Why All the Inflation Worries?

J. Bradford DeLong is Professor of Economics at the University of California, Berkeley and a research associate at the National Bureau of Economic Research.

(…) The US is not currently in a situation where too much money is chasing too few goods, which would result in a surfeit of demand for labor and likely trigger an inflationary spiral. This is despite the fact that the ongoing COVID-19 pandemic and its associated disruptions continue to cause a substantial undersupply of labor.

Today, the US economy’s overall employment-to-population ratio is three percentage points below what we used to regard as its full-employment level. (…)

The inflation worriers then argue that the COVID-19 crisis has permanently damaged the supply side of the economy by causing a lot of early retirements, as well as lasting disruption to the lean-and-mean supply chains on which a good deal of productivity and prosperity had depended. Perhaps. (…)

But so far, rising inflation has not been incorporated into any of the “sticky” prices in the economy, according to the measure constructed by the Atlanta Federal Reserve. True, the financial market’s current 30-year breakeven inflation rate, at 2.35%, is more than half a percentage point above where it settled in the second half of the 2010s. But today’s rate is similar to that in the first half of the decade, and slightly below the level that would be consistent with the US Federal Reserve’s inflation target of 2% per year. (…)

There is no sign that inflation expectations have become de-anchored. The labor market is still weak enough that workers are unable to demand substantial increases in real wages. Financial markets are blasé about the possibility of rising inflation. And a substantial fiscal contraction is already in train. (…)

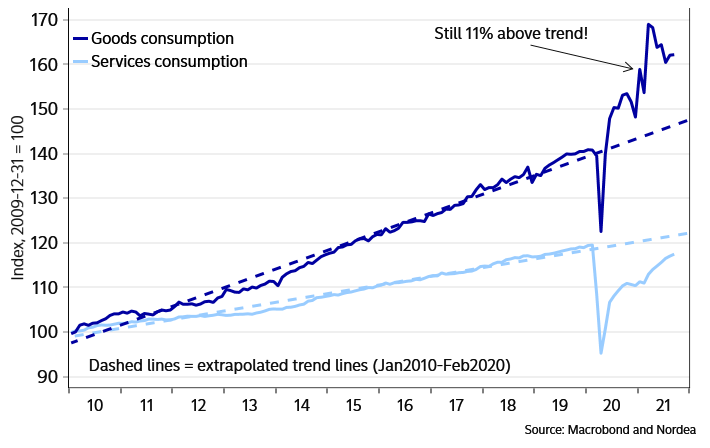

- On DeLong’s first point: there is excess demand on scarce goods.

Composition of demand still inflationary

- On his second point: the labor force has declined and is showing no signs of recovering just yet. Demand is clearly stronger than supply.

- On his third point: stickiness is not so sticky…

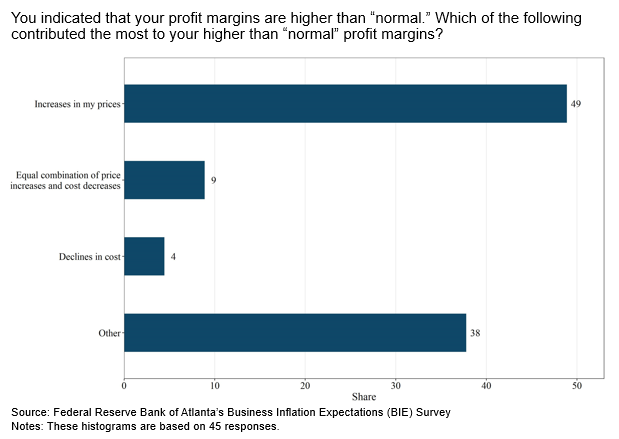

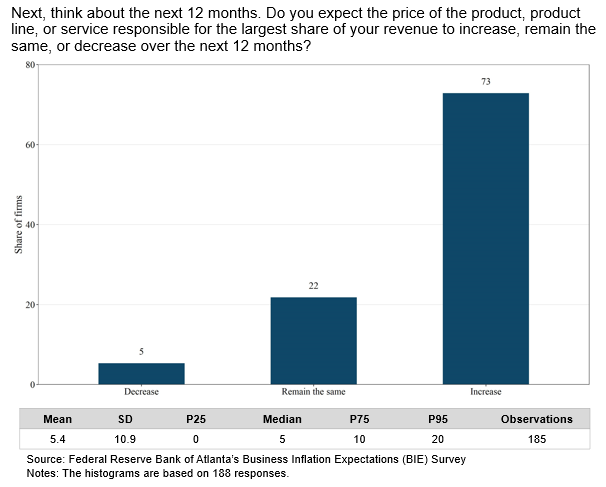

- On his fourth point: consumers are clearly feeling inflation. Confident biz people are clearly feeding inflation.

Companies Order Record Number of Robots Amid Labor Shortage North American firms ordered nearly 29,000 robotics units in first nine months of 2021.

Total robotics sales for the first nine months of the year were $1.48 billion, topping a previous record of $1.47 billion set over the same period in 2017, according to the Association for Advancing Automation, or A3. Sales rose from $1.09 billion in the first nine months of last year.

A3’s data look at industrial robots, which often are used for assembling parts or transporting heavy materials in production settings, according to the association.

“With labor shortages throughout manufacturing, logistics and virtually every industry, companies of all sizes are increasingly turning to robotics and automation to stay productive and competitive,” A3 President Jeff Burnstein said. (…)

Growth in nonautomotive orders rose faster than in automotive-related orders, according to the association.

Companies ordered 9,928 robots in the third quarter, and 6,302 of those were from nonautomotive industries, A3 said. The growth in nonautomotive orders was driven by the metals industry, which saw year-over-year growth nearly triple. Behind metals was the food and consumer goods industry, with growth of 40%; and semiconductors, electronics and photonics, with growth of 26%. (…)

The Nov. 8 Daily Edge talked about robots and their relatively slow installations in the U.S.:

High Energy Prices Likely to Mean Less Oil Demand, OPEC Says Soaring fuel costs amid a global energy crunch were showing signs of weighing on demand, said the Organization of the Petroleum Exporting Countries, and weaker than expected demand for oil in China and India was now likely.

In a closely watched monthly market report, OPEC said global demand for oil would grow by 5.7 million barrels a day this year, 160,000 barrels a day less than it expected last month. The revision means the oil-producers group now expects demand for oil in 2021 to total 96.4 million barrels a day. (…)

In Europe, low stockpiles of natural gas and limited supplies ahead of the winter months have sent the continent’s natural gas prices surging to record levels. That has led some industries facing high energy bills to cut back on output.

High coal and gas prices have led to power cuts in China, while Beijing has encouraged factories to reduce output to ease the strain on its power grid. (…)

The organization left its forecast for demand growth next year steady at 4.2 million barrels a day. Oil demand is expected to amount to 100.6 million barrels a day next year, half a million more than in 2019. (…)

OPEC said Thursday supply from oil producers that aren’t part of its cartel should grow by 700,000 barrels a day this year, and by 3 million barrels a day next year. (…)

From Oil & Energy Insider:

International oil majors have suggested US shale output might see tangible increases over 2022 as many are seeking to utilize their windfall profits by investing in shale. With producers less likely to hedge their annual production next year, the anticipated ramp-up in US crude production might materialize relatively soon. This, along with the Biden Administration’s alleged readiness to tap into crude SPRs to tame runaway gasoline prices has helped to more than offset OPEC+’s decision to maintain supply discipline.

Apple supplier Foxconn cautious on 2022 revenue outlook Apple supplier Foxconn (2317.TW) forecast on Friday that a global chip shortage would run into the second half of 2022 and its fourth-quarter revenue for electronics, including smartphones, would fall more than 15%.

(…) As well as forecasting the slide in revenue in its consumer electronics business, which includes smartphones, Foxconn said it expected overall fourth-quarter revenue to fall between 3% and 15% in the period. Analysts predicted an 11% drop, according to a Refinitiv consensus estimate.

Still, Foxconn said it expected supply shortages in Southeast Asia to ease this month and the next.

The outlook came after a strong third quarter, in which revenue rose 9% on the year, helped by strong smartphone demand that remained stable despite the supply problems. (…)

Apple said last month that supply chain woes cost it $6 billion in sales in the July-September quarter, and that this would worsen during the year-end holiday period. read more (…)

La Niña Is Coming to Shape Winter. What to Know. Weather phenomenon threatens to prolong West’s drought and keep northern areas colder than usual

NOAA predicts that water and air temperatures over the Pacific Ocean—closely watched metrics ahead of winter in the U.S.—have created La Niña conditions with a 90% chance of continuing through the winter and a 50% chance during the spring. (…)

The changes in wind movement and water temperature in the Pacific Ocean region that cause a La Niña have a pronounced effect on weather in the U.S. and around the world. (…)

A La Niña winter, in which the high-pressure system over the northern Pacific pushes the jet stream north, allows warm, dry air to the south to move north and create unusually warm conditions in the West, potentially prolonging the Southwest’s drought. Meanwhile, the Pacific Northwest can expect more precipitation and the northern U.S. could be colder than normal.

While La Niña’s impact is most pronounced in winter in North America, it can affect winds and air circulation around the globe. That can bring wetter-than-normal conditions to Australia, Indonesia, Colombia and Brazil, for example, but drier conditions to other countries.