments, plastic resins and other selected basic industrial chemicals. It first originated through a study of the relationship between the business cycles in the production of selected chemicals and cycles in the larger economy.

The index provides a longer lead (performs better) than the National Bureau of Economic Research (NBER). The CAB leads by two to fourteen months, with an average lead of eight months.

U.S. Housing Retreats from 12-Year High

Building activity retraced some of last month’s strength. Housing starts fell a greater-than-expected 9.4% in September (+1.6% year-on-year) to 1.256 million-unit annual rate, from an upwardly-revised 1.386 million in August. The August reading was the strongest pace since June 2007; though starts remain well below their January 2006 peak of 2.273 million. The Action Economics Forecast Survey expected 1.316 million starts during September.

A 28.2% drop in volatile multi-family starts drove the decline (-5.1% y/y). However, this followed a 41.4% jump in August and left activity multi-family sector slightly above its July level, but at the low end of the range it has been for the last two years. Meanwhile, single family starts edged up 0.3% in September (4.3% y/y), though still remain below the 11.5 year high reached this January.

Starts fell in all regions in September led by a 34.3% drop in the Northeast (-22.1% y/y). The Midwest fell 18.9% (-2.3% y/y). Starts declined 4.0% in the South (+18.6% y/y) and 1.9% in the West (-14.4%).

In contrast to starts, while building permits decreased they remained at an elevated level. Total permits declined 2.7% last month (+7.7% y/y) to 1.387 million from an upwardly-revised 1.425 million pace. Permits to build multi-family homes dropped 8.2% (+17.4% y/y) while single-family permits rose 0.8% (2.8% y/y).

Top Economic Advisers Warned Trump on Tariffs Before China Truce President Trump’s top economic advisers last week arranged an Oval Office briefing with outside experts who warned the president that escalation of the U.S.-China trade tensions could hurt the economy—and his re-election bid.

The Oct. 8 briefing, which came two days before trade talks between senior U.S. and Chinese officials, was arranged by Larry Kudlow, the director of the White House National Economic Council. The meeting included Stephen Moore, an economic commentator and a former candidate for the Federal Reserve Board, and Republican economist Lawrence Lindsey, the people said.

“There was a general consensus that the economy was really strong, the best economy we’ve had in 30 years, and that what’s going to get him re-elected is the economy,†said Mr. Moore, who advised Mr. Trump during his 2016 campaign.

But “we all agreed that the uncertainty about the trade situation with China is a negative,†Mr. Moore said.

Mr. Trump countered that the Federal Reserve shared blame for any signs of a downturn, and should be doing more to stimulate growth. Midway through the meeting, he called in one of his closest China advisers, Peter Navarro, a trade hawk who believes the U.S. has been far too accommodative with China.

“Where’s Peter?†Mr. Trump said, according to two people familiar with the meeting. “Get Navarro in here.â€

Mr. Navarro appeared in the Oval Office a few minutes later. (…)

Mr. Moore and his colleagues urged the president to seek a truce, saying such a detente would remove “that obstacle to growth right now, you’ll see a nice rebound in 2020, and he’ll be in a very strong position to get re-elected.†(…)

About the “general consensus that the economy was really strongâ€, let’s review some evidence:

On a YoY basis, real GDP peaked at +3.2% in Q2’18. It was +2.6% in Q1’19, +2.3% in Q2 and looks like +1.9% in Q3. QoQ, also peaked in Q2’18 at +3.5%. It was +3.1% in Q1’19, +2.0% in Q2 and looks like +1.5% in Q3.

The Conference Board’s LEI has dropped sharply in 2019:

Even though one of its key components remains well within its low range channel:

Advisor Perspectives offers the best perspective on the LEI:

The 12-m m.a. of the 12-m rate of change has no false signals since 1960. It looks reasonably comfy at +3.2% but the LEI is only up 0.8% YoY in August. A flat LEI for the next 4 months would take the 12-m m.a. to a much less comfy +1.5%…

Recession probabilities are still not terrifying:

The yield curve, also part of the LEI, has not really inverted:

And the Fed, partly responsible for the decline at the long end of the curve, is now trying to help at the short end:

- Fed Eyes Another Rate Cut, Weighs When to Stop Federal Reserve officials are heading into their meeting in two weeks likely to cut interest rates while debating whether they’ve done enough for now to vaccinate the economy against growing risks of a sharper slowdown.

