ADVANCE MONTHLY SALES FOR RETAIL AND FOOD SERVICES, NOVEMBER 2021

Advance estimates of U.S. retail and food services sales for November 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $639.8 billion, an increase of 0.3 percent (±0.5 percent)* from the previous month [street expectations +0.8%], and 18.2 percent (±0.9 percent) above November 2020. Total sales for the September 2021 through November 2021 period were up 16.2 percent (±0.7 percent) from the same period a year ago.

The September 2021 to October 2021 percent change was revised from up 1.7 percent (±0.5 percent) to up 1.8 percent (±0.2 percent).

U.S. Producer Prices Climbed Sharply in November Prices that suppliers charge businesses and other customers jumped 9.6% last month from a year ago, the most on record

The so-called core PPI, which excludes often volatile food and energy components, climbed 7.7% from a year ago, also the highest on record. (…)

The index, which generally reflects supply conditions in the economy, rose 0.8% from October, an acceleration from the 0.6% gain in each of the previous three months. Higher prices for energy, wholesale food, and transportation and warehousing contributed to the pickup in inflation. (…)

Prices for goods, excluding food and energy, climbed 0.8% in November from October, faster than the 0.6% increase the previous month. The services index advanced 0.7% on the month, up from 0.2% in October, driven in part by a pickup in hotel room rates and airfares. (…)

Haver Analytics’ table provides the best snapshot of the key trends:

- Core final demand PPI (yellow) is furiously accelerating;

- Core goods PPI is up 9.3% YoY in November. Last 3 months annualized: +7.8%. Last 2 months: +8.7% a.r..

- Services are also accelerating, now +7.1% YoY after +1.9% on average in the last 3 years.

U.S. manufacturers are enjoying a rare period when they can easily pass their costs increases on to their customers. For how long?

FIBER: Industrial Commodity Prices Improve Slightly

The Conference Board’s latest Measure of CEO Confidence reveals that “79% of CEOs expect to increase wages by 3% or more over the next year, up from 66% in Q3.”

Wirecutter Union, New York Times Agree to Contract Three-year deal after Black Friday strike includes average wage increases of about $5,000; lowest paid staffers to get 18% raises immediately, union says.

The three-year contract also includes minimum guaranteed pay increases of between 2% to 2.5% a year, according to the union.

Increases on union members’ healthcare costs are also capped and the agreement includes a ban on nondisclosure agreements referencing harassment or discrimination, the union said. (…)

- Food prices in Canada forecast to rise at highest rate in more than a decade

- U.K. Inflation Accelerates at Fastest Pace in a Decade November saw inflation in the country reach its fastest annual rate in more than a decade, propelled by supply-chain disruptions and higher energy costs that are pushing up consumer prices across many advanced economies.

- South Africa Inflation Reaches 5.5%, Highest in Almost Five Years

- UK house prices grow 10.2% in year to October

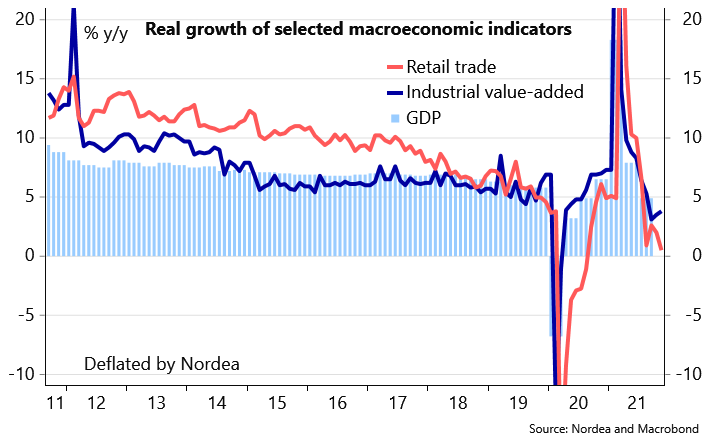

China’s Economic Activity Slows on Property Slump, Weak Consumption The latest economic data point to a further slowdown in China’s economy that began to sputter in the third quarter on the back of a power crunch that curbed factory output, and sporadic Covid-19 outbreaks that hit consumption.

(…) Industrial production expanded by 3.8% in November from a year ago, accelerating from 3.5% growth in October, a rare bright spot in China’s economy as efforts to alleviate electricity shortages led to increased coal output in recent weeks. (…)

Fixed-asset investment increased 5.2% in the January-to-November period, down from the 6.1% pace recorded in the first 10 months, official data showed. The reading was in line with the expectations of economists polled. (…)

New-home prices dropped 0.33% in November from October across 70 cities, the biggest month-over-month decline in about six years, according to calculations by The Wall Street Journal based on official data released Wednesday.

New-construction starts by property developers, which provide jobs for migrant workers and boost China’s demand for commodities, dropped 9.1% in the January-to-November period from a year earlier, widening from a 7.7% on-year decline in the first 10 months of the year.

Retail sales, a proxy for China’s consumption, rose just 3.9% last month from a year ago, down from October’s 4.9% year-over-year growth and lower than the 4.5% expected increase among economists polled by the Journal. China’s strict Covid-19 restrictions affected sectors including catering, where sales fell 2.7% in November, a larger decrease from a fall of 2% in October. (…)

At least 20 manufacturers based in Zhejiang, a large manufacturing region producing a range of products including textiles and LED lights, halted production over the past week after local officials imposed lockdowns, according to the companies’ filings. Most companies didn’t disclose when the factories will reopen but said they expected the disruptions to be short-lived. (…)

(Bloomberg)

The recent news about the first Omicron case in China and the possibly low efficiency of the Chinese vaccinations to tackle the Omicron mutation increases the worries on that front, and the recent report by the Beijing University explicitly showed that the scale of virus cases in an environment of looser restrictions could be such that the Chinese healthcare system simply cannot handle it. (Nordea)

China has been pouring money into residential construction for years: the excess stock of housing is far larger than we previously thought. In addition to the stock of housing ‘under construction’, it seems that there is a rapidly growing stock of housing whose construction has been ‘paused’ and not restarted. Some of this stock will have been demolished, though it is unclear how much.

