U.S. Added Just 266,000 Jobs in April

U.S. employers added a modest 266,000 jobs in April, a report Friday by the Labor Department showed, far short of the one million that economists had forecast and the weakest monthly gain since January. The deceleration came after payrolls rose a downwardly revised 770,000 in March and left total employment down by 8.2 million from its pre-pandemic level.

The unemployment rate ticked up to 6.1% in April from 6% a month earlier, partially reflecting an increase in people entering the workforce. (…)

Some businesses are cautious about ramping up hiring, given that the pandemic and related uncertainty continues. Others are reporting they can’t find enough workers due to expanded unemployment benefits, workers’ fear of contracting Covid-19 and child-care burdens due to school closures, economists say. (…)

Payrolls grew solidly last month in many sectors that were hard-hit by the onset of the pandemic, and they declined in many that previously benefited. Transportation and warehousing employers cut jobs. Temporary-help employment fell by 111,000. Manufacturing employment was down 18,000—predominantly in motor vehicles, where semiconductor-chip shortages idled some factories. [Car and car-part manufacturers lost 27,000 jobs.] Retail jobs fell by 15,000, despite robust consumer spending this spring. (…)

The leisure and hospitality sector, including restaurants, accounted for the bulk of employment creation in April, adding 331,000 jobs. (…)

[But] Food and beverage stores—the supermarkets and such that saw sales jump as Americans cooked more at home—shed 49,000 jobs last month. Courier and messenger services, which have been busy delivering packages throughout the crisis, cut 77,000 jobs. Temporary-help services, to which many employers probably turned in lieu of making permanent hires as they saw demand go up as a result of the pandemic, cut 111,000 workers. (…)

Wages for workers rose in April as some employers appeared to lift pay to attract or retain employees. Average hourly earnings for private-sector employees rose by 21 cents to $30.17 in April. The gain is notable because strong hiring in the lower-wage hospitality sector—which occurred in April—would typically put downward pressure on average earnings. (…)

The average workweek increased to 35 hours in April, an indication some employers added worker hours to compensate for the lack of labor. (…)

Under federal relief plans, those receiving jobless benefits get an additional $300 a week on top of regular state benefits, nearly doubling the average of $318 a week, according to the Labor Department. That means the average unemployment recipient earns better than the equivalent of working full time at $15 an hour. Those enhanced benefits are available until September, for a maximum of nearly 18 months—about three times as long as most states typically allow. (…)

Consensus was nearly 1M new jobs, Goldman was at 1.3M. How could they all be so wrong?

- Pandemic unemployment stats for April trended much like March…

- …but regular unemployment claims (blue line above and bars below) flattened in April. Actually, last week’s number was revised higher by 37K to the highest level of claims in three weeks.

- Yet, various surveys suggested suggested continued strong job gains in April:

- The ADP National Employment Report indicated that April nonfarm private sector payrolls increased 742,000 (10.4% y/y). The rise followed a 565,000 March gain, revised from 517,000 and a 180,000 February increase, revised from 176,000.

- Markit’s Manufacturing PMI: “employment increased strongly and at the second-fastest pace since December 2017”.

- Markit’s Composite PMI: “Companies indicated a sharp upturn in employment during April, amid a marked accumulation in backlogs of work. Pressure on capacity led to the second-strongest rise in workforce numbers on record.”

- The Paychex | IHS Markit Small Business Jobs Index, compiled from aggregated payroll data of approximately 350,000 clients, “increased 4.33 percent from March to 98.34 in April, and returned to its pre-pandemic peak, seen in February 2020. The country has been waiting for a significant increase in job growth since this time last year—and April delivered.”

- The J.P. Morgan employment tracker is ahead of the BLS data:

It may be that the BLS seasonal adjustments have not adjusted to the rather unseasonal distortions of the pandemic. Indeed, non-seasonally adjusted payrolls rose 1.1M in April after +1.2M gains in February and March. From Feb. 2020, the number of people employed was down 10.0M last January, 8.8M in February, 7.7M in March and 6.6M in April when total employment was 4.3% lower than in February 2020. That number is -2.2% for goods-producing employees and -4.7% for service-providers. The same number for the leisure and hospitality sector is -14.1% or -2.3M employees, one third of the missing total.

Covid-19 stimulus payments boosted the purchase of goods. Reopening the economy will boost services. Based on May 3rd data from Chase consumer card spending tracker, spending in restaurants was 11.9% below its pre-pandemic trend, airlines -45.5% and other travel and entertainment -28.2%.

But it is what it is, until the next revision. February was revised up by 68,000, from +468,000 to +536,000, and the change for March was revised down by 146,000, from +916,000 to +770,000.

U-6 unemployment, a good measure of labor slack, declined from 11.1% in February to 10.7% in March and to 10.4% in April. At that rate, labor slack will be back to its 7.0% pre-pandemic level, when the unemployment rate was 3.5%, in 10 months, Feb. 2022. If the objective is 4% unemployment, U-6 would need to be around 8%, which could be reached before Christmas.

Importantly, there is no slowdown in the payrolls index (employment x hours x wages) which now exceeds its February 2020 level by 1.8% even though employment is still down 5.4%.

Statistical quirks due to the pandemic surely distort average wage data but average weekly wages are booming unrelentlessly. The 1.0% MoM gain in April is particularly remarkable given the mix of new jobs which favored lower wages.

A recent Bank of America’s survey reveals that corporate America is concerned about rising cost, materials and labor:

VariantPerception says that “the rising Quit Rate suggests workers are confident enough of finding a new role if they quit, and this often leads to rising wages.” The Atlanta Fed wage tracker shows that job switchers are enjoying wage gains of 4.0%, but this is down from 4.7% pre-pandemic. There could be some compositional quirks there too. VP continues:

VP continues:

(…) companies are having to raise wages to attract better quality labour, especially in lower-skilled jobs.

Chart Source: Bloomberg, Macrobond Variant Perception

This is reflected in the median wage for low-skilled occupations rising the fastest. (…)

The Chase consumer card spending tracker keeps trending up (through May 3) with even Travel and Entertainment almost reaching back the 100 level:

Based on its credit card data, Chase estimates that Control retail sales rose 1.3% MoM in April coming after the huge +6.9% actual growth in March which Chase had estimated at +7.0%. There is no let up in the “Spend up” thesis so far.

More signs of dis-saving.

Consumers are confident enough to take on more debt. Consumer credit outstanding strengthened $25.8 billion during March after rising $26.1 billion in February, revised from $27.6 billion. The gain came after credit edged $1.6 billion higher in January, revised from a $0.1 billion. Earlier figures were revised. A $20.0 billion March rise had been expected in the Action Economics Forecast Survey. The ratio of consumer credit outstanding-to-disposable personal income fell to 19.4% compared to 23.9% during all of last year and 25.7% during 2019.

Canada’s job report also underwhelmed but for more obvious reasons:

The economy lost a net 207,100 jobs last month, undoing some of the 303,100 gain in March, Statistics Canada said Friday. The unemployment rate rose to 8.1 per cent from 7.5 per cent. All told, Canada has recovered about 83 per cent of its pandemic job losses.

A reversal in Canada was widely expected for April, given rising infection rates that month and the response to contain them. Employment fell by 152,700 in Ontario, where a stay-at-home order and other measures went into effect April 8. British Columbia, which implemented “circuit breaker” restrictions at the end of March, lost 43,100 positions. (…)

Chinese Consumers Are Opening Their Wallets Again The world’s second-largest economy is rebalancing as consumer spending—the weak link so far in its post-coronavirus recovery—picks up steam, a burst of data suggests.

(…) Now, with the last coronavirus resurgence having been brought under control for several months, Chinese citizens—still confined within their own borders—are beginning to open up their wallets again.

In April, the Caixin China services purchasing managers index, a private gauge of services activity, rose to 56.3, up from 54.3 in March and hitting the highest level since December, Caixin Media Co. and research firm IHS Markit said Friday.

Strong overseas demand for some Chinese services—such as consulting and other knowledge-intensive work—played a big role in boosting activity in the sector, prompting companies to add to their staffing levels for a second straight month, Caixin said.

But traditional consumer spending is also picking up.

During the five-day Labor Day holiday that began on May 1, official data showed Chinese travelers made a total of 230 million trips, topping the 195 million trips recorded during the same holiday in 2019 and marking the first time that traveler numbers have surpassed their pre-virus levels for any public holiday normally associated with heavy traffic.

China’s box office also broke new records for revenue and visitor numbers during the five-day holiday. Movie ticket sales rose to 1.67 billion yuan, the equivalent of $258 million—a 9.4% increase from the same holiday period in 2019. Movie theaters were shut down during last year’s Labor Day holiday.

“The robust holiday activities suggest consumption, especially consumer services, is emerging as a new growth driver,” Citigroup economists told clients in a note Wednesday.

Despite the rebound in the number of trips, tourists collectively spent 23% less money this year than during the same holiday in 2019, official data showed. Citigroup economists attributed the cautious consumption to a discounting of travel products and a shift toward shorter-distance tourism.

For the first quarter of the year, all of China’s 31 provinces reported double-digit percentage growth in gross domestic product when compared with the year earlier, state media reported Friday. Hubei province, the original epicenter of the coronavirus, saw its first-quarter GDP skyrocket by 58.3% from the previous year’s exceptionally low base.

Consumers Feel the Pinch as Prices Rise Americans accustomed to years of low inflation are beginning to pay sharply higher prices for goods and services as the economy strains to rev back up and the pandemic wanes.

Price tags on consumer goods from processed meat to dishwashing products have risen by double-digit percentages from a year ago, according to NielsenIQ. Whirlpool Corp. WHR 1.09% freezers and dishwashers and Scotts Miracle-Gro Co. SMG 1.53% lawn and garden products are also getting costlier, the companies say. (…)

Costs are rising at every step in the production of many goods. Prices for oil, crops and other commodities have shot up this year. Trucking companies are paying scarce drivers more to take those materials to factories and construction sites. As a result, companies are charging more for foods and consumer products including foil wraps and disposable cups.

Kellogg Co. , maker of Frosted Flakes, Cheez-Its and Pringles, said Thursday that higher costs for ingredients, labor and shipping are pushing it and other food makers to raise prices. “We haven’t seen this type of inflation in many, many years,” Chief Executive Officer Steve Cahillane said. (…)

Costs for apples are up 10% to 20% depending on the variety, said Mike Ferguson, vice president of produce and floral at Topco Associates LLC, an Elk Grove Village, Ill.-based cooperative of more than 40 food companies including grocer Wegmans Food Markets Inc. Bananas and leafy greens are more expensive too, Topco said, while vegetable oils and oil-heavy products like salad dressing and mayonnaise are also getting pricier in part because of higher ingredient prices.

(…) Kimberly-Clark Corp. said it would increase prices by mid-to-high single digits on Scott bathroom tissues, Depend adult diapers and Huggies baby-care products. (…)

Kevin Hourican, CEO of food-distributor Sysco Corp., said that even at higher prices the pent-up demand for restaurants is enormous. “People feel bad for their local restaurants. They want to support them,” he said. (…)

(…) As producers attempt to navigate supply-chain pitfalls for the commodities necessary to produce their wares, wage growth is beginning to percolate. A recent Labor Department report showed the largest quarterly increase in worker pay at companies since 2003.

This combination of higher labor and materials costs will probably lead to a bigger pickup in consumer inflation at a time when monetary and fiscal policies are conducive to faster economic growth. (…)

Wait times of factories for production materials grew to 79 days in April, the longest in records dating back to 1987, according to the latest Institute for Supply Management data. The average delivery time of supplies for maintenance, repair and operations was also the longest in ISM data. (…)

The ISM’s monthly reports also provide a clear indication of a growing number of commodities in short supply. In November, purchasing managers listed just 8 materials companies were struggling to get their hands on. Five months later and it’s expanded to 24. (…)

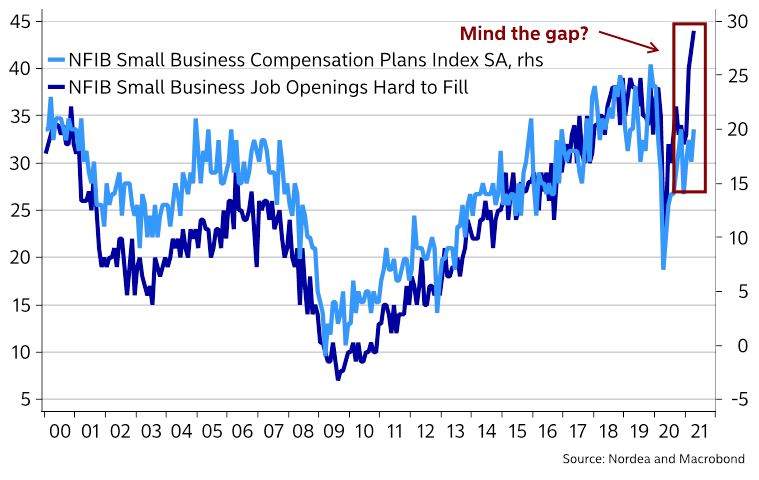

Jobs openings are plentiful and hard to fill – time to pay more?

BTW, directly from the horses’ mouths, thanks to The Transcript:

- “(…) 73% of Americans are planning a trip and the highest in history was 37. So it’s going to — America is going to party the summer like 19 — like it’s 1929.” – Starwood Property Trust (STWD) CEO Barry Sternlicht

- “…we are on pace to see record leisure demand in the U.S. over the summer months with April bookings for the summer exceeding 2019 peak levels by nearly 10%.” – Hilton (HLT) CEO Christopher Nasseta

- “…business travel volumes already 75% of what they were in ’19 in those markets. So I think it is — even though not fully through it, not fully open anywhere, I think it is really good evidence that as people get back to work, as kids in the fall go back to school, which at this point, I think, is very highly likely, you’re going to see a step change into the third and fourth quarter in business transient.” – Hilton (HLT) CEO Christopher Nasseta

- “I would say and many have reported already, but the summer looks strong, particularly in the U.S. and in other markets where vaccinations are well along the way. We are already seeing booking trends well above 2019 levels for leisure destinations, beach, mountains, et cetera. And that goes for not only vacation rentals, but also for conventional lodging.” – Expedia (EXPE) CEO Peter Kern

- “The fundamental drivers of our operating businesses improved during the first quarter. Based on data reported by the FAA, flight activity nationwide was up 8% in the first quarter versus the first quarter in 2020 and just 3% below the level recorded in 2019. Activity levels for the month of March exceeded those in March of 2019 by 7%.” – Macquarie Infrastructure (MIC) CEO Christopher Frost

- “…the booking window is very, very compressed. But again, speaking to the pent-up demand, it’s filling up quickly. (…) For the first half of 2022, our load factor is meaningfully ahead of 2019 with pricing higher when excluding the dilutive impact of future cruise credits” – Norwegian Cruise Line (NCLH) CEO Frank Del Rio ” –

- (…) fans are buying tickets and events are selling out faster than ever. In the US, Bonnaroo, Electric Daisy and Rolling Loud festivals all sold out in record times at full capacity.” – Live Nation (LYV) CEO Michael Rapino

- In fact, we have booked twice as many shows in ’21 as we did in ’19.” – Liberty Media Corporation (LSXMK) CEO Greg Maffei

- I think we’re now looking at it [inflation] being in the high end of the mid-single-digit rate for 2021.” – Kellogg (K) CEO Steven Cahillane

- “Our research team recently published a survey based mover report…the report indicates that the pandemic has indeed caused people to rethink where they live, and concludes that approximately 8 million existing homeowner households that have been on the sidelines may enter a real estate market already be set by unrelenting demand. Additionally, 8.9% of consumers plan to purchase a home in the next six months near a 20 year high per the conference board’s April consumer confidence survey.” – Zillow (Z) CEO Rich Barton

So, we have this environment:

- the payrolls index (employment x hours x wages) now exceeds its February 2020 level by 1.8% even though employment is still down 5.4%;

- employment is quickly closing the gap with its pre-pandemic level;

- wages/compensation (QoQ % change), already gathering pace before the pandemic, are accelerating again:

- It seems that the pandemic boosted productivity to offset sharply higher compensation per hour (averaging 6.4% in the last 5 quarters vs 3.4% during the previous 5 quarters);

- how much longer can the average work week get?

- U.S. personal savings are 3.7x higher than normal, around $2T of excess savings;

- the Biden administration proposes to keep boosting the economy for several more years;

- the Fed is obliging, keeping all interest rates well below normal when the economy’s output gap is closing rapidly and fiscal boost coming;

- the rest of the world is in a relatively similar excess savings position with dovish central banks and increasingly liberal fiscal policies;

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output” said Milton Friedman:

US money supply growth vs. US inflation

Source: BofA Global Research

Question: “transitory” to what?

This week, we get inflation and retail sales data and they are likely to keep the debate very hot.

TECHNICALS WATCH

Large caps roared ahead last week even without support from the NDX and smaller cap stocks. Overall, buying measures remain on the weak side but so are selling measures. Looks like equity markets are also in a transitory mode, but transitory to what?