CONSUMER WATCH

Via The Transcript:

- “I think every quarter for the last 12 quarters, I’ve been asked what’s going to happen in the U.S. when the consumer goes away, you guys are too far over, right? And so for the same 12 quarters, we’ve said things are going fine.” – Live Nation Entertainment ($LYV ) President Joe Berchtold

- “So we just have not really seen any weakening in the consumer right now. We feel good about the macro environment and the consumer, and despite the headwinds of tariffs and sort of the headlines that are out there.” – Urban Outfitters ($URBN ) COO Francis Conforti

- “From our view, the consumer is healthy and resilient, remarkably resilient. You think about the challenges the consumer has been through over the last 5, 6 years, and they’ve just been remarkably resilient through it. They’ve evolved, iterated, and adjusted based on the conditions, but GDP continues to be strong. Consumer spending continues to be strong. And that’s what we see in our business.” – Tractor Supply ($TSCO ) CEO Harry Lawton

- “Our consumer is an upper-middle-income consumer. So roughly 2/3 of what we sell is at a household level income of over $100,000. And so we continue to see that consumer healthy…The other side we’ve seen is certainly that you see a consumer that is strained, that is getting more constrained, particularly if tariff costs are passing through to the consumer.” – La-Z-Boy ($LZB ) CEO Melinda Whittington

- “And the state of our consumer is very strong. I think that — but it goes back to that compelling creating want and creating an emotional connection and making her feel something. So the intimates market has been soft for some period of time.” – Victoria’s Secret ($VSCO ) CEO Hillary Super

- “But I think of the broader lens, they’ve been surprisingly Uber resilient, right? And I think about in our lens, Sabrina alluded to getting rid of double stacking. And so you would think despite pulling back on some of that, you look at our second quarter results on sales versus first quarter on a 2-year stack, we actually had 100 basis point sequential improvement. And so that, to me, big picture allude to the consumers remain resilient as we’ve tightened.” – Petco Health and Wellness ($WOOF ) CEO Joel Anderson

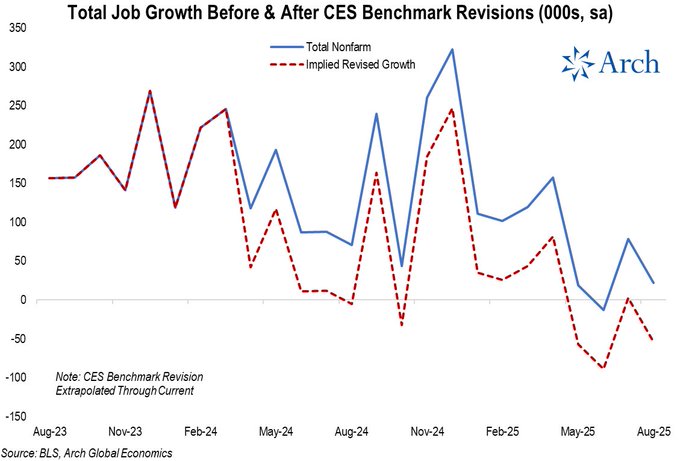

- The underlying, I think, fundamentals are still quite good. We’re still seeing employment growth. Wage growth, in particular, continues to be strong.” – Automatic Data Processing ($ADP ) CFO Peter Hadley

Short-Term Inflation Expectations Tick Up, Job Finding Expectations Reach Series Low

The Federal Reserve Bank of New York:

Inflation

- Median inflation expectations ticked up by 0.1 percentage point to 3.2% at the one-year-ahead horizon in August. They were unchanged at the three-year- (3.0%) and five-year-ahead (2.9%) horizons. (…)

- Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—increased at the one- and three-year-ahead horizons and declined at the five-year-ahead horizon.

- Median home price growth expectations remained unchanged for the third consecutive month at 3.0%. This series has been moving in a narrow range between 3.0% and 3.3% since August 2023.

- Median year-ahead commodity price change expectations declined by 0.9 percentage point for the cost of college education to 7.8%, by 1.0 percentage point for rent to 6.0%, and by 0.4 percentage point for the cost of medical care to 8.8%. Median year-ahead price change expectations remained unchanged for gas (3.9%) and food (5.5%) for the third consecutive month.

Labor Market

- Median one-year-ahead earnings growth expectations fell by 0.1 percentage point to 2.5% in August, remaining below its 12-month trailing average of 2.8%. The series has been moving within the range between 2.5% and 3.0% since May 2021.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased by 1.7 percentage points to 39.1%. The series remains above its 12-month trailing average of 38.1%.

- The mean perceived probability of losing one’s job in the next 12 months ticked up by 0.1 percentage point to 14.5%. The reading is above the series’ 12-month trailing average of 14.0%. The mean probability of leaving one’s job voluntarily in the next 12 months decreased by 0.1 percentage point to 18.9%, remaining slightly below its 12-month trailing average of 19.0%.

The mean perceived probability of finding a job if one’s current job was lost fell markedly by 5.8 percentage points to 44.9%, the lowest reading since the start of the series in June 2013. The decline was broad-based across age, education, and income groups, but it was most pronounced for those with at most a high school education.

The mean perceived probability of finding a job if one’s current job was lost fell markedly by 5.8 percentage points to 44.9%, the lowest reading since the start of the series in June 2013. The decline was broad-based across age, education, and income groups, but it was most pronounced for those with at most a high school education.

Household Finance

- The median expected growth in household income remained unchanged for the second consecutive month at 2.9% in August, equaling its 12-month trailing average.

- Median household spending growth expectations increased by 0.1 percentage point to 5.0%. The series has been moving in a range between 4.8% and 5.2% since February 2025.

- Perceptions of credit access compared to a year ago improved with a smaller share of households reporting it is harder to get credit. Expectations for future credit availability deteriorated somewhat, with a smaller share of respondents expecting it will be easier to obtain credit in the year ahead. (…)

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 0.6 percentage point to 38.9%.

(…) Anderson Economic Group reports that tariffs on Canadian and Mexican cars and parts totalled $1.4 billion in July alone, about two and a half times the monthly average through June. Tariff costs jumped even as imports of some product categories fell. The share of Mexican cars exempt from tariffs fell to 20% in July from about 90% before Mr. Trump’s border taxes took effect. (…)

Meantime, a Federal Reserve business survey last week noted that “automobile dealers experienced an increase in demand for parts and service as consumers chose to keep their vehicles longer,” but “new car sales were flat to down.” (…)

BYD has predicted a bloodbath in the Chinese car industry in the wake of Beijing’s crackdown on aggressive discounts, warning that roughly 100 carmakers needed to be “pushed out” of the hyper-competitive market. (…)

Without the ability to offer discounts to attract customers, “some of the original equipment makers will be pushed out”, said Stella Li, BYD’s executive vice-president, on the sidelines of the Munich motor show. “Even 20 OEMs is too much.”

Until now, about 130 manufacturers have jostled to capture share in the world’s largest car market for pure battery electric vehicles and plug-in hybrids. (…)

Of the 129 brands selling EVs and hybrids in 2024, consulting firm AlixPartners estimates that 15 will remain financially viable by 2030. BYD rival Xpeng has previously predicted the world’s car industry will shrink to only 10 companies over the coming decade. (…)

BYD and other Chinese brands have been rapidly expanding their sales in the UK and other European markets by offering affordable EVs and plug-in hybrids with advanced software and other technologies. State-owned Changan has also recently launched in the UK as part of its overseas push. (…)

Leapmotor is considering producing its B10 electric sport utility vehicle at a Stellantis plant in Spain but Xin said the company was able to sell vehicles made in China at competitive prices as it was able to use Stellantis supplier and dealer networks.

Producing cars in Europe was “super complicated”, Xin said. “The [labour] cost is so high and the energy is so high.”

(…) Of course, the industry is in a challenging situation. It’s a race and that will get tougher and tougher, especially for the Europeans. (…)

The industry will be electric — there’s no turning back. It may take a bit longer in some regions, but the direction is clear. In (about) 10 years, cars will all be electric and they will be lower cost.

There will be new dominant players, exactly as Ford, GM, Toyota and Volkswagen were in the old world. In the new world, there will be two or three very strong Chinese brands. That makes the room for the old ones tougher. So this will trigger a (wave of) restructuring. Some companies will adapt to new circumstances and survive. Others will not.

- Tesla’s U.S. market share dropped below 40% — the lowest since 2017. Its aging lineup of electric vehicles is facing new competition from General Motors, Ford, Hyundai and others. Go deeper.

Data: Cox Automotive. Chart: Axios Visuals

EARNINGS WATCH

From Ed Yardeni:

(…) The weekly S&P 500 forward earnings per share series is an excellent year-ahead leading indicator of actual quarterly earnings per share, which rose to a record high during Q2. It should continue doing so according to the forward earnings series.

Forward earnings is equal to forward revenues times the forward profit margin. Weekly forward revenues continues to rise in record high territory, as does quarterly revenues. The former tracks the latter very closely indeed. (Neither forward revenues nor forward earnings do a good job of anticipating recessions, which is our job.)

Remarkably, the weekly forward profit margin of the S&P 500 rose to a record high of 13.9% during the week of August 28. It too is an excellent weekly coincident indicator of the quarterly series. There is no sign that rising tariff costs and labor shortages are squeezing profit margins. We have to conclude that productivity growth must be strong.

The S&P 500’s aggregate forward earnings in dollars has been growing at a faster pace in recent weeks. The Magnificent-7 have certainly contributed to this performance. But so have the Impressive-493.

Finally, we note that the forward P/E of the S&P 500 has been range-bound since August 2020, which is when the pandemic losses in the index were fully recovered. It is currently near the top end of this range at 22.5. Forward earnings is up 96% since August 2020, accounting for all of the increase in the S&P 500 since then! It has been an earnings-led bull market, and it should continue to be so.

American high-school seniors’ scores on major math and reading tests fell to their lowest levels on record, according to results released Tuesday by the U.S. Education Department.

Twelfth-graders’ average math score was the worst since the current test began in 2005, and reading was below any point since that assessment started in 1992. The share of 12th-graders who were proficient slid by 2 percentage points between 2019 and 2024—to 35% in reading and 22% in math.

There also were drops in the proportion of students who were able to reach at least a basic level of performance, a tier below proficiency. (…)

The learning loss has been broad and substantial, showing up on international exams and tests of children just entering school. Few if any student groups or regions of the country have been entirely spared. (…)

Scores also fell on newly released 8th-grade science tests. (…)

On other exams in earlier grades, scores have partially bounced back in math. Reading scores have generally remained low or fallen further. (…)

(…) Large language models (LLMs) such as ChatGPT, Google Gemini and Anthropic’s Claude excel at locating, synthesizing and connecting knowledge. They don’t add to the stock of knowledge.

By contrast, when humans answer questions, such as whether Einstein should be energy secretary, they often pursue novel avenues of inquiry, creating new knowledge and insight as they go. They do this for a variety of reasons: salary, wealth, fame, tenure, “likes,” clicks, curiosity.

If LLMs come to dominate the business of answering questions, those incentives shrivel. There is little reward to creating knowledge that then gets puréed in a large language blender.

Consider the fate of Stack Overflow, a website where software developers ask and answer questions, becoming both a wellspring and repository for knowledge.

But then developers started putting their questions to ChatGPT. Six months after its introduction in November 2022, the number of questions on Stack Overflow had fallen 25% relative to similar Chinese and Russian language sites where ChatGPT wasn’t an alternative, according to a study by Johannes Wachs of Corvinus University of Budapest and two co-authors.

The drop was the same regardless of quality, based on peer feedback, refuting predictions that AI would displace only low-value research.

As of this month, the number of questions is down more than 90%. Why should anyone other than Stack Overflow’s owners care? Because, as tech writer Nick Hodges explained in InfoWorld, “Stack Overflow provides much of the knowledge that is embedded in AI coding tools, but the more developers rely on AI coding tools the less likely they will participate in Stack Overflow, the site that produces that knowledge.”

Stack Overflow may be an extreme case. A different study found no similar decline on Reddit.

But there are signs of similar effects elsewhere. Many LLMs are trained on Wikipedia, a repository of knowledge compiled and curated by humans. Columbia University business professor Hannah Li and five co-authors found that between the year before and the year after ChatGPT’s launch, views fell for Wikipedia pages most similar to what ChatGPT could produce. Edits also dropped, a potential sign of less incentive to contribute, although the data were inconclusive.

Meanwhile, as Google has enabled users to answer queries through AI without clicking on links, web publishers large and small have seen referral traffic from search plummet. (…)

If LLM output comes to dominate the web, the web will become, well, dumber. Columbia’s Li said in an interview: “What happens when we train LLMs on other LLM outputs? The overall outcomes get worse. The models get worse. This is what they call model collapse.”

There is a parallel in what index funds and other passive strategies have done to the stock market. They don’t do research and price discovery (the process of negotiation that reveals an asset’s value). Instead, they free ride on the research and price discovery of active investors. In other words, they exploit market efficiency without contributing to it. In the process, they are squeezing out active investing, leaving a market increasingly dominated by algorithms trading against each other.

These are, I’ll admit, dystopian scenarios. I could tell a different story of how AI will help scholars discover connections between otherwise disparate bits of knowledge across the web. Joshua Gans, a University of Toronto economist who has written extensively on AI, thinks that so long as new knowledge has value, it will find a way to be created. He says when AI insights are incremental, humans will pivot to more truly novel research.

Maybe. But instead of pivoting, what if humans lose interest in learning altogether? Reliance on AI can cause critical thinking to atrophy, just as reliance on GPS weakens spatial memory. A study by Nataliya Kosmyna at Massachusetts Institute of Technology and seven co-authors asked three groups of subjects to write essays, one using an LLM, one using internet search, and one just their brains. Scans later showed the LLM group had the least engagement across brain regions such as for memory recall and executive functioning; the brain-only group had the most. (…)