Transportation indicators are gloomy:

Union Pacific Corp. yesterday reported an 8% YoY drop in volumes in Q3. Revenues declined 7%. CEO Lance Fritz said on CNBC: “It feels to me like the economy is slowing, and it’s slowing quite a bit.”

But Services need no physical transportation modes. However, Services’ resiliency seems to have disappeared lately…

…weighing on the Composite PMI:

Everybody agrees that the American consumer has been saving the economy so far, thanks to resilient employment in services, rising wages and subdued inflation, particularly on essentials such as food (+0.6% YoY in September) and energy (-4.7%).

But

- Restaurant Industry Sales for Q3 Show Year-Over-Year Contraction for First Time in Two Years

- Restaurant Industry Grappling with ‘Relentless Erosion of Guest Counts’

While average guest checks continue to grow at the same pace, year-over-year, as they have for three quarters now, same-store sales have declined. […] same-store traffic growth […] was negative 3.5 percent in Q3—the worst result in the last two years and the only time guest counts declined by more than 3 percent during the same period.

However, the personal savings rate has been trending upward in recent years with a propensity to suddenly spike up. Possible black swan there.

Consumers’ expectations are diverging from their current conditions:

It’s the younger Americans, the non-savers, who are the most confident:

Don’t hang all your hats on these iffy hooks…

China Economic Growth Slows Even More in Third Quarter China’s economy expanded by 6% in the third quarter from a year earlier, down from the period before, which hit the bottom end of Beijing’s target range for growth this year.

Growth across the board cooled in the third quarter, despite some recoveries in industrial production and retail sales at the end of the quarter, according to data published Friday by the National Bureau of Statistics.

But investment in fixed assets, a measure of construction activity that has long been a major economic driver but is becoming less so, was weaker in the first nine months, with a 5.4% rise from a year earlier. That compared with a 5.5% pace in the first eight months and was down from 5.8% growth announced after the first half.

Investment in the agricultural, manufacturing and industrial sectors retreated in September while infrastructure investment accelerated ahead of the Communist Party’s celebration of its 70th year in power on Oct. 1. (…)

The deceleration reported Friday compares with a 6.2% rate of growth posted in the second quarter—which economists said was driven by more lending—and a 6.4% figure in the first quarter, which was helped by a March tax cut worth 2 trillion yuan ($283 billion). (…)

“Despite increased downward pressure on economic growth, major economic indicators remained in a reasonable range,†a spokesman for the Statistics Bureau, Mao Shengyong, said, citing steady employment and inflation, aside from energy and food prices.

The fourth quarter, Mr. Mao forecast, would feature “conditions and supports†for the economy, including a less-steep drop in auto sales and industrial production, as well as stabilizing infrastructure investment. (…)

Source: Bloomberg

Source: Bloomberg

(…) The main growth driver was still infrastructure projects. These projects have moved from the investment stage to the production stage. Fixed asset investment growth stabilised at 5.4% from 5.5% in August. The transition from investments to production has supported industrial production, which grew by 5.8% in September from 4.4% in August. Transportation grew 10.5% YoY, which also boosted mining investments by 26.2%YoY YTD.

Private sector manufacturing activities continued to shrink, e.g. smartphone production contracted by 3.6% YoY in September. This highlights that some production lines in the private sector could have been scaled down in China and moved to other locations in Asia due to the US tariffs.

Consumption made up 60.5% of the GDP growth in the third quarter, higher than the 60.1% recorded in the first half. Overall retail sales grew 7.8% YoY in September from 7.5% in the previous month.

It seems to have been a good month for consumption but the details paint a slightly different picture. Only essential items saw strong growth. For example, food, household items and drugs grew more than 10% YoY in September. The only non-essential item that grew more than 10% was cosmetics. In contrast, automobile spending fell 0.7%. (…)

There is another CNY1 trillion yuan from the local government special bond quota, borrowed from next year, to be used until the end of 2019. These bonds are the source of financing for infrastructure projects. As such, both investment and industrial production will continue to rely on infrastructure.

This will mark even bigger differences between private and public sector growth. The private sector will continue to suffer from the scaling down of factory activity due to the US tariffs. This will add even more uncertainty in terms of job security and salary growth which, in turn, will put pressure on consumption, even if substantial public sector growth acts to counter these negative pressures.

The good news is that we expect 5G infrastructure, production and services to start to make a visible contribution to the economy from the fourth quarter. Although it is still uncertain how much 5G can help China’s exports, domestic usage of 5G alone should offer good support to the economy.

While both China and the US say they are drafting the texts of a “phase one” trade deal, it’s still unclear what exactly will be in the agreement. China has asked for a rollback of all tariffs imposed by the US before it commits to increasing annual purchases of US agricultural products.

Meanwhile, the technology war rages on. Just before the last round of trade talks, the US added eight Chinese technology companies to its Entity List, effectively blocking US companies from doing any business with these companies. China could retaliate with its own unreliable entity list.

All of this is negative for the future growth of the Chinese economy.

If the US decides to roll back some of its tariffs, the picture will change. Manufacturers may think twice before moving factories to another location, which is very costly. Unfortunately, this is not our base case.

To facilitate a lower interest cost for local government special bonds-which will support infrastructure investments- we expect a five basis point cut in the Loan Prime Rate on 20 October, and a 0.5 percentage point cut in the required reserve ratio (RRR) in the fourth quarter.

Without a lower interest rate, the economy may not be able to sustain growth of 6% in the fourth quarter.

We are raising our forecast for 4Q19 GDP growth from 5.8% to 6.0%. As such, our GDP growth forecast for the whole of 2019 will be 6.15%.

If the trade agreement in November is drafted in line with market expectations, i.e., China purchases $50 billion of US agricultural produce annually without the US rolling back its current tariffs, the USD/CNY could trade around the 7.0-7.1 level. If the US does roll back some of the tariffs, we may see USD/CNY strengthen below 7.0. But again, this is not our base case.

Then there are the planned US tariffs in December. If the US does not defer those tariffs, the USD/CNY will weaken to around 7.20 or even higher.

In short, volatility should remain high, and the progress of trade talks will be key.

- Samsung has successfully pulled all its manufacturing out of China, in order to “diversify risks”—it’s now turned to Vietnam and India, and has a tiny market share in China these days anyway. “We used Chinese production for overseas sales as well in the past but its competitiveness as a global manufacturing base has decreased,” a Samsung executive said. Financial Times

- New Trump tariffs on EU goods are due to take effect today. Levies on up to $7.5 billion of European products, including cheese, wine and Scotch whisky, will kick in after the WTO authorized their imposition as retaliation for illegal government aid to Airbus. French Finance Minister Bruno Le Maire said Europe is ready to strike back. He’ll meet USTR Robert Lighthizer today. (Fortune)

EARNINGS WATCH

As of Thursday morning, we had 63 reports in, an 83% beat rate, a +4.4% surprise factor and a –2.9% blended growth rate for the quarter, down from –2.2% on Oct. 1. Actual earnings growth for the 43 companies having reported is –1.4% on revenue growth of +3.5%.

By comparison, after 66 reports during Q2, the beat rate was 80%, the surprise factor +4.6% and the blended growth rate +0.6%, up from +0.3% on July 1. Actual earnings growth for the 43 companies having reported was +9.3% on revenue growth of +2.4%.

Trailing EPS are now $162.66, down 1.0% from $164.31 at the end of September and down 0.4% from $163.24 after 43 reports during Q2.

-

Renault Trims Revenue Outlook, Sending Shares Sharply Lower Renault cut its revenue and operating-margin guidance for the year, citing slumping sales outside Europe and higher costs associated with developing cleaner car models.

Shares in the French auto maker fell 14% Friday morning.

Renault said group revenue is expected to decline between 3% and 4%, compared with previous expectations of revenue close to last year’s €57.42 billion ($63.44 billion). Renault previously cut its revenue forecast for the year in July.

Renault also cut its outlook for its operating margin to around 5%, compared with a previous forecast of around 6%. (…)

European regulators are establishing some of the strictest emissions regimes in the world, which, combined with high labor costs, are squeezing regional auto makers’ bottom lines. (…)

Arndt Ellinghorst, an auto analyst with brokerage Evercore ISI, said Renault’s cut to guidance “paints a rough outlook on what might come in 2020 when markets will more likely be tougher and CO2 rules will add significant incremental costs to the system.â€

TECHNICALS WATCH

Following up on Lowry’s Research’s analysis of Supply vs Demand: “yesterday’s demand remained lacklusterâ€.

Where’s Vara?

Remember Trump’s “Where’s Peter?†above?

This is from the South China Morning Post:

A key source quoted frequently by US President Donald Trump’s top trade adviser and anti-China author Peter Navarro has been outed as a fake and reprints of his book Death by China will contain a publisher’s warning that it contains a fictional character.

The book, which accuses China of currency manipulation, deliberately harming Americans with dangerous consumer goods and a laundry list of other accusations came under renewed scrutiny this week following a report that one of its sources does not exist.

All reprints of Navarro’s supposedly non-fiction Death by China will “alert†readers that the Harvard-educated economist Ron Vara quoted within its pages is faked, according to Pearson, which owns the book’s publisher Prentice Hall.

The move follows a report by The Chronicle Review citing Death by China’s co-author Greg Autry, that Vara was actually Navarro’s “alter ego†and a fictionalised “everyman characterâ€. (…)

To draw the connection between Vara and Navarro, The Chronicle Review, which focuses on the arts and academia, interviewed Tessa Morris-Suzuki, who had been examining references to Vara in Death by China and earlier works by Navarro.

Morris-Suzuki had been working on an essay about the language attributed to Vara in Navarro’s writing, particularly its similarity to terms like “yellow perilâ€, which had been common in political rhetoric a century ago, when she began trying to find details about Vara.

“I quickly discovered that [Vara] was invisible,†Morris-Suzuki told the Post. (…)

The thesis that Navarro laid out in his book had come under criticism even before news that the book contains at least one faked source.

Despite serving as one of Trump’s most trusted advisers on China, Navarro does not speak Mandarin and has spent little time in the country.

Numerous China experts quoted in a 2017 Foreign Policy profile spoke of Navarro as someone who made no effort to interact with specialists in the field, with one describing his work as full of “hyperbole, inaccuracies†and a “cartoonish caricature of Chinaâ€. (…)

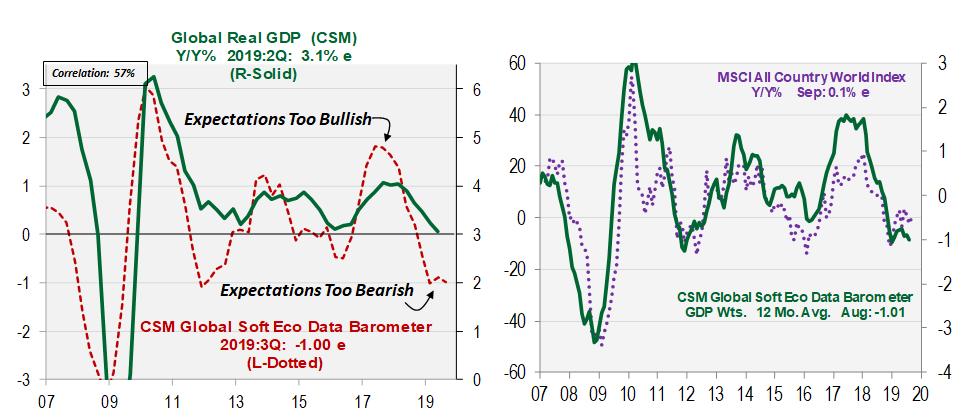

Source:

Source:

(Cornerstone Macro)

(Cornerstone Macro)