U.S. Initial Jobless Insurance Claims Rise Moderately

Initial claims for unemployment insurance rose 45,000 to 770,000 in the week ended March 13 from 725,000 the week before; that earlier week was revised from 712,000. The Action Economics Forecast Survey had expected 705,000 initial claims for the latest week. The four-week moving average of initial claims decreased to 745,250 from 762,250; this was the lowest four-week average since November 28.

Initial claims for the federal Pandemic Unemployment Assistance (PUA) program fell to 282,394 in the March 13 week from 478,914 the week before; that had been the largest amount since September 19. These initial claims do move relatively widely from week to week. The PUA program covers individuals such as the self-employed who are not included in regular state unemployment insurance. Given the brief history of this program, which started April 4, 2020, these and other COVID-related series are not seasonally adjusted.

Continuing claims for regular state unemployment insurance fell to 4.124 million in the week ended March 6 from 4.142 million in the prior week, marginally revised from 4.144 million. Continuing PUA claims for the week of February 27 dropped to 7.615 million from a little-revised 8.388 million in the prior week. The number of Pandemic Emergency Unemployment Compensation (PEUC) claims also decreased in that week to 4.815 from their record 5.456 million, which was revised just slightly from the original 5.455 million. That program covers people who were unemployed before COVID but exhausted their state benefits. An extension of the PEUC benefits was included in the American Rescue Plan bill passed by the Congress last week and they will now be available until August 29.

The total number of all state, federal and PUA and PEUC continuing claims fell to 18.216 million in the week ended February 27 from 20.118 million in the February 20 week. This grand total is not seasonally adjusted.

But there is no improvement overall so far this year as this Bespoke chart illustrates:

(Bespoke)

Economy Revs Up as Americans Spend on Flights, Dining Out Older people are spending more on plane tickets. Restaurant visits are up on OpenTable. Hotel occupancy is at a 20-week high. The U.S. economy is showing signs of a revival.

(…) Economists surveyed by The Wall Street Journal this month raised their average forecast for 2021 economic growth to 5.95%, measured from the fourth quarter of last year to the same period this year (…). The pickup is arriving sooner than many economists had expected at the start of the year, before Congress and the White House approved a $1.9 trillion stimulus package. In the Journal’s March survey, respondents upped their average forecasts of economic growth in the first quarter to an annualized rate of 4.9%, from 2.8% in February’s survey. (…)

The weekly average of the number of seated diners tracked on restaurant reservation platform OpenTable is up markedly from mid-December, but still down 33% from 2019. In Miami, the recent upsurge in activity has put restaurant attendance 8% above where it was in 2019.

Spending on gyms, salons and spas recently climbed to the highest levels since the pandemic first hit the U.S., forcing many to shut down and scaring away clients fearful of infection, according to data from Earnest Research, which tracks trends in credit- and debit-card purchases. (…)

Spending on vacation rental sites Airbnb and Vrbo surged in the week ending March 3, and is well above pre-pandemic levels, according to Earnest Research. The number of transactions for air travel, lodging and on online travel platforms has climbed sharply in recent weeks, and is now at the highest level since the pandemic began, the firm’s data show.

Some of this spending might be for future travel, but much is happening already. U.S. hotel occupancy hit a 20-week high of 49% in the week ended March 6, led by small and medium-size hotels, according to STR, a research firm specializing in the hospitality sector. Occupancy is still down nearly 30% from 2019. (…)

More than 12% of the overall population has been fully vaccinated, including almost 39% of Americans age 65 and above, according to the U.S. Centers for Disease Control and Prevention. (…)

The Chase spending tracker is up 5.3% YoY through March 14, up from +0.7% at the end of February:

- For FedEx, Covid-19 Pandemic Keeps Delivering Profit In the quarter ended Feb. 28, FedEx’s package volumes rose 25% in its Ground unit, which handles most of its e-commerce deliveries and the bulk of its holiday shopping orders.

Spending on goods was strong through February. In addition:

(…) While e-commerce is driving its overall growth, FedEx said that U.S. business-to-business volume returned to pre-pandemic levels in January with a focus on healthcare, retail and technology-related shipments.

“We have not seen it fully come back in automotive and industrial, so we think that there’s some upside there,” Chief Marketing Officer Brie Carere said on a conference call Thursday. (…)

(…) “Bookings are up dramatically and we are trying to avoid congested ports, but it’s not easy.”

The backups that started building up late last year have grown during a normally slack period in shipping demand, tying up inventories for weeks in some cases as ships wait to reach berths while offloaded containers sit for long periods at packed freight terminals. (…)

But Mr. Seroka [Port of LA] said another rush of ships was scheduled to arrive in the coming days and the port expects the rush to continue “into the spring and early summer.” (…)

”The transport cost is at least double. I will have to bring up my prices in June.” (…) At the Harrison Market, a supermarket in Harrison, N.Y., shop manager Dan Tores is already changing the price labels on products. (…)

- Tourists Trickle Back to New York City After a pandemic-ravaged year in which tourists largely stopped coming to New York, the city is starting to see an uptick in visitors as Covid-19 quarantine restrictions are set to ease.

Canada’s inflation rate edges higher, sets stage for jump in coming months

Annual inflation rose 1.1 per cent in February, compared to 1 per cent in January, Statistics Canada said on Wednesday. The year-over-year growth in the CPI last month was driven by gas prices, which rose 5 per cent year on year and 6.5 per cent compared with January. This was offset by a drop in prices of clothing, travel accommodation and phone service. (…)

The core inflation measures favoured by the Bank of Canada in its forecasting remained largely unchanged, at an average of 1.7 per cent. The central bank said last week that it expects overall inflation to approach 3 per cent in the coming months, before cooling down in the second half of the year “as base-year effects dissipate and excess capacity continues to exert downward pressure.”

The bank does not expect inflation to sustainably return to its 2-per-cent target until the economy returns to full employment and the output gap – the difference between what Canada can produce and what it does produce – closes. (…)

The homeowners’ replacement cost index, which is tied to the cost of new homes, was up 7 per cent year over year, as pricier building materials, low interest rates and demand for larger homes pushed new home prices higher. “This is the largest yearly gain recorded since February, 2007,” Statscan said.

By contrast, the index that tracks mortgage servicing costs fell 5.4 per cent last month, as Canadians renewed or initiated mortgages at historically low interest rates.

Rent prices increased 0.1 per cent across the country in February, compared with the previous year. British Columbia was an outlier, with rent prices declining 2.9 per cent in February. (…)

Russia Surprises With First Rate Hike Since 2018, Signals More The Bank of Russia unexpectedly increased interest rates for the first time since 2018 and warned of further hikes after inflation accelerated faster than expected.

The benchmark rate was raised 25 basis points to 4.5% on Friday. (…) Annual inflation in Russia accelerated to 5.7% in February, the fastest in more than four years and well above target. Food prices in particular have shot up, adding to a decline in living standards during the pandemic.

The central bank “holds open the prospect of further increases in the key rate at its upcoming meetings,” according to a statement published on its website. Inflation is running above forecast but is expected to return close to the target of 4% in the first half of 2022, it said.

Russia is the third major emerging-market central bank to unexpectedly tighten monetary policy this week, after similar decisions from Brazil and Turkey. The key rate could be raised to 5.5% or higher before the end of this year, particularly if the government goes ahead with plans for additional spending, a person familiar the central bank’s discussions said earlier. (…)

SENTIMENT WATCH

John Authers: Wile E. Coyote Stocks Are Nearing the Cliff Edge With bond yields rising inexorably, better hope that the market doesn’t look down.

(…) The story from Thursday, after a startlingly dovish statement from the Federal Reserve, was clear enough. The spread of 10-year over two-year Treasury bond yields passed another landmark, briefly topping 160 basis points. Meanwhile, the 10-year yield itself topped 1.7% for the first time since last year’s Covid shutdown. Investors are evidently prepared to believe the Fed when it says that it will leave interest rates low come what may, and let the economy run “hot.” (…)

This [is] the outcome of the latest asset allocation survey carried out by Absolute Strategy Research Ltd. of London, based on regular interviews with a panel of money managers responsible for more than $7.5 trillion in assets between them:

(…) Worries that higher bond yields could derail the rally in equities haven’t, for the most part, shaken the confidence of asset allocators:

(…) We are going through a process where a narrative is tested against the market. If we reverse, it will come at the moment when that narrative can no longer create its own reality, and instead has to succumb to it.

(…) bond traders had come to rely on the downward trend in the 10-year Treasury yield, which had persisted ever since Paul Volcker crushed inflationary psychology in the early 1980s. A trend line joining the 10-year yield’s high points in the years following formed an almost perfect straight line. The summer of 2007 saw that trend line broken for the first time (it’s just visible on the chart below), and many financial engineers suddenly had to confront the possibility of a world in which long-term rates didn’t float downward forever. The idea was appalling, and bond yields swiftly resumed their downward progress:

The points at which the long-term downward trend in bond yields was breached are both circled. In both cases, the point when investors finally confronted the notion that yields would move much higher overlapped exactly with the point when stocks started to underperform. This was true even though bond prices started to fall:

(…) Now, higher yields and the steepening in the yield curve suggests that another such test is under way. Going by past experience, the 10-year yield can rise to about 2.8% (where the long-term trend line is at present) before this moment of truth.(…)

Users of the FRED database might already be jittery:

A little perspective:

Krugman Dismisses 1970s-Style Inflation Risk, With Faith in Fed

(…) The Federal Reserve has “easy” tools to address price pressures if needed, and is unlikely to adopt the “seriously, seriously irresponsible monetary policy” of the 1970s, said Krugman, who’s currently a professor at the City University of New York.

The worst-case scenario out of the fiscal stimulus package would be a transitory spike in consumer prices as was seen early in the Korean War, Krugman said. The relief bill is “definitely significant stimulus but not wildly inflationary stimulus,” he said. (…)

“No one at the Fed wants to be the people responsible for bringing back the 1970s, so I don’t think they’re that much constrained.”

It was a combination of excessive expansionary fiscal policy under President Lyndon B. Johnson, two oil shocks, and irresponsible monetary policy under the Fed Chair Arthur Burns that combined to create the double-digit inflation of the 1970s that peaked in 1980, Krugman said. (…)

“It’s not silly to think that there might be some inflationary pressure” from the fiscal package, Krugman said. But it was designed less as stimulus than as a relief plan, he said.

Bank of Japan Drops Stock-Buying Target After Market’s Rise The Bank of Japan dropped its annual target for stock purchases, a shift for the central bank after years of building a stock portfolio worth hundreds of billions of dollars.

(…) Since 2016, the Bank of Japan had said it would seek to buy about ¥6 trillion, equivalent to $55 billion, in exchange-traded stock funds annually. In March 2020, when the coronavirus pandemic was developing, it added that it could buy up to twice that amount annually when the market was falling rapidly.

On Friday, it dropped the ¥6 trillion target but reiterated it was ready to step in with larger purchases if needed. It said the higher purchase limit, previously described as a temporary pandemic response, would continue even after the pandemic subsides. (…) The BOJ previously bought Nikkei-linked stock funds, but it said future stock purchases would be made only in funds tied to the Topix. (…)

(…) As of March 1, the BOJ’s stockholdings were worth more than $450 billion, according to NLI Research Institute, making it the single largest holder of shares in the Tokyo market. (…)

The BOJ said the 10-year Japanese government bond yield could move more freely around its zero target. It said it would let the 10-year JGB yield move in a range between minus 0.25% and plus 0.25%. The target range, put in writing for the first time, compared with previous verbal guidance that put the band roughly between minus 0.2% and plus 0.2%. (…)

It said it expected monetary easing will be prolonged because prices are likely to keep falling for now. (…)

COVID-19

- European Countries to Resume Using AstraZeneca Shots The European Union’s health agency said AstraZeneca’s Covid-19 vaccine was “safe and effective” and didn’t increase the risk of blood clots. France, Germany, Italy and others said they would start vaccinating residents again.

- The number of new cases in Germany hit a two-month high, Hungary extended curbs and Paris is back in lockdown.

- German officials warn of ‘exponential’ growth in infections

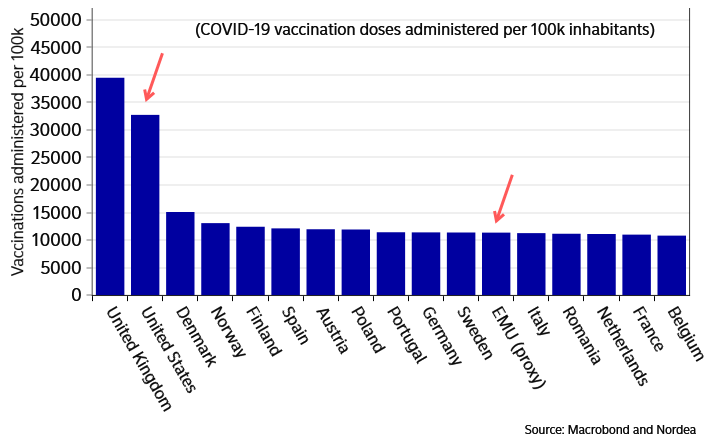

AstraZeneca story – just another example of EU’s vaccination failure?