The opacity of the data means that we also do not know and cannot estimate the starting level of the ‘paused’ stock of housing, but we do know how much it has contributed to the overall housing excess in recent years.

Consequently, it seems likely that the combined stock of housing under construction and housing paused but not restarted is in the order of 9 billion square metres, enough to house over 200 million people (roughly the population of Brazil) in comfort. Someone, somewhere, thought that was an investment: they will be disappointed or bailed out — the Evergrande crisis so far suggests the latter for homebuyers at least.

SENTIMENT WATCH

- Luminar, CEO, Board Members, and Management Announce Plan to Purchase a Total of $250 Million of LAZR Stock, Dec. 14, 2021 “Today, we’re putting our money where our mouth is by executing this significant purchase of shares as we accelerate our industry leadership.”

Knowing LAZR is down 70% this year, anybody would be impressed by the above. But read beyond the headline (my emphasis):

Luminar Technologies, Inc. (Nasdaq: LAZR), with support of its CEO, board members, and management, today announced its authorization and intent to purchase $250 million or more of its Class A common stock, which is anticipated to commence today after market open. The company plans to use a portion of the proceeds from a proposed private financing transaction for the share repurchase. (…)

The timing and number of shares repurchased will depend on a variety of factors, including stock price, trading volume, and general business and market conditions. The repurchase program has no time limit, does not obligate Luminar to acquire any particular amount of Class A common stock and may be modified, suspended or discontinued at any time at the company’s discretion. The Board has authorized an increase in the size of the repurchase program to 50% of the aggregate principal amount of the company’s recently proposed private financing, if greater than $250 million.

Almost Daily Grant writes:

The text of the press release conveyed a slightly less compelling message. Turns out it’s Luminar, the company, more than Luminar, the executives, that will do most of the buying, funded not by the insiders’ after-tax income but by a $500 million convertible note offering. The CEO, board, and management instead lend their “support” to the effort, while conducting unspecified purchases of company stock “as part of pre-arranged trading plans.”

CEO Austin Russell, who stated in the press release that today’s repurchase announcement shows that “we are putting our money where our mouth is,” personally sold 10.5 million shares of LAZR in July at a 40% premium to current price levels, cashing out $221 million. The 26-year old executive has been putting those funds to work, shelling out $83 million for a Pacific Palisades mansion, real estate publication Variety Dirt reported last week.

Some day, LAZR will amend its release with “…putting your money where our mouth is”.

ADG notes that LAZR is still selling at 40 times 2023 expected revenues.

And near the end of the year likely to become known as “the year of the suckers”, ADG also informs us that

Meanwhile, a founding member of the great 2021 meme stonk revolution looks for its own blockchain-based share price salvation. AMC Entertainment Holdings, Inc. announced last week that it will gift an “exclusive, one-time” non-fungible token for all members of AMC Investor Connect, a self-identified cadre of shareholders in the company. The NFT, which depicts a glimmering gold-colored medallion embossed with the words “I Own AMC,” follows the theater chain’s Nov. 29 NFT offer for members who purchased a ticket to the upcoming Spider Man: No Way Home (the fourth Spider Man film since 2017 and the ninth in the past 20 years).

AMC shares sit 62% below their June 2 highs, though the company still commands a $12.8 billion market cap, up from less than $1 billion on the eve of the pandemic despite a cumulative $3.5 billion net loss since the start of 2020.

Needless to say, that charmed status as a bulwark of the Reddit retail army has not escaped management’s attention: Last week, CEO Adam Aron and CFO Sean Goodman disclosed the sale of 312,500 shares and 18,316 shares, respectively, netting the pair about $10 million in proceeds. After those transactions, Aron, who disclosed plans to sell 1.25 million shares in an early November filing, now holds fewer than 100,000 shares in AMC, while Goodman no longer holds any shares on a discretionary basis (the executive is periodically granted shares according to continued employment and performance incentives).

Trouble under the surface of the Nasdaq 100

“When we zoom out over the past 20 years, we can see that there have been 4 relatively similar periods. All preceded a tough market for the index over the next year or so.” (SentimenTrader)

- Bloomberg: “ Some of the richest Americans—think Elon Musk, Jeff Bezos, Mark Zuckerberg—are unloading shares in the very companies that made their fortunes. They’ve sold $42.9 billion in stock this year, more than double the $20.2 billion they sold in 2020.”

- But here’s your dose of optimism from JPM’s Marko Kolanovic:

Our view is that 2022 will be the year of a full global recovery, an end of the pandemic, and a return to normal economic and market conditions we had prior to the COVID-19 outbreak. In our view, this is warranted by achieving broad population immunity and with the help of human ingenuity, such as new therapeutics expected to be broadly available in 2022. This would result in a strong cyclical recovery, a return of global mobility, and a release of pent-up demand from consumers (e.g. travel, services) and corporates (in particular inventory, capex, and buyback recovery). We stress that this demand would happen in a backdrop of still-easy monetary policy (zero rates and incrementally smaller but positive quantitative easing). For these reasons, we remain positive on equities, commodities and emerging markets, and negative on bonds.

- Bank Of America’s clients are more circumspect: