U.S. Wholesale Inventories Tick Higher; Sales Firm

Note that the Haver chart on the right is the % change in the I/S ratio. The actual ratio is still very high:

Job Openings Declined in May, a Month of Weak Job Market Performance The number of job openings slid in May to the lowest level of the year, underscoring the weakness in the labor market that month although separate reports have shown a rebound in June.

The number of job openings fell to 5.5 million in May from 5.85 million in April, according to the Labor Department. (…) Job openings declined in May, but there’s far fewer unemployed people per job than just a few years ago. During the worst parts of the recession, there were more than 6 unemployed people for every available job opening. Today, that ratio is down to about 1.35 unemployed workers per opening.

All JOLT charts here. But there is another one showing the big slowdown in the number of job openings through May. In fact. job openings declined 345k MoM in May which more than eliminated the 241k new openings between February and April. Last 4 months: –104k job openings. Why and how we could get 287k new jobs in June is a mystery which, perhaps, only future revisions will help us understand.

More Americans Have Rainy Day Funds, But Savings Remain Skimpy

(…) A survey of more than 27,000 Americans, released Tuesday by the FINRA Investor Education Foundation, showed the ratio of respondents who have set aside three months of emergency funds rose to 46% last year, compared with 40% for its previous survey in 2012 and 35% in 2009.

About 62% said they could certainly or probably come up with $2,000 if an unexpected need arose within the next month, up from 56% in 2012.

The increase in rainy day funds reflects improvement in overall financial standing, which in turn reflects gains in the broader economy. The number of respondents who had no difficulty covering expenses and paying bills rose to 48% in 2015 from 40% in 2012 and 36% in 2009.

Debt burdens have also declined, with the exception of student loans. More than half the respondents reported they always paid their credit cards in full, while one in three homeowners said their down-payment was more than 20% of the purchase price of their homes, up from less than one in four in 2009. (…)

The percentage of respondents who spent less than their income–meaning they had money left over to save–actually declined to 40% in 2015 from 41% in 2012 and and 42% in 2009. About 58% have retirement accounts, up from 54% in 2012 but nearly flat from 57% in 2009.

One factor keeping people from saving more for retirement may be the increased burden of student loans, said Gary Mottola, research director at the foundation. More than one in four respondents had student loans to repay, with 45% of those between 18 and 34 reporting such obligations. Reflecting the heavy toll on their financial lives, 53% of the student-loan holders said they would make a change if they could go through the process of taking out student loans again.

Despite improvement in financial conditions, a large chunk of the population continued to face hardship. More than one in five said they had past-due medical bills, and more than one in four had borrowed money from companies other than banks in the past five years, including 16% who used pawn shops and 12% payday loans.

FYI: U.S. Wages Accelerating

- July 12 (NY Post) — Starbucks employees are getting a 5% to 15% raise.

- July 12 (NYT) — Over the next three years, JPMorgan will raise the minimum pay for 18,000 workers from $10.15, to $12.00 to $16.50.

China Exports Stabilize in June

- Overseas shipments fell 4.8 percent from a year earlier, imports dropped 8.4 percent [Exports are down 7.7% in first half]

- Trade surplus slips slightly to $48.11 billion

- Both exports and imports in yuan terms looked better, with outbound shipments eking a small gain, reflecting the influence of a weakening currency

- Exports face downward pressure in the third quarter, a customs administration official said at a briefing in Beijing. Trade will remain sluggish, though may continue to stabilize in the second half, the official said, adding that exporters face increasing labor costs while other countries are competing with cheaper wages.

- Exports to U.S.,China’s top export market, fell 10.4 percent, while those to Brazil plunged 21.5 percent. Shipments to the European Union – its second biggest market – fell 3.6%.

- Imports from Canada slumped 44.6 percent, and from U.S. dropped 12.7 percent.

China H1 rail freight down 7%, but passengers up

If you want to see where China’s economy is headed, just look to the railways.

New figures from the state-owned China Railway Corporation show domestic rail freight volume for the first half of 2016 fell to 15.7bn tonnes, down 7.6 per cent compared to the same period a year prior.

The year-to-date freight figure represented a fall of 129m tonnes in absolute terms, but actually represented a moderation from the fall of 192m tonnes seen in H1 2015.

Most of the fall in freight volume in recent years is due to less coal being shipped across China, though contraction in overall freight shipments has moderated more noticeably than coal since the start of 2016.

While some of the fall in coal shipments may be the result of expanded electricity transmission lines from western regions to the coast that make rail shipments less appealing for certain areas, the lion’s share is a result of the downturn in heavy industry and manufacturing, which has pared down growth in electricity demand substantially. (…)

China on Pace to Meet Economic Targets This Year, Premier Says

Premier Li Keqiang said the Chinese economy is “basically stable” and on course to meet its major targets this year, with its second-quarter growth rate likely to be close to the first quarter’s 6.7% level when results are announced Friday. (…)

Mr. Li said China plans to cut between 100 million and 150 million tons of overcapacity over the next few years, including 45 million tons from the steel industry this year, and said China is “determined to address the problem.” (…)

-

Despite Defaults, China’s Zombie Companies Stay Alive In mature economies, defaults usually usher in wrenching change. But China’s efficiency drive—aimed at long-coddled state industries—is taking a back seat to short-term concerns about growth and jobs.

(…)China is sitting on the world’s largest pile of corporate debt as a percentage of GDP. Some $1.3 trillion comes due in the second half of this year. Of that, some $24.7 billion is among the most toxic, owed by rust-belt producers such as Dongbei that have less cash than short-term debt, according to Fitch Ratings.

Defaults nearly doubled in the first half of this year from a year earlier, as the government tried to spur corporate overhauls. The International Monetary Fund and other analystswarn that shocks from a large wave of defaults in China could ripple through global markets.

Dongbei is a sprawling steelmaker stitched together a decade ago by Liaoning province, which merged three producers and owns 70% of the closely held company. It is the country’s largest producer of specialty steel—alloys treated to increase resistance, such as to corrosion or heat—and employs 10,000 in the dusty city of Dalian. It exports nearly a third of its output to markets including the U.S., Japan and Europe. (…)

The company got in trouble by spending heavily during the boom, when it gorged on credit from fund-management companies and state-owned banks. Outlays included $2 billion on a huge new headquarters in 2012, just as steel prices were collapsing. Dongbei now looms over 305 hectares (754 acres)—570 football fields—and has the capacity to produce more than twice its actual output of 1.8 million metric tons. Company data show that its debt is twice the level of its annual revenue.

When Dongbei missed a debt payment of $121 million in March, it was hailed as a watershed in the government’s efforts to unwind debt-fueled excess. It was one of the biggest state-owned firms to stumble, and the default came as Beijing called for bankruptcy and mergers to reshape the corporate sector.

“We won’t let ‘zombie enterprises’ survive for long,” Sun Xuegong, a senior official at the economic planner National Development and Reform Commission, said last month.

Yet the company has stayed largely intact, according to interviews with creditors, employees and suppliers. Instead of reorganizing its operations, Dongbei and its owner, the provincial government of Liaoning, are pressing creditors to accept payment for just a third of what they are owed, swap another third into equity and roll over the rest, according to an official who helped organize meetings between the company and its creditors. (…)

Dongbei is among at least six state companies that have reneged on debt in a little more than a year. Only two, Baoding Tianwei Group Co. and Guangxi Nonferrous Metals Group Co., have filed for bankruptcy reorganization.

In May, Beijing gave control of government-owned builder China City Construction Holding Group Co. to a consortium of state financial giants to help it avert default. Twice last year, Beijing persuaded bondholders to extend redemption deadlines for Sinosteel Co., a trader owned by the central government.

The Liaoning government has a powerful interest in saving Dongbei. Formal bankruptcy would oblige the province to lay off and retrain potentially angry workers. The province already is dealing with scores of failing rust-belt industries. Its economy was the only one among the country’s 31 provinces to contract in the first quarter. (…)

Japan chops GDP growth forecast down to 0.9%

The Japanese Cabinet Office clipped its growth forecast for 2016 to 0.9 per cent from 1.7 per cent projected in January, citing the delay in imposing a new consumption tax. (…)

The decision to delay the consumption tax hike to 10 per cent from the current 8 per cent, was cited as the prior reason for the revision, the Nikkei reported.

A last-minute demand rush prior to the tax raise, initially scheduled for April next year but put off until October 2019, was counted in the initial projection for this year.

The council also confirmed plans to put together a new stimulus plan by the end of this month, following Mr Abe’s sweeping victory in Sunday’s Upper House elections.

Malaysia Unexpectedly Cuts Rate to Shield Growth as Risks Mount

Malaysia’s new central bank Governor Muhammad Ibrahim unexpectedly cut interest rates for the first time in seven years, joining Asian counterparts from Indonesia to Taiwan in easing policy as global risks mount.

In his second rate-setting meeting since taking office two months ago, Muhammad lowered the overnight policy rate by 25 basis points to 3 percent, a decision that came as a surprise to all but one of the 18 economists surveyed by Bloomberg. (…)

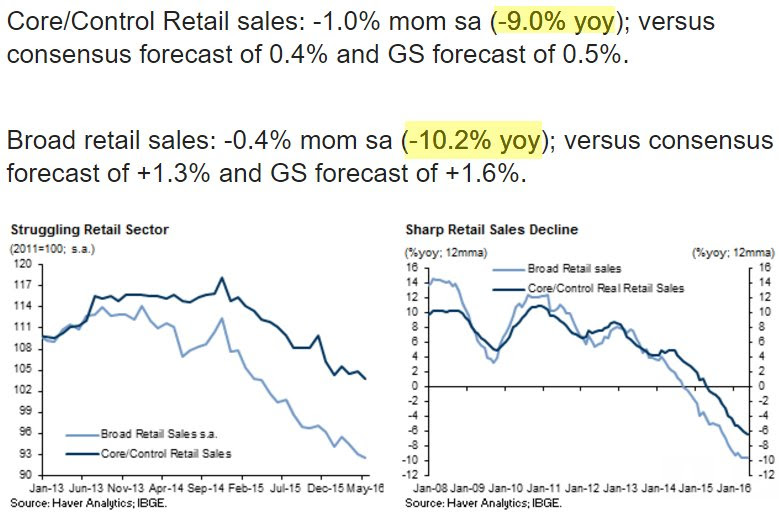

Brazil’s retail sales report was a disaster, and no improvement is expected in Q3.

From The Daily Shot:

Huge stocks overhang threatens oil price recovery: IEA The global glut in oil is refusing to ease and acts as a major dampener on crude prices despite robust demand growth and steep declines in non-OPEC production, the International Energy Agency said on Wednesday.

-

OPEC wins production battle

Oil production from the Middle East has climbed to a record, according to the International Energy Agency, while U.S. output has slumped. Oil prices have dropped by about 40 percent since OPEC shifted strategy in November 2014 to prioritize sales over prices in order to drive higher-cost producers from the market. While most new projects planned over the next decade are economically viable below $60 a barrel, prices as high as $85 may be needed in order to make sufficient supply available to meet the demand that’s anticipated over the next decade, according to Wood Mackenzie Ltd.

Buybacks Pump Up Stock Rally

(…) Shares outstanding in the S&P 500 have fallen this year from year-earlier levels, on track for the first yearly decline since 2011, according to S&P Dow Jones Indices. Companies in the S&P 500 bought back $161.39 billion of shares during the first three months of the year, the second-biggest quarter for repurchases ever. (…)

Companies have authorized $357 billion in 2016 through the end of last month, according to research firm Birinyi Associates. That is down 28% from a year earlier, though it is unclear how much will be instituted until firms report earnings.

Companies had $156 billion of unused authorizations at the beginning of the second quarter, according to Goldman Sachs Group Inc. (…)

To be sure, buybacks aren’t the only driver shrinking S&P 500 stock outstanding.

Corporations broadly are selling fewer shares, and more mergers and acquisitions are being funded by cash rather than share issuance, reflecting in part the ease with which high-quality borrowers can take out debt at low rates and make purchases without diluting shareholders, as stock-financed acquisitions do. (…)

Fundamentally, said Mr. Melcher of PNC, what drives stocks higher is earnings growth. But companies in the S&P 500 are expected to report their fifth consecutive quarter of contracting earnings, according to FactSet. While earnings are important, many portfolio managers view revenue growth as better reflecting firm performance in the context of the broad business environment, and therefore more germane to routine investment analysis.

“What we’d like to see is earnings growth coming from higher revenues and economic activity running at a faster pace,” Mr. Melcher said. “Those are typically more solid underpinnings for stocks.”

Companies in the S&P 500 spent $166.3 billion on share buybacks during the first quarter, which marked a new post-recession high. Since 2005, only Q3 2007 produced a larger amount of buybacks ($178.5 billion). Dollar-value buybacks in Q1 represented a 15.1% increase in spending from the year-ago quarter, and a 15.6% jump from Q4. This breakout in the first quarter of the year comes amid somewhat of a stabilization period for buybacks since the middle of 2014. With that said, buyback spending still remained at very high levels for the index during this period.

EARNINGS WATCH

According to Thomson Reuters, 60% of the 25 S&P 500 companies having reported Q2 so far beat estimates with a beat rate of +1.6%. Q2 EPS are now forecast to decline 5.0% from –4.8% last week.

If revenues are getting more important to “many investors”, only 52% of the companies beat revenue estimates and the beat rate is –0.2%.