Fed Holds Steady on Interest Rates, Bond Purchases Central bank maintains easy-money policies while noting recent economic gains

(…) “Amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened,” the Fed said in a statement released after the conclusion of its two-day policy meeting. “The sectors most adversely affected by the pandemic remain weak but have shown improvement. Inflation has risen, largely reflecting transitory factors.”

Fed Chairman Jerome Powell said at a news conference Wednesday that the recovery has advanced “more quickly than generally expected,” while adding that it “remains uneven and far from complete.” (…)

[Fed officials] also repeated Wednesday that they want to see the economy make “substantial further progress” toward maximum employment and 2% average inflation before starting to reduce the pace of bond purchases. Mr. Powell has said that process would likely begin well before the Fed starts to raise rates.

He said Wednesday “it’s not time yet” for officials to start discussing a pullback in the Fed’s asset purchases.

“Economic activity and hiring have just recently picked up after slowing over the winter,” Mr. Powell said. “And it will take some time before we see substantial further progress.” (…)

“We know that the [inflation] base effects will disappear in a few months,” Mr. Powell said. While increased demand for goods and services is harder to predict, he said, “We think of them as not calling for a change in monetary policy, since they’re temporary and expected to resolve themselves.” (…) (WSJ)

This Haver Analytics chart shows the FOMC forecast to which I have added Goldman Sachs’ own views. But GS’s inflation expectations remain very muted: “Based on our bottom-up inflation model, we forecast core PCE inflation of 2.05% at end-2021, 2.0% at end-2022, 2.1% at end-2023, and 2.2% at end-2024.”

Goldman Sachs on goods inflation:

Commodity supply is basically inelastic. “Only physical scarcity can sustain backwardation, and importantly, backwardation is now in over half of all commodity markets…sustained backwardation is showing us how commodity markets are becoming progressively tighter today.” (The Market Ear)

Nordea on wage inflation:

The Fed is also clear that the only true inflation, is inflation stemming from a tight labour market. Bottlenecks and base-effects will not be considered when setting monetary policy. The big risk is now if the Fed underestimates the roaring comeback that employment may make over summer. If we get 2-3 months of significant labour market progress, this may test the current Fed stance. Inflation prints above 2% are not enough as they will be deemed transitory. We still consider the Fed behind the curve on this topic.

Powell: “These base effects will contribute about 1% in headline and 0.7% of core inflation. The other thing I want to talk about is bottle-necks. A bottle-neck is a temporary blockage of supply chains… We think of bottle-necks as something that will be resolved, hence they are temporary of nature”

BTW: Eurozone: Economic sentiment goes through the roof The European Commission’s economic sentiment indicator soared in April, with the services sector now also in expansion mode. We can now declare the Covid-19 recession over. Inflation expectations also continue to increase (ING)

The European Commission’s economic sentiment indicator surged to 110.3 points in April from 100.9 in March, dwarfing the consensus forecast of 102.2. In two months’ time sentiment has gained 16.9 points, now firmly standing above its long-term average. Amongst the bigger member states, all countries saw higher sentiment figures, with the Netherlands gaining 10.7 points, Spain 9.1, France 8.5, Germany 5.7 and Italy 5.3.

Industrial confidence is now at a record high, while sentiment in the service sector surprised with an 11.7 point jump. Confidence in retail and in construction saw a significant increase, while consumer confidence also improved. It is very encouraging to see that all forward-looking indicators are rising. Production expectations in industry reached their best reading on record, while stocks were considered scarce as never before. Order books and demand expectations are swelling in all sectors. The Employment Expectations Indicator (EEI) exceeded its long-term average for the first time since February 2020 on the back of a hefty increase in April (+9.9). All surveyed business sectors showed more optimistic employment plans.

The quarterly survey showed that the rate of capacity utilisation rose to 82.5%, a marked 5.0 percentage points higher than in January and now above both the indicator’s long-term average and pre-pandemic level. This bodes well for a recovery in business investment in the course of this year. With unemployment expectations declining, it comes as no surprise that a growing number of consumers is planning major purchases over the next 12 months. The Covid-19 recession can now be declared officially over.

Selling price expectations rose for the second month in a row across all surveyed business sectors. Consumer price expectations increased only mildly. Selling price expectations in industry are now close to a record high, but they are now also in construction, retail and even the services sector above their long term average. The big question is how temporary these price increases will be. Will they disappear once some of the supply chains problems are resolved?

With strong demand to be expected in the second half of the year and a further inventory build-up in the offing, we doubt that price tensions will disappear quickly. To be sure, it is probably too early to anticipate a price-wage spiral. But if we see a strong recovery in the coming months, which seems to be suggested by today’s data, the hawks in the ECB’s Governing Council will likely become a bit more vocal. The chances of the Pandemic Emergency Purchase Programme being lengthened after March 2022 are getting slimmer by the day and the central bank could even suggest that it will not fully spend the current envelope.

Morning Consult:

In the latest update to our Return to Normal tracking data, for the first time in Morning Consult tracking, over half of members of all generations say they’re comfortable returning to their normal routine, with baby boomers setting a new high mark at 53 percent. Read More.

66 percent of Americans said they are or are willing to be vaccinated, while 20 percent said they are unwilling and 14 percent said they are uncertain.

Gallup:

Fifty-seven percent now describe their current financial situation as excellent or good. That is one percentage point higher than the 56% recorded in 2019 and significantly better than the 49% recorded a year ago, at the start of the pandemic.

Axios: Big government is back, trickle-down economics is out!

“My fellow Americans, trickle-down economics has never worked. It’s time to grow the economy from the bottom up and the middle out.”

Biden wants to spend a phenomenal amount of money — his accomplishments and proposals total $6 trillion — and mobilize the government to touch every corner of American life.

- The great bet is that all this spending won’t lead to runaway inflation.

Advance U.S. Trade Deficit in Goods Deepens to Record in March

(…) Imports of autos & parts rose 7.3% (8.3% y/y) following two months of significant decline. Food & beverage imports rebounded 7.0% (9.4% y/y) last month after falling 4.9% in February. Nonauto consumer goods imports rebounded 7.0% (37.5% y/y) following a 4.2% drop. Auto & parts imports rose 7.3% (8.3% y/y) after falling sharply for two straight months. Industrial supplies imports strengthened 7.6% (22.1% y/y) with higher oil prices. Capital goods imports rose 5.7% (16.6 y/y) after a 0.3% improvement.

Canadian Retail Sales Rebound After Second-Wave Lockdowns

Retail sales rose 4.8% in February, while preliminary estimates for March showed a 2.3% gain for that month, according to data released on Wednesday by Statistics Canada. It represents a bounce back from a flat reading in January and a sharp decline of 5.5% in December, when many businesses were forced to close because of a second wave of Covid-19.

THE CANADIAN DOLLAR

The Loonie has been the best performing

major currency so far this year. Here’s my friend Hubert Marleau’s take:

Coincidently, the Loonie is trading at Palos’ estimated purchasing power parity rate (PPPR) which is 80 US cents. While the PPP possesses the property of pulling currency prices toward its rate, prices often trade below or above the PPPR. Exogenous factors like changes in terms of trade, monetary policy and foreign inflow of capital can price currencies differently from their fundamental values, forcing currencies to trade far away from their perceived fair value or equilibrium rate. Unfortunately, it is very hard to forecast where exchange values are heading because the aforementioned forces that drive prices are unquantifiable. The forex market responds to narratives and usually acts as a shock absorber. Additionally, when it comes to pinpoint currency values, everything is relative.

Nonetheless, it just so happens that the Canadian dollar might be in a sweet spot– that Canada is in one of those rare moments when the three main factors that usually determine the performance of the Loonie are in sync. It could trend higher, perhaps to 85 US cents, even though Canada is not terribly competitive when the Loonie trades above its PPPR.

Firstly, the Canadian terms of trade have significantly improved as a result of the rapid and robust increase in commodity prices like energy, lumber, agricultural products, industrial metals and minerals. For example, at the end of last December, on average the commodity prices were up 15% whilst the commodities which are particularly important to the Canadian economy were up by significantly more. For the comparable period, the exchange value of the Canadian dollar is up less than 2%.

Presently, the grim situation in India could for a time be a drag on the trajectory of the Canadian dollar. (…) India represents 5.4% of world oil demand, so a 20% fall equates to about 1% drop. Oil analysts believe the decline will not amount to much. The interlude should be relatively easy to absorb, in spite of bigger than expected flows of unsanctioned Iranian crude, because other economies are growing rapidly. The Citi team led by Edward Morse, a leading expert on the oil market, said that the current pause in the rise of oil price is not a function of deteriorating fundamentals. It is related to financial flows rather than change in supply versus demand bearishness. Citi still expects quarterly declines in total oil inventories through 2021 and possibly into 2022. That spells higher prices into the $70 range for Brent oil, bringing better terms of trade for Canada.

Secondly, the monetary stance of the Bank of Canada has meaningfully diverged from that of the Fed. Interest rate differentials have widened at the front-end and narrowed at the back-end of the yield curve in favour of Canada. The Bank of Canada (BOC) has allowed this to happen because inflationary pressures have been

mounting, the housing market is red-hot and the economic recovery appears to be ahead of schedule. A few weeks ago, Deputy Governor Toni Gavelle announced that the central bank was winding down emergency liquidity programs, including programs to buy provincial and corporate bonds it deployed to grease the money and capital

markets when the coronavirus struck last year. On Wednesday last, Tiff Macklem, governor of the BOC officially broke it to the market that he’s slowing down the pace of the bank’s bond purchases. In a nutshell, the BOC is cutting its bond-purchase target to $3 billion a week from a minimum of $4 billion and made it clear that a rate hike may be warranted sooner than originally expected–the second half of 2022 is now a probability.Given that the Loonie is not internationally important and a very marginal reserve currency, the BOC can afford to take more liberty to do what it thinks than the ECB or the Fed. It has no real risk of offending emerging economies or force the ECB and the Fed to catch up. In the words of Louis Vachon, CEO of the National Bank of Canada, the hawkish tone of Tiff Macklem is about being prudent and giving the BOC optionality in terms of policy. As a matter of fact, the Canadian yield curve has steepened to some 30bps (ten’s minus two’s), strongly suggesting that bond traders are expecting a lot more aggressiveness from the Canadian monetary authorities with swaps trading giving a 50% chance of a rate hike by next March.

Thirdly, Canada has not been in a better position than now to abundantly attract foreign capital. For the first time in years, the relative attractiveness of Canada as a destination for investments has not been better than now. The government introduced a $100 billion growth plan over three years without any increase in the personal income tax, capital gains tax and corporate tax rate. Neither was reference made to a wealth tax. By contrast, the US administration is determined to raise taxes on personal income, capital gains and corporate profit. Interestingly, it’s happening when a strong cyclical reflation is apparent, the indirect beneficial effect of Biden’s infrastructure package on Canada’s economy could be huge and Washington is viewing Ottawa as a strategic partner in the development of minerals deemed critical for national defense. The Canadian stock market, adjusted for foreign exchange, is very cheap when compared to the S&P 500–the ratio is only 3.7x. History shows that this ratio could be considerably higher especially when cyclical reflation dominates the headlines.

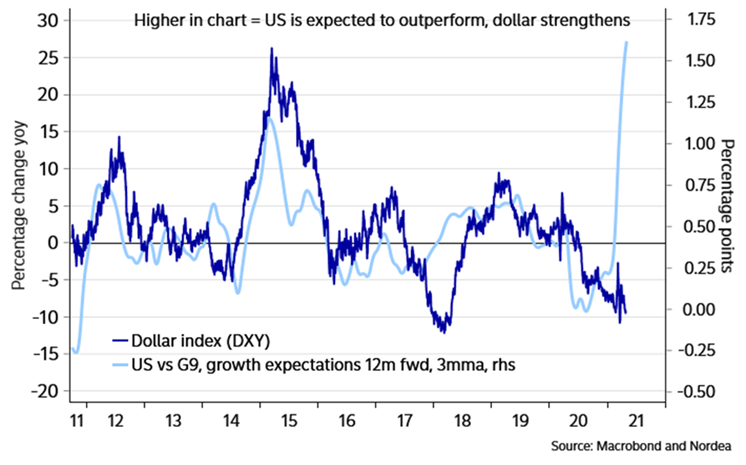

Nordea on the USD:

The US is likely to outperform all peers growth-wise this year, which over time usually leads to a stronger USD versus other currencies as a result of the side-effects of a stronger growth pace. First, USD bonds may continue to yield better than most peers, second the Fed is more likely to respond to strong growth rates via a slightly tighter policy, maybe via a tapering discussion already this summer.

USD-comeback to be driven by much higher growth in the US compared to peers?

EARNINGS WATCH

We now have 201 reports in, an 86% beat rate and a huge +22.7% surprise factor (+3.1% on revenues). The 201 companies having reported so fare show a combined +56.4% earnings growth rate on revenues up 8.4%.

Tailing EPS are now $152.56, rising to $180.96 for the full year 2021 and $205.02 in 2022. If so, earnings will have jumped 26% from 2019 to 2022, that is +8.6% on average per year. That compares with +7.4% on average between 2014 and 2019 with no global pandemic and a huge U.S. corporate tax cut. Truly amazing!

We also have 54 STOXX 600 companies in, showing a 65% beat rate and a +34.3% surprise factor (+3.5% on revenues).

BUYBACKS ARE BACK

Apple Signals Hot Streak to Continue as Sales, Profit Surge Demand for new 5G iPhones helps fuel a more than doubling of quarterly profit to $23.6 billion

AAPL’s results reflect amazing technology but also strong consumer demand across the board of products and price ranges.

New, more expensive models of the iPhone 12 have been a hit with customers, and revenue from Mac computers and iPads also rose during the quarter on strong demand from employees and students conducting their work at home.

Apple’s fiscal second-quarter results set new highs in what could be a record-setting year for profit and revenue. Analysts predict full-year profit will exceed $70 billion, nearly a third more than last year.

The Cupertino, Calif. company reported a profit of $23.6 billion in the latest quarter as revenue rose 54% to $89.6 billion, far exceeding Wall Street expectations. The company also announced a 7% increase to its cash dividend to 22 cents a share and that the board had authorized an increase of $90 billion to an existing share-repurchase program. (…)

Apple’s revenue results beat estimates from analysts surveyed by FactSet by 16% while profit was 42% better than expected. (…)

Apple was able to avoid a microprocessor shortage in the March period. But Mr. Maestri cautioned, during a public conference call, that a shortage would contribute to a decline in revenue in the current quarter steeper than the typical falloff following the March period. Supply constraints will primarily affect Macs and iPads. (…)

The real engine of 2021 is the latest iPhone: Overall iPhone revenue for the March quarter rose 65% to $47.9 billion. Analysts had expected a 42% rise.

Higher-end versions of the iPhone 12 appear to be providing a boost. The average retail price in the U.S. during the past three months rose $52 to $847 from a year earlier, according to data from Consumer Intelligence Research Partners LLC, which surveys buyers.

The most expensive version, the iPhone 12 Pro Max with a 6.7 inch display that starts at $1,099, saw its share grow to 20% of sales from 13% a year earlier, the survey found. (…)

Greater China sales in the latest quarter nearly doubled to $17.7 billion. (…)

Apple saw record demand for Mac computers and an 11% rise in iPad tablet sales. That growth continued in the March period. On Wednesday, Apple said Mac sales rose 70% to $9.1 billion and iPads increased 79% to $7.8 billion. That beat analyst expectations for increases of 27% and 29%, respectively. (…)

GS:

Our original view that the iPhone cycle would disappoint in the midst of COVID was clearly wrong. Not only has Apple done better than we expected on iPhone during the cycle but Mac and iPad have also materially outperformed our forecasts. iPad demand is so strong that the company believes they will leave $3bn-$4bn of revenue on the table in FQ3 to June.

Bloomberg:

Apple Inc. became the latest company to signal that the global semiconductor shortage was leading to production curbs. Executives warned that lost sales of iPads and Macs would knock $3 billion to $4 billion off third quarter revenue. The situation seems to be only getting worse for automakers, with Honda Motor Co. and BMW AG saying they would be pausing production at some plants and Ford Motor Co. reduced its full-year earnings forecast on the component shortage.

COVID-19

New COVID infections fell by roughly 16% over the past week in the U.S. — a big improvement after weeks of stasis, Axios’ Sam Baker and Andrew Witherspoon write.

- More than half of American adults have gotten at least one vaccine dose, and that seems to finally be putting a dent in the size of the country’s outbreak.

- The U.S. averaged about 55,000 new cases per day over the past week, down from about 66,000 per day the week before.

The number of new infections declined in 26 states and rose in only four.

- New York and Michigan saw the biggest improvements: New cases were down about 30% in each state.

Data: CSSE Johns Hopkins University; Map: Andrew Witherspoon/Axios

Cruise Lines Could Start U.S. Sailings by Mid-July, CDC Says The update paves the way to resume operations that have been suspended for longer than a year due to the Covid-19 pandemic, and allows operators to avoid test cruises if 95% of passengers and 98% of crew are vaccinated.

FYI via Axios:

- BioNTech chief confident Covid jab will work on variant found in India Biotech has tested vaccine it pioneered with Pfizer against more than 30 strains of the virus