Jobless Claims Fall to Pandemic Low Claims now at lowest level since mid-March 2020, when pandemic shut down the economy

Worker applications for unemployment benefits fell to 473,000 last week from a revised 507,000 a week earlier, the Labor Department said Thursday. (…) The four-week moving average, which smooths out volatility in the weekly numbers, also reached a new pandemic low of 534,000. (…)

A total 16.9 million people were receiving benefits in the week ended April 24 through one of several programs, including regular state aid and federal emergency programs put in place in response to the pandemic. Total claims are down about 3 million from the first week of March, but still nearly eight times as high as before the pandemic’s onset. (…)

This will soon impact the IP and labor:

Empty Lots, Angry Customers: Chip Crisis Throws Wrench Into Car Business Car makers have cut production of 1.2 million vehicles in North America because of a shortage of computer chips, losing sales amid high demand.

(…) “We may just be in the greatest new-car market of our existence,” Philadelphia-area car dealer David Kelleher said, “and we’re doing it with no cars.”

He recently woke up at 3:30 a.m. in a cold sweat and scrolled an iPad to check on his inventory of Jeeps and Ram trucks. After posting his best months ever in March and April, Mr. Kelleher was heading into the busy summer sales season with 98 vehicles on his lot instead of the usual 700. (…)

Dealers had fewer than 2 million vehicles on the ground or en route to stores at the end of April, roughly half the normal number and the lowest level in more than three decades, according to research firm Wards Intelligence. (…)

Car makers are building some models without needed semiconductors and parking them until chips are available to install. Tens of thousands of these vehicles sit at airport lots, a quarry, a racetrack and other makeshift holding pens near assembly plants in the South and Midwest. (…)

Demand has pushed the average price for a new vehicle to $37,572 in April, up nearly 7% from a year earlier and a record for the month, according to research firm J.D. Power. (…)

GM said it was building some full-size pickup trucks without software that helps manage fuel consumption, reducing miles per gallon. “By taking this measure, we are better able to meet the strong customer and dealer demand for our full-size trucks,” a spokeswoman said. (…)

For smaller companies that make products for vehicle assembly plants, the chip shortage slammed the brakes on orders. Months ago, auto plants were working overtime to catch up on production lost early in the pandemic. (…)

- Chip shortage to cost automakers $110 bln in revenues in 2021 – AlixPartners The global semiconductor chip shortage will cost automakers $110 billion in lost revenues this year, up from a prior estimate of $61 billion, consulting firm AlixPartners said, as it forecast the crisis will hit the production of 3.9 million vehicles.

- The Global Chip Shortage Won’t Ease Soon Because demand will remain high and supply will remain constrained, we expect this shortage to last through 2022 and into 2023. (Forrester)

Need a Credit Card or Auto Loan? Banks Are Making Them Easier to Get Some banks are reducing credit-score requirements and offering more generous loan terms, eager to lend after tightening up when the pandemic hit.

The net share of banks that loosened underwriting standards for credit cards hit a high in roughly the first quarter, according to a survey of loan officers conducted by the Federal Reserve. The net share of banks relaxing underwriting on other consumer loans such as installment loans also notched a record. For auto loans, that share was the highest level in more than eight years. (…)

- Banks Plan to Issue Credit Cards to People With No Credit Scores Some of the largest U.S. banks plan to start sharing data on customers’ deposit accounts as part of a government-backed initiative to extend credit to people who have traditionally lacked opportunities to borrow.

U.S. PPI Surges Versus Last Year

The Producer Price Index for final demand increased 0.6% (6.2% y/y) during April following a 1.0% March gain. The index has risen at an 8.5% annual rate during the last three months. A 0.3% rise had been expected in the Action Economics Forecast Survey. The PPI excluding food & energy strengthened 0.7% (4.1% y/y) for a second straight month. The index rose at an 6.1% annual rate during the last three months. A 0.4% rise had been expected. The PPI less food, energy & trade services rose 0.7% (4.6% y/y) after increasing 0.6% in March. The PPI data series dates back to November 2009. (…)

The 0.7% strengthening in the core PPI reflected a 1.0% surge in goods prices last month, up from 0.9% in March. Private capital equipment prices strengthened 0.6% (2.0% y/y) after edging 0.1% higher in March. Higher prices for core government goods prices again were strong with a 0.8% gain (3.7% y/y). Core consumer goods prices rose 0.6% (2.5% y/y) following a 0.5% rise. The cost of durable consumer goods prices strengthened 0.8% (3.0% y/y), the largest increase since October 2008. Core nondurable consumer goods increased 0.5% (2.2% y/y) for a second straight month.

Services prices increased 0.6% last month following a 0.7% rise. Trade services rose 0.5% after strengthening 1.0% in March. The price of transportation & warehousing of finished goods for final demand rose 0.5% (7.7% y/y) following a 1.6% rise. Services prices less these categories increased 0.5% (4.4% y/y) after gaining 0.4%.

Construction costs strengthened 1.1% (2.1% y/y) following a 0.5% rise.

Intermediate goods prices jumped 1.6% in April (18.4% y/y) following a 4.0% rise.

Core Goods PPI in the last 3 months: +0.3%, +0.9%, +1.0% = +9.1% annualized.

Finished Core Goods PPI, last 3 months: +0.2%, +0.3%, +0.6% = +4.5%.

There is still inflation in the pipeline.

TRANSITORY WATCH

Moody’s: “The headline CPI rose 0.8% in April, noticeably more than our above-consensus forecast. (…) Our back-of-the-envelope calculation is that transitory factors [reopening, “one-timers”] added 0.46 percentage point to the CPI in April.”

Since the CPI rose 0.77%, that leaves +0.31% “non-transitory”, +3.7% annualized.

- Fed’s Waller Says Inflation Jump Likely Temporary, Urges Patience Fed governor said officials need to see ‘several more months of data’ before determining when to adjust policy

(…) “The May and June jobs report may reveal that April was an outlier, but we need to see that first before we start thinking about adjusting our policy stance,” Mr. Waller said in a speech. “We also need to see if the unusually high price pressures we saw in the April CPI [consumer-price index] report will persist in the months ahead.” (…)

“The economy is ripping, it is going gangbusters,” he said. (…) “For me, if I were to see 4% inflation month in, month out, month in, month out, I would get very concerned,” he said.

- Fed’s Bullard Upbeat on Recovery, Not Ready for Monetary-Policy Change St. Louis Fed leader James Bullard said that he expects the economy to produce inflation notably above the central bank’s 2% target for some time and that the job market is probably much stronger than it appears.

- Fed’s Clarida ‘Surprised’ by Inflation Report, But Stresses Need to See More Data

- Bank of Canada Says Complete Recovery Needed to Withdraw Support

- Macklem Says Further Loonie Gains Could Be Economic Headwind

Mr. Market sees the short-term problem but agrees it will prove transitory:

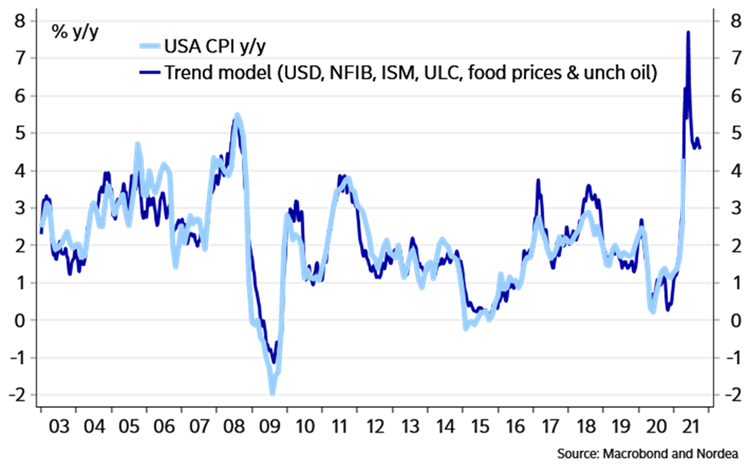

Our trend-model suggests that we can reach 8% inflation this summer but whether it is enough to scare anyone, including the Fed, remains to be seen. The biggest monthly increase the US core inflation since 1982 hardly scared anyone but Robert Kaplan.

The true test is therefore whether inflation will stay around after summer. The “direct bonuses” of the Biden administration will run until September, but in parts of the US the cheques will already be halted during June (e.g. in Iowa and Mississippi), which will give us an early flavour of how the labour market looks post the money handout.

Currently there is a massive amount of job openings that are hard to fill as benefits are too high compared to the offered wage, while the overall mobility in the labour market is low due to Covid restrictions and border closures. This will inevitably force service-employers to hand out money before September to lure people back to work before the governmental hand-outs projectably end. This is another reason to believe in inflation staying around longer than anticipated by many, not least as there is obviously a crystal-clear risk that higher benefits and direct transfers turn into perma-instruments in the US fiscal policy. There is nothing as permanent as a temporary governmental program.

Should higher benefits and bonus cheques prove much more permanent, then workers will finally have a decent force in negotiations versus employers in the US for the first time in several decades. What’s more, we expect inter-regional border closures to remain effectively intact for several years still, as the global population will likely not be vaccinated within the same season until 2023 the earliest. This is, albeit Covid fueled, a clear step in the direction of a de-globalization of the labour market.

Business Inflation Expectations Increase to 2.8 Percent

The Atlanta Fed’s BIE was created to measure the year-ahead inflationary sentiments of businesses in the Sixth District. It also helps inform our view of the sources of cost changes and provides insight into the factors driving business’ pricing decisions.

- Inflation expectations: Firms’ year-ahead inflation expectations increased significantly to 2.8 percent, on average.

- Current economic environment: Sales levels are at normal levels while profit margins “compared to normal” remain near average levels. Year-over-year unit cost growth increased significantly to 2.8 percent, on average.

- Quarterly question: Approximately one quarter of firms expect labor costs to put significant upward influence on prices while one third expect nonlabor costs to do the same. About 40 percent of firms expect sales levels to put moderate upward influence on prices over the next 12 months.

-

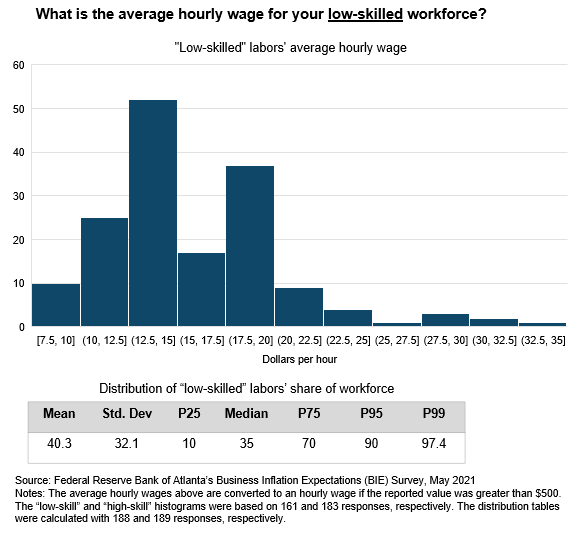

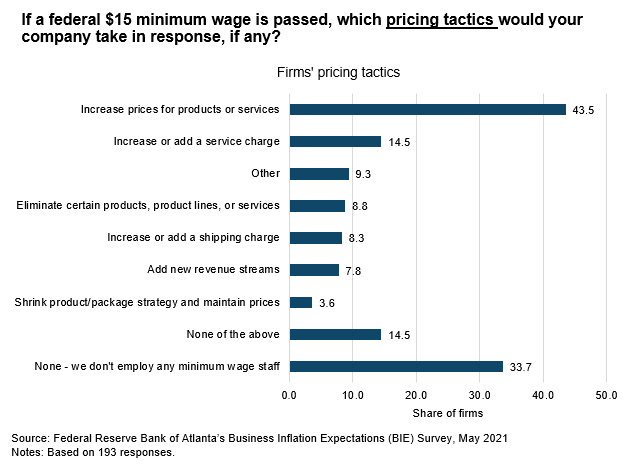

Special question: May 2021: Firms and the Minimum Wage:

Right on cue, in today’s WSJ:

Amazon, McDonald’s, Others Woo Scarce Hourly Workers Large U.S. employers of lower-wage workers are raising pay and adding perks, with Amazon set to add 75,000 employees and offer signing bonuses and McDonald’s boosting wages at company-owned restaurants.

Amazon.com Inc. said Thursday that it would hire 75,000 more workers and offer $1,000 signing bonuses in some locations, its latest hiring spree in a year of tremendous job growth at the e-commerce giant. McDonald’s Corp. said it wants to hire 10,000 employees at company-owned restaurants in the next three months and that it would raise pay at those locations. Chipotle Mexican Grill Inc., Applebee’s and KFC are among other chains seeking to hire tens of thousands of workers as they restore indoor seating and seek to bolster staffing there. (…)

Amazon said its open roles are offering average pay of $17 an hour, an increase over its typical starting wage of $15 an hour. The company in April said it was raising wages for more than 500,000 hourly employees, giving them pay increases of between 50 cents and $3 an hour, an investment of more than $1 billion. (…)

McDonald’s said it would raise wages for more than 36,500 hourly workers at company-owned stores in the U.S. by an average of 10% over the next several months. The fast-food chain owns a fraction of its 13,900 U.S. restaurants, around 95% of which are operated by franchisees.

The National Owners Association, a group representing U.S. franchisees, said in an email to its members Sunday that strong sales should allow operators the choice to raise menu prices to offset higher spending on pay and benefits.

“We need to do whatever it takes to staff our restaurants and then charge for it,” the association said.

Chipotle, which said Monday that it would raise wages at its 2,800 restaurants to an average of $15 an hour by the end of next month, has increased prices on delivery orders. (…)

The median hourly wage for a U.S. fast-food worker in mid-2020 stood at $11.47, Labor Department data show.

McDonald’s said it decided to raise pay at company stores after looking at what other restaurants were paying and as more states and the federal government consider mandating minimum-wage increases. (…)

McDonald’s said it expects the average wage at the restaurants it owns to reach $15 an hour by 2024. (…)

[Walmart] starts many of its 1.3 million U.S. employees at $11 an hour. Earlier this year, Walmart said it would raise wages for about 425,000 of its U.S. workers, increasing its average hourly wage to above $15 an hour, up from an average above $14 in early 2020.

Walmart is promoting employee perks such as a $1 a day subsidized university degree program for workers. In April, Walmart said it planned to make about two-thirds of its hourly workforce full time by the end of the year. In 2016, around 53% of hourly workers held full-time roles, the company said. (…)

Karen Cate, chief financial officer and head of operations at Thrive Market, an online grocer with about 700 hourly employees, said the company offers stock options and recently decided to maintain a $2 hourly raise it gave hourly employees during the pandemic. (…)

Goldman Sachs:

-

Much weaker-than-expected job growth and much stronger-than-expected wage growth in last Friday’s employment report suggests that the labor market is much tighter, at least temporarily, than a 6.1% headline unemployment rate suggests.

-

The current labor market tightness reflects a quick reopening-driven recovery in labor demand at a point when labor supply is still constrained by unusually generous unemployment insurance (UI) benefits and lingering virus-related impediments to working. As a result, the ratio of unemployed workers to job openings has fallen to a level typically associated with tight labor markets, particularly in the low-wage service sectors that face more competition from UI benefits and account for a large number of remaining job losses.

-

This temporary labor imbalance is probably the cause of the recent strength in wages, including the 0.7% jump in average hourly earnings in April. Additionally, generous UI benefits have put upward pressure on wages, particularly for lower-income workers, whose average self-reported reservation wage—the lowest wage they would accept for a new job—has increased by 21% since the fall.

-

It is hard to know exactly when in the next few months that labor supply and wage growth will normalize, since some supply constraints from school closures and health risks are rapidly retracing, but disincentives from UI benefits will persist in most states until early September. Our best guess is that labor supply constraints will keep labor markets somewhat tight and push wage growth moderately above 3% in the near term, but fade in the coming months and disappear by the fall.

FYI:

Battery breakthrough for electric cars Harvard researchers design long-lasting, stable, solid-state lithium battery to fix 40-year problem (tks Pat)

(…) Li and his team have designed a stable, lithium-metal, solid-state battery that can be charged and discharged at least 10,000 times — far more cycles than have been previously demonstrated — at a high current density. The researchers paired the new design with a commercial high energy density cathode material.

This battery technology could increase the lifetime of electric vehicles to that of the gasoline cars — 10 to 15 years — without the need to replace the battery. With its high current density, the battery could pave the way for electric vehicles that can fully charge within 10 to 20 minutes.

The research is published in Nature. (…)

Another pandemic underway:

- Colonial Pipeline Said to Pay Hackers Ransom The operators of the fuel pipeline made the payment to regain control over their computer systems, say people familiar with the matter. The company is now resuming service. The ransom, paid in cryptocurrency, was approximately $5 million at the time of the transaction.

- Toshiba unit hit by hacker group DarkSide earlier this month European subsidiary attacked by same criminal group that hacked Colonial petroleum pipeline

Another Hack:

Nearly 3 in 5 Unvaccinated Adults Say a Big Financial Incentive Would Sway Them to Get a COVID-19 Shot Unvaccinated adults were asked if they would get a COVID-19 shot if the following incentives were offered to them:

From Morning Consult:

- Since Morning Consult began tracking in mid-March, the share of total vaccine skeptics (uncertain plus unwilling) has dropped from 39 percent to 33 percent of the adult population.

- Of the 20 states with the highest rates of unwillingness to get vaccinated, Trump won 19. Of the 20 states with the lowest rates of vaccine unwillingness, Biden won 18.

- Twenty-seven percent of Republicans do not plan on getting vaccinated, the highest level of any major demographic group.

- Russia and Australia have the highest rates of vaccine skepticism with 54 and 42 percent either unwilling or uncertain, respectively.