The Pension Bailouts Begin Congress spends $86 billion to rescue multi-employer retirement funds with no demands for reform.

Democrats left no liberal interest group behind in their $1.9 trillion spending bill this month. That includes private unions whose ailing multi-employer pension plans will get an $86 billion rescue. This is the first of many such air-drops to come.

It was perhaps inevitable that Congress would bail out multi-employer pensions for the Teamsters and other private unions after doing so for coal miners in 2019. But the Democrats’ spending bill does nothing to fix the structural problems that have made these union pensions funds so sick.

Multi-employer pension funds became common after World War II in industries like trucking, construction, manufacturing and retail. They allow employers with a common union to join together and offer collective pension plans. Labor and management collectively bargain benefits and contributions as well as jointly administer the plans.

Unions like the plans because workers continue to accrue benefits if they switch employers. If one business goes bankrupt, others must pick up the cost for worker benefits. Workers also don’t lose benefits—at least not immediately—if union-driven costs contribute to putting employers out of business.

(…) 430 or so multi-employer plans are now at risk of failing.

The federal Pension Benefit Guaranty Corp. (PBGC) insures pension benefits up to $12,870 annually for participants with 30 years on the job. But because more and more multi-employer pension plans over the years have collapsed, the PBGC is also now in imminent danger of failing, which would result in most retirees receiving less than $1,000 per year.

Believe it or not, Congress passed bipartisan legislation in 2014 to head off this tsunami. The Multiemployer Pension Reform Act allowed ailing plans to reduce benefits and make other changes to avoid insolvency. Twenty or so plans have taken advantage of the law’s flexibility, but most haven’t, betting instead on a bailout from Congress.

The Obama Administration also blocked benefit cuts by the Teamsters’ Central States Pension Fund, which is projected to fail in the middle of this decade. That fund’s liabilities could take down the PBGC too. The Democratic spending bill heads off this disaster by allowing the PBGC to make lump sum payments through 2025 that keep the sickest 185 or so plans solvent through 2051.

Yet it prohibits the PBGC from conditioning aid on reforms to governance, funding rules or benefit cuts. There’s also nothing in the law that forbids benefit increases. The upshot is that many of these bailed out plans may need another cash infusion not too many years from now. Other sick but not yet moribund plans will have little incentive to make reforms that could make them healthier.

The Congressional Budget Office projects this pension rescue will cost a cool $86 billion, but that’s merely the start. The 430 or so at-risk plans have some $300 billion in unfunded liabilities. Government unions in Illinois, New Jersey and Connecticut are also sure to cite the precedent to demand that their employee pensions be bailed out too.

Perhaps the only silver lining is that private employers can now more easily exit multi-employer plans and move to 401(k)s because their “withdrawal liability” will shrink due to the federal infusion into the funds. But, as usual, taxpayers are getting stuck with the bill.

This is from the WSJ editorial board. Here’s how Grant’s Interest Rate Observer explains the “Butch Lewis Emergency Pension Plan Relief Act of 2021”:

“A legislative prelude to a future federal bailout of America’s underfunded state and local pension plans”. (…)

The defined-benefit problem is an interest-rate problem. Or, at least, it’s a problem about the shortage of assets with which to deliver expected returns in a time of ultralow interest rates. Whereas, since 2009, the 10-year Treasury yield has tumbled to 1%-plus from 3.8%, assumed rates of return on multiemployer fund assets have been marked down only to 7% from 7.5%. Thus, cue the taxpayers.

“[A]ctuaries are trained to be intergenerationally fair,” Sean McShea, executive vice president at Sage Advisory Services, tells colleague James Robertson Jr. “But now, you want my kids to pay for current services and past services, because you [the Treasury] are going to issue debt? And the difference is that a taxpayer is going to pay for those coupons? That’s not fair. That’s a moral hazard.” (…)

And behind the $86 billion problem looms a $4.2 trillion iceberg, that is, the Federal Reserve’s current estimate of the unfunded liability of the nation’s state and local defined-benefit pension plans. (…)

“Now, the state and local pensions follow suit and try to get bailouts for their pension plans. If they see multiemployer pensions get bailed out, of course they’re going to try, and we’re just going to go broke as a society.”

Or maybe a brisk bond bear market will save the national bacon.