ADVANCE MONTHLY SALES FOR RETAIL AND FOOD SERVICES, AUGUST 2019

Advance estimates of U.S. retail and food services sales for August 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $526.1 billion, an increase of 0.4 percent (±0.5 percent)* from the previous month, and 4.1 percent (±0.7 percent) above August 2018.

Total sales for the June 2019 through August 2019 period were up 3.7 percent (±0.5 percent) from the same period a year ago. The June 2019 to July 2019 percent change was revised from up 0.7 percent (±0.5 percent) to up 0.8 percent (±0.1 percent).

Retail trade sales were up 0.6 percent (±0.5 percent) from June 2019, and 4.6 percent (±0.7 percent) above last year. (…)

Weak Energy Prices Held Down Overall Inflation In August Firm underlying inflation leaves Fed on track for rate cut next week

From a year earlier, the CPI increased 1.7% in August and core prices climbed 2.4%, the fastest annual pace since July 2018 when core prices also rose 2.4%.

Prices for an array of goods and services rose last month. Rent and medical prices were among the drivers behind stronger inflation in August.

The inflation figures leave the Federal Reserve on track to cut interest rates next week by a quarter-percentage point. (…)

On track to cut? Hmmm…Let’s see what the Fed’s preferred gauge of inflation does when it’s released in 2 weeks. In the meantime, core CPI says “mission accomplished” on the 2.0% target. Reminder: annualized core PCE inflation was 2.5% in the last 2 months, 2.2% in the last 3 and 3.0% in the last 4 months.

Here’s the Cleveland Fed table: both median and 16% trimmed-mean inflation are comfortably above 2.0%. Excluding energy, inflation is ramping up widely.

The Atlanta Fed’s sticky-price consumer price index (CPI)—a weighted basket of items that change price relatively slowly—rose 3.5 percent (on an annualized basis) in August, following a 3.4 percent increase in July. On a year-over-year basis, the series is up 2.7 percent.

On a core basis (excluding food and energy), the sticky-price index rose 3.6 percent (annualized) in August, and its 12-month percent change was 2.6 percent.

The flexible cut of the CPI—a weighted basket of items that change price relatively frequently—decreased -6.5 percent (annualized) in August, and is down -0.4 percent on a year-over-year basis.

The Atlanta Fed wage growth tracker shows wages well around the 4.0% mark and rising.

And initial unemployment claims remain quiet at the low end of their historical low levels.

These are conditions to …ease?

The ECB yesterday:

The Governing Council now expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2%.

Core inflation in the eurozone is stuck below 1.0% while Germany, Italy and the UK are in or close to recessions.

Who Can Go Lower? Japan Considers Deeper Negative Rates After ECB Cut The Bank of Japan is growing more open to cutting short-term interest rates deeper into negative territory, responding to global risks that are forcing other central banks to cut. The European Central Bank cut its rate target to minus 0.5% Thursday and reintroduced an asset-purchase program.

If the bank were to do so, however, it would look for ways to avoid sharp declines at the longer end of the yield curve, the people said. The goal is to keep an upward slope from low short-term rates to higher long-term rates, which makes it easier for life insurers and pension funds to make investment returns.

Amid concerns about a global slowdown and trade tensions, the European Central Bank on Thursday cut its rate target to minus 0.5% and reintroduced a program to buy eurozone debt. The Federal Reserve at its meeting Sept. 18 is poised to cut its key policy rate, currently set at a range between 2% and 2.25%. Investors widely expect a cut of a quarter-percentage point, but President Trump in a recent tweet called for cutting rates to zero or lower. (…)

The Bank of Japan’s policy board is leaning toward keeping policy steady at its own meeting next Wednesday and Thursday because the domestic economy looks relatively solid and the markets are stable, said the people familiar with the bank’s thinking.

The central bank also wants to see the impact of a sales tax increase, which will be introduced Oct. 1, and the results of its quarterly corporate sentiment survey, released the same day. The policy board meets again in late October. (…)

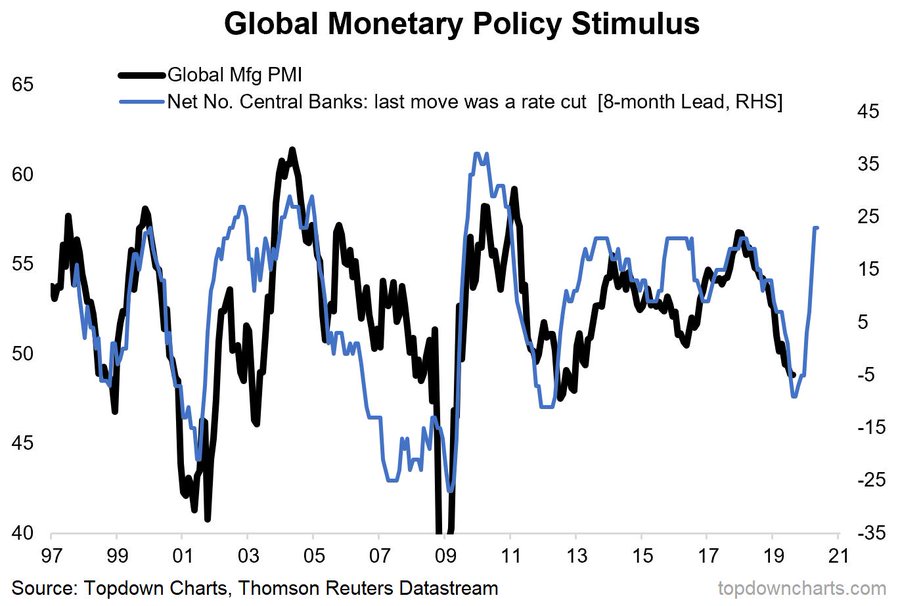

World central banks are totally aligned fighting the manufacturing slump caused by the trade war:

Speaking of the trade war, soybean stems are the modern olive branches:

China to Exclude U.S. Soybeans and Pork From Additional Tariffs The move by Beijing follows President Trump’s two-week postponement of higher tariffs on some Chinese goods.

The official Xinhua News Agency said Friday that China would buy “a certain amount” of agricultural products from the U.S., and that the government would exempt such purchases from punitive tariffs. The Commerce Ministry and China’s economic development agency decided on the measures, the report said. (…)

-

China Seeks to Narrow U.S. Talks to Break Deadlock Beijing wants to narrow the scope of its negotiations with the U.S. to only trade matters, putting thornier national-security issues on a separate track.

As Trump says: “We’ll see what happens”.

![]() But Trump also said, smelling the ballot boxes:

But Trump also said, smelling the ballot boxes:

“It’s something we would consider, I guess,” Trump told reporters at the White House on Thursday, referring to an interim agreement.

Trump administration officials have discussed offering a limited trade agreement to China that would delay and even roll back some U.S. tariffs for the first time in exchange for Chinese commitments on intellectual property and agricultural purchases, according to five people familiar with the matter.

Here’s one scenario: a truce is declared, tariffs are lifted, trade resumes, no hard Brexit, manufacturing revives, capex rise. What then happens to already rising inflation, tight labor markets and already accelerating wages? Fed up?

We’ll see what happens.

47,000 grocery workers in California avert a strike with new contracts

After six months of talks, the deal avoids what would have been the largest private-sector strike since 74,000 General Motors employees walked off the job in 2007 and the second major work stoppage in the supermarket industry this year. In April, 31,000 Stop & Shop workers at 240 stores in New England walked out of their jobs for 10 days. That campaign drew support from Democratic presidential candidates Elizabeth Warren, Joe Biden and Bernie Sanders.

The union representing California cashiers, stockers and clerks at more than 500 stores declared victory on Thursday. (…)

The new Ralphs and Albertson contracts met a list of union demands. They include wage increases between $1.55 and $1.65 an hour for workers over the course of the three-year contract, the union said. They also include provisions for pension funds, provide additional guaranteed hours for veteran workers and expand health care access to workers’ family members. (…)

U.S. Deficit Tops $1 Trillion for First Time in Seven Years

(…) “It will be a very substantial tax cut,” Trump told congressional Republicans at a retreat in Baltimore. He said the tax cut would be “very, very inspirational” without providing details. (…)

The administration has also put off the idea of a possible cut in payroll taxes, Treasury Secretary Steven Mnuchin told CNBC earlier Thursday. Mnuchin said that Trump was focused instead on a second round of proposed tax cuts. (…)

Last fall, ahead of the midterms where Republicans ultimately lost their majority in the House, Trump suggested he would cut taxes for middle-earners by 10%. (…)

The tax cut announcement came as a surprise to administration officials and Trump’s allies in Congress. That plan was never released. (…)

Mnuchin Says U.S. Looking Closely at Issuing 50-Year Bond The Treasury Department is “very seriously considering” issuing a 50-year bond next year, Treasury Secretary Steven Mnuchin said, as the Trump administration looks to take greater advantage of low interest rates to slow soaring borrowing costs.

Falling Yields Unleash Flood of Muni ‘Century Bonds’ State and local governments, along with universities, are joining companies in a dash to issue debt and lock in low rates, sometimes for up to 100 years.

US junk bond inflows signal investor optimism More money put into high-yield funds this week than in any since February

FYI:

SENTIMENT WATCH

Stocks have ‘sufficient tailwind’ to climb higher — keep buying: Credit Suisse

Going against the wary crowd is our call of the day from Credit Suisse’s global equity strategist Michael Strobaek, who thinks the S&P 500 can climb higher and now’s the time to buy more stocks.

“Recent weeks have seen political risks in Europe diminish and the U.S.A. and China make renewed efforts to resume talks. Accommodative central banks should further underpin investor sentiment,” Strobaek told clients in a note. He’s boosting equity exposure to overweight — meaning they see better value for money in stocks — with an emphasis on the U.S.

Stocks simply have more return to offer than bonds right now, he said. “Moreover, throughout the strong year for equities to date, many investors have proven reluctant to jump on the bandwagon, leaving many with cash to deploy. This as well as still depressed investor sentiment suggest that this rally still has legs,” added Strobaek.

Gundlach sees 75% recession chance, has a warning about the corporate bond market

(…) Gundlach, to a London audience, outlined a number of worrying signs, including declines in purchasing indexes, which peaked at right about the same time the U.S. and global stock markets SPX, +0.29% did.

Gundlach said neither Trump nor China would be willing to agree to a trade deal, with the Chinese side waiting for the possible electoral defeat of the White House incumbent.

He also pointed to a New York Fed model showing a rising likelihood of a U.S. recession but did concede that jobless-claims data have been indicative of a strong labor market, even if jobs growth has slowed.

A bear on the U.S. dollar DXY, -0.31% , Gundlach expects more interest-rate cuts from the Federal Reserve, with the bond market having priced in four. (…)

In corporate bonds, Gundlach does foresee crisis, noting one piece of Morgan Stanley research concluding that a third of investment-grade debt should really be rated high-yield.

He said the corporate bond market has surged in size and is highly leveraged, with weak covenants. “So when you have the recession, there won’t be an ability to address these issues,” he said. (…)

CHANGE TO THE RULE OF 20 STRATEGY

The Rule of 20 Strategy makes no forecast, no scenario and only uses known trailing EPS and inflation.

The Q2’19 earnings season closed on trailing EPS of $164.44, practically unchanged from the end of June ($163.99). This metric will not change much in September.

Yesterday, we got CPI data for August and core CPI is now +2.4% YoY. This metric will also not change this month.

As a result, we know that the Rule of 20 Fair Value is 2894 on the S&P 500 Index (20 – 2.4 * 164.44). This value will not change any more in September.

Because of the rise in core inflation, the Rule of 20 P/E reached 20.73 at yesterday’s close (3014) which triggers a boost in cash from 20%, set on August 6, to 30%.

However, because the Rule of 20 Fair Value is down 3 consecutive months and its moving average is also declining, cash is doubled to 60%.

These charts plot the S&P 500 Index with the Rule of 20 Fair Value moving average for 3 periods since 1957. Equity markets tend to move in sync with earnings amplified by oscillation from under to over valuation. A cheap equity market can withstand a weakening Fair Value like in the late 1970s, in 1985-86, in 1990-91 and 2012-13. An overvalued market can get even more overvalued like in 1961, 1968, 1971, 1987 and 1998 until they succumb to the lack of genuine fuel.

The Rule of 20 Strategy aims at maximizing equity exposure when valuation is attractive and protecting capital when equity valuation becomes excessive. It also seeks to add another layer of protection when the Rule of Fair Value, based on profits and inflation, is in a downtrend which happens in recessions but also during “profit recessions” and/or when inflation rises faster than profits, the condition we are currently in.

The Credit Suisse strategist quoted earlier sees “tailwinds” in political and monetary events or scenarios. The only winds the Rule of 20 Strategy would consider come from trailing profits and inflation.

These provided steady tailwinds from mid-2009 to mid-2015 and since the end of 2016. But investors are now facing headwinds from stalled profits and rising inflation.

Huawei’s Ren Zhengfei ready to sell 5G tech to a Western buyer to help create rival, level playing field

Ren Zhengfei, the billionaire founder and chief executive of Huawei Technologies, said he is ready to share its 5G technology with potential western buyers.

Ren said Huawei is willing to give buyers perpetual access to Huawei’s existing 5G patents, licences, code, technical blueprints and production know-how for a one-time fee, according to a two-hour interview with The Economist on September 10, the contents of which were confirmed by Huawei.

The acquirer would be allowed to modify the source code, meaning that neither Huawei nor the Chinese government would even have hypothetical control of any telecoms infrastructure built using equipment produced by the new company. Huawei would likewise be free to develop its technology in whatever direction it pleases. (…)

According to the interview, Ren’s stated aim is to create a rival that could compete in 5G with Huawei (which would keep its existing contracts and continue to sell its own 5G kit). To his mind, this would help level the playing field at a time when many in the West have grown alarmed at the prospect of a Chinese company supplying the gear for most of the world’s new mobile-phone networks. (…)