![]() Note: I am travelling in Asia until April 24. Limited equipment and different time zones will limit the frequency and depth of my postings.

Note: I am travelling in Asia until April 24. Limited equipment and different time zones will limit the frequency and depth of my postings.

PPI Not As Hot As CPI

Today’s PPI report threw some cold water on yesterday’s hotter-than-expected CPI. Our opinion is that the Fed won’t be lowering interest rates this year because the economy and labor market will remain strong. Yesterday’s CPI confirmed our conclusion based on the wrong premise. We aren’t expecting inflation to get stuck above the Fed’s 2.0% target. We think it will continue to moderate closer to that goal by the end of this year. So we don’t expect that the Fed will have to start thinking about thinking about raising interest rates again. Consider the following:

(1) PPI final demand. For the past year through March, the PPI final demand inflation rate has been hovering around 1.0% y/y with goods up only 0.8% and services up 2.8%.

(2) PPI final demand consumer goods & services. The headline PPI for consumer goods and services was up 2.6% in March. The headline PCED inflation rate was 2.5% in February. Both are well below the March headline CPI inflation rate of 3.5%. (The PPI does not include rent.)

(3) Financial services. A big contributor to the March PPI was a 3.1% increase in the PPI for securities brokerage, dealing, investment advice, and related services. It is up 45.7% over the past 24 months! Is that price inflation or a reflection of significant asset appreciation?

(4) China’s deflation. Meanwhile, China continues to export deflation. The country’s PPI fell 2.8% y/y during March. It has been falling since October 2022. The price index for US goods imported from China has been falling since January 2023, and was down 3.1% y/y in February . These developments should continue to put downward pressure on the US PPI for finished goods.

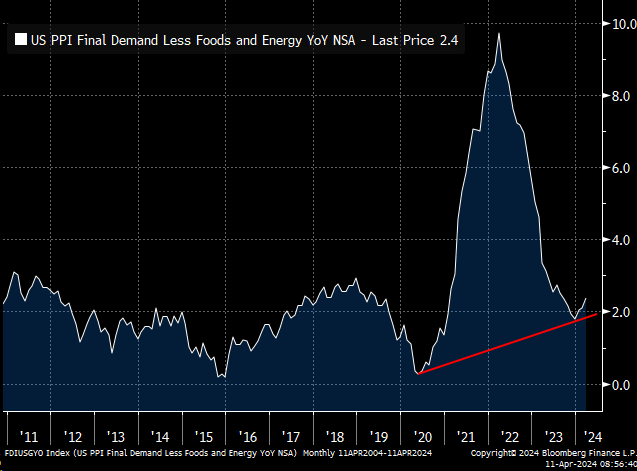

Richard Bernstein, looking at core PPI, is not so convinced: “Today’s PPI report seems to be the latest counter-argument to the hard-to-kill consensus that #inflation is under control.”

Goldman Sachs has the 6-m trend chart. Core services are still above 4.0%. Energy prices have turned upwards since.

KKR’s view:

The latest data confirm our view that markets have been too complacent in expecting the Fed to cut rates quickly. See below for details, but ‘left tail’ risks of low growth and low inflation in the second half of 2024 look increasingly remote, which leaves little incentive for cuts. Against this backdrop, our Regime Change thesis is unfolding even more powerfully than we thought. As such, we are having to make few changes to our forecasts.

Amid this firmer nominal growth backdrop, we think the Fed will be less focused on downside risks to GDP and inflation and inclined to hold rates at current levels through year-end.

Importantly, we do not think economy is overheating, which continues to give us confidence that Fed rates have peaked. Labor indicators are still softening at the margin, the global context is weak (most other OECD economies are in, or flirting with, mild recession), and leading inflation indicators are better.

We now think the Fed will hold rates at current levels through year end. At the end of last year, 3-month moving average Core CPI was 3.4% annualized and payroll growth was just +165k. Today, those numbers are 4.5% and 276k. What this means is that the risks for the Fed have fundamentally shifted, and we think policymakers will no longer see a need to hurry to ease financial conditions. We raise our 2024 forecast to 5.375% (no cuts), from 4.875% previously (two cuts) and our 2025 forecast to 4.375% (four cuts) from 4.125% previously.

We continue to think duration is attractive with 10-year yields in the 4.5-4.75% range. We are not changing our long-term rates or inflation forecasts and maintain our year-end 2024 10-year U.S. Treasury forecast of 4.25%. In terms of market technicals, net issuance, foreign demand (driven by lower hedging costs and domestic yields), and investor positioning all suggest 10-year U.S. Treasury yields cannot sustain just above 4.75%.