U.S. February Consumer Prices Rose 7.9% From Year Earlier Rising energy, food and services prices pushed U.S. inflation to a 7.9% annual rate last month with oil and commodity market disruptions from the Ukraine crisis expected to add more cost pressures.

(…) Excluding volatile energy and food prices, the Labor Department reported Thursday that consumer inflation rose at a 6.4% annual rate in February, up from 6% the prior month. (…)

Some economists believe that inflation is still likely to peak soon, perhaps as early as this month. But the war in Ukraine increases the chance that the peak will be higher, and the descent to lower levels will take longer, they say. (…)

The BLS table shows how inflation was rising just about everywhere, before Ukraine. The cost of food has been skyrocketing since September (+12.8% a.r.), core Goods are up 11.0% a.r. since October while core Services keep accelerating with shelter costs:

My CPI-Essentials series is now up 7.5% YoY, highest since 1982

The MoM trend is not offering much hope for immediate relief. February was up 1.0% and the last 3 months are +8.2% annualized.

The “All Items Less Food, Shelter and Energy” rose 0.5% MoM in February and is up 7.8% a.r. in the last 3 months. Even taking cars and trucks out, it is up 0.6% MoM in February and 7.0% a.r in the last 3 months. Core Goods less cars and trucks are up 0.6% MoM in February and 9.5% a.r. in the last 3 months.

CPI ESSENTIALS VS WAGES

(…) Having inflation at 7.9% on a year-ago basis, compared with the 2.1% average growth in 2018 and 2019, is costing the average household $296.45 per month, up from $276 in January. (…)

It is going to get worse before it gets better. U.S. gasoline prices are set to rise further because of past gains in global oil prices. Our rule of thumb is that every $10 per barrel increase in the West Texas Intermediate crude oil price will lift U.S. retail gasoline prices by 30 cents per gallon. Therefore, the Russia military conflict with the Ukraine has boosted retail gasoline prices by $1 per gallon.

Wholesale gasoline prices suggest that average U.S. gasoline prices are going to eclipsed $4.50 per gallon soon. The U.S. average gasoline price is currently $4.25 per gallon, compared with $3.50 per gallon this time last month and $2.80 per gallon this time last year.

The cost to consumers is high. Every 10-cent increase in the price of gasoline costs consumers a combined $11 billion or more over the course of a year. Also, higher gasoline prices will weigh on consumer sentiment and will boost inflation expectations. (…)

All before Ukraine…

RECESSION WATCH

(…) Economists at Goldman Sachs have now cut their forecast for growth for the world’s largest economy in 2022 to 1.75%, from 2% previously and the consensus of 2.75%.

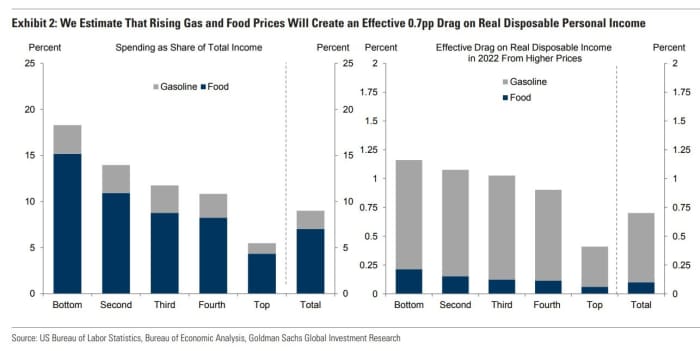

“Combining our commodity strategists’ forecasts with estimates of pass-through to consumer prices, we estimate that rising gas and food prices will create an effective 0.7 percent point drag on real disposable personal income in 2022 with larger drags for lower-income households whose spending is typically more sensitive to fluctuations in income,” said the note written by Joseph Briggs. “Although households will likely partially offset this income drag by reducing savings, this hit to income should weigh on spending in 2022.” (…)

“Even after these downgrades, we still see risks around our growth forecast as skewed to the downside, particularly if sanctions escalate or if oil prices rise even further, for example, to the $175/barrel price target our commodity strategists see as possible if supply losses reach four million barrels a day. Additionally, we have not assumed any growth hit due to metal shortages since—aside from palladium—only a small share of U.S. commodity demand is met by Russian exports,” said Briggs.

Recession risks, they said, are mounting. While they expect further service-sector reopening and spending from excess savings to keep the U.S. economy growing, they said the chances of a recession next year are between 20% and 35%, or roughly as implied by the slope of the U.S. Treasury yield curve.

Goldman’s GDP growth forecast is half the Fed’s! If the FOMC decides to err closer to GS’ view, they may well surprise us next week and go slow given what’s going on.

The Chase consumer card spending tracker is not showing signs of weakening just yet. This is through March 5.

Iran Nuclear Talks Break Off Without a Deal The negotiations broke off following Russian demands for guarantees from Washington that would prevent Western sanctions on Moscow over Ukraine stopping Russia doing business with Iran.

BlackRock hit by $17bn in losses on Russian exposure

Chinese Stocks Plunge After SEC Stokes Delisting Concerns A further step by the Securities and Exchange Commission toward forcing companies from China off American exchanges helped trigger the worst decline in U.S.-listed Chinese stocks since the global financial crisis, and sparked a second selloff in Hong Kong.

(…) On Thursday, the SEC provisionally named five companies, including the biotechnology group BeiGene Ltd. BGNE -5.87% and Yum China Holdings Inc., YUMC -10.94% the operator of KFC in China, as firms whose audit working papers couldn’t be inspected by U.S. regulators.

A 2020 law, the Holding Foreign Companies Accountable Act, would ban trading in securities of companies whose audit papers can’t be checked for three years in a row. Strategists at Morgan Stanley said they expected the SEC to add more names to the provisional list in the coming weeks, as those companies released their annual reports. (…)

The market value of the MSCI China Index has fallen by some $1.45 trillion from a peak in February of last year, when it was worth some $3.6 trillion, Refinitiv data shows. (…)