CONSUMER WATCH

U. Of Michigan Survey Of Consumers

Sentiment continued its downward descent, reaching its worst level in a decade, falling a stunning 8.2% from last month and 19.7% from last February. The recent declines have been driven by weakening personal financial prospects, largely due to rising inflation, less confidence in the government’s economic policies, and the least favorable long term economic outlook in a decade.

Importantly, the entire February decline was among households with incomes of $100,000 or more; their Sentiment Index fell by 16.1% from last month, and 27.5% from last year. The impact of higher inflation on personal finances was spontaneously cited by one-third of all consumers, with nearly half of all consumers expecting declines in their inflation adjusted incomes during the year ahead. In addition, fewer households cited rising net household wealth since the pandemic low in May 2020, largely due to the falling likelihood of stock price increases in 2022.

The recent declines have meant that the Sentiment Index now signals the onset of a sustained downturn in consumer spending. (…)

I have never been a great fan of consumer sentiment surveys. They are generally merely coincident and often influenced by trends in gasoline prices. However, this recent survey is interesting given that its plunge is not happening during a recession and is happening in spite of the high accumulated savings and wealth of the past 2 years.

The fact that the wealthiest households come out as the most worried is even more concerning. They own most of the wealth and excess savings and are thus seen as a strong economic buffer. Can we really count on their economic support?

Americans generally spend their labor income (employment x hours x wages), using their savings in and around economic downturns to maintain their standard of living.

The combination of the pandemic and the broad increase in inflation has brought about a meaningful decline in real wages in the last year. Consumers are surprised by the blow and this survey suggests that they are scared.

The U.of M.’s release ends with this note:

(…) The depth of the slump, however, is subject to several caveats that have not been present in prior downturns: the impact of unspent stimulus funds, the partisan distortion of expectations, and the pandemic’s disruption of spending and work patterns. Households have amassed substantial savings and reserve funds from the stimmies as well as due to more limited consumption choices, especially services. There may be a lessened need for additional precautionary savings and a greater desire to engage in discretionary spending.

Not happening just yet.

Through Feb. 6, the Chase card spending tracker is back to its pre-Covid trend after a very poor Christmas season but much of that is inflation. Actually, Chase says that the first week of February is down 0.6% YoY. That’s in nominal dollars…

The Chicago Fed Advance Retail Trade Summary (CARTS) tracks the U.S. Census Bureau’s Monthly Retail Trade Survey (MRTS) on a weekly basis, providing an early snapshot of national retail spending. “For the month of January, retail & food services sales excluding motor vehicles & parts (ex. auto) are projected to increase 0.4% from December on a seasonally adjusted basis and to be unchanged when adjusted for inflation.”

If so, real retail sales ex-auto would be down 14.7% annualized in the 3 months to January, the most important period of the year. FYI, at December 31, 2021, Amazon’s inventories were up 37% YoY. Its net sales rose 9.4% in Q4 and 22% for the full year. Dry spell for new orders ex-autos ahead, impacting economies world wide.

The WSJ’s Justin Lahart suggests that Americans are very anxious to spend… but that would only aggravate inflation and motivate the FOMC to be more aggressive.

- Another Spring Thaw for the Economy With Covid-19 cases in retreat in the U.S. and around the world, the economy could heat up all over again

(…) [Because of] people’s growing impatience with the pandemic, (…) the initial spending response to the fading of Omicron might be more pronounced than what occurred last winter. And there are other factors that could magnify that boost. (…)

Even so, expanding workforce participation and a better supply-chain situation probably won’t be enough to keep the Federal Reserve at bay. To the contrary, the increase in demand and boost to hiring that comes with the fading of Omicron could be stronger than the Fed—and most investors—now expect, leading the central bank to raise interest rates sharply. (…)

Since the Fed seems focused on fighting the inflation that excessive monetary and fiscal stimulations created, we should perhaps all hope that a scared/cautious consumer will provide us with a salutary soft landing.

David Rosenberg is not optimistic:

The year-over-year inflation rate is now at 7.5%, up from 7.0% in December, and the highest since February 1982. In the past sixty years, not once did the economy manage to skirt a recession at this level of inflation. Sad to say. The core inflation rate leapt to 6.0% from 5.5%. It goes without saying that this last period four decades ago occurred in the context of a recession and a bear market in equities; but the comparable inflation rates back then were on their way down and the Fed was in an easing cycle, not embarking on a tightening phase with a yield curve at half the slope it typically is heading into a rate-hiking process.

Rosie could have pointed out that in the past sixty years, “this level of inflation” [7.5%] only happened twice, somewhat diminishing his correlation with recessions. He could also have mentioned the 9.6% CPI print in April 1951, more than 2 years before the next recession.

Nevertheless, high inflation is generally not positive for the economy:

Inflation Is Everywhere Some 55% of items saw price increases of 5% or higher in January.

The WSJ Editorial Board pressures the FOMC:

If you can believe it—and at this point you probably can—some people still say the sustained surge in prices across developed economies is transitory.

(…) the important fact is that the current inflation is nearly everywhere, including around the world. The United Kingdom’s central bank expects inflation to exceed 7% this spring and for inflation-adjusted living standards to decline by about 2% this year. Inflation in the eurozone hit 5.1% in January, prompting the perennially dovish European Central Bank to start contemplating an interest-rate increase this year.

(…) the supply chain, or a pandemic shift toward consuming goods instead of services, or a chip shortage, or some other one-off factor (…) doesn’t explain why everyone nonetheless has an unusual level of inflation. (…)

Some 73% of the [CPI] items saw annual price rises of 3% or higher in January, and some 55% of items saw inflation of 5% or higher.

This is the pattern that typified the inflation of the 1970s. (…)

The lesson of the 1970s is that once inflation appears, it needs to be corralled with urgency, or it will become embedded and increasingly hard to rein in. (…) The evidence of the inflation mistake is everywhere you look.

- The Hidden Ways Companies Raise Prices Businesses are passing their rising costs on to consumers with new fees, truncated services and reduced contents in packaged goods, which don’t always show up in inflation data; “shrinkflation” hits a block of cheese.

- Soaring Inflation Means Britons Face Biggest Fall in Real Incomes in 30 Years Inflation is shooting past wage growth in the U.K., as energy and food prices surge.

- Waning stockpiles drive widespread global commodity crunch ‘Unprecedented’ base metal shortage coincides with rush for raw materials and food staples

Maybe the Reserve Bank of Australia will show another alternative to the increasingly hawkish Fed: move the goal posts:

(…) “The approach that we are running at the moment, waiting for the evidence, does run the risk that inflation will be above 3% for a period of time and that risk is acceptable,” Lowe said in response to questions from a parliamentary panel on Friday. “We think running that risk is an appropriate thing to do.” (…)

EARNINGS WATCH

From Refinitiv/IBES:

Through Feb. 11, 358 companies in the S&P 500 Index have reported revenue for Q4 2021. Of these companies, 76.5% reported revenue above analyst expectations and 23.5% reported revenue below analyst expectations. In a typical quarter (since 2002), 62% of companies beat estimates and 38% miss estimates. Over the past four quarters, 79% of companies beat the estimates and 21% missed estimates.

In aggregate, companies are reporting revenues that are 2.6% above estimates, which compares to a long-term (since 2002) average surprise factor of 1.2% and the average surprise factor over the prior four quarters of 4.0%.

The estimated earnings growth rate for the S&P 500 for 21Q4 is 31.0%. If the energy sector is excluded, the growth rate declines to 22.6%.

The estimated revenue growth rate for the S&P 500 for 21Q4 is 14.5%. If the energy sector is excluded, the growth rate declines to 10.3%.

The estimated earnings growth rate for the S&P 500 for 22Q1 is 6.5%. If the energy sector is excluded, the growth rate declines to 2.1%.

Q1 estimates for the S&P 500 index have not declined so far but analysts are growing uncertain as time goes on:

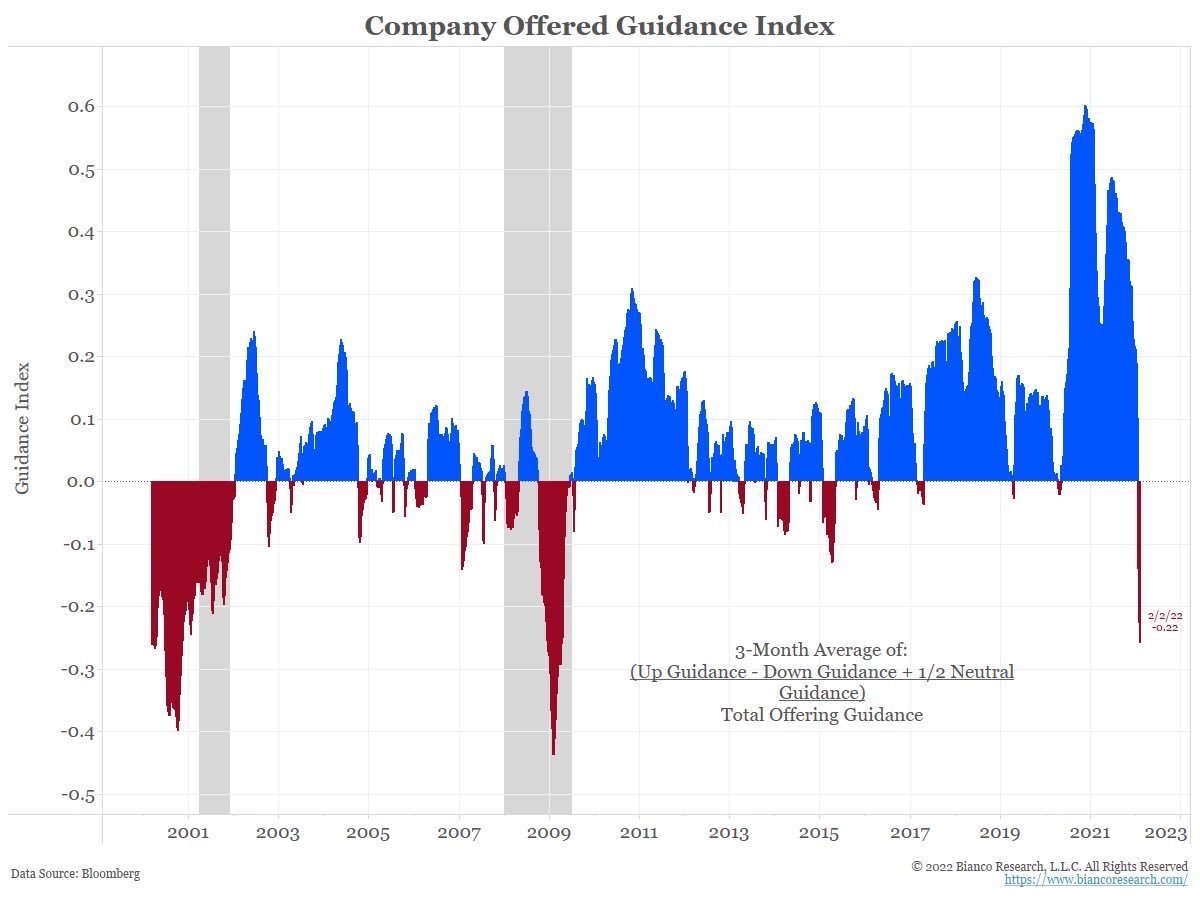

Much fewer S&P 500 companies are offering formal guidance, let alone positive guidance:

But Bloomberg tallies all U.S. companies and their guidance has turned most negative since 2009, per an index constructed by @biancoresearch and @Bloomberg via @LizAnnSonders.

We are at Q1’s mid-point. Many companies will want to wait until the end of February to decide whether they need to pre-announce or not.

Equities remain very expensive and the acceleration of inflation is more than offsetting the current growth in profits (yellow line below). Generally a headwind for equity valuation. As John Authers writes: “For investors, the risk is that what companies give by being able to extract higher profit margins [through higher prices], they’ll also take by forcing higher rates and lower earnings multiples.”

Miners are likely to report a drop in profits. The top-five western diversified mining companies, including iron-ore giants Rio Tinto Group, Vale SA and BHP Group Ltd., may see combined 2021 second-half earnings of $73 billion, according to analysts’ estimates, compared to $82 billion in the first half. (…)

China’s property market, which consumes around a third of the country’s steel output, has been cooling — Bloomberg Intelligence expects new home starts to decline by 5% this year. And Beijing’s bid to cling to its Covid-zero status, even as regional outbreaks become more frequent, is the X factor that’s likely giving some resource executives sleepless nights. (…)

BHP and Rio have said that a lack of workers in key roles are having an impact on their operations. Fortescue Metals Group Ltd., the world’s No. 4 ore producer, reported last month that its costs had risen 20% over the past 12 months driven primarily by rising fuel prices and labor shortages. (…)

CREDIT MARKETS

John Authers:

(…) it’s always important to keep an eye on the credit market. Higher rates would logically lead to some kind of problem with solvency, and so it’s encouraging that to date the spreads of high-yield bonds compared to Treasuries remain historically low, even though they’re back up to their highest in some months. It is hard to discern any serious angst in the credit market at present:

Could it be that public credit markets are no longer the dependable canary in the coal mine they have always been?

Moody’s recently revealed that within the rated speculative-grade universe, 65-75% of issuers rated B3 Negative or lower (i.e. distressed borrowers) are owned by PE sponsors. Moody’s combed 12 prominent PE portfolios to find that they all “comprise borrowers that maintain average debt-to-Ebitda ratios of over 6x, which is a much higher average than for borrowers in bank loan portfolios and above the Federal Reserve’s Leverage Lending Guidance.”

TECHNICALS WATCH

Equity inflows have not even been close to being negative for a single week during this whole sell-off.

(EPFR via The Market Ear)

Yet, sellers broadly keep overwhelming buyers:

Source: Ned Davis Research

Larger cap equities have so far held up better than mid and small caps but beware:

S&P 500 Large Cap Index – 13/34–Week EMA Trend

Foreign Buying of US Equities: This is one of those things you tend to see later in the cycle (and further reinforcing the widening valuation gap between US vs Global equities). Time to go against the crowd? (Callum Thomas)

Source: @MFHoz

Wood’s ARK Stays the Course, Betting Big on Innovation Cathie Wood’s flagship ARK Innovation exchange-traded fund has bought more than $400 million of high-growth stocks over the past two weeks.

(…) She says the companies, which span videogaming, digital payments, trading and other industries, have the potential to change the world. (…)

“Today, we are still seeing things very differently from many others out there, particularly when it comes to inflation and interest rates and most importantly, innovation,” Ms. Wood said in a video to investors this month.

Ms. Wood added that a rise in Treasury yields to 3% would be more of an issue for mature growth companies facing steeper competition rather than the “super growth companies” she favors. (…)

ARKK has gotten $350.8 million of net inflows over the past week, including more than $300 million on Thursday, its biggest single-day inflow since June, according to FactSet. (…)

Bearish bets against ARKK account for nearly 16% of the fund’s shares, according to data from S3 Partners. That is down from a peak of 17.3% in mid-January, but well above levels over most of the fund’s lifespan. (…)

Besides that, an ETF designed to track the inverse of ARKK’s performance, the Tuttle Capital Short Innovation ETF, has taken net inflows of nearly $200 million from investors so far this year, pushing assets to $309.8 million, according to FactSet data. The ETF, which goes by the ticker SARK, is up 24% in 2022.

“There’s demand out there to be short ARKK,” said Matthew Tuttle, chief executive of Tuttle Capital. “We look at this as a better way to hedge your portfolio.” (…)

“I think history tells us not to bet against innovation,” [Ms. Wood] said.

ARK does good industry and corporate research. But history also tells us that one not only needs to get the story right, one also needs to get what that story is actually worth right. Profits and valuations matter.

FYI:

- From housing economist Tom Lawler via CalculatedRisk which rightly notes that this is valuable demographic